Home / Publications / Research / Learning to Fly: How Canadians Can Navigate a More Complex Financial Landscape

- Research

- |

Learning to Fly: How Canadians Can Navigate a More Complex Financial Landscape

Summary:

| Citation | Bernard Morency and Michaud, Pierre-Carl. 2025. "Learning to Fly: How Canadians Can Navigate a More Complex Financial Landscape." 695. Toronto: C.D. Howe Institute. |

| Page Title: | Learning to Fly: How Canadians Can Navigate a More Complex Financial Landscape – C.D. Howe Institute |

| Article Title: | Learning to Fly: How Canadians Can Navigate a More Complex Financial Landscape |

| URL: | https://cdhowe.org/publication/learning-to-fly-how-canadians-can-navigate-a-more-complex-financial-landscape/ |

| Published Date: | November 11, 2025 |

| Accessed Date: | November 12, 2025 |

Outline

Outline

Related Topics

Files

by Pierre-Carl Michaud and Bernard Morency

-

Canadians are managing more money and more financial decisions than ever. Over the past 30 years, household wealth has more than doubled, while traditional supports like workplace pensions have faded. With fewer defined benefit plans and limited growth in public retirement benefits, people have to make more choices on their own – about saving, investing, and when to retire.

-

Most people aren’t fully prepared for those choices. Financial literacy in Canada remains low, and many struggle with basic concepts like compound interest, inflation, investment risk, and taxes. These gaps can lead to costly mistakes – choosing the wrong savings plan, paying high fees, or missing out on investment returns – especially as retirement decisions become more complex.

-

Technology can help, but financial literacy remains the foundation. Artificial intelligence could make financial learning and advice more accessible and affordable. Still, people need a basic level of understanding to use it safely. Governments and regulators should set clear leadership and guardrails for AI in personal finance, support quality advice, and make financial education a bigger part of helping Canadians chart their course and reach financial security safely.

Introduction and Motivation

Managing personal finances is part of everyone’s life, but today there is more to manage. We are richer than we were 50 years ago. That’s part of the story. But managing finances was also once simpler: people faced only a few important choices at different moments in life, such as which job to take or whether to buy a home. Choice was limited. Consider retirement planning, for instance. Whether because workers had little to save, because governments and employers were doing it for them, or because retirement years were shorter given shorter life expectancy, there was limited personal responsibility for retirement planning. Retirement planning, just like personal finance management, was often on autopilot.

While that’s still true for some – such as individuals with lower lifetime earnings or those whose employers still offer defined benefit (DB) pension plans – the situation has become much more complex for everyone else, particularly in the private sector. A 65-year-old today with median lifetime earnings can expect to live more than 20 additional years but will receive, on average, less than 40 percent of their career income in guaranteed, inflation-protected retirement benefits from universal programs like Old Age Security (OAS), the Guaranteed Income Supplement (GIS), and the Canada or Québec Pension Plan (C/QPP). To maintain purchasing power in retirement and protect against various risks, individuals now face a series of demanding financial decisions: how much to save, where to invest, how to draw down assets, and whether to purchase insurance products.

The range of financial decisions households must make today goes well beyond retirement planning. Managing mortgages, debt, insurance, and investments has also become more complex. While greater flexibility and a wider array of financial products offer clear benefits, they also create a more complicated decision-making environment. As a result, households are more likely than ever to make choices with significant long-term consequences they may not fully understand. In effect, households are now in the cockpit – flying through turbulence with a crowded dashboard in front of them. Yet, mounting evidence in Canada shows that even basic financial literacy remains limited. Despite sustained efforts to improve it, progress has been modest (Boisclair et al. 2017). It seems that, despite many hours in the flight simulator, most of us have not yet learned to fly with confidence.

In this Commentary, we first outline how the financial landscape has changed and how many consumers lack knowledge and understanding about the important decisions they must make. We then describe how to help them “fly and land the plane safely”: the role advisors and planners can play, and the steps governments can take to support households without adding confusion or uncertainty. The paper draws on research from Canada and abroad to identify what we know, where the gaps lie, and how we can adapt to this new environment. We believe technology can play a role – particularly by carefully harnessing the potential of artificial intelligence (AI). We argue that AI can improve financial literacy and foster lifelong learning, improve the efficiency and quality of financial advice and, ultimately, generate better outcomes for Canadians.

Increasing Autonomy and Limited Knowledge

On Average, Canadian Households Have a Higher Net Worth

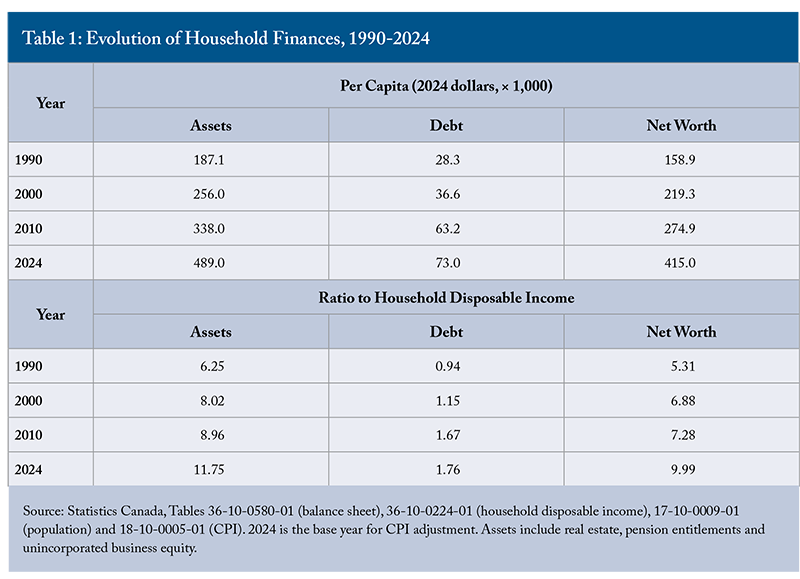

To appreciate what is at stake, it helps to look first at how much consumers must manage financially and how that has changed. Using national balance sheet data from Statistics Canada, we can trace the assets, debt, and net worth of households since 1990, both on a per capita basis and as a ratio of household disposable income. The trend is clear: households have far more to deal with today (Table 1). Between 1990 and 2024, real net worth grew from $158,900 to $415,000 – a more than twofold increase.11 This includes life insurance and pension assets. This growth has outpaced income gains: in 1990, net worth represented 5.3 times household disposable income. By 2024, it had reached 10 times that level.22 Means may be distorted by the skewness of the wealth distribution, and the rise in inequality could explain the increase. But the rapid increase is also seen with medians. See, for example, Bedard and Michaud (2021) and Boisclair et al. (2025).

This Additional Net Worth Can Help Canadians Maintain Their Standard of Living throughout Their Lifetime

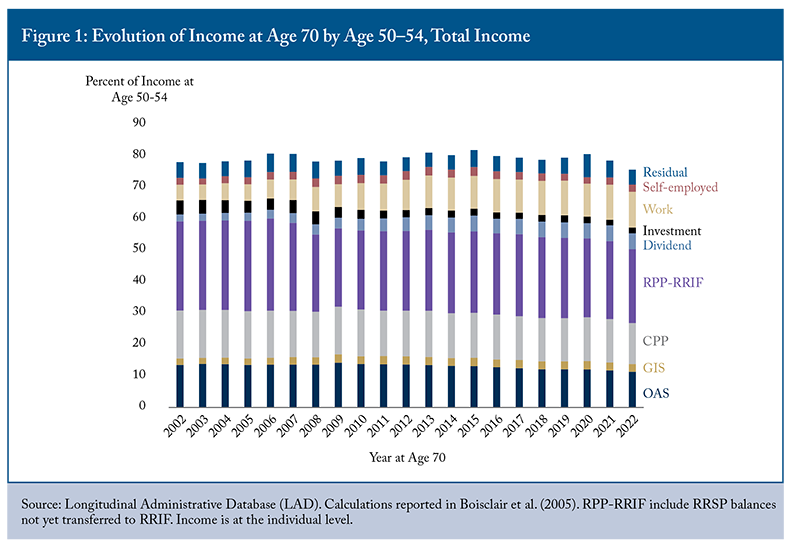

This is great news: on average, Canadian households now have a higher net worth. Part of this additional net worth has helped, and will continue to help, Canadians maintain their standard of living over their lifetimes, especially in retirement. To illustrate this, we use the Longitudinal Administrative Database (LAD), enabling us to follow T1 tax data at the taxpayer level. Each year, we identify those aged 70 and look back at their incomes when they were likely at their earnings peak: around ages 50 to 54. We show replacement rates by source of income at age 70 (as shown in Figure 1).

Public programs such as OAS, GIS, and C/QPP replaced 32 percent of income earned at ages 50–54 for those aged 70 in 2002. In less than 20 years, that number decreased to 27 percent, a 5 percentage point drop. When income from private registered pension plans is added – which includes employer pension plans as well as Registered Retirement Savings Plans (RRSPs), Registered Retirement Income Funds (RRIFs), and other annuity income – the replacement rate dropped from 58 percent to 48 percent over the same period, a 10-percentage-point decrease in 20 years. Yet, overall, the average income at age 70 has remained above 75 percent of income at ages 50–54 throughout those two decades, thanks to a combination of higher net worth and people working longer. This trend is particularly true for those with higher incomes, for whom public programs replace a smaller share of career earnings.

The Landscape Is Changing: There Is A Greater Need for Many Canadians to Save on Their Own

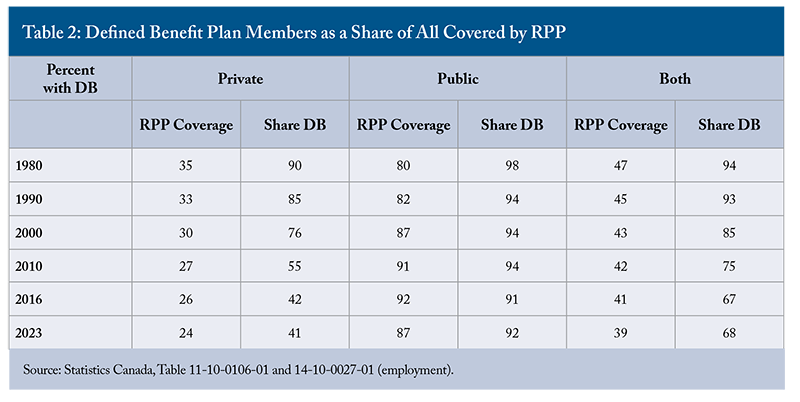

The landscape is changing rapidly for employer-sponsored Registered Pension Plans (RPPs). Coverage in the private sector has continued to erode. It’s always been low despite high hopes when the retirement system was first established. In 1980, 35 percent of private sector workers were covered by an RPP (Table 2, column 1). Today, coverage has fallen to fewer than one in four workers.

Defined benefit (DB) pension plans require very little action from workers. Unlike defined contribution (DC) plan members, participants in DB plans do not need to figure out how much to save or how to invest, and their benefits are automatically converted into an annuity at retirement – protecting them against longevity risk. Over time, however, the types of pension plans available to Canadians have shifted. While the level of benefits provided by DB plans has changed little, there is now greater risk sharing and less guaranteed post-retirement indexation.

In 1980, 31 percent of private sector workers had access to a DB RPP (90 percent of the 35 percent who had RPPs). By 2023, that share had dropped to below 10 percent (41 percent of the 24 percent who have RPPs). Including the public sector – where DB plans remain the norm – the overall DB coverage rate in the Canadian economy rises only to 26 percent (68 percent of the 39 percent who have RPPs).33 Dostie and Morris (2025) study in depth the trends in RPP coverage and differences in wage and job mobility by RPP coverage. This continuing decline puts a significant burden on individuals, especially those working in the private sector, to plan and manage their retirement savings.

While C/QPP expansion will eventually kick in, its effectiveness in raising replacement rates will be offset by the declining earnings replacement capacity of OAS, which grows at inflation. Retraite Québec, which is responsible for QPP, projects that the combined (OAS-GIS-C/QPP) replacement rate at age 65 for those earning the Yearly Maximum Pensionable Earnings (YMPE), currently around 40 percent, will remain essentially at that level in 2065, even after the C/QPP enhancements are fully phased in.44 Portrait de la retraite au Québec, Retraite Québec, December 2024.

Are Individuals Well-equipped to Make Sound Financial Decisions?

The growing need to save and make financial choices is not necessarily a problem if all of us are excellent pilots. After all, it is unclear that mandating saving and other financial decisions would create a better financial system. Flexibility and autonomy can also be a good way to go. However, there is plenty of evidence (Lusardi and Mitchell 2007) that many lack knowledge in very basic dimensions of financial decision-making. Low levels of financial literacy have been observed worldwide.

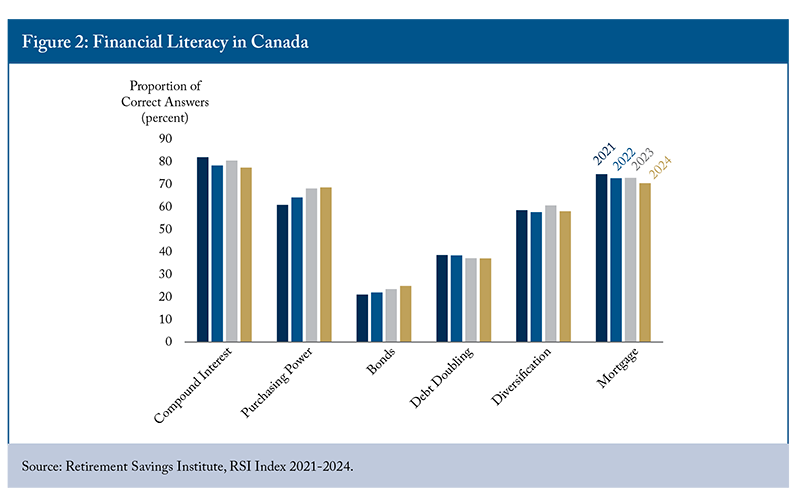

In Canada, the most recent evidence we have comes from the Retirement and Savings Institute (RSI Index), which asks the working-age population about both general financial knowledge and knowledge of the retirement income system.55 Information on the index can be found at https://ire.hec.ca/en/index. Figure 2 illustrates the share of respondents over the past four years who could correctly answer simple questions covering key dimensions of financial literacy – such as compound interest, purchasing power (inflation), the relationship between bond values and interest rates, compound interest on debt, risk diversification, and mortgages. For most questions, fewer than two-thirds of respondents answered correctly, and the needle is not moving fast – if at all. These are basic questions. To keep the analogy going, this is akin to being able to perform simple tasks in the cockpit. Overall, over these six questions, just over half (53 percent) answered more than three questions correctly.66 Previous research has obtained similarly low levels of financial literacy using different samples. For example, Boisclair et al. (2017) report that only 42 percent can answer correctly the questions on compound interest, purchasing power, and diversification. The first study we are aware of was performed by Mullock and Turcotte (2012).

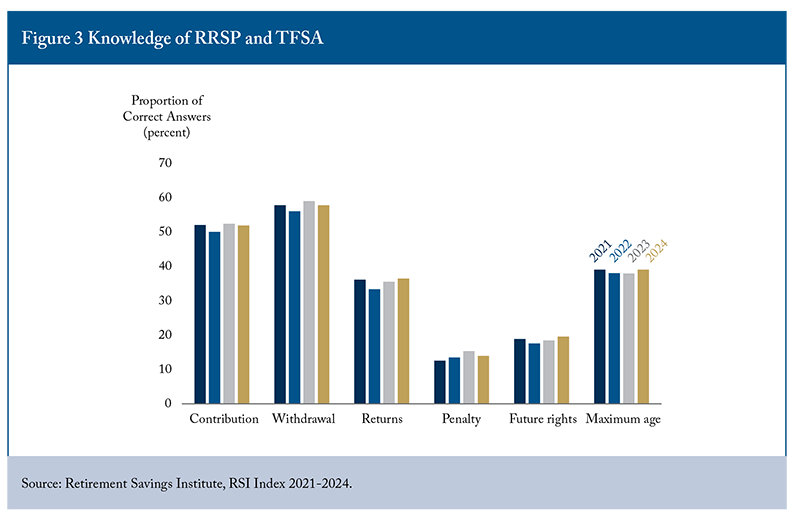

Another dimension of financial literacy is how workers factor taxes into their choices. Our retirement income system features a third pillar, which involves saving through tax-assisted savings vehicles, namely, a registered retirement savings plan (RRSP), and a tax-free savings account (TFSA). Their tax treatment is different. While RRSPs feature tax-exempt contributions and taxable withdrawals, TFSAs do not provide a tax deduction for contributions and do not tax withdrawals. They also differ on several dimensions. Figure 3 reports statistics from the RSI Index on knowledge of RRSPs and TFSAs. Understanding of the tax treatment of contributions, returns, and withdrawals is limited. Many believe there are penalties for withdrawing from RRSPs and TFSAs early. Most do not understand how future contribution rights work. Overall, less than 26 percent of workers get more than three questions correct (out of six).

Sub-optimal Decisions Can Be Very Costly

The wrong choice of savings vehicle, depending on marginal tax rates, can severely impact the net rate of return on savings (Boyer et al. 2022). In other words, these mistakes can be costly. Think of saving as a production technology. You can increase savings by sacrificing consumption. This is costly. Being productive with savings means getting good after-tax returns. You get more consumption in retirement. For the same amount of future savings (or consumption), being unproductive at saving means you need to sacrifice more consumption today. Boyer et al. (2022) show that respondents in an online experiment essentially flip a coin when choosing between RRSPs and TFSAs, even when the marginal tax rates clearly indicate which is financially optimal. Laurin et al. (2023) show that those with higher financial literacy are better at timing their withdrawals from RRSPs (when marginal tax rates are lower).

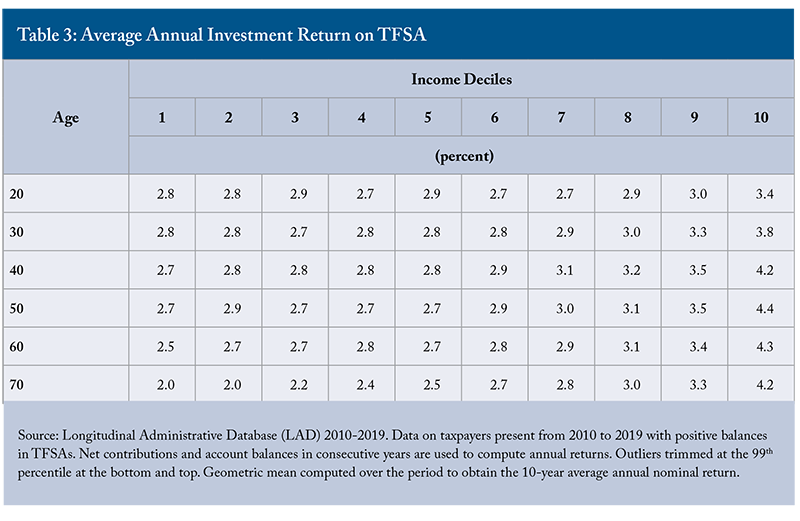

Being productive at saving also means avoiding common mistakes, such as high fees, having a concentrated stock portfolio, or selling low and buying high. A glimpse of the kind of heterogeneity this lack of financial literacy creates is evident in long-term effective returns in TFSAs. TFSAs are now widely used in financial planning and have even surpassed RRSPs in terms of new contributions (Busby and Loriggio 2023). Tax data from the Longitudinal Administrative Database contains information on contributions, withdrawals, and market values of TFSA accounts since 2009. Hence, we can compute average rates of return over 10 years for a large group of Canadians who contribute to these accounts. Since financial literacy is generally found to increase with income, we can look at the effective rate of return from 2010 to 2019 by age and income.

Table 3 reports these nominal returns. The first striking observation is how low they are. In a 2019 survey of the Retirement and Savings Institute, respondents were asked what share of their TFSA holdings was invested in stocks (Boyer et al. 2022). The average stock share was 40 percent. Over that period, a hypothetical portfolio composed of 40 percent stock (MSCI World Index) and 60 percent short-term Government of Canada bonds would have produced an average annual return of 4.6 percent. This is significantly more than the return we observe in Table 3, except for the top income decile after age 40 (and even then, the hypothetical portfolio earns more). In other words, actual returns for TFSA holders saving for retirement are considerably lower than might be expected.77 Based on the same survey, the share invested in stocks is 60 percent for RRSPs (Boyer et al. 2022).

Returns also vary considerably with income, particularly above the median. For example, at age 40, the difference between the first and last income deciles is 1.5 percentage points. That may seem small, but cumulated over 30 years of active saving, the gap becomes significant. Suppose an individual contributes $1,000 each year for 30 years. When the rate of return is 4.5 percent compared to 3 percent, applied to a 30-year savings stream, you will accumulate 29 percent more in savings for the same savings effort. With $5,000 annual contributions, this means $67,000 more after 30 years: $305,000 versus $238,000. Put differently, a saver earning the higher return could save $3,900 per year instead of $5,000 to accumulate the same amount. This means $1,100 more per year to spend. These disparities contribute to wealth but also consumption inequality.88 Messacar and Morissette (2020) show that returns in TFSAs are larger for those with employer pension plans. Many reasons may explain these differences, including different exposure to risk and fees. Disparities in investment returns might also be exacerbated through investments in other domains, such as housing and real estate, which constitute a large portion of household wealth (Kronick and Laurin 2016).

Turning Savings into a Stream of Income Is Also Challenging

While there has always been a lot of focus on the accumulation of savings, the focus has recently shifted towards decumulation – that is, how to convert accrued savings into income after retirement. There are several reasons for this shift. First, new and future generations of retirees are more dependent on their private savings than current and past retirees.

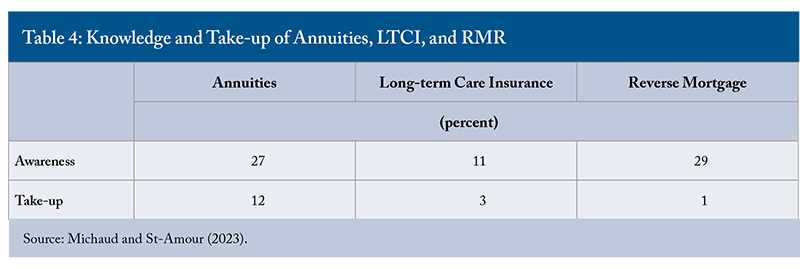

Second, retirees today can expect to live longer, which means a bigger need to manage the risk of outliving their savings. Yet, despite this growing need, life annuities – which protect against longevity risk – remain unpopular for a host of reasons related to pricing, longevity expectations and various behavioural biases (Boyer et al. 2020).

Third, the public system is failing to provide low-cost services for long-term care (Clavet et al. 2022). The system is under pressure. This means that the next generations of retirees might face higher costs and financial risks for long-term care needs (Boyer et al. 2020). Yet, long-term care insurance (LTCI) also remains unpopular. Boyer et al. (2020) find that information frictions, such as awareness and misperceptions, are the main culprits for the lack of popularity. The fear of losing coverage or not having the insurer pay out benefits may be another reason (Boyer et al. 2020, 2019). Over the last 10 years, fewer institutions have offered such products.

Fourth, house values have risen rapidly in Canada. Lots of retirees are rich on paper, want to stay in their house, but face pressures in terms of purchasing power. Accessing some of that wealth on the balance sheet is difficult. Reverse mortgages (where borrowers access the equity they have put into their home and don’t have to repay the loan until they sell or die) remain untapped, and knowledge of this product is limited (Choinière-Crèvecoeur and Michaud 2023). Michaud and St Amour (2023) report a take-up rate of 2 percent in the Survey of Financial Security of 2019. Although the take-up might have increased since then, it remains low.

One issue, explored by Choinière-Crèvecoeur and Michaud (2023), is pricing. Reverse mortgages command an interest premium of roughly 2 percent relative to a Home Equity Line of Credit (HELOC). This spread is hard to rationalize (i.e. seems too high) using a standard actuarial pricing model to price the non-negative equity guarantee (NNEG), which effectively protects households from owing more than the value of their home at termination. This suggests the market for reverse mortgages is mostly targeted to households facing liquidity constraints, for whom HELOCs are not available.

The point is that there are risk management solutions available, but they are underutilized, mainly because of complexity, cost, and retirees’ lack of awareness (Michaud and St Amour 2023). Advice may also be perceived to be expensive or hard to access. As shown in Table 4, less than 30 percent knew of annuities and reverse mortgages in 2019, and less than 11 percent knew of LTCI. Take-up is even lower: less than 12 percent have purchased life annuities, less than 3 percent LTCI, and less than 1 percent reverse mortgages. Clearly, decumulation is not on automatic pilot either, and although retirees may be somewhat aware of the risks looming ahead, they are ill-equipped to mitigate these.

Past Successes Are No Guarantee for the Future

Households need to make more financial decisions than ever before and can rely less on autopilot. The success of the babyboomer generation in terms of retirement replacement rates – despite limited financial literacy and limited knowledge of both the retirement income system and financial products in general – is unlikely to continue for current workers. The trends outlined suggest more headwinds are coming, perhaps some storms as well. How can we best prepare for this? What are the policy options? And perhaps interestingly, how does the advent of easily accessible AI change this?

Traditional Policy Toolbox

More Choice Is Not Always Better

Consider first the traditional toolbox. In a world with perfect knowledge and rationality, more options in a choice architecture are better. The basic lesson from economics 101 is: if one option is better for someone, adding other options cannot hurt. At worst, it will be ignored. However, a large body of research has shown that in the real world – where knowledge is imperfect and rationality is bounded – more choice is not always better (Schwartz 2016). Keim and Mitchell (2016), for example, show in the context of 401(k) investment choices that simplifying the menu of options in a large US firm has led to large cost savings for workers.

Making decisions is costly, and that cost rises when knowledge is limited and when complexity increases. It takes time and effort to get more informed and to try to understand the differences between the menu of options. Some individuals can rationally decide not to incur those costs, leading to poorer decisions in more complex choice environments.

How Can We Help Individuals Choose among the Many Options Offered to Them?

There is a role then for intervention, limiting the choice set, reducing complexity, and sometimes steering choices. The toolbox for intervention contains many tools. One could target financial education to empower consumers, encourage the use of financial advice, create new incentives to steer choices, and embark on choice architecture interventions: for example, defaulting people into plans or mandating choices (Thaler and Sunstein 2003).

In Canada, we use each of these tools in different domains. There is no silver bullet. Each tool has advantages and disadvantages. For example, we mandate basic retirement savings through the Canada and Quebec Pension Plans. We regulate what type of mortgages can be sold and the maximum interest rates on credit cards. We use choice architecture in several employer pension plans and voluntary retirement savings plans. Quebec’s RVER, or voluntary retirement savings plan (VRSP), requires workers to contribute a set percentage of their wages to their retirement account. Individuals also have flexibility in deciding when to begin receiving their C/QPP pension, including incentives to delay. Finally, many governments mandate financial education in schools (McGregor 2018) or have active financial education initiatives, such as those led by the Financial Consumer Agency of Canada (FCAC) and provincial regulatory authorities like the Autorité des marchés financiers (AMF) in Quebec and the Financial Services Regulatory Authority of Ontario (FSRA). These programs aim to empower future consumers to make good financial decisions.

As it turns out, many alternative strategies to financial education are, in fact, complements rather than substitutes. Their effectiveness increases with the basic level of financial knowledge in the population. As an example, think of steering choices using financial incentives. Both CPP and QPP have actively incentivized delays in claiming since 2012 and 2014, respectively. Glenzer, Michaud, and Staubli (2024) show that the 2012 increase in the reward for claiming CPP later (and the 2014 increase for QPP) had very little impact on increasing delays. It was largely ineffective. However, in an experimental setting, these authors show that those with higher financial literacy responded more significantly to changes in financial incentives to delay than those with limited financial literacy. Interestingly, the average age of claiming CPP and QPP retirement benefits has increased in recent years as more and more advisors and news media have explained the advantages of delaying.

Choice architecture and financial literacy are also complements. Nudging is powerful in the presence of psychological factors, such as procrastination and loss aversion (Thaler and Sunstein 2021). While early research showed that defaulting people into participating in 401(k) savings had strong effects (Madrian and Shea 2001), of late, it appears its long-term effectiveness for saving has been overestimated (Choukhmane 2025). Among the different reasons, there are substantial leakages, with workers withdrawing funds from their accounts at later ages (Choi et al. 2024).

While choice architecture is powerful at addressing psychological barriers, notably inertia, it is much less effective when knowledge barriers are the cause of mistakes, as in the case of under-saving. If one does not understand why they must save more, they are likely to steer away from the default they were put in at some point. Default enrollment is often presented as a superior choice architecture, for example, relative to mandates or opt-in choice architecture, because it gives the possibility to opt out (Thaler and Sunstein 2003). But the necessary condition for default enrollment to improve outcomes without doing harm is that those for whom the default choice is not optimal can recognize this and opt out after initial enrollment. When knowledge barriers are the reason why individuals stray from optimal choices, defaulting someone into these savings mechanisms loses that superiority. Those who are harmed do not opt out because of inertia.

Since individuals differ in their preferences and circumstances, uniform defaults are unlikely to outperform other interventions when knowledge barriers are significant. Glenzer et al. (2025) test framing as a tool to encourage delayed CPP claiming, a form of choice architecture manipulation exploiting psychological barriers. In their experiment, a subset of respondents was shown a scenario in which benefit amounts were identical at each age, but the “normal” claiming age was presented as 67 instead of 65. Compared to baseline answers, those exposed to this simple framing effect indicated a higher intended claiming age. It proved to be the most powerful of all the interventions they considered.

But when looking at participants who changed their claiming age, the researchers found no statistically significant financial gain from those delays. Some who changed their behaviour lost, and others gained in the experiment. By contrast, respondents who obtained financial education, specifically regarding longevity prospects, adjusted their claiming age in a way that led to improved financial outcomes.

Financial Advice Is a Complement to Financial Education, Not a Substitute

Advice is often presented as a substitute for financial literacy. But as it turns out, financial advice complements financial literacy for several reasons. Financially literate consumers are more likely to seek advice (Kim et al. 2021). More financially literate consumers are likely to get more from advice than those who are financially illiterate. So financial literacy reduces the perceived cost of entry.

More financially literate consumers are likely better able to discriminate. Although the quality of advice in Canada is high, advisors may suffer from biases, even unconscious ones, when providing advice. For example, d’Astous et al. (2024) show, using a representative sample of financial planners in Canada, that advisors can suffer from familiarity bias, being more likely to recommend products they own themselves. The ability to avoid mimicking the advice given by some advisors requires financial literacy. Second, it is reasonable to believe that advisors likely need to exert more effort and time to explain recommendations to a less financially literate client than to a more literate client. The productivity of encounters is likely higher with more literate clients. Finally, acting on recommendations correctly requires some level of financial literacy, foremost because it requires understanding the recommendation and executing it.

The bottom line is that the various tools in the policy toolbox interact in important ways. A common denominator is that none of them can substitute for a good level of financial literacy. This complementarity should be at the cornerstone of any strategy to improve financial decision-making. Providing basic financial literacy to the broader population and specific education at particular moments in the life-cycle can enable consumers to then seek specialized advice or tools, which may help them make decisions.

Agencies such as the FCAC and provincial financial services regulators could be involved in policy design, particularly in discussions on changes to the retirement income system, to support financial education and provide tools for consumers. Next, we argue that technology may help foster this complementarity.

Is AI Different?

AI is reshaping the financial advisory landscape, presenting both considerable opportunities and significant challenges. In our view, there are three potential uses of AI in helping consumers fly and land the personal finances plane safely. First, AI can be used to increase financial literacy, providing consumers with an easily accessible conversational tool to learn about financial concepts. Second, it can help advisors drill down into massive amounts of information to better tailor advice to clients and automate information-gathering tasks to increase their own productivity, reduce costs, and increase access. Third, and this is the most sensitive potential role, using AI to provide direct, personalized financial advice to clients.

As we have seen, levels of financial literacy are low. AI may help with two key challenges. The first challenge is reaching those with low financial literacy and bringing them into the classroom. Formal education is costly, at least in terms of opportunity costs, and could deter some from pursuing financial education (Lusardi et al. 2020). By lowering the cost of acquiring financial education, publicly available AI tools, especially conversational ones like ChatGPT, Gemini, or CoPilot, have the potential to help consumers better understand basic financial literacy concepts. In this sense, AI can serve as a “literacy booster.”

The second challenge is that financial literacy is a form of human capital that depreciates over time. Hence, teaching basic concepts such as compound interest, purchasing power, and diversification in high school can be effective, but more complex topics like wealth decumulation may not stick in the student’s mind by the time they need to use it. This has led to the rise of “just-in-time” financial education, such as computer programs and apps that deliver guidance immediately before consumers make big decisions. But this is hard to do and to target. For example, not everyone gets their first mortgage at the same age.

Again, AI tools may help in this domain by allowing consumers to choose when just-in-time happens. One potential issue is that control over the quality of what AI tools can produce is limited. If that is a concern, regulatory bodies or professional organizations – such as FP Canada, which certifies financial planners – could develop their own AI-powered tools using large language models (LLMs) trained on the expertise of certified advisors. For example, a user could “ask Chuck or Nancy” about mortgages through an AI assistant trained on real-world financial planning knowledge.

Access to such an LLM could then be made free to the public and promoted at key life stages, since many consumers simply don’t know what they don’t know. One avenue would be for the FCAC, along with provincial financial services regulators, to build and host those tools and promote their use or mandate financial institutions to inform their customers about their existence. Investment in the production of this type of public good may be of limited value to any particular private-sector actor, but could help generate externalities that all actors will eventually benefit from. The FCAC has already taken the lead in developing financial literacy tools and would be a natural catalyst for this effort.The potential of AI to drill down into massive amounts of information should not be underestimated. That said, there is some skepticism about how transformative it will be. Indeed, many existing predictive models are quite sophisticated; tagging AI to an existing model may or may not make it more useful.

Where AI shows particular promise is in helping individual advisors to format and interrogate massive amounts of information they hold on their clients, even if they are not trained in modelling and programming. The potential for individual advisors to create their own “data lab” may yield important efficiency gains. Similar gains are equally promising in routine data-gathering tasks. Advisors already use AI to deliver meeting notes and summaries of their client discussions. Many apps are doing this now. For example, Jump and Zocks are specifically designed to support these interactions.

But the frontier can be pushed much further (and there are probably startups already working on this). In discussions with advisors, a common complaint is that a lot of time in meetings is spent updating records and collecting information from clients. This can be automated using LLMs implemented as conversational agents. Clients could easily spend some time prior to meeting their advisors, filling in new and required information for the meeting. Unlike filling out a static form, a well-trained LLM can adapt questions to each client’s circumstances and investigate areas which might be relevant for advice given to the client. This would allow advisors to spend more time tailoring and conveying advice as well as developing their human relationship with clients. Innovations like this are already being implemented in other settings, such as healthcare. Similarly applied in financial services, AI has the potential to be a true productivity booster for advisors.

The most problematic potential use of advice is in providing specific advice to clients. Clearly, publicly available LLM-based tools such as ChatGPT are capable of the best and the worst. They are subject to “hallucinations” where they make up recommendations. This is where the complementarity between AI and financial literacy is important. The ability to spot hallucinations is probably higher for clients with better financial literacy.

Privately-trained LLMs, say by advisors, are also prone to hallucinations. Completely eliminating hallucinations is virtually impossible. The effects of something going wrong are massive for large financial institutions, even if the risk of occurrence is quite small. Hence, it is difficult to imagine a world in which consumers can completely rely on advice provided by AI. This also raises the question of accountability: who is accountable when advice is wrong? Two-step validation of advice provided by AI, where an advisor verifies the advice, is a safer bet. This may also help rein in other forms of implicit bias due to stereotypes or other social constructs in AI recommendations. In the end, advisors should be responsible for the advice provided.

One potential solution is to design AI-based LLM tools that propose a menu of recommendations from which advisors can pick. This solution could be particularly promising in settings where large financial institutions may want to control the menu of recommendations they would like distributed through their networks, while still allowing advisors to tailor advice by picking from the menu what fits best with each client’s situation.

This model may not be very different from existing practice for investment products, where clients are presented with a choice menu based on their risk profile. But it could be very useful in other contexts, such as decumulation solutions, where a mix of insurance and investment products needs to be considered. In these cases, even experienced advisors may sometimes themselves not be fully versed in these more complex solutions and default to simpler ones. Done right, AI can serve as an advice-giver, including to advisors themselves.

The potential for a life-course approach to relationships between consumers and their LLM and their advisor is both exciting and promising. But a point remains: AI increases the returns to continued efforts to raise financial literacy. And it can play a role in that educational effort.

Conclusion

Where does that leave us? We have shown that households are now managing more money in situations where their decisions have far-reaching consequences. For retirement savings in particular, it is perhaps surprising, given the low levels of financial literacy, that replacement rates have remained relatively stable and high. There are several reasons for this. First, in Canada, we have relatively solid first (OAS and GIS) and second (C/QPP) pillars of retirement. Second, the share of income replaced by RPPs for current retirees remains high. But it is declining as the employer-provided pension plan landscape slowly disappears, with DB coverage now under 10 percent of workers in the private sector. There is a greater role for private savings, and with households having difficulty differentiating what’s best between RRSPs and TFSAs – and little awareness of the decumulation problem with associated looming risks – there are a number of warning lights on the dashboard of the plane.

Our mix of policy interventions, going from choice architecture to incentives, requires a minimum level of financial literacy, which remains too low. Hence, an efficient complement to these policies is to continue targeted financial education interventions. Technology can play an important role in this effort. On the supply side, AI offers the possibility of more efficient advice at a reduced cost. On the demand side, it can be used effectively to strengthen financial literacy in Canada, at a time when it is very much needed.

Where Do Governments Fit In?

There are two critical roles for government intervention. The first is regulatory. Policymakers need to catch up with current AI advances and provide clear guidelines on how it can and cannot be used in financial services. Guardrails need to be put in place, in terms of auditing and reporting, explanation standards, hallucination controls, human-in-the-loop models, data privacy compliance, and model risk management. We think this is largely doable, and many governments around the world are already working to balance the benefits of AI with the risks and costs it may introduce.

We discussed earlier the possibility of regulatory bodies, or organizations such as FP Canada, producing their own LLM AI tool to combat difficulties in controlling the quality of the AI tools in the market. The example we gave was FCAC, in collaboration with provincial financial services regulators, which could build, host, and promote such a tool, while mandating financial institutions to inform their customers about its existence.

In the retirement domain, this proposal complements existing recommendations for a national pension dashboard that brings together information on their various pension entitlements (Bush 2025). Imagine what a well-designed AI tool could do with comprehensive, high-quality data. One should also note that collaboration with the private sector in such initiatives is essential, as they are a key actor in financial education, helping design legislation that supports new products and increasing awareness of existing solutions.

The second role is leadership by putting someone in charge. The current policy and educational environment for household finances, and in particular for retirement savings (accumulation and decumulation), is extremely fragmented, with many actors dealing with their own parts of the system without sufficient interaction with one another or with the broader public.

Take retirement savings, for instance. Public pensions are already fragmented. The CPP has an independent investment board, an Office of the Chief Actuary, and Employment and Social Development Canada (ESDC), all playing separate roles. Meanwhile, OAS and GIS are managed out of ESDC without clear, strong integration with CPP. No one is really responsible for assessing how changes to employer pension plans are affecting the retirement income prospects of future retirees, nor for monitoring how RRSPs and TFSAs complement retirement incomes.

The FCAC oversees providing education on various aspects of managing money, but produces very little information on retirement savings accumulation and decumulation, of the sort we advocate for here. Notably, there is little material on their website on risk, a notable omission given that risk is at the core of many households’ financial decisions. As a result, consumers are left to navigate a patchwork of tools gathered across the internet, often coming from financial institutions themselves.

More than ever, there is a need to identify a clear leader within government or regulatory agencies – someone responsible for coordinating retirement savings policy and providing trusted, comprehensive information on the various aspects of these crucial decisions in every Canadian’s life. Returning to our earlier analogy, Canada needs a “pilot” in government charged with developing a personal finance flight simulator that Canadians can use to train in how to fly and land their personal finance plane.

The challenge is not simply giving Canadians more tools but ensuring they can use them wisely. Financial literacy, complemented by advice and technology, must be the foundation of a system that helps households land the plane safely.

The authors extend gratitude to Keith Ambachtsheer, Iqbal Amiri, Mawakina Bafale, Hande Bilhan, Carlo Campisi, Charles DeLand, Joanne De Laurentiis, Jeremy Kronick, Dave Longworth, Janice Madon, James Pierlot, Brent Vandekerckhove, Mark Zelmer, and several anonymous referees for valuable comments and suggestions. The authors retain responsibility for any errors and the views expressed.

REFERENCES

Bedard, N., and P.-C. Michaud 2021. “Playing with Fire? Household Debt near Retirement in Canada.” Canadian Public Policy 47(1). https://doi.org/10.3138/cpp.2019-041.

Boisclair, D., Lusardi, A., and P.-C. Michaud. 2017. “Financial Literacy and Retirement Planning in Canada.” Journal of Pension Economics and Finance 16(3). https://doi.org/10.1017/S1474747215000311.

Boisclar, D., X. Dufour-Simard, and P.-C. Michaud 2025. “Retirement Incomes in Canada: Past, Present and Future, Retirement and Savings Institute.” Working Paper 19.

Boyer, M. M., Box-Couillard, S., and P.-C. Michaud. 2020. “Demand for annuities: Price sensitivity, risk perceptions, and knowledge.” Journal of Economic Behavior and Organization 180: 883–902. https://doi.org/10.1016/J.JEBO.2019.03.022.

Boyer, M.M., P. d’Astous, and P.-C. Michaud. 2022. “Tax-Preferred Savings Vehicles: Can Financial Education Improve Asset Location Decisions?” Review of Economics and Statistics 104(3): 541–556. https://doi.org/10.1162/rest_a_00973.

Boyer, M.M., P. De Donder, C. Fluet, M.L. Leroux, and P.-C. Michaud. 2020. “Long-Term Care Insurance: Information Frictions and Selection.” American Economic Journal: Economic Policy 12(3): 134–169. https://doi.org/10.1257/POL.20180227.

Busby, C., and T. LoRiggio. 2023. “The Rise of TFSAs: Trends in Savings Vehicle Usage in Canada.” RSI Brief No. 3. Montréal: HEC Montréal Retirement and Savings Institute. September.

Bush, K. 2025. “Roadmap for Retirement: The Case for a National Pension Dashboard.” E-Brief 375. Toronto: C.D. Howe Institute. July 8. https://cdhowe.org/publication/roadmap-for-retirement-the-case-for-a-national-pension-dashboard/.

Choi, J. J., Laibson, D., Cammarota, J., Lombardo, R., and Beshears, J. 2024. Smaller than We Thought? The Effect of Automatic Savings Policies. NBER Working Paper 32828. https://doi.org/10.3386/W32828.

Choinière-Crèvecoeur, I., and P.-C. Michaud. 2023. “Reverse Mortgages and Financial Literacy.” Journal of Financial Literacy and Wellbeing 1(1): 79–102. https://doi.org/10.1017/FLW.2023.4.

Clavet, N.J., R. Hébert, P.-C. Michaud, and J. Navaux. 2022. “The Future of Long-Term Care in Quebec: What Are the Cost Savings from a Realistic Shift toward More Home Care?” Canadian Public Policy 48: 35–50. https://doi.org/10.3138/CPP.2022-031/ASSET/IMAGES/CPP.2022-031_F05.JPG.

d’Astous, P., I. Gemmo, and P.-C. Michaud. 2024. “The Quality of Financial Advice: What Influences Recommendations to Clients?” Journal of Banking and Finance 169: 107291. https://doi.org/10.1016/J.JBANKFIN.2024.107291.

Dostie, B., and T. Morris. 2025. The Labour Market Impacts of Employer Pension Plans. Toronto: Global Risk Institute. https://globalriskinstitute.org/publication/the-labour-market-impacts-of-employer-pension-plans/.

Glenzer, F., P.-C. Michaud, and S. Staubli. 2025. “Frames, Incentives, and Education: Effectiveness of Interventions to Delay Public Pension Claiming.” Journal of Public Economics, forthcoming. https://doi.org/10.3386/W30938. https://ire.hec.ca/en/wp-content/uploads/sites/3/2023/09/Note-IRE-03-EN_final.pdf.

Keim, D.B., and O.S. Mitchell. 2016. Simplifying Choices in Defined Contribution Retirement Plan Design. NBER Working Paper 21854. https://doi.org/10.3386/W21854.

Kim, H.H., R. Maurer, and O.S. Mitchell. 2021. “How Financial Literacy Shapes the Demand for Financial Advice at Older Ages.” Journal of the Economics of Ageing 20: 100329. https://doi.org/10.1016/J.JEOA.2021.100329.

Kronick, J., and A. Laurin. 2016. The Bigger Picture: How the Fourth Pillar Impacts Retirement Preparedness. Commentary 457. Toronto: C.D. Howe Institute. September. https://cdhowe.org/publication/bigger-picture-how-fourth-pillar-impacts-retirement-preparedness/.

Laurin, M., D. Messacar, and P.-C. Michaud. 2023. “Financial Literacy and the Timing of Tax-Preferred Savings Account Withdrawals.” Journal of Accounting and Public Policy 42(2): 106922. https://doi.org/10.1016/J.JACCPUBPOL.2021.106922.

Lusardi, A., and O.S. Mitchell. 2007. “Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education.” Business Economics 42(1): 35–44. https://dx.doi.org/10.2145/20070104.

Lusardi, A., P.-C. Michaud, and O.S. Mitchell. 2020. “Assessing the Impact of Financial Education Programs: A Quantitative Model.” Economics of Education Review 78. https://doi.org/10.1016/j.econedurev.2019.05.006.

Madrian, B.C., and D.F. Shea. 2001. “The Power of Suggestion: Inertia in 401(k) Participation and Savings Behavior.” Quarterly Journal of Economics 116(4): 1149–1187. https://doi.org/10.1162/003355301753265543.

Martin Boyer, M., P. De Donder, C. Fluet, M.-L. Leroux, and P.-C. Michaud. 2019. “A Canadian Parlor Room-Type Approach to the Long-Term-Care Insurance Puzzle.” Canadian Public Policy 45(2). https://doi.org/10.3138/cpp.2018-023.

McGregor, S.L.T. 2018. “Status of Consumer Education and Financial Education in Canada (2016).” Canadian Journal of Education / Revue canadienne de l’éducation 41(2): 601–632. https://journals.sfu.ca/cje/index.php/cje-rce/article/view/3294.

Messacar, D., and R. Morissette. 2020. “The Long-Term Effects of Employer-Sponsored Pension Plans on Non-Workplace Returns on Investments.” Journal of Pension Economics and Finance 19(2): 198–216. https://doi.org/10.1017/S147474721800029X.

Michaud, P.-C., and P. St-Amour. 2023. Longevity, Health and Housing Risks Management in Retirement. NBER Working Paper 31038. https://doi.org/10.3386/W31038.

Mullock, K., and J. Turcotte. 2012. Financial Literacy and Retirement Saving. Department of Finance Canada Discussion Paper 2012-01. Ottawa: Government of Canada. https://publications.gc.ca/site/eng/438400/publication.html.

Schwartz, B. 2016. The Paradox of Choice: Why More Is Less. Revised Edition. New York: HarperCollins.

Taha Choukhmane. 2025. “Default Options and Retirement Savings Dynamics.” American Economic Review, forthcoming.

Thaler, R.H., and C.R. Sunstein. 2003. “Libertarian Paternalism.” American Economic Review 93(2): 175–179. https://www.jstor.org/stable/3132220.

Thaler, R.H., and C.R. Sunstein. 2021. Nudge: The Final Edition – Improving Decisions about Money, Health, and the Environment. New York: Penguin Books.

Related Publications

- Intelligence Memos

- Intelligence Memos

- Research