June 13, 2019 – Canada’s senior governments receive grades ranging from A to F for transparency and reliability in their financial reporting, in the C.D. Howe Institute’s latest fiscal accountability ranking. In “Show and Tell: Rating the Fiscal Accountability of Canada’s Senior Governments, 2019,” authors William B.P. Robson and Farah Omran grade the transparency and reliability of the federal, provincial and territorial governments’ budgets and financial reports, and propose easy steps to improve them.

“Governments’ extraordinary powers to tax and coerce citizens make monitoring their behavior particularly important,” commented Robson. “Canadians need budgets and financial reports they can understand and use to hold governments accountable.”

The C.D. Howe Institute report focuses on the relevance, accessibility, timeliness and reliability of governments’ key financial documents: their budgets, the estimates their legislatures vote to authorize spending, and the audited financial statements they publish after year-end.

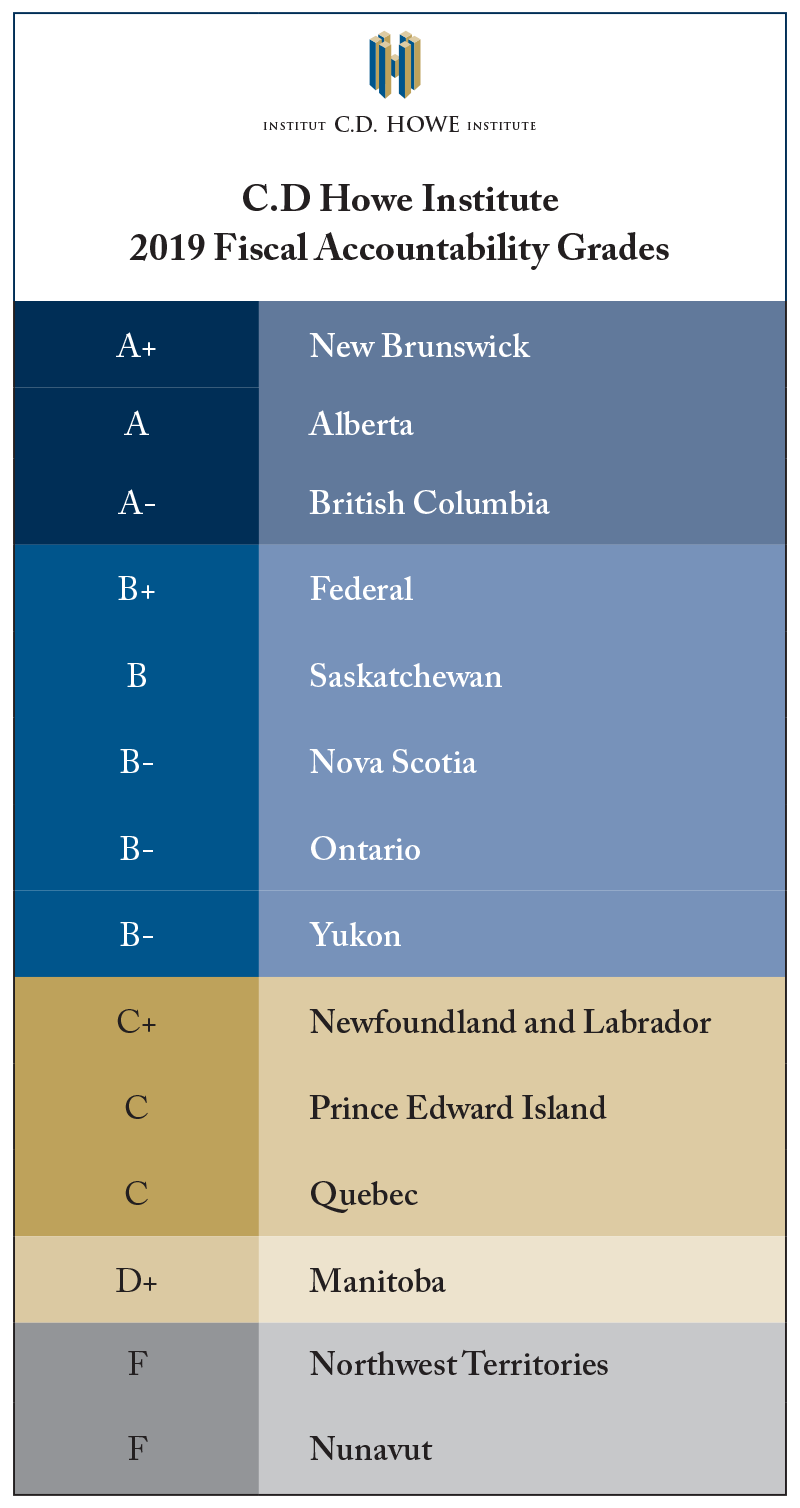

In this year’s report, which covers the budgets for fiscal year 2018/19, and the financial statements for fiscal year 2017/18, New Brunswick tops the class with an A+, Alberta ranks second with an A and British Columbia ranks third with an A–. At the other end of the scale are Manitoba with a D+ and the Northwest Territories and Nunavut, each scoring an F.

The federal government (B+), Saskatchewan (B), and Ontario, Nova Scotia and Yukon (B-) could join the top rank with relatively small improvements, such as making key numbers easier to find, more timely presentation and publication, and helping legislators understand how their votes on programs reconcile – or not – with budget plans.

Among the important positive highlights this year is a marked improvement in Ontario’s score, thanks to the province cleaning up problems with its accounting that had prompted qualified opinions on its financial statements from the provincial auditor general.

“We are glad to report that, over time, the fiscal transparency of Canada’s senior governments has improved. Two decades ago, none of them presented budgets you could compare to their results; today, consistent accounting is the rule,” said Robson. “The remaining deficiencies and instances of backsliding are fixable, as the examples of the leading jurisdictions show.”

The authors suggest a number of improvements that would foster better fiscal accountability by Canada’s senior governments.

- Financial Statements Should Reflect Public Sector Accounting Standards - represented by an unqualified opinion from the relevant auditor general – as should in-year updates on the evolving situation. Public accounts should as well include reconciliation tables explaining differences between projections and outcomes.

- Budgets Should Match Financial Statements. Governments should not confuse users of their financial documents with more than one set of headline figures, or inconsistent aggregating and netting that make what should be a simple comparison of projections and results practically impossible.

- Budgets Should Precede the Start of the Fiscal Year. It is an affront to accountability to ask legislatures to approve a plan after money has already been spent.

- Estimates Should Be Timely and Easily Reconciled with Budgets. Legislators often get, and vote on, estimates after the financial horses have already started leaving the barn, and may have no idea whether their votes are consistent with the budget plan

- Key Numbers Should Be Accessible and Recognizable. Relevant and accurate numbers are less useful if potential users cannot find them or recognize them.

- Year-End Results Should Be Timely. Legislators and citizens need timely information about whether the government fulfilled its promises, and to understand the size of, and reasons for, deviations from targets.

“If Canadians demanded better financial reporting from their governments, they could get it,” said Omran.

For more information contact William B.P. Robson, President and CEO, Farah Omran, Junior Policy Analyst, or Laura Bouchard, Manager of Communications, C.D. Howe Institute at 416-865-9935 or lbouchard@cdhowe.org

The C.D. Howe Institute is an independent not-for-profit research institute whose mission is to raise living standards by fostering economically sound public policies. Widely considered to be Canada's most influential think tank, the Institute is a trusted source of essential policy intelligence, distinguished by research that is nonpartisan, evidence-based and subject to definitive expert review.