April 18, 2024 – All governments should present financial information that is transparent, useful and timely. However, as the C.D. Howe Institute’s latest annual report card on the fiscal transparency of Canada’s largest cities shows, too many do not.

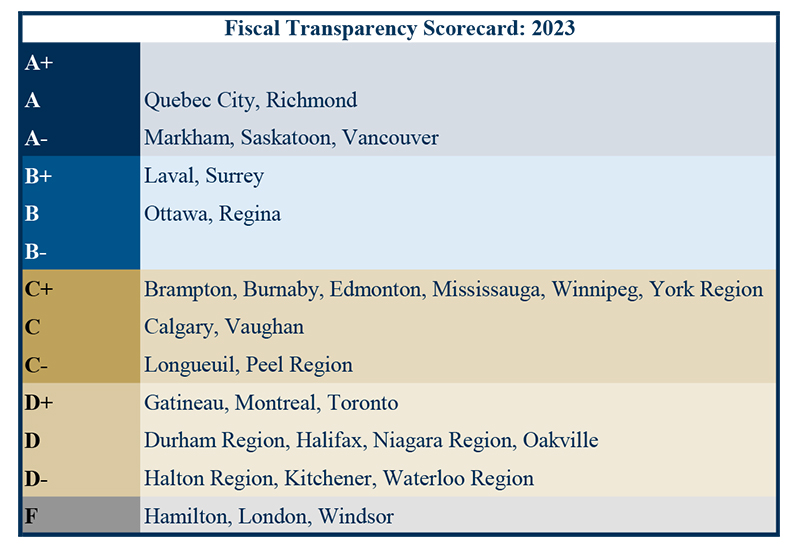

In “The Municipal Money Mystery: Fiscal Accountability in Canada’s Cities, 2023,” authors William B.P. Robson and Nicholas Dahir score the budgets and financial statements of 32 major Canadian municipalities. Grades for these cities range from A to F, reflecting how well their financial documents allow councillors and non-expert citizens to see proposed changes in revenues and expenses, compare results to plans, and understand budgets’ implications for their city’s capacity to deliver services.

The stars in 2023 were Quebec City and Richmond, with As for clarity, completeness, and promptness. Markham, Saskatoon and Vancouver earned grades of A-. Meanwhile, Hamilton, London, and Windsor got Fs. Their low grades reflect multiple issues with transparency, reliability and timeliness.

Overall, Robson and Dahir find that municipal budgets and financial statements have improved overtime – but not consistently, and not enough.

They find that most municipalities still present budgets that do not match their financial statements. That means that people cannot compare plans and results, and cannot see what a budget implies for their municipality’s capacity to deliver services in the future. They also note that many municipalities separate operating and capital spending, and tax- and rate-supported activities, presenting a fragmented and incomplete picture of costs and programs. Furthermore, many city budgets are late – so councillors often vote on budgets after the year has started and money was already committed or spent.

Robson and Dahir answer the question: How could more municipalities earn A grades?

“First, they should prepare their budgets using the same public sector accounting standards (PSAS) that they use in their financial statements,” explains Robson, adding that accrual accounting would modernize municipal capital budgeting, expensing long-lived assets as they deliver services, rather than showing massive cash outlays up front and nothing later. PSAS-consistent budgets would show the same consolidated revenue and expense measures that appear in financial statements, including all entities that the municipal government controls and that depend on it for financing.

Further, they say that provincial governments that impede municipal budget presentations by requiring separate operating and capital budgets need to stop, that cities should seldom post below-the-line adjustments and that opaque budgets discourage engagement and informed input.

Robson and Dahir warn that a slowing economy, demands for housing and infrastructure, and constrained finances of senior governments will cause financial stresses for municipalities in the years ahead. Better information, they conclude, “would help raise the financial management and fiscal accountability of Canada’s cities to a level more in line with their importance in Canadians’ lives.”

For more information contact: William B.P. Robson, CEO, C.D. Howe Institute; Nicholas Dahir, Research Officer, C.D. Howe Institute; and Lauren Malyk, Senior Communications Officer, C.D. Howe Institute, 416-865-1904 Ext. 0247, lmalyk@cdhowe.org

The C.D. Howe Institute is an independent not-for-profit research institute whose mission is to raise living standards by fostering economically sound public policies. Widely considered to be Canada's most influential think tank, the Institute is a trusted source of essential policy intelligence, distinguished by research that is nonpartisan, evidence-based and subject to definitive expert review.