March 7, 2023 – The budgeting practices of many major Canadian cities are needlessly opaque and confusing, says a new report from the C.D. Howe Institute.

In “Show Us Our Money: Fiscal Accountability in Canada’s Cities, 2022,” William B.P. Robson and Nicholas Dahir present the C.D. Howe Institute’s annual assessment of the transparency and quality of 32 major Canadian municipalities’ budgets and financial statements.

“This evaluation is not about whether municipalities tax and spend too much, or too little, or in the wrong ways,” explains Robson, C.D. Howe Institute CEO. “It is about how well their financial documents help councillors, taxpayers and citizens make those judgements.”

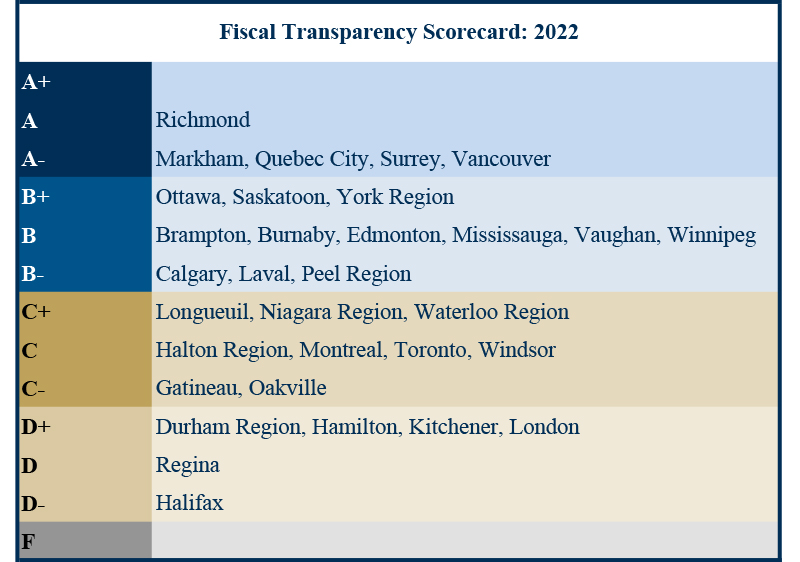

The report awards these cities grades ranging from A to D- based on their 2022 budgets and 2021 financial statements. At the top was Richmond, which earned an A for clarity, completeness and promptness. Others among the top of the class included Markham, Surrey, Vancouver and Quebec City, which all earned grades of A-.

At the other end of the scale were Durham Region, Kitchener, London, Hamilton, Regina and Halifax. All received marks in the D-range because of numerous problems of transparency, reliability and timeliness.

Among the major cities in the middle of the pack were Toronto (C), Montreal (C) and Calgary (B-).

A pervasive problem is that, even though these municipalities publish year-end financial statements that are consistent with public sector accounting standard-consistent (PSAS) and get clean audits, most do not present even summary PSAS-consistent figures in their budgets. Most also presented separate operating and capital budgets, with the latter prepared on a cash basis, and many budgets also separated tax- and rate- supported activities. The authors note that even experts will struggle to reconcile these budgets with past and future results as published in financial statements.

Robson and Dahir urge all municipalities to present budgets that are consistent with their financial statements so that any motivated, but non-expert, reader can easily find and interpret the key figures. They further urge provincial governments that impede PSAS-consistent municipal budget presentations through requiring separate operating and capital budgets to stop doing so.

“Timeliness is also critical to good governance and accountability,” says Dahir. “A city should not be collecting revenue and incurring expenses before council has passed the budget. Financial statements should appear quickly, while the information is still fresh and can inform budget decisions.”

“Better and timelier budgets and financial statements would help raise the financial management of Canada’s cities to a level more appropriate to their importance in Canadians’ lives,” conclude Robson and Dahir.

For more information contact: William B.P. Robson, CEO, C.D. Howe Institute; Nicholas Dahir, Research Assistant, C.D. Howe Institute; Lauren Malyk, Communications Officer, 416-865-1904 Ext. 0247, lmalyk@cdhowe.org

The C.D. Howe Institute is an independent not-for-profit research institute whose mission is to raise living standards by fostering economically sound public policies. Widely considered to be Canada's most influential think tank, the Institute is a trusted source of essential policy intelligence, distinguished by research that is nonpartisan, evidence-based and subject to definitive expert review.