The Study in Brief

Competition policy and enforcement need to be able to keep pace with business models that have emerged in the digital age. Fittingly, Canada is in the midst of a review of its Competition Act that is addressing this question.

A key goal of any reform should be to deter anti-competitive practices by firms whose business models rely on gathering and leveraging large troves of data through digital technologies, when those practices threaten competition, innovation or harm Canadian consumers.

Achieving this goal will require Canada’s competition authorities to have the ability to better assess whether in fact certain transactions, conducts, or strategic acquisitions, predicated on applying algorithms to very large user-derived data sets, unduly hinder competition in ways that cause harms to Canadians.

One model being considered for reform would apply special “ex-ante” or preventive rules to a few so-called “Big Tech” companies, on the assumption that they are causing or likely to cause economic harms that cannot be corrected after the fact.

While it is true that the business models of these, but also of other firms, resting on user-provided data and on technology, can generate substantial network economies that some competitors may find difficult to overcome, they have also been the source of real benefits for Canadian users of their services.

Whether a firm’s business model, its conduct, or even its dominant position in a market harms competition or Canadians more generally, is an empirical matter that should be decided on a case by case basis, using widely applicable rules that encompass all existing or even potential competitors and competing technologies in a market. In this respect, the use of the term “digital markets” can be unhelpful, given the wide array of business practices covered by this term, including brick and mortar firms that also sell on-line and gather information on their customers.

Instead of separate rules applying to Big Tech or “digital markets,” the Competition Bureau needs new techniques and tools that would allow it to gain more information about, and quickly pivot its attention toward emerging issues.

This approach would include rewarding pro-competitive behaviour by instituting an objective way of identifying companies that should, from time to time, be targeted for special pro-active attention for previously causing well defined harms to competition or to consumers – whereas others would be freer to operate and innovate without such special scrutiny.

It would include new tools to improve real-time monitoring of market transactions online and their impact on competition, and metrics to properly measure the state of competition and to assess whether mergers are likely to have anti-competitive impacts in non-traditional markets.

It would include providing more incentives for private parties to seek redress in court for anti-competitive behaviour that they can show has hurt both their business and competition itself. And it would include approaching competition as part of a collaborative effort between many relevant authorities, for example, at the intersection of privacy and competition rules.

The author thanks Jeremy Kronick, Benjamin Dachis, Tim Brennan, Dan Ciuriak, Peter Glossop, Konrad von Finckenstein, Mark Warner and anonymous reviewers for helpful comments on an earlier draft. The author retains responsibility for any errors and the views expressed.

Introduction

An intense policy debate is taking place in Canada and elsewhere about corporate strategies enabled by digital technologies and their impact on competition and on Canadians’ standards of living.

Participants in this debate agree that vigorous competition among firms is generally a good thing, as well they might: ultimately, lack of competition harms innovation and workers’ purchasing power. Corporate behaviour that resulted in lower availability or quality of valuable goods and services, prevented new competitors from providing alternatives in the marketplace or involved illegal actions such as false advertising or predatory pricing, would lower Canadians’ standards of living. Competition policy is meant to ensure that such outcomes are avoided through the maintenance of vigorous competition – failing which, regulators can correct for or even punish anti-competitive behaviour.

How is competition policy to be conducted in the digital age? Much of the discussion on this issue has focused on companies that offer online services, or applications or physical products such as smartphones that allow access to these services. Some of these companies – often referred to collectively as “Big Tech”

In turn, these approaches are premised on the view that these companies exercise too much power in the markets in which they operate. The twin questions of whether they do and, if they do, what legislatures and competition authorities

These and other companies’ proprietary technologies and user bases – and the information they derive from these users – give them an unprecedented ability to meet or anticipate demand, execute speedily and in general hold their users’ interest and attention. It is fair to say that consumers and businesses everywhere lap up the capabilities they offer. Many would say this is not a bad thing. But others would argue that this leaves users with no practical alternative to obtain the products and services they desire. That is, users and the public at large are “locked into” a potentially inferior outcome if better alternatives are kept from emerging due to dominance of the market by a few firms.

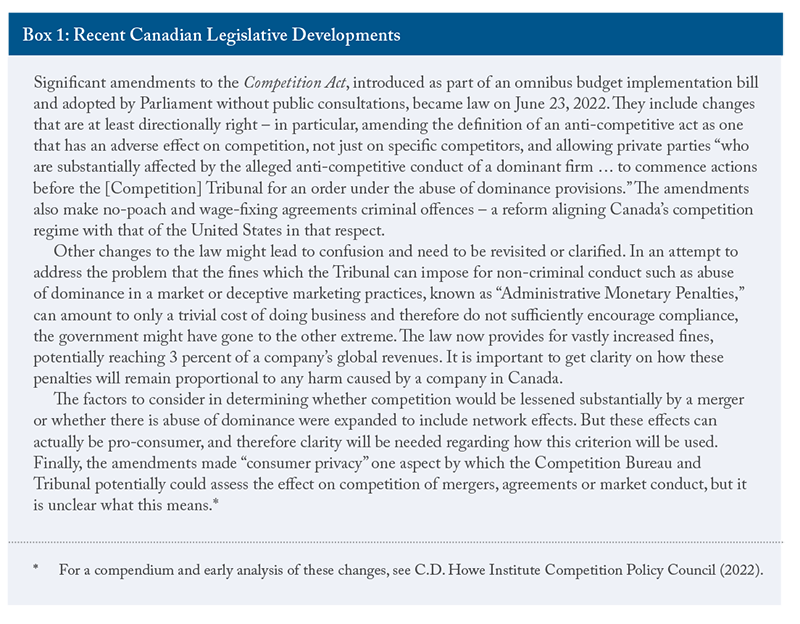

The federal government has launched a review of the Competition Act that will consider these issues, and has published a discussion paper (Canada 2022b) outlining a range of possible approaches and reforms, but ultimately committing to a new role for the Competition Bureau “in line with steps taken by many of Canada’s key international partners” and appropriate for the digital age. The review follows early moves by the government in the 2022 Budget Implementation Act (see Box 1).

In this Commentary, I examine the issue of competition in the digital age, as well as key areas for reform identified in the federal government’s discussion paper, and what these considerations might mean for the direction that reform of the Competition Act should take. I argue that the threat to competitive markets posed specifically by the use of digital technologies – notably the ability they provide to gather online, analyze and use enormous amounts of data – and from the business models and even the large firms built around the use of these technologies, does not warrant introducing rules of competition that would apply ex ante only to a set of companies and not to others that compete with them and that might engage in the same conduct, and only because these companies loom large in designated “digital markets.” Doing so would itself distort the marketplace and competition more generally.

Efforts should certainly be directed at ensuring that large firms offering internet-based services – and these go well beyond “Big Tech” – play by a set of widely applicable rules, including rules outside the ambit of competition policy proper, such as privacy, tax or safety rules, each of which appropriately involves its own regulatory sphere. As well, policymakers should ensure that competition authorities have the tools and resources needed to understand and address the potential impact on competition of online transactions, of algorithms used by companies to attract users or set prices or of the impact of potential mergers and acquisitions in a fast-moving technological space. Below I give a few examples of what these tools might be.

That being said, the federal government and legislators should be parsimonious in allocating new powers to the Competition Bureau, such as the ability to compel the production of private information outside of a formal investigation or to act outside the confines of sometimes lengthy litigation (Canada 2022b, 51–4), including on an ex ante or preventive basis. They should ensure accountability to the public regarding how these powers are used. Although such powers could help Canada harmonize its approach to relevant competition issues with those in other countries, harmonization risks importing mistakes made elsewhere that might only become apparent over time, while losing the benefits of an approach that might be better suited to Canada’s needs, economic structure, institutions and position as a middle economic power.

Indeed, as I outline below, legislators should ensure that any such new powers are accompanied by safeguards that describe as clearly as possible the circumstances in which they may be exercised, so as to minimize the risk that the Bureau could take actions that inadvertently limit the benefits of digital adoption to Canadians or, more generally, the efficiency and adaptability of Canada’s economy. Efficiency and adaptability should remain a central goal of the Competition Act, informing how competition policy can also help achieve other goals beneficial to Canadians.

Why Does This Matter? It’s about Innovation and Living Standards

Over time, the rise in standards of living depends closely on the spread of useful innovations and, at the level of individual Canadians or communities, on how gains from innovation are distributed. To benefit Canadians, therefore, Canada’s approach to competition policy in the digital age must be rooted in a vision of how to promote and distribute the benefits of innovation.

The digitalization of business, research and government activities in Canada has had a positive impact on the country’s economic performance (Liu 2021). It contributed to employment and economic resiliency during the pandemic (Aston et al. 2020; Bank of Canada 2021, chart 17; Mahboubi 2022). It has ushered in useful innovations in fields as diverse as commerce, manufacturing, medicine, environmental science and government services. Almost every business, institution and individual with internet connectivity and basic education and skills is now able to reach or offer services to the general public or tap credible sources of information to which they would not otherwise have access.

Canada’s approach to competition in the digital age needs to reflect these realities. Illegal or harmful practices that occur by or through those that provide information or services online need to be addressed and, if possible, prevented, just as they would if occurring through other channels. But they are not unique to the “tech” companies, the online world or the digital provision of services.

Successful innovation stems from the quest to make new, more or better products (or invent solutions) that meet the demand for better living standards at the same or lower cost than before through new technologies or methods or more efficient use of society’s economic resources. Firms’ ability to adapt to changes ushered in by innovation are a benefit to society at large. Innovation is a broader and more dynamic concept than efficiency, which refers to the most economical use of available resources given available technology. Efficiency also yields more resources potentially to allocate among Canadians through lower costs. Both concepts are related: the search for efficiencies or, if you will, for lower costs can lead to useful innovations (Harberger 1998).

This explains the purpose of Canada’s Competition Act, which is not just to encourage and maintain competition, but to do so specifically to “promote the efficiency and adaptability of the Canadian economy.” This is a unifying check on other goals that efficiency and adaptability can promote – namely, to “expand opportunities for Canadian participation in world markets…ensure that small and medium-sized enterprises have an equitable opportunity to participate in the Canadian economy and…to provide consumers with competitive prices and product choices” (s. 1.1).

This is not to say that these other goals currently embedded in the act or that have been mooted as part of the debate over modernization of the act are not important; rather, efficiency and adaptability are directly linked to rising Canadians' standards of living and, as Iacobucci (2021) notes, “Economic efficiency is always at stake in competition policy matters, while other [policy] values only occasionally arise” (p. 56) and can be addressed through other policy means.

Thus, while it is important to ensure that small businesses or, indeed, other groups have the opportunity to grow – and, therefore, that the state of competition should be evaluated through that lens – competition policy should not favour small businesses as a class of business. Otherwise it risks doing so at the expense of overall economic well-being, since many small businesses by their nature cannot alone provide the scale or cost competitiveness that larger ones do and that benefit consumers and workers.

Concerns around Dominance by a Few Companies in the Digital Age

The key worry about competition in the digital age is that a few firms come to dominate the markets they operate in, as a result of dynamics that digital technologies have enabled or amplified.

In Canadian law, “dominance” refers to a situation in which “one or more persons substantially or completely control, throughout Canada or any area thereof, a class or species of business.”

Dominance – also referred to as “monopoly power” and extending all the way to a pure monopoly situation in which a single firm dominates the entire market – is thus the most extensive form of “market power” that a firm potentially can wield. Conventional indicators of a firm’s market power include the ability to maintain higher prices or lower-quality services, the existence of barriers to entry into the relevant market, the extent of change and innovation in the relevant market, any countervailing power by downstream (customers) or upstream (suppliers) entities doing business with the firm and so on.

However, the growth of two-sided markets operating on digital platforms has challenged the traditional means of assessing market power or dominance. Two-sided markets involve the potential for the number of users on one side to generate positive externalties on the other side – for example, the more a radio station has listeners on one side, the more it can charge advertisers on the other. Two prominent examples in the digital age are the business models of Google and Facebook, which provide services at no monetary cost to individual users (and at low marginal cost to them per additional user), in exchange for their data – which become more valuable the larger the dataset and can be monetized with advertisers or others who are interested in the characteristics of these users. In such cases, market power can hardly be gauged by the price charged individual users in one market, although it affects what users such as advertisers can be charged in the other market.

In these circumstances, it would be incorrect, as Tirole (2017, 393) argues, to automatically “condemn low pricing as predatory, or high pricing as excessive” on platforms that mediate between two communities of users. These pricing structures are not signs of monopoly power per se, since they “are adopted even by the smallest platforms entering the market” (393). Other methods of assessing market power should be found in these cases before asserting that a firm is “dominant,” as I discuss below.

Sources of Potential Market Dominance Specific to the Digital Age

Collecting and interpreting information about one’s customers and suppliers have always been essential to successful businesses. What has changed over the past three decades is the ability to collect, process and analyze astronomical quantities of information – “Big Data” – using digital technologies. Scale is of critical importance in extracting information from “Big Data,” in particular through sophisticated algorithms such as artificial intelligence (AI) that can enable a business to offer better-targeted goods or services more efficiently – an ability sometimes referred to as “mass customization” – or even assume decision-making a role itself in the market.

The question is whether these developments mean that a few companies, whose business model rests on their investments in these technologies, have acquired an insuperable economic advantage – “dominance,” if you will – in some markets, which they tend to exploit unchecked at the expense of their users or of others in the economy, or of the state of competition itself.

The fear is that such a dynamic – driven by a combination of powerful network effects,

While network effects can offer great potential benefits to users, such a dynamic could lead to a “winner-take-all” scenario in which would-be competitors are kept at bay by the high cost and risk of building and trying to entice users to switch to a possible rival network. This could, for example, confer on the firm offering such a service a natural hold over its users, including over suppliers trying to reach potential customers through the service. The firm might then use its power to squeeze lower prices from suppliers, or to substitute its own product for those of such suppliers, using information about product demand which it obtains from the transactions it intermediates.

The market power of a firm benefitting from such dynamics could also have a deleterious effect on innovation. The firm might not feel the pressure it otherwise would from competitors to introduce useful innovations of benefit to users and to the broader economy (United Kingdom 2020). As well, the data hoarded in the firm’s proprietary data “enclaves” might deprive potential startups of that key material – the better for the large firm to be able to buy them up cheaply or at least control their research agenda to its benefit, again limiting the potential for beneficial innovation in the economy (Birch 2022).

In practice, however, and as I show below, it is incorrect to assume that data and technology, combined with network effects, necessarily lead to a market’s “tipping” into dominance by one firm or very few firms such that competitors would be prevented from emerging or, in general, that the power of companies that have risen thanks to big data, technology and network effects is unchecked by other factors. The latter include regulations of general application throughout the economy, and factors that differentiate their competitors from them. As understandably obsessed as we are with data and technology, the network economies they help generate and the market predictive abilities they confer, they nevertheless do not constitute the entire universe of comparative advantages that competitors may deploy, such as an established brand, desirable physical location or superior management.

This is true in a dynamic sense as well. Data have been called “the new oil,” and in terms of their economic importance, that analogy makes sense. But data are easily replicable or shared electronically at practically zero cost, their value might decline over time in certain contexts and, indeed, similar data from the same user can be collected multiple times by different organizations and hence be available simultaneously to many competitors.

In short, the question of whether “winner-takes-all” obtains in practice, and whether today’s “winners” can maintain themselves in that position, is an empirical one.

Is Dominance Automatically a Bad Thing?

Market dominance by a firm is not necessarily a bad thing for users of that firm’s goods or services. In the digital age, data and digital technologies allow a range of companies, across industries, to better target their offerings to specific potential customers, which is why they are so valuable to both their individual users and to those trying to reach them. These capabilities have made a number of digital services appear indispensable – but perhaps they just offer great value and a compelling experience, and for that reason have become very popular. And therein lies the rub: popularity by a successful firm is not an economic sin, except from the viewpoint of those whose offerings of goods or services, or own influence, suffer as a result.

Indeed, the Competition Bureau currently “recognizes that firms may acquire a dominant position by simply outcompeting their rivals, for example, by offering higher quality products to consumers at a lower price. In these cases, sanctioning firms for simply being dominant would undermine incentives to innovate, outperform rivals and engage in vigorous competition” (Canada 2019, 3). Echoing this thought, the recent federal discussion paper notes that “[m]uch of the success of large digital platforms is the reward for innovation and producing compelling goods and services, offered in many cases at zero monetary cost to the consumer, and enhanced by critical network effects” (Canada 2022b, 31).

Even the European Commission, which shepherded a Digital Markets Act and a companion Digital Services Act through the EU adoption process, took care to specify that the size and reach of “Big Tech” companies also underpin potential for good. Indeed, many obligations under the Digital Services Act leverage the capabilities of these large firms to assist the EU in preventing activities online that are illegal more generally, such as hate speech or manipulation of the political process, or breaches of privacy.

Such power to deliver goods, services and information to and from individuals, governments and other institutions, and businesses, which companies of a smaller reach could not provide on their own, became evident in Canada during the COVID-19 pandemic. From the viewpoint of users – be they ordinary Canadians, small businesses or even governments – size and reach can be a great feature, not a bug.

The Relevant Market and Competitors when Assessing Market Power

The term “digital markets” is in widespread use in discussions around digital technologies and competition.

A similar observation applies to the terms “gatekeepers,” “tech firms” or “Big Tech,” which are in widespread but not consistent use to describe specific companies targeted by authorities within “digital markets”: there is no economic point imposing special strictures on “gatekeepers” when users can easily go around the gate. With digital technologies so ubiquitous, it is hard to fathom which large successful or growing company is not a “tech” firm these days. And just as the term “platform” subsumes a variety of business models and competitive circumstance (OECD 2019), the term “Big Tech” is not useful as an indicator of the actual competitive circumstances that companies often grouped under this moniker – and their users and competitors – experience in the markets in which they operate. As a result, the use of these terms can obfuscate the true extent or nature of competition in the provision of certain services offered digitally, and hence of any market “dominance” a firm might exercise or threat it might pose to competition generally.

Competition authorities and legislators that do not keep these semantic and conceptual pitfalls in mind risk concluding that there is an apparent lack of competition, thus exaggerating threats to the public welfare while ignoring the public benefits and triggering a potentially over-restrictive regulatory response as a result, which could damage innovation and income growth. Below, I examine some specific ways in which these fuzzy concepts can lead competition authorities to misjudge the extent of competition.

The technological and data revolution that has brought the digital age to the fore has certainly created new ways for customers or users of traditional services to access retail, news, entertainment, taxi, restaurant, medical and hotel services, and for providers of these services to reach customers. Business models based on digital technologies have challenged incumbents to do better by their customers, and challenged the business models of previously established intermediaries between buyers and sellers – such as those of newspapers and magazines that relied on advertising revenues and now must rely more on subscriptions (as some do quite successfully). But the revolution has not changed fundamentally the needs that industries and providers of services fulfil.

The reality is that “legacy” competitors have increasing access to digital tools, which they are using to gain or regain their competitive footing against more “tech-based” delivery models. Examples include increasingly sophisticated data-based strategies on the part of traditional “bricks-and-mortar” retailers, which collect data on their customers through loyalty programs and add online shopping to their in-store offerings, or on the part of suppliers that use an increasing panoply of digital tools and support services to sell directly to customers online. Having access to platforms offered by Canadian companies such as Shopify or Lightspeed, for example, has provided Canadian and non-Canadian sellers an array of options to reach Canadian and foreign consumers (Schwanen 2021).

Competitors can flex advantages such as brand and location. For example, Dollarama is growing in popularity thanks to its private brands that outcompete those of other large companies on price (Fournier 2022), while smaller retailers are banding together to be able to compete with them on logistics (see Brault 2022). In short, and although it might have been obscured by the temporary above-trend growth of online retail sales during the pandemic, the future of retail is “omnichannel,” and within that future the demise of traditional retail is vastly exaggerated (Schwanen 2022).

Similarly, “legacy” local taxi services now have their own apps and rating systems emulating Uber and Lyft, and many restaurants provide deliveries (or, as in retail, curbside or in-store pickup) through their own website or apps. Another example is the entertainment market. Not long ago, Netflix was included with Facebook, Apple, Amazon and Google among the so-called FAANG high-flying “tech” entertainment companies. Netflix was gradually supplanting traditional cable services, and there seemed to be no rivals in sight for its streaming service. However, new and traditional media competitors have set up similar or more attractive services that also deliver compelling stories to consumers’ screens, drawing potential viewers from Netflix. It transpires that, despite its pioneering model and early technological lead, Netflix is now just another media company, which has been overtaken by the soon-to-be 100-year-old Disney Company.

Even in the era of booming online advertising led by Facebook and Google, which has benefited small businesses in particular through new means of reaching promising customers (United Kingdom 2020), other means for advertisers to reach specific audiences remain a robust part of the market. Examples are TV, radio or public transit ads, billboards, sponsorship of festivals and other events, sports teams or facilities and even newspapers.

Competing for Large Social Media and Search Platforms

What is the relevant market by which to assess the market power of a company such as Facebook, to use that prominent example? Is it the market for “social networking” – services that facilitate for free the sharing of images and stories with friends or people who share similar interests? In that case, there certainly is competition from platforms such as TikTok, Snapchat, Pinterest and Twitter, or perhaps LinkedIn and other such “freemium” services. Facebook caught on among early social networks, quickly evicting MySpace from the top spot and growing into the social networking behemoth we know today. But is it unrivalled? Can it keep out all potential rivals? Is it, as claimed by the US Federal Trade Commission, a “monopoly”?

The FTC’s initial attempt to break up Facebook’s “monopoly” was dismissed by a US court in 2021 because the commission had not defined the market within which Facebook was said to exercise this monopoly. The court allowed a revised case to proceed, while noting that the FTC faced a “tall task” in proving its case, warning that the bar for breaking up Facebook was very high, given that the FTC previously had allowed Facebook to proceed with its acquisitions of Instagram and WhatsApp (Economist 2021; Zakrzewski 2022).

We know that there are rivals for the attention of Facebook users – for example, among specific demographics. Certainly, a new entrant able to grab the public’s attention with a new products or services, such as TikTok, has no problem growing, competing and accumulating a treasure trove of data in the process, including from existing or would-be Facebook users (Naughton 2022). Facebook has to walk a fine line such that the uses of its platform, or changes it makes to the user experience in order to become more profitable, do not turn its users off.

Indeed, Facebook needs to maintain the trust of users and that of the public writ large. If users reduce their time on the platform, the vaunted network economies (and with them their attraction to advertisers) might start withering away, especially as the data Facebook has on hand risk becoming stale. Of course, some users might be “hooked,” as others are hooked on TV shows or video games, but in general they have alternative ways to communicate between them, or other platforms on which to spend their time. Facebook is hardly an essential service – it is useful and fun for many, in part because many others choose to be on the platform and presumably because Facebook knows how to target content to its individual users.

What, then, is the appropriate way to circumscribe the market in which Facebook and others operate two-sided markets online? I argue that it is the market for users’ attention – more precisely, the one in which firms sell their users’ attention (or the data they harvest that can help others grab these same users’ attention) to advertisers, political parties and so on. As remarked as early as 1971 by Herbert Simon, future winner of the Nobel memorial prize in economics, an abundance of information means a relative scarcity of what information consumes: attention. This scarcity creates an increasingly rewarding market for attention, and the ingenuity of Facebook and Google is that they offer something useful for free, in exchange for users’ attention, which is a marketable commodity. This attention is sustained through algorithms or other means to keep users engaged, notably for the purpose of selling advertising.

That being the case, a key metric of Facebook’s market power should be how much time people in the aggregate across an economy (or across specific sub-groups) spend as active users of its apps, relative to other uses of their time during which data on their activity can be collected and monetized.

Since there are only 24 hours in a day, analysts and competition authorities should look at use of time, Internet use and other surveys that might reveal the extent to which Canadians are beholden to one platform or are using multiple ones. Such data would yield crucial insights, since market power cannot be inferred from aggregate platform usage alone, but depends on the ability of potential consumers to “multi-home,” or use a number of competing platforms within a certain time period (Prat and Valletti 2021).

A related aspect of a platform’s market power is its vulnerability to competitive challenges in the form of reduced popularity, even if relative to that of emerging competitors, or reduced ability to harvest users’ data. For example, the devices with which users access third-party apps might give them the option of not allowing data about their other interactions to be shared with the app. Devices that allow more privacy protection – such as privacy rules that limit what personal data can be collected and how they can be used – and providers of rival services that offer better privacy, whether or not for a fee, are all significant competitive threats to business models that rely on, in effect, monetizing users’ attention in order to harvest their data. At the same time, these threats also force companies to take their users’ individual privacy seriously.

In short, the contribution of a platform to overall market expansion and accessibility of resources it offers, as well as the vulnerabilities of its business model given options at its users’ disposal, should be considered when assessing market power.

Treating “Big Tech” as a Monolithic Threat to Competition

As the Organisation for Economic Co-operation and Development (OECD 2019) has pointed out, the respective business models of various platforms, and the competitive environment in which they operate, differ a lot. And this applies to “Big Tech.” Some indeed compete in highly concentrated markets – Microsoft’s Windows and Apple’s MacOS together hold more than 90 percent of the global market for desktop computer operating systems. This contrasts with other sectors, such as retail, where traditional “bricks and mortar” stores selling equivalent products are able successfully to take on Amazon and other e-commerce pioneers, especially in the post-pandemic context in which e-commerce has fallen from its recent heights as a share of total retail trade (Schwanen 2022). Such differences in both operational structures (headcounts, margins, etc.) and competitive environments means that these companies should not all be looked at through the same lens.

In some markets where they make their services available to users for free, “Big Tech” platforms can be so popular that they have leveraged users’ data to gain a significant market share in highly targeted online advertising. At that juncture, indeed, any collusion between them is an obvious potential negative for the users of their services. Competition authorities have been on the lookout for such anti-competitive behaviour: Google is now facing charges brought by multiple US states alleging that it and Facebook distorted the auctions for online ads, which would have had an egregious impact on advertisers, given their significant respective shares of the advertising market which they helped expand in the first place (McKinnon and Tracy 2020).

Different competition issues can arise related to ownership of the hardware or underlying systems that connects individuals and businesses in the digital age. It is unreasonable to expect consumers to carry multiple phones, each based on a different system or to switch from one to the other device on a regular basis. When both apps and individual users need a service to reach each other, such as with smartphones’ operating systems, the system’s owner/operator can flex this market power by hindering transactions on its system between third parties who effectively need the service to conduct them, in order to benefit its own products.

A prominent US court case illustrating just this situation is that of app maker Epic Games. That company was unable to receive payments from its app’s users on phones using Apple’s iOS system unless the transactions went through Apple’s mobile phone-specific payment system, which took a significant cut from the app user’s payment. That situation existed, in part, because of an effective duopoly in the market for ubiquitous smartphones’ operating systems between Apple and Android. One outcome of this case was that alternative payment methods were made available for users accessing apps through mobile phones.

The general point here is that, while they flex their market power, as any company would, “Big Tech” companies have different interests befitting their different business models, and therefore can take different sides of specific competition issues – for example, Facebook intervened on the side of Epic Games in its case against Apple. And these large firms can compete ferociously against one another on access to users and on gaining users’ trust. For instance, many analysts argued that a new Apple iPhone privacy policy could threaten Facebook’s business model, which prompted the latter to accelerate its development of proprietary hardware under the company’s new name, Meta.

Fast-growing cloud services provide another example of fierce competition. Large firms compete for these services with one another and with the broader information technology ecosystem. Businesses that use these services have numerous alternatives, including cloud providers, on-premises technology and hardware providers, private data centres, hosted installations, co-located data centres, software providers, managed service providers and hybrid solutions that combine these options. Even the cloud itself is segmented into different offerings tailored to the customer’s needs, replete with consultants and other intermediaries advising firms on the right product for them. Moreover, each segment is competitive, with not only Amazon, Google and Microsoft offering services in that space, but also IBM, Dell, Salesforce and quite a few others (Song 2021).

All this discussion points to the deficiencies of a broad-brush discourse (let alone policy) aimed at restraining “Big Tech” compared to an approach tailored to the competitive circumstances actually obtaining in the markets in which each company operates. That being said, it also points to competition authorities needing to ensure that competition policies and enforcement capabilities effectively apply in light of rapidly emerging technologies and business models that characterize the digital age.

Tackling and Preventing Misuses of Market Power

As I have argued, competition in markets in which large online marketplaces or social media companies operate is far more robust, and the dominant position of “Big Tech” far less secure, than is often described as justification for attempts to apply a special competition regime to these platforms. In particular, I highlighted the problem of looking at companies with a single and dedicated lens that presumes a “winner-take-all” outcome, as opposed to approaching them in light of the relevant individual and often quite dynamic circumstances of each case. This is largely because Canada should try to avoid an approach that seems to target companies mainly because they are big, technology-intensive and successful, which would send the wrong signal about its trying to attract or grow more of its own successful companies.

Having said this, each company typically grouped under the “Big Tech” label has been found, notably by competition authorities in the United States and the EU, to have abused their positions or otherwise engaged in anti-competitive or misleading practices at some point. In that context, some prominent analysts have asked why Canada’s Competition Bureau was not investigating these same companies, on par with other jurisdictions. The answer provided is that the bar is too high for the Competition Bureau to win cases in this country, and that it is also hamstrung by lack of power to compel companies to produce evidence without formally launching an investigation (Bednar and Shaban 2021).

A related consideration is whether competition authorities are able to assess in real time what are generally acknowledged to be very dynamic market conditions, both for digitally conducted transactions and for control of relevant technologies and access to user bases. Thus, part of the argument in favour of “ex ante” scrutiny and restrictions on the activities of “Big Tech” seems to rest on officials’ difficulty in staying on top of business decisions they might see as problematic, given the speed with which technology is being developed, the myriad individual connections and transactions conducted online, and the role of algorithms, in addition to the difficulty of uncovering potentially misleading advertising or other potential underhanded means by which companies attempt to hold on to their users online. This means, in turn, difficulty in assessing in a timely way negative developments that might be difficult to undo after the fact (Canada 2022b, 51).

Bednar, Qarri, and Shaban (2022) review types of cases in which the Competition Bureau’s ability to intervene to maintain competition and bring Canada up to par with recent international experience and developments could in their view be considerably strengthened. In turn, many of the recommendations for reform put forward by the Competition Bureau itself (Canada 2022a) and contemplated in the ISED discussion paper (Canada 2022b) address how the ability of the Competition Bureau to address such cases could be bolstered and in general how Canada could reduce the differences between it and other jurisdictions when it comes to tackling potential anti-competitive conduct in the digital era.

As mentioned, the 2022 Budget Implementation Act introduced much enlarged penalties for non-criminal anti-competitive conduct, and included network effects among the factors the Competition Bureau will consider when determining whether a merger would result in a lessening of competition or whether a company in a dominant position has acted in such a way as to result in a lessening of competition.

Key additional reforms now on the table, as detailed throughout the discussion paper (Canada 2022b), are as follows.

- Give the Competition Bureau additional power to identify, and roll back or seek to punish, so-called exclusionary “unilateral conduct” – that is, conduct not involving mergers or collusion with other firms – in which companies might engage to boost their market position and which would lessen competition (not just harm individual competitors) to such an extent as effectively to constitute an abuse of a dominant position. Examples cited of such conduct include self-preferencing (see footnote 11 above) and “parity” conditions that an online marketplace can impose on vendors on its site, such as requiring them not to offer the same products at a lower price on their own or on third-party sites.

- Expand the means by which the Competition Bureau can address objectionable conduct automatically, such as by enabling it to infer anti-competitive agreements between competitors simply from market developments; diluting the criteria required to establish that a company engaging in the conduct enjoys a dominant position; or indeed doing away with the need to show whether there are competitive harms at all. For example, the discussion paper (Canada 2022b) opens the door wide to expanding the list of conducts that would be considered per se as harming competition (a list currently limited to a few items where civil matters are concerned, notably deceptive marketing) or even just considered to compete “unfairly” with small businesses.

- Streamline and accelerate the Competition Bureau’s ability to address civil matters more generally – for example, challenging a merger or trying to demonstrate that there was abuse of dominance – by removing the need for the Bureau to first convince the Competition Tribunal before proceeding.

- Give the Competition Bureau much greater powers to review mergers across the economy for potential anti-competitive effects – notably by focusing on the acquisition by a “dominant” firm of a smaller one that might possess or develop the technology to challenge it (so-called killer acquisitions) by, among other changes, lowering the threshold for merger notification and enabling the Bureau to rescind its approval after the fact, even after a number of years, if an approved merger unexpectedly resulted in a lessening of competition.

Issues with the Contemplated Reforms

In an era of continuing convergence between digitally and physically delivered products, of continuing technological innovation and, I would argue, of emerging alternatives for individual users and businesses to meet their needs, having one approach to competition apply to some firms but not to others, based on their size and on whether they are successful and operate as “platforms” in “digital markets,” risks unduly tipping the playing field toward less nimble competitors. This would be a costly outcome for Canadians, compared with an approach that would more surgically modernize rules targeting anti-competitive behaviour across the economy, and enhance the tools available to competition authorities to ensure that problematic behaviour online, or other misuse of market power by any company in the digital age, can be quickly identified and countered. No doubt the companies targeted by what would be in effect a dual regime under the first approach have significant market power. But it is incorrect to see this power as uniformly unconstrained and destined to remain so without the imposition of a dedicated regulatory regime.

Canadians should be very sceptical of the advantages being touted by those who would break up “Big Tech” or arbitrarily enforce a separation between the lines of business they enter, as if somehow authorities and experts could predict the future with any accuracy.

Authorities the world over, including here in Canada, tout the benefits for consumers and small businesses of network economies provided by the business models and activities of these and other companies. And yet, they are also ready to constrict existing and future ways by which these specific companies operate, regardless of whether they actually engage in anti-competitive behaviour and without proper safeguards to ensure that this approach does not end up working against individuals’ ability to choose what benefits them or against opportunities for small businesses and others to benefit from the wider economy.

One of Canada’s fundamental economic problems is the difficulty small businesses have to grow here. This is essentially a problem of commercialization and of spreading the benefits of digital innovation to smaller firms. Yet it is hard to see how the new powers proposed for the Competition Bureau, and in general the European-style precautionary approach underlying many proposed competition reforms (see Appendix A), will encourage growth among innovative and efficient businesses in the current context where Canada is already struggling to foster the capital spending and talent retention essential to such growth.

Instead, adopting an EU-like set of regulations targeting “gatekeepers” could be a shortcut to making governments and their agencies the prime gatekeepers, and certainly not always to the benefit of competition. Ultimately, governments and their agencies would be able to decide who is subject to special rules and who is not, and who will be specially scrutinized including outside the confines of a formal investigation in a particular conduct, even without having to show potential harms to Canadians, or giving an impugned company an opportunity to demonstrate the benefits to Canadians of its business model or conduct.

This potential for arbitrariness is worrisome, especially when considering that the Competition Bureau is hampered by the “regulated conduct” doctrine from intervening in cases where governments themselves allow or maintain a number of potentially harmful barriers to competition. These, in turn, are supported by lobby groups whose arguments are often related only tenuously, if at all, to concerns about the overall welfare of Canadians – similar to industry participants that oppose the spread of the digital transformation to their sectors.

The danger, in short, is that regulators in effect would impose a new, supposedly pro-competitive structure on business activities that take place online, or on companies relying on online transactions to do business – lumped together as “digital markets” – that could have harmful effects on competition, innovation and standards of living.

Canada should not automatically emulate these elements of the EU or of some proposed US approaches that risk constraining innovative business behaviour that could benefit consumers and the public.

In general, the greater the powers given to the Competition Bureau, the more legislators should ensure that it applies these powers to problems, existing or prospective – as in the case of mergers – that are clearly defined. Legislators should also ensure that the Bureau delineates in each case why it thinks that a harm it seeks to address negatively affects the efficiency and adaptability of the economy – or other goals, such as the growth of small business or the participation of Canadians in economic opportunities – via a lack or suppression of competition in markets defined by the type of services sought and potential alternatives available to users, rather than, per se, by the technology used or by the business model of competitors. Any penalty the Bureau argues should be ordered by the Competition Tribunal should be proportional to the alleged harm caused. And legislators should formally appoint an independent body to regularly monitor the effects of the new legislation and of its application on Canadians’ economic well-being.

Options and Recommendations

Instead of emulating outside jurisdictions, Canada could leapfrog them for the better by adopting a more flexible yet rigorous approach that would still mean greater interoperability with the jurisdictions of key trading partners. This approach would rest on rules of competition that are generally applicable across all firms and sectors, and allow the Competition Bureau to gain more information about, and quickly pivot its attention toward, emerging issues. These include the issues specific to companies that benefit from network economies, large data troves and information asymmetry.

The approach should also recognize the need for cross-agencies and cross-jurisdiction cooperation to build and preserve trust – critical to an economy founded on data and digital interactions and on the technologies that facilitate and extract value from them – but in a way that also promotes innovation, key to Canadians’ future standards of living. Here, I discuss the basic elements of this approach.

Reward Pro-Competitive Behaviour

The Competition Bureau should institute a more objective way of identifying companies that can be targeted for special attention, to counter the dangers of using broad labels such as “Big Tech,” “platforms” and “digital markets.” There should be a lower bar for investigating or compelling information from companies that have been found to repeatedly run run afoul of competition rules before, including competition rules elsewhere that are relevant for the Canadian market. Such companies would be, for a while, in the “penalty box,” whereas companies free of such sanctions would be allowed instead in the “sandbox,” where they can experiment with innovations or adjust their practices, depending on market conditions, without worrying that they will be singled out among their competitors in the markets in which they operate. This approach recognizes that, although authorities would want to increase their ability to slow things down in the name of prudence in certain cases, more generally companies need to be able to experiment and grow in order to innovate. Yet it would not favour some competitors over others. This approach also could foster an economy of enforcement resources for

the public.

Improve Real-Time Monitoring of Market Conditions

It seems clear that competition authorities need more robust and timely information, and sophisticated ways to process this information themselves, as a way to keep track of market developments that take place online. New tools, possibly including AI and bots, should be brought to bear to gauge market conditions within large online networks, platforms or marketplaces – for example, to be able to detect deceptive marketing activities or monitor the impact of price or quality changes online.

Monitoring and analyses of these data, and flagging concerns with companies and intervening as necessary, could lead to more pro-consumer and pro-innovation outcomes than prohibiting only a few companies from engaging in specific “unilateral” conduct which not only could benefit consumers (depending on the case), but that only they would be prohibited from engaging in. The idea would be to focus directly and in a more timely way on market impacts and behaviour, rather than demanding to “look under the hood” of algorithms themselves, which surely would discourage companies across the board from innovating and could actually foster unfair competition itself if just targeted at a few firms.

New and regular surveys of the extent to which Canadians engage with different platforms that offer them content or networking for free (and the extent to which they “multi-home”) would provide insights into the state of “competition for attention” in these markets, and hence their implications for competition in the other side of two-sided markets, where this attention is actually marketed, such as in advertising.

Arguably, such improved monitoring of practices and conditions in key platforms or marketplaces would be more useful than giving the Competition Bureau the power to compel evidence for “market studies” without having launched an investigation into a specific practice. Such market studies are lengthy, expensive and might be obsolete by the time they are concluded (Krane, Opashinov, and Wu 2021). If reforms of the Competition Act result in new market studies powers for the Bureau, proper safeguards should be in place to ensure such assessments are necessary and not unduly onerous to businesses.

Enhance the Role of Private Litigation

In addition to the new tools and approaches just discussed, Canada should rely more on one much-used feature of the US system, litigation, by providing more incentives for private parties to seek redress in court for anti-competitive behaviour that they argue has hurt their business. Most analysts agree that a dearth of case law in Canada makes it hard for competition authorities to predict confidently the outcome of cases they might be tempted to initiate. I would also say that it makes it easy for commentators simply to speculate about what these outcomes should be.

Encouraging private court actions could help delineate the boundaries of what reasonably can be described as a dominant or monopolistic position, and what counts as abuse of those positions, based on the particular facts of the case. From that perspective, recent amendments to the Competition Act granting Canadians the possibility of access to the Competition Tribunal to stop abuses of a dominant position are a step in the right direction. But they are unlikely to provide sufficient incentive for companies to take any action, considering the expense a complainant would need to incur and that any penalty levied on an offending company would go to the federal government. This new provision should be amended to allow complainants themselves to receive full compensation, by allowing them to claim damages (Glossop 2022).

At the same time, the bar should be set high enough for such challenges to avoid clogging the Tribunal with purely private matters; claimants should first have to demonstrate that a win for them would also be a win for consumers or for enhanced competition more generally.

Improve Assessments of the State of Competition Pre-merger

The worry about mergers runs somewhat counter to the idea that “Big Tech” firms will arrive at a “tipping point” toward dominance of their industry in some predetermined “winner-take-all” scenario. Instead, the worry is that they (and presumably other large firms across the economy) will seek to expand or maintain their leading positions by either swallowing or seeking to control the development of a potential competitor before it emerges as a viable entity, or even “horizontally” by acquiring valuable complementary databases that can enhance the marketable benefits from their own data.

There are notorious cases where competition authorities wished they could revisit certain acquisitions they had cleared – this is what is driving the FTC’s current attacks on Facebook. As its reaction to the acquisitions of Instagram and WhatsApp by Facebook in 2012 and 2014 demonstrate, it is easy in hindsight to say, but hard to show before the fact (Johnson 2021), that a nascent company would have grown into a much bigger competitor had it not been bought, and that such competition would have benefited the public.

In responding to these concerns about potential mergers, competition authorities should make extensive use of available metrics of whether a market is nearing a “tipping point” at which one company comes to dominate the market, such as that relying on a company’s continued drive to spend on research and development proposed by Petit and Belloso (2021). Authorities similarly should take an empirical approach to mergers or acquisitions by large companies of new databases that can be cross-referenced and yield new insights into existing or future users, whose effects are not necessarily anti-competitive (see Calvano and Polo 2021). The purpose of adopting these approaches should be to provide the market with as much guidance as possible regarding how the Bureau might view a proposed mergers.

As mentioned, a lowering of the monetary threshold under which the Competition Bureau does not need to be notified of a potential merger is currently being considered. Safeguards need to be in place to ensure that this extra leeway to challenge mergers and acquisitions does not unduly impede the incentive to form and grow businesses in Canada. The same reasons invoked by the commissioner for getting rid of the efficiencies defence – that Canadians are harmed in every case it is invoked, should also apply in the converse: if parties to a merger can reasonably show that there are no reasons to think it will harm Canadians generally, not just private competitors, then it should be allowed, especially in dynamic markets. The Bureau should issue clear guidelines on which type of company will fall under this new lower threshold and, in the case of foreign acquisitions, should strive to harmonize its approach with that in effect under the notification system in the Investment Canada Act.

Uniquely in Canada, those proposing an otherwise anti-competitive merger, including one that might raise prices for consumers although it would lower costs elsewhere, can invoke the generation of efficiencies alone in defence of letting a merger stand, as opposed to its being one factor, or the key factor, to consider in the merger. It would be one thing if merging companies invoking that defence were required to explain how the merger would benefit Canada’s competitiveness or innovation, or result in savings being passed on to Canadians – but they are not.

Therefore, I concur with assessments (see, for example, Canada 2022a; Glossop 2022) that the efficiency argument in support of mergers needs to be scaled back to the status of an anchoring factor to be taken into account when considering whether and on what conditions to approve a merger. Or, failing which, that at least the onus of demonstrating that efficiency gains will outweigh the losses elsewhere due to reduced competition should ultimately rest on the parties proposing the merger, rather than the Competition Bureau’s having to demonstrate the opposite (see also Iacobucci 2022).

Approach Competition across Many Relevant Authorities

In general, given how ubiquitous the “digital economy” has become, and the multi-agency and multi-jurisdictional interests in questions around privacy, security and online information and the regulation of specific industries, competition authorities cannot carry alone the responsibility of ensuring fair competition in the digital age. Not everything concerning competition needs to be laid at the feet of competition authorities or legislation, just as not everything about trade has to be handled through trade policy. Appendix B elaborates on that point.

In that context, I propose that the new AI and Data Commissioner, announced in the 2021 federal budget, a role reiterated in the Digital Charter Implementation Act, play a central, if essentially coordinating and consultative, role among other relevant Canadian regulators such as the Privacy Commissioner, the Competition Commissioner, the Canadian Centre for Cybersecurity and relevant industry and provincial regulators. In this role, the commissioner would seek to streamline Canada’s approach to cross-cutting issues stemming from the digital transformation, and seek from these partner agencies assurances that they will implement their respective mandates in such a way as to leave the door as open as possible to beneficial data- and technology-based innovation. This would give effect to the initial promise of Canada’s Digital Charter to “leverage Canada’s unique talents and strengths in order to harness the power of digital and data transformation.”

This coordinating group should consider, among other tools, a framework for data sharing and a code of conduct applying to large data-gathering organizations, both of which would provide additional ways to address or prevent anti-competitive behaviour. Noting the interaction of competition with issues around the ownership and use of data in general, the potential for data- sharing models, in targeted circumstances where their application could spur competition of benefit to consumers or business growth, should be addressed to get the full picture of how competition can be encouraged in the digital age. Policies around data sharing and interoperability should foster competition, without jeopardizing the economic and social benefits stemming from network economies (Krämer and Schnurr 2022). It will be important for the new AI and Data Commissioner to address uncertainties in the policy framework around these questions outside of competition policy per se, which hampers Canada’s ability to grow and generate jobs around digital technologies, and impedes the application of competition policy itself, given that privacy consideration can now be incorporated formally in the evaluation of mergers.

A code of conduct applying to large public and private data-gathering organizations – ranked by their user bases in Canada – could identify risks and foster desirable outcomes in the context of rapid innovation. Such a tool, inspired partly by the United Kingdom’s current experiment and partly by Canada’s successful mix of “rules-based” and “principles-based” regulation for financial services, could be particularly helpful given that business practices often appear to move too fast for regulators. Adherence could be voluntary, but adhering would constitute a strong signal, emphasizing a duty of care, trust, security and transparency, encompassing but going beyond legislated obligations, including not acting against the interest of their users (much as actors at the centre of financial markets are bound to similar principles). The AI and Data Commissioner, along with key agencies mentioned above, should meet from time to time with these major actors to discuss their current and forward-looking compliance with the principles underlying Canadian legislation and any relevant international instrument and with the code of conduct, so that all parties are better able to anticipate and proactively address issues and problems. The idea here is that principles-based, but timely, information gathering and supervision is preferable to hard-and-fast rules that can quickly become obsolete and dampen future innovation.

Conclusion

More competition is generally a good thing. Competition authorities need to be vigilant and have the tools to address anti-competitive behaviour. The job should be done, however, with the well-being of Canadians in mind and in a way that is supportive of beneficial innovation and consistent with the ultimate objective of improving the efficiency and adaptability of the Canadian economy.

In reality, what are often described as “digital markets” cover a diversity of competitive situations, and are often more contestable than suggested by approaches applying the “dominant” label to a few companies. That being said, better rules and tools would enforce competition in the digital age, characterized by the now-widespread use of digital technologies across all sectors of the economy.

In particular, reforms of the Competition Act should include an enriched analytical and regulatory toolbox, greater ability of Canadians to seek redress before the Competition Tribunal, legislative safeguards that produce greater certainty around the implementation of competition policy – including concerning the approval of mergers – and a formal coordination structure between different government agencies whose respective areas of responsibilities involve the regulation of digital activities. These steps would address effectively the issues around competition in the digital economy in the Canadian context. They would also help weigh against the possibility that stronger powers of enforcement directed at “digital markets” are not unwittingly wielded in a way that reduces the advantages that Canadians can expect from the digital age.

Efficiency and adaptability remain key goals of competition policy. The approach I suggest here would support a coherent policy framework enabling Canadians to benefit fully from digital innovation, while at the same time making it easier to counter any harms from misuses of data or technology more generally, thus fulfilling the promise of Canada’s Digital Charter.

Appendix A: European Efforts to Restrain “Big Tech”

The EU, in its recently adopted Digital Markets Act (DMA) uses the term “gatekeeper” to describe “Big Tech” companies on which this new law will impose substantial restrictions and obligations. The EU draws a telling parallel between these special obligations or restrictions imposed on large companies it considers to be in the “digital space” and regulations imposed on “too big to fail” financial institutions in the wake of the global financial crisis of 2008. But the parallel is flawed: the DMA imposes strict restrictions and obligations on a handful of companies whose failure to meet obligations would not have the systemic impact on wealth of a financial meltdown, while allowing similarly situated companies to compete freely.

Indeed, the definition of “gatekeeper” in the legislation is based on size (user base) and relationship with other businesses that use the purported gatekeeper’s platform services. There is no correlation with or connection to the potential for harm.

It remains for the EU to designate which “gatekeepers” are “entrenched” in the market – one of the elements, along with size, that determines whether a digital company is to be treated as a gatekeeper. By this is meant a company that is assumed to possess sufficient market power to cause harm to others in the market, and presumed likely to use such power to nefarious effect.

A preventive regulation sometimes is warranted. For example, one stricture of the EU’s Digital Services Act, a companion legislation to the DMA, forbids large digital marketplaces from acting against the interests of their users. This is akin to regulations governing insider trading or required disclosures in securities markets, where one of the consequences of self-dealing by traders can be to erode the trust necessary for the market to function at all. The problem here is not that there is such a stricture, or that it should be enshrined in legislation or a code of conduct. Rather, the problem is the ways in which governments would apply rules to certain firms and not others, and what information these firms might be required to provide in the name of compliance, and under what circumstances.

The EU legislation targets a suite of activities that are at the heart of substantial innovation – for example, by potentially compelling companies to share customer and platform data, algorithms and technical infrastructure without the authorities having to demonstrate actual or even potential harm from the activities, or indeed without consideration of the data-security or privacy risks that might result. This pre-emptive approach is an extension of the EU’s much-vaunted “precautionary principle.” Beyond its otherwise laudable desire to prevent harm before it can occur, however, this approach presumes to know how the public and markets will react to innovation, very possibly hindering the growth across the economy of useful applications of digital technologies or of business partnerships that foster their creation and adoption.

In that sense, the EU’s ex ante approach is not only arbitrary, targeting companies for their size rather than behaviour or for the impact they have on the specific markets they operate in; it can also have profoundly anti-innovation effects.

Appendix B: Competition between Digital Platforms and Legacy Services

Disputes are ongoing over whether and how digital platforms should be able to compete with legacy services. Typically, these concerns are addressed by bringing digitally provided services under a general set of rules that take into account the advantages and greater competition offered by new models and by the fact that many legacy services now offer comparable tech-enabled services. For example, claims by traditional operators of unfair competition by Uber or Airbnb because they were not subject to similar rules (such as safety rules) in how they dealt with customers or communities were effectively addressed by regulating both under a common framework that preserved some flexibility of the newer model. Other relevant examples of regulatory interventions include the Quebec government’s very public intervention against the reportedly greater cuts that DoorDash, Uber Eats, Lyft and other “tech” companies offering food delivery services started demanding from restaurants at the height of closures during the pandemic, resulting in an equally public voluntary reduction of those fees.

Issues around labour standards similarly are being worked out via legislation and regulations that seek to preserve the advantages of more flexible work for individuals, firms and customers – often associated with certain digital business models – while ensuring that the former have access to certain benefits available to employees in more traditional work relationships. This “regulatory playing field” agenda is available to governments that wish to address fair competition issues at the local or provincial level – fostering healthy competition among regulatory models themselves. At the same time, it illustrates the point that analysts and competition authorities should not view competition in “digital markets” as separate from competition in “physical” markets that perform the same function.

References

Aghion, Philippe, and Peter Howitt. 2008. The Economics of Growth. Cambridge, MA: MIT Press.

Akcigit, Ufuk, et al. 2021. “Rising Corporate Market Power: Emerging Policy Issues.” IMF Staff Discussion Note, March. Online at https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2021/03/10/Rising-Corporate-Market-Power-Emerging-Policy-Issues-48619

Aston, Jason, Owen Vipond, Kyle Virgin, and Omar Youssouf. 2020. Retail e-commerce and COVID-19: How Online Shopping Opened Doors while Many Were Closing. COVID-19 series. Ottawa: Statistics Canada. Online at https://www150.statcan.gc.ca/n1/pub/45-28-0001/2020001/article/00064-eng.htm

Bank of Canada. 2021. “Monetary Policy Report.” July. Online at https://www.bankofcanada.ca/2021/07/mpr-2021-07-14/

Bednar, Vass, and Robin Shaban. 2021. “Why Canada’s toothless Competition Bureau can’t go after Big Tech.” National Post, March 26. Online at https://nationalpost.com/opinion/opinion-why-our-toothless-competition-bureau-cant-go-after-big-tech

Bednar, Vass, Ana Qarri, and Robin Shaban. 2022. “Study of Competition Issues in Data-Driven Markets in Canada.” Ottawa: Vivic Research for Innovation, Science and Economic Development Canada. January. Online at https://vivicresearch.ca/work/study-of-competition-issues-in-data-driven-markets-in-canada

Bird and Bird LLP. 2022. “UK confirms its new Digital Markets Competition regime.” Lexology, June 20. Online at https://www.lexology.com/library/detail.aspx?g=533984e3-c891-48c1-9a05-31f556237b90

Birch, Kean. 2022. “Big Tech, Little Oversight.” Policy Options, February 23. Online at https://policyoptions.irpp.org/magazines/february-2022/big-tech-little-oversight/

Brault, Marie-Soleil. 2022. “Le succès d'une entreprise quand les voient se croisent”, Le Soleil numérique, November 9. Online at https://www.lesoleil.com/2022/11/09/le-succes-dune-entreprise-quand-les-voies-se-croisent-081229360aecd7f44dff2b3853830f04

Calvano, Emilio, and Michele Polo. 2021. “Market Power, Competition and Innovation in Digital Markets: A Survey.” Information Economics and Policy 54 (March): 100853. https://doi.org/10.1016/j.infoecopol.2020.100853

Canada. 2019. Competition Bureau. “Abuse of Dominance Enforcement Guidelines.” Ottawa. Online at https://ised-isde.canada.ca/site/competition-bureau-canada/en/how-we-foster-competition/education-and-outreach/publications/abuse-dominance-enforcement-guidelines

———. 2022a. Competition Bureau. “Examining the Canadian Competition Act in the Digital Era.” Submission to Consultation initiated by the Hon. Howard Wetston on Examining the Canadian Competition Act in the Digital Era. Ottawa, February 8. Online at https://www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/04621.html#sec00

———. 2022b. “The Future of Competition Policy in Canada.” Ottawa: Department of Innovation, Science and Economic Development. Online at https://ised-isde.canada.ca/site/strategic-policy-sector/en/marketplace-framework-policy/competition-policy/future-competition-policy-canada

C.D. Howe Institute Competition Policy Council. 2022. “Ottawa moving with unnecessary haste on competition law reforms.” Communiqué, June 9. Online at https://www.cdhowe.org/council-reports/ottawa-moving-unnecessary-haste-competition-law-reform

Ciuriak, Dan. 2018. “The Economics of Data: Implications for the Data-Driven Economy.” Waterloo, ON: Centre for International Governance Innovation. March 5. Online at https://www.cigionline.org/articles/economics-data-implications-data-driven-economy/

Economist. 2021. “Is Facebook a Monopolist?” July 3. Online at https://www.economist.com/business/2021/07/03/is-facebook-a-monopolist

European Commission. 2019. “Digital Markets Act: Rules for digital gatekeepers to ensure open markets enter into force.” Press release, October 31. Online at https://ec.europa.eu/commission/presscorner/detail/en/IP_22_6423

Fournier, Marie-Eve. 2022. “Moins cher que Walmart et Amazon.” La Presse, July 24. Online at https://www.lapresse.ca/affaires/chroniques/2022-07-24/moins-cher-que-walmart-et-amazon.php

Glossop, Peter. 2022. “Damages for Abuse of Dominance: A Necessary Reform.” C.D. Howe Institute Intelligence Memo, June 21. Online at https://www.cdhowe.org/intelligence-memos/peter-glossop-damages-abuse-dominance-necessary-reform

G7 United Kingdom. 2021. Compendium of Approaches to Improving Competition in Digital Markets. Online at https://www.gov.uk/government/publications/compendium-of-approaches-to-improving-competition-in-digital-markets

Grant, Nico, and Cade Metz, “Chat Bot Is a 'Code Red' for Google,” The New York Times International Weekly, January 7, 2023, p.8.

Greenstein, Shane. 2020. “The Economics of Digitization.” Reporter 2 (July). Online at https://www.nber.org/reporter/2020number2/economics-digitization

Harberger, Arnold C. 1998. “A Vision of the Growth Process.” American Economic Review 88 (1): 1–32. Online at http://www.econ.ucla.edu/harberger/vision.pdf

Hern, Alex. 2022. “‘Stop trying to be TikTok’: User backlash over Instagram changes.” Guardian, July 26. Online at https://www.theguardian.com/technology/2022/jul/26/instagram-changes-user-backlash-trying-to-be-tiktok

Howitt, Peter. 2015. Mushrooms and Yeast: The Implications of Technical Progress for Canada’s Economic Growth. C.D. Howe Institute Commentary. Accessed at: https://www.cdhowe.org/sites/default/files/attachments/research_papers/mixed/Commentary_433.pdf

Iacobucci, Edward M. 2021. “Examining the Canadian Competition Act in the Digital Era.” Discussion paper prepared for the Consultation initiated by the Hon. Howard Wetston on Examining the Canadian Competition Act in the Digital Era. September 27. Online at https://sencanada.ca/media/368377/examining-the-canadian-competition-act-in-the-digital-era-en-pdf.pdf

———. 2022. “The Competition Bureau’s Approach to the Efficiencies Defence.” C.D. Howe Institute Intelligence Memo, May 2. Online at https://www.cdhowe.org/sites/default/files/2022-04/IM_Iacobucci_2022_0502.pdf

Krämer, Jan, and Daniel Schnurr. 2022. “Big Data and Digital Markets Contestability: Theory of Harm and Data Access Remedies.” Journal of Competition Law and Economics 18 (2): 255–322. https://doi.org/10.1093/joclec/nhab015

Krane, Joshua, Mark Opashinov, and William Wu. 2021. “Vigorous enforcement, not studies, are what Canada’s competition laws need.” National Post, April 13. Online at https://nationalpost.com/opinion/opinion-vigorous-enforcement-not-studies-are-what-canadas-competition-laws-need

Johnson, Paul. 2021. “A Competition Conundrum: Winner-Take-All Markets.” C.D. Howe Institute Intelligence Memo, November 29. Online at https://www.cdhowe.org/intelligence-memos/paul-johnson-competition-conundrum-winner-take-all-markets#:~:text=In%20winner-take-all%20competition%2C%20a%20single%20competitor%20will%20serve,a%20very%20small%20number%20of%20very%20large%20firms

Liu, Huju. 2021. “Economic Performance Associated with Digitalization in Canada over the Past Two Decades.” Statistics Canada Economic and Social Report 2021002. Ottawa. https://doi.org/10.25318/36280001202100200001-eng

Mahboubi, Parisa. 2022. The Knowledge Gap: Canada Faces a Shortage in Digital and STEM Skills. Commentary 626. Toronto: C.D. Howe Institute. August. Online at https://www.cdhowe.org/sites/default/files/2022-08/Commentary_626_0.pdf

McKinnon, John D., and Ryan Tracy. 2020. “Ten states sue Google, alleging deal with Facebook to rig online ad market.” Wall Street Journal, December 16. Online at https://www.wsj.com/articles/states-sue-google-over-digital-ad-practices-11608146817

Murray, Kyle B., and Gerald Häubl. 2012. “Why Dominant Companies Are Vulnerable.” MIT Sloan Management Review 53 (2). Online at https://sloanreview.mit.edu/article/why-dominant-companies-are-vulnerable/