The Study in Brief

As a primary pillar of Canada’s social safety net, Employment Insurance (EI) has proven itself to be slow to react to downturns, weakening its ability to automatically stabilize the economy. It has also gone off track from its original main goal: to provide insurance against unpredictable job losses.

- EI should be modernized with an eye to making it a more effective counter-cyclical income support tool by making the access criteria more equitable and ensuring that benefit durations respond quickly and effectively to unemployment shocks.

- During the Great Recession of 2008/09, the oil price collapse in 2014/15, and the most recent pandemic, however, the program has proven itself unable to meet in timely fashion the needs of many workers who face job losses. During the commodities shock, unemployment rates in some regions in Alberta rose sharply, but there was no immediate increase in either benefit duration or ease of access. A similar pitfall emerged in low-unemployment regions at the beginning of the COVID-19 pandemic.

- Benefit entitlements should be less oriented to indemnifying chronic unemployment and more responsive to covering unemployment caused by cycles or totally unanticipated shocks like the pandemic.

- The authors make three main policy recommendations: (i) Implement uniform or more universal entrance requirements. (ii) Sharply reduce the number of EI regions. (iii) Improve the responsiveness of the benefit duration formula to labour market downturns and recoveries.

Introduction

The federal government recently held extensive consultations aimed at modernizing the Employment Insurance (EI) program for the post-pandemic period. In that spirit of reform, this E-Brief proposes options to align EI more closely with its original objective: to respond to the needs of Canadian workers during labour market downturns. The current provisions are hardwired to accommodate seasonal and part-year workers situated in high-unemployment regions, and as such are too focussed on structural unemployment issues.

The EI regime determines both access to any benefits at all as well as the length of entitlement durations according to two criteria: hours worked in the last 52 weeks as well as the unemployment rate level in the EI region in which a claimant lives (of the 62 regions). Because unemployment rate levels, whether high or low, tend to be quite persistent over time in each of the EI regions, the responsiveness of the program to address economic shocks is inadequate.

As we discuss below, our proposed reforms would transform EI by putting in place more flexible, nimble provisions, which would give broader access to benefits that would last for longer durations when labour market conditions deteriorate. To do so, benefit entitlement durations would be based on changes in unemployment rates instead of on their levels in given regions, whether high or low. To greatly streamline the structure and reduce the administrative burden, we also recommend that the number of EI regions regions be reduced from 62 to 10 or fewer.

The EI System’s Flaws and History of Ad-hoc Responses

Recent major economic shocks exposed EI’s shortcomings in responding to them. Among the problematic features are: 1) variable entrance requirements that are slow to adjust to increases in unemployment; 2) benefit durations that are also slow to respond to increases in unemployment; and 3) finely divided administrative regions with boundaries that reinforce and prolong the inequities in both entrance criteria and potential benefit durations.

Variable Entrance Requirements: Eligibility for EI depends on the number of insurable hours that a claimant accumulates during the 52-week period preceding the claim, and that number varies depending on the unemployment rate of the EI administrative region in which the claimant typically resides. For example, to qualify, a worker must have worked only for 420 hours in the last 52 weeks in high-unemployment regions with rates above 13.1 percent, such as in eastern Nova Scotia. Meanwhile, an otherwise similar worker would need to have worked for 700 hours in a region with a lower regional unemployment rate (6 percent or below), such as in Vancouver.

According to the EI Coverage survey for 2019, 90,500 potentially eligible unemployed individuals had not worked enough hours to qualify. The logic underlying these provisions is that workers residing in low-unemployment-rate regions should be able to remain employed longer (until the layoff occurs) and also to find new jobs more easily than those residing in high-unemployment-rate regions. This reasoning ignores the reality of the conditions that workers face when the labour market enters a significant downturn and job opportunities dry up. When a broad-based downturn occurs, displaced workers in low-unemployment regions could be in a comparably worse position than their counterparts in high-unemployment regions, facing a tougher transition to shocks that affect both somewhat equally.

Benefit Duration Extensions: Compounding the impact of those entry provisions, those who do qualify in low-unemployment regions also receive shorter-lasting benefits than their counterparts situated in high-unemployment-rate regions. These rules were designed to provide longer-lasting benefits to unemployed workers in regions with fewer job opportunities and to minimize the risk that they would exhaust their benefit entitlement before finding a new job. Yet, here too, adjustments to benefit durations are inadequate during economic downturns.

On seven separate occasions since 2004, federal pilot projects were implemented to extend benefits beyond the durations set by the “EI entitlement matrix.” In the same vein, during the pandemic, the federal government ensured that all regular beneficiaries would have access to a minimum of 26 weeks of benefits, which was later extended to 50 weeks for claims established in the period covering September 27, 2020, to September 25, 2021. This amounted to an average of 19 additional weeks. Clearly, standard provisions stipulated in the EI entitlement matrix are insufficiently responsive to sudden and massive job losses. Implementing ad hoc, sometimes retroactive, benefit extensions are arbitrary, entail delays and undermine the intention of automatic stabilization.

One notable pilot project that occurred in the last decade was the “commodities cycle” initiative, which provided benefit extensions to workers in energy-producing regions affected by the steep decline in global commodity prices in 2014-2015. It was unique because in the 15 EI regions that were selected, changes in unemployment rates – as opposed to levels of them – were utilized as the basis for making benefit duration more responsive to severe negative labor market shock. As we explain below, the design of this pilot project is the inspiration behind our main reform proposal.

Finely Divided Administrative Regions: The 62 EI regions that partition Canada are expressly shaped and demarcated such that their respective labour market conditions are similar within their borders. By design, they are separated and sorted along a continuum ranging from regions with the lowest unemployment rates to those with the highest rates.

New Solutions Are Required

In the discussion above, we have argued that the design of the EI system’s passive benefits does not address the needs of claimants who are unemployed during an economic downturn.

Implement Uniform or More Universal Entrance Requirements: We repeat the recommendation that we made in Gray and Busby (2009) that more uniform entry requirements be established across the regions of Canada. Before the pandemic hit in March 2020, there were nine different bands of hours worked requirements that ranged from a low of fewer than 420 to a high of 700 or more hours. As an emergency measure, until September 24th, 2022, these hours worked were temporarily set to a uniform level of 420 hours. For the sake of equity, and to reduce adjustment costs for some claimants who would face shortened benefit durations under our proposed reforms, the temporary threshold of 420 insurable hours should be made quasi-permanent, subject to a subsequent evaluation. Another, more gradual, option along these lines would be, as Miles Corak advocates, to move towards more uniform entrance requirements by reducing the number of unemployment rate bands that determine hours-worked requirements (see Table 2 in Busby, Chejfec and Tambourri 2022). Under either option there would be less need to revise access criteria during economic shocks.

According to the federal budget of 2022, EI premium rates are set to rise from $1.58 per $100 of earnings in 2022 to $1.73 per $100 earnings by 2025, increasing by five-cent increments annually, to help pay off the increase in the accumulated deficit of the EI operating account brought about by higher EI costs during the pandemic.

Improve the Responsiveness of EI Benefits Using New Parameters: The second reform would use the monthly changes in provincial unemployment rates as the indicator for labour market conditions to adjust the durations of benefit entitlements according to shocks to unemployment. Utilizing the changes in unemployment rates nets out the persistent elements of unemployment – its structural and seasonal components – to distill in sharp relief the cyclical and the frictional, idiosyncratic elements that EI was originally designed to address.

As the change in the unemployment rate is highly correlated with labour market shocks (either positive or negative), it is more closely aligned with insurance principles than is the level of the unemployment rate. Most notably, it conforms with the principle that insurance should cover unforeseeable and random losses rather than foreseeable and systematic losses. As jobs are destroyed, benefit durations would be lengthened accordingly; as the labour market strengthens, they would be shortened accordingly. For its part, Employment and Social Development Canada has long pointed out that the current program parameters do adjust to extend durations in the event of a labour market downturn. While true, the speed of the response is inadequate: by combining EI uptake with levels of unemployment in 62 separate EI regions, the current administrative apparatus is much less responsive to negative labour market shocks than it could otherwise be.

Under our proposed reform, variation in the length of the benefit entitlement periods would be driven by changes in local unemployment rates. Sudden job loss would trump recurring seasonal layoffs or chronic layoffs in regions with persistently high unemployment.

We conducted a statistical analysis of the variation in the historical levels of the ten provincial unemployment rates. This allows us to assess the degree to which the current program design addresses negative shocks, like an economic downturn or a commodity bust, versus the degree to which it addresses quasi-permanent disparities across regions.

Our analysis over the period from Jan. 2006 until Dec. 2019 (shortly before the pandemic) reveals that across the 10 provinces, approximately 85 percent of the variation in provincial unemployment rates reflect between-province differences, while 15 percent reflects changes in unemployment rates over time. Working through the EI entitlement matrix, this breakdown implies that a very predominate share of the differentials in EI benefit entitlement durations are associated with layoffs and separations occurring in regions characterized by persistently high unemployment rates and chronic employment instability, which includes but is not limited to seasonal layoffs. Only a small share of the differentials is triggered by layoffs caused by cyclical shocks.

The discrepancy stems from both between-province elements and within-province elements. The between-province component captures the persistent differences in the levels of unemployment between provinces and reflects factors associated with structural unemployment. The within-province component captures transitory differences in the levels of unemployment within provinces over time and reflects factors associated with cyclical unemployment, which, consistent with insurance principles, is what generic unemployment insurance (UI) regimes (and the pre-1971 Canadian regime) are designed to indemnify.

These findings imply that the dominant proportion of the variations in the EI qualification and benefit entitlement parameters, as stipulated in the EI entitlement matrix, is driven by persistent components of unemployment, whether structural or seasonal. The program is thus much more sensitive to the long-standing inter-regional disparities in unemployment rates than to labour market shocks. If those parameters were gauged according to the changes in unemployment rates as opposed to their levels, as we propose, the level of generosity would fluctuate the least in the Atlantic provinces and fluctuate the most in the three western provinces – in sharp contrast to the workings of the current program.

We recommend that benefit entitlements should be less oriented to indemnifying chronic unemployment and more responsive to covering unemployment caused by cycles or totally unanticipated shocks like the pandemic. The overall cost of what we propose depends on the choice of new parameters in a redesigned EI entitlement matrix. Only during recessions would our formula trigger longer EI benefit entitlement durations, and they would subsequently be shortened during recoveries. Therefore, we would see cost increases during recessionary periods and cost reductions during economic expansions. This cyclical responsiveness would therefore not necessarily increase EI costs over an economic cycle.

Reduce the Number of Administrative Regions: The complex web comprised of 62 EI regions would be aggregated into many fewer regions. An extreme configuration would consist of five large regions,

While our suggested reforms do not directly address the question of repeat use, they would complicate the design of EI for seasonal and part-year workers. Although these workers would be able to qualify as easily as ever – and for some of them these requirements would be loosened – depending on how the benefit duration parameter is designed, they could become entitled to shorter benefit periods. This point might need to be weighed versus the other features in considering how best to design a new system.

An Illustration of a Redesigned EI Entitlement Matrix

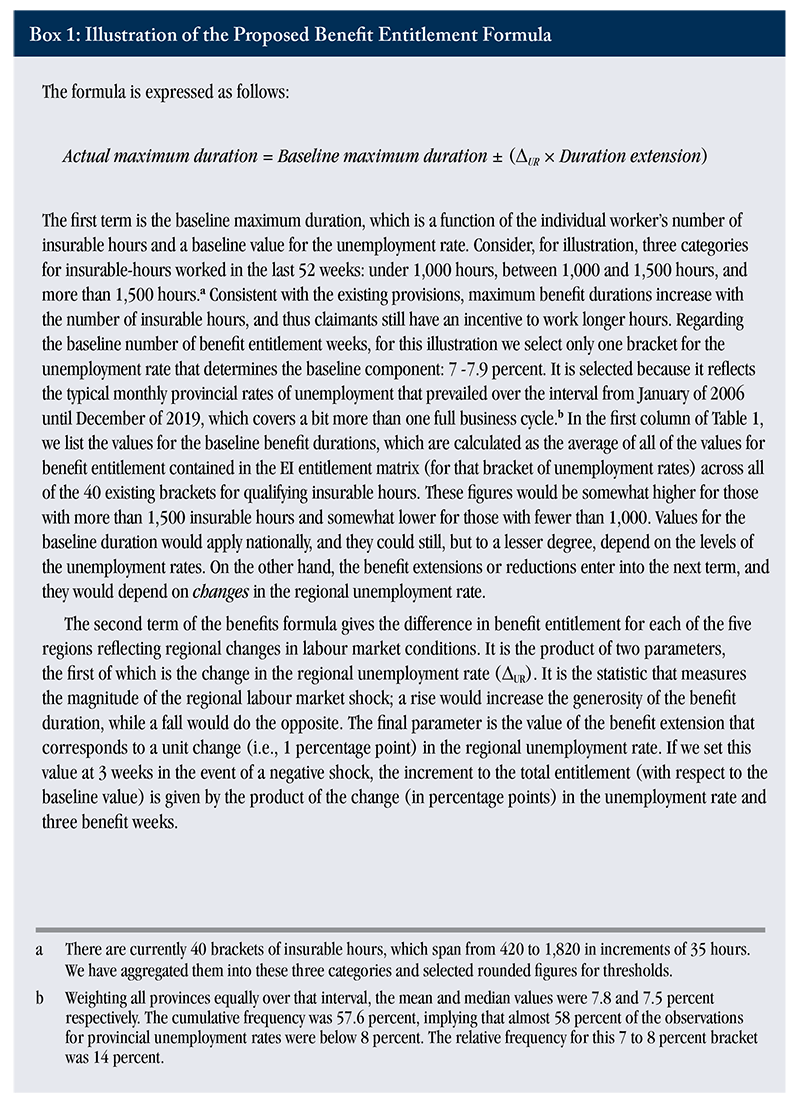

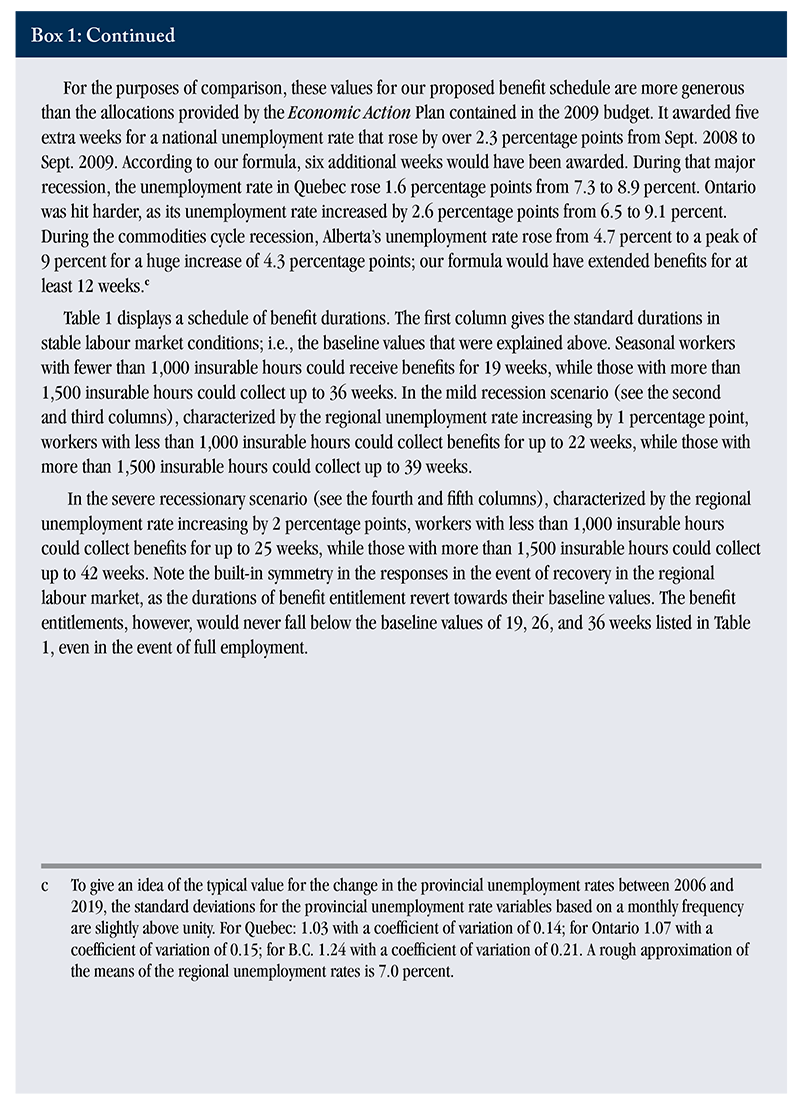

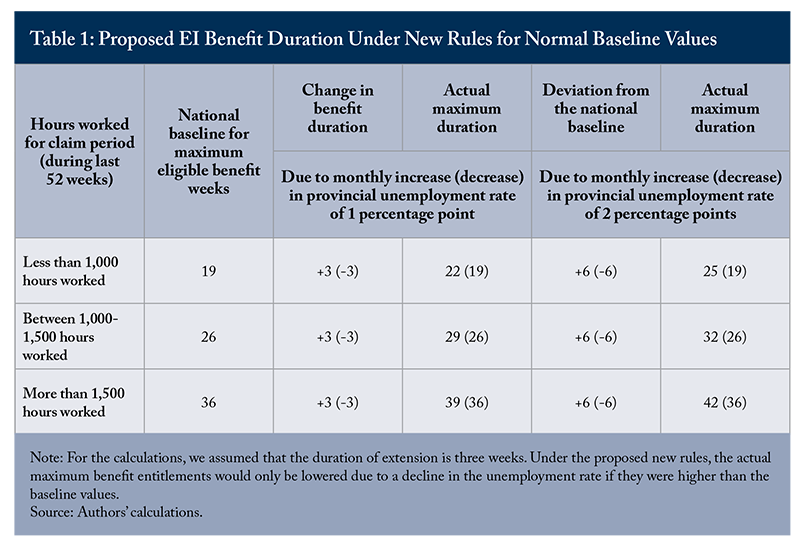

To provide greater clarity on what our proposal might look like in practice, we provide an illustration of a new formula for determining the benefit entitlement. The maximum benefit durations would depend on baseline values set for all of Canada but would vary according to changes in the labour market conditions in those respective five regions. The key features of this apparatus would be the following:

- An economic variable according to which benefit entitlement durations are adjusted , for which our preference is the change in the unemployment rate.

- A baseline value for the length of benefit entitlement.

- A variable that, when triggered by a movement in the indicator for the change in labour market conditions, causes increases or decreases in benefit duration.

- A time interval, such as every three or four years, in which it could be evaluated and recalibrated.

To illustrate the mechanics of our proposed benefit entitlement formulas, we show a scenario consisting of baseline values combined with the adjustments to the maximum duration of benefits based on changes in the unemployment rate in Box 1. Our intention for this exercise is to illustrate concretely how we could replace the current mechanism; it is not to suggest that the specific values that we insert be adopted. This framework allows for many permutations of the program parameters that could render it either more or less generous.

A Recession-Ready EI for the 21st Century

The three policy recommendations that we make are the following:

- Implement uniform or more universal entrance requirements.

- Sharply reduce the number of administrative regions.

- Improve the responsiveness of the benefit duration formula to labour market downturns and recoveries.

These proposed reforms would streamline the regime on a regional basis and render it much more responsive to either national or regional recessions. When the regional unemployment rate increases, maximum benefit durations would be raised immediately. The need to intervene retroactively with pilot programs would be greatly reduced.

The benefit entitlements formula would be consistent with widely accepted insurance principles. Entrance requirements would be simplified and equitable. In stable labour market conditions, eligible unemployed workers would be entitled to reasonably similar benefit durations across Canada. Benefit durations would change alongside changes to regional unemployment rates. The cost of removing the inequity of regional differences in accessing the program with uniform or more universal entrance criteria would likely require a small increase to EI premiums. However, the net cost of what we propose depends on the generosity of the revised program rules and the potential savings from increasing benefit durations in a recession and decreasing them in an economic expansion.

The authors thank Parisa Mahboubi, Tingting Zhang, Alexandre Laurin, Nicholas Dahir, Miles Corak and anonymous reviewers for helpful comments on an earlier draft. The authors retain responsibility for any errors and the views expressed.

References

Busby, Colin, Ricardo Chejfec, and Rosanna Tamburri 2022. “How to Modernize Employment Insurance: Toward a Simpler, More Generous and Responsive Program.” IRPP Working Group Report. Montreal: Institute for Research on Public Policy. May.

Gray, David., Colin Busby, and André Laurin. 2009. “Back to Basics: Restoring Equity and Efficiency in the EI program.” E-Brief No. 84. Toronto. C.D. Howe Institute. August

Corak, Miles. 2020. “An Employment Insurance System for the 21st Century: Lesson 1, Big Shocks Matter.” October. https://milescorak.com/2020/10/30/an-employment-insurance-system-for-the-21st-century/#more-8835S

Guillemette, Yvan. 2007. “Chronic Rigidity: The East’s Labour Market Problem and How to Fix It.” E-Brief No. 51, C.D. Howe Institute Institute. December. https://www.cdhowe.org/sites/default/files/attachments/research_papers/mixed//ebrief_51.pdf

Mowat Centre. 2010. “Help Wanted: How Well Did the EI Program Respond During Recent Recessions?” Report. https://munkschool.utoronto.ca/mowatcentre/new-mowat-centre-research-finds-ei-has-not-performed-well-for-ontario-and-parts-of-western-canada-during-recent-recession/

This E-Brief is a publication of the C.D. Howe Institute.

David Gray is a Professor of Economics at the University of Ottawa.

Colin Busby is a former associate director of research at the C.D. Howe Institute and a former research director at the Institute for Research on Public Policy.

This E-Brief is available at www.cdhowe.org.

Permission is granted to reprint this text if the content is not altered and proper attribution is provided.

The views expressed here are those of authors. The C.D. Howe Institute does not take corporate positions on policy matters.