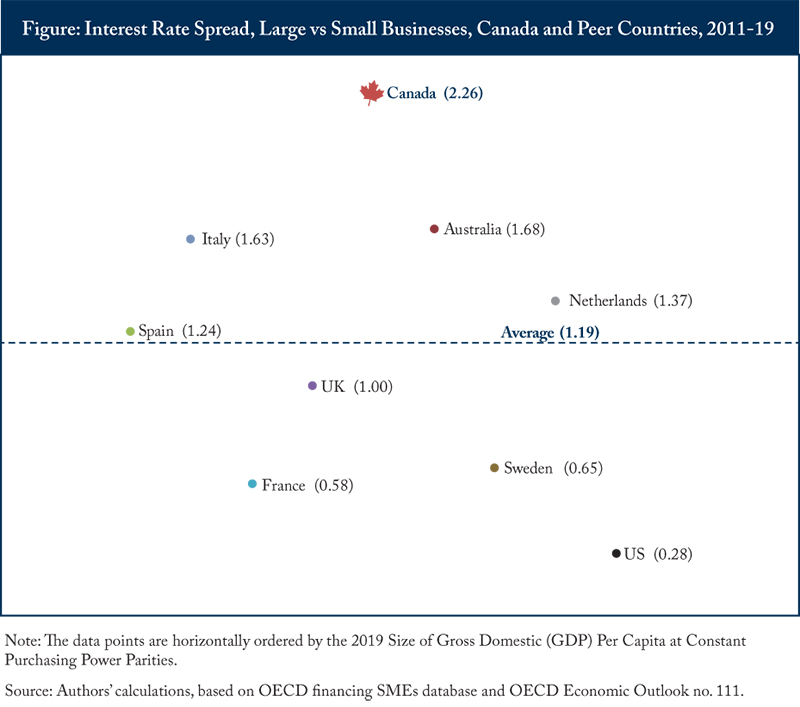

In this edition of Graphic Intelligence, we compare Canada’s lending conditions for small and medium enterprises (SMEs) to that of a set of OECD countries we are often measured against. Canadian small and medium businesses pay a premium for financing relative to SMEs in other OECD countries.

Canada’s SMEs face numerous challenges that impede their ability to scale up. The C.D. Howe Institute has launched a policy working group to explore ways governments can help Canada’s SMEs grow by removing barriers to the availability and access to patient long-term financing, and deepen capital markets.

Our recent Memo finds that, compared to large businesses, Canadian small and medium businesses pay the most for financing relative to SMEs in other OECD countries. During the decade preceding the pandemic, Canada's small and medium enterprises had the largest spread between the interest rate for their loans versus those offered to large firms – a gap that cannot be explained away by looking at interest rate levels. Many things drive interest rates, but Canada’s concentrated financial sector means there is scope to deepen capital markets to alleviate the interest rate sensitivity SMEs face from a dearth of alternatives.