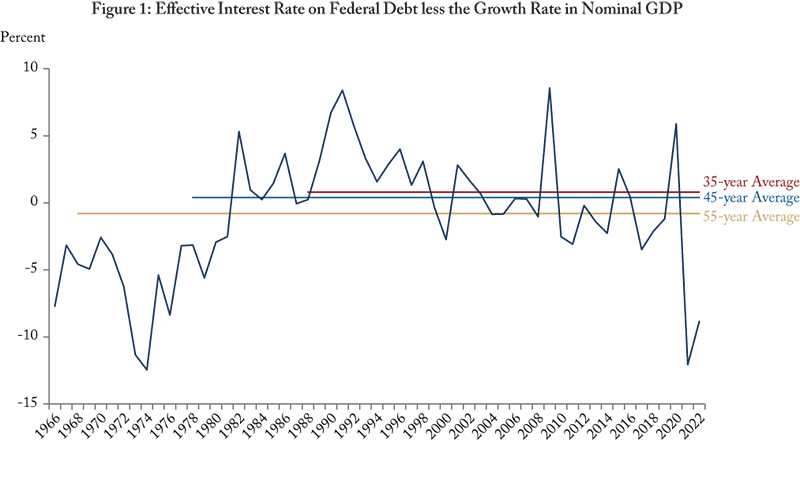

The federal government’s Fall Economic Statement last November contains a long-term projection showing the debt to GDP ratio declining continuously for 31 years starting in 2025/26. Several optimistic assumptions underpin this result, one of which is that the effective interest rate on government debt will remain below the growth rate of GDP over the entire projection period. This assumption means that debt interest payments decline as share of GDP over the forecast horizon without the government taking any explicit measures to improve its fiscal situation.

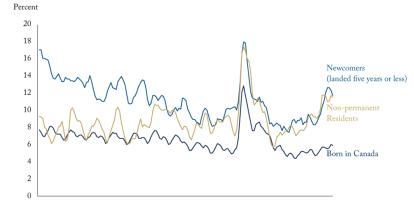

Including both the medium-term forecast and the long-term debt projection, the statement shows the effective interest rate less than the rate of growth for 33 years. The historical record does not offer much support for this assumption. On average over the past 35 years, the rate has exceeded GDP growth by 0.8 percentage point, and by 0.4 percentage point over the past 45 years (Figure 1). Extending the averaging interval to 55 years does change the relationship: The interest rate was 0.8 percentage point less than growth over this period.

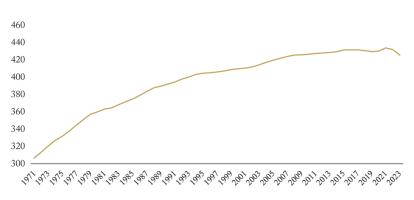

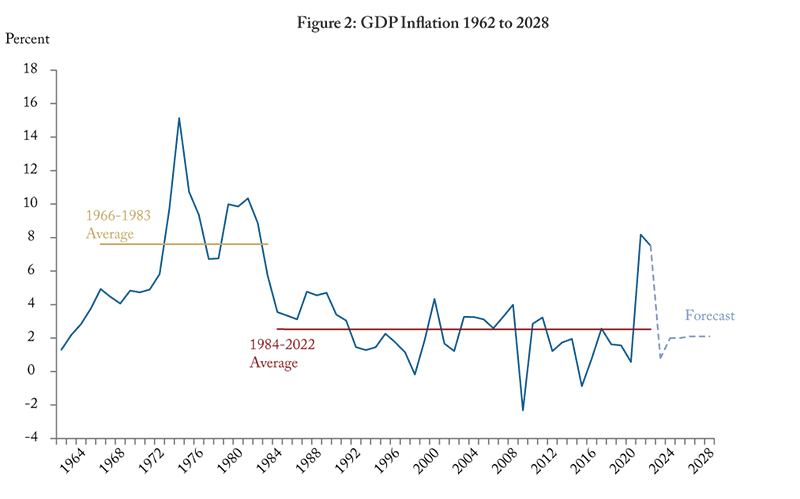

Note, however, that the longer time interval includes the period of unusually high GDP inflation from the mid-sixties to the early 1980s (Figure 2). From 1966 to 1983 inflation averaged 7.6 percent, compared to 2.5 percent over the following 39 years. If GDP inflation falls to 2 percent and remains there over the entire projection period as assumed by the statement, it is highly unlikely that the effective interest rate will be less than GDP growth for a substantial part of the next 31 years.

Read John Lester and Alexandre Laurin's Intelligence Memo for more.