The size of assets and incomes of Canadian firms, 2009. In order to qualify for the Small Business Deduction, firms must make less than $500,000 of income, and have less than $10 million in assets.

Oops! If you are seeing this message, it may be because the chart is not displaying correctly. Try upgrading your browser or enabling Javascript.

C.D. Howe Institute | Source: Statistics Canada

Special supports for small businesses are a hallmark of both federal and provincial tax policy. The purpose of these programs is to improve overall economic performance by mitigating inefficiencies in the market. However, since receiving benefits is conditional on staying small, some have argued that these programs could act as a barrier to growth.

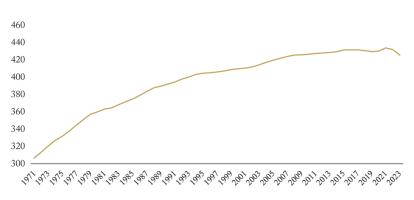

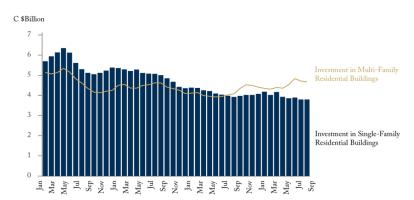

To help illustrate this question, the two graphics above illustrates the amount of small businesses making under $700,000 per year, as well as the amount with less than $12 million in assets. Notice the cluster of businesses that appear around the $475,000 mark, just before they reach the $500,000 income range, the point at which the corporate income tax rate changes. This shows clear evidence of tax planning. However, the same lump around the cutoff for a small business’s assets is absent, suggesting that the impact of the small business tax deductions is unclear.

Despite this lack of clarity on growth, we can see that there are economic costs to federal and provincial tax support for small businesses. For more, read “Small Business Preferences as a Barrier to Growth: Not so Tall After All,” by Benjamin Dachis and John Lester.