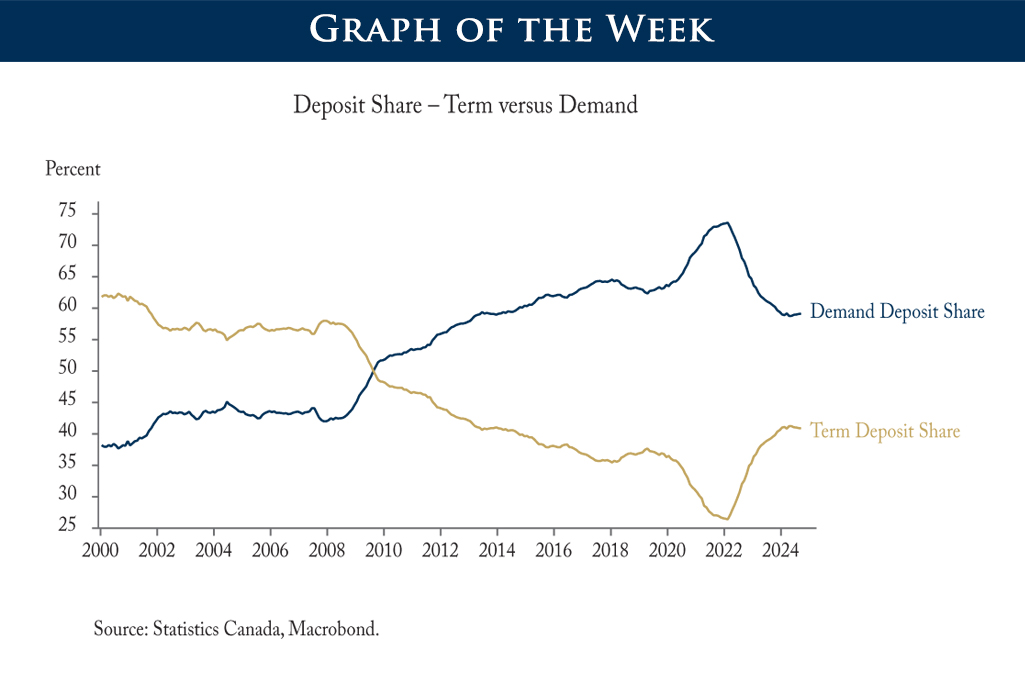

Term deposits (think GICs) used to be a larger share of total deposits than demand deposits (think chequing accounts). When interest rates hit rock bottom in the Great Financial Crisis, their popularities swapped places. As interest rates started increasing in mid-2022, the gap favouring demand deposits began to narrow, a good thing for an industry looking for more stable forms of funding - however, that seems set to reverse as interest rates start to fall again.

Graph of the Week: Deposit Preferences Shift as Interest Rates Fluctuate

November 25, 2024