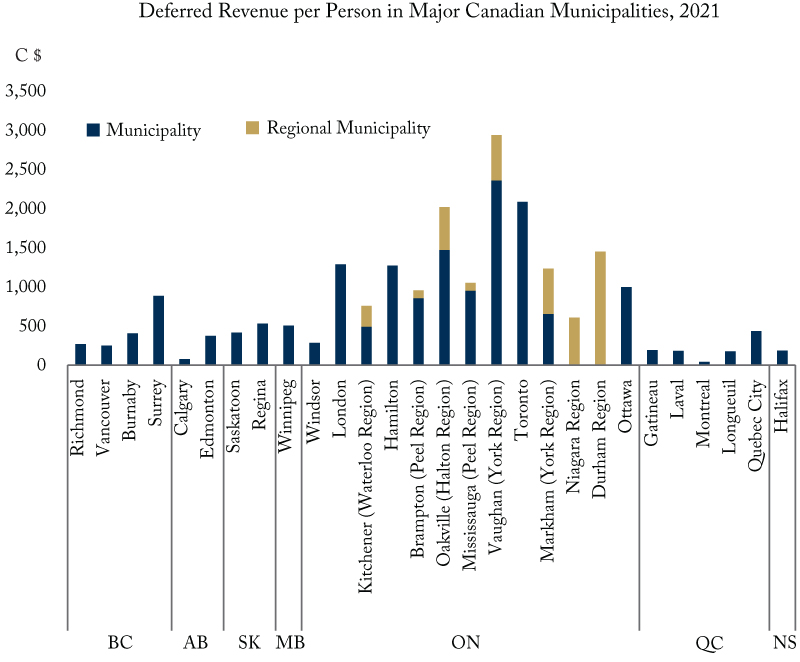

Canadian municipalities collect some revenues in advance of the outlays they will fund. This money, typically shown as flowing into reserves in municipal budgets, appears in financial statements as “deferred revenue.” Deferred revenue is a liability. It means the funds are dedicated to a certain purpose and/or a certain time. An important source of this deferred revenue is grants from senior governments for capital projects. Another is development charges – up-front levies from builders of houses, for example, to finance infrastructure.

When municipalities carry large balances of deferred revenue, they owe it to their citizens to invest the money wisely. Municipalities could earn better returns without undue risk if they pooled their funds under professional management, according to a recent C.D. Howe Institute publication. Another concern is that municipalities are collecting too much up-front for projects that may not be built for years. This Graphic Intelligence compares the deferred revenues of Canada’s largest 32 municipal governments from our latest report card on municipal fiscal transparency. The numbers per person are presented to allow comparisons, combining lower and upper-tier regional municipalities where they overlap. What stands out is Ontario’s outsized share of these unspent funds. Development charges are a major reason: in some Ontario municipalities, development charges add more than $100,000 on a new single-family home. Aligning the collection of funds better with the actual construction of projects would distribute the costs of infrastructure more fairly.