From: Alexandre Laurin

To: Concerned Canadians

Date: October 5th, 2016

Re: Provincial Fiscal Health Much Worse Than Municipal Counterparts

Last month, Statistics Canada released its latest quarterly data for its new system of Government Finance Statistics (GFS), which enables the comparison of fiscal revenues, expenditures, assets, and debts of Canadian governments on a consistent and consolidated basis.

Municipalities and other local public institutions, such as educational and health institutions, are ultimately governed by provinces, but differences exist amongst provinces with respect to the entities responsible for delivering similar public services. For example, the cost of social assistance is shared with municipalities in Ontario, while it is not in other provinces.

GFS data consolidation, by including all of the expenditure and revenue sources ultimately governed by provinces, and by eliminating the effects of internal transactions within each jurisdiction, provides a mean through which we may make comparisons amongst provinces.

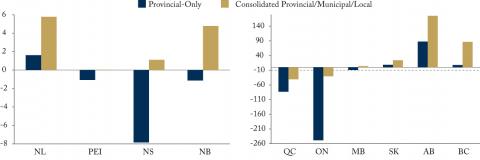

Looking at consolidated GFS data makes one point clear: municipalities collectively run large surpluses, while provincial governments are dragging us down. The balance sheet of all provinces looks much healthier once provincial governments are combined with their municipalities. In particular, Ontario’s net worth (in budget’s terminology, its accumulated deficits) moves from a $250 billion provincial public debt to a consolidated provincial/municipal/local $30 billion debt figure – a huge improvement.

Net Provincial Worth, $ Billion (Fiscal Year 2014-15)

Source: Cansim tables 385-0034 and 385-0042.

The reason for this lies in part in budget accounting practices documented here by Dachis and Robson. Municipalities, by budgeting capital infrastructure projects on a cash accounting basis, exaggerate capital up-front costs and understate them later on expenses. Modern accrual accounting methods adopted by provincial governments and the GFS spread the cost of long-lived assets such as buildings and infrastructure on a long time period as those assets slowly depreciate and deliver their value. The result is that under conventional accrual accounting methods, municipalities often register large annual surpluses and collectively have balance sheets deep in the black.

Therefore, governments should take the necessary steps to ensure that comparable accounting standards are used by all in their budgets – including municipalities who should report on an accrual basis. This is critical to be able to readily understand the relative fiscal health of each level of government. And on this score, provincial governments are doing much worse.

Alexandre Laurin is Director of Research at the C.D. Howe Institute

To send a comment or leave feedback, email us at blog@cdhowe.org.