From: Brian Lewis

To: Ontario poverty watchers

Date: October 3, 2024

Re: Fully Indexing Ontario Social Assistance is Long Overdue

October 1 was the six-year anniversary of the last inflation adjustment for Ontario’s social assistance payments. Their real value has steadily eroded ever since, made worse by inflation’s recent return. This leaves Ontario’s most financially vulnerable citizens in a precarious situation. Going forward, the province should index these benefits to changes in prices.

For most government programs, indexing benefit levels or parameters to adjust to inflation is a widely accepted practice. This is simply because it allows benefit levels and taxes to maintain their real value as prices rise.

For the taxes that governments impose, maintaining real values with indexation can support economic growth by eliminating unintended tax increases that could diminish labour supply and discourage business investment.

For transfer programs, indexing can support fairness by protecting low-income groups whose benefit payments would otherwise not rise in line with their cost of living.

Major federal and provincial government taxes and benefit payments in Canada are often indexed. Notable exceptions from indexation result in a growing tax burden on many Canadians as outlined by C.D. Howe Institute research. Likewise, there are significant exclusions from benefit indexation, including key components of the Ontario social assistance program.

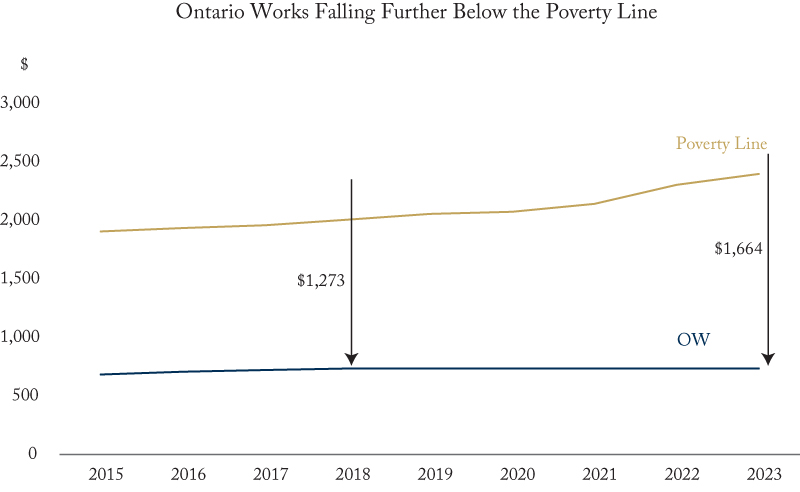

For single working-age adults, the Ontario government has not increased the maximum basic needs and shelter amounts under the Ontario Works (OW) program since October 2018. In the mid-1990s, the previous Progressive Conservative government cut OW benefits by 22 percent and froze them for many years thereafter. The subsequent Liberal government resumed annual increases, but not enough to restore the lost value of the benefits.

The cost of living has increased significantly since the last increase in OW amounts. Full indexation of combined OW amounts since 2018 would result in them being 21 percent ($149) above their current amount ($733) for a single individual. The situation has deteriorated less for recipients under the Ontario Disability Support Program because the Progressive Conservative government increased those amounts by 5 percent in 2022 and reintroduced indexation commencing in 2023. As such, the real value of these benefits has been eroded by only 4% since 2018.

The lack of indexation of OW amounts has become a growing problem due to the surging cost of living over the past two years. Low-income individuals are uniquely vulnerable to rising food and shelter costs because these represent a relatively high share of household expenses. For example, the cost of living for an Ontario household living at the poverty line increased more during 2022 and 2023 (7.6 and 4.1 percent, respectively) than for a typical household (6.8 and 3.8 percent). Due to the different weights of various expenditures for low-income individuals compared to the average family, their cost of living has increased an estimated 22 percent over the past six years, while CPI has increased 20 percent.

Benefits for low-income individuals should be indexed to reflect their circumstances, and I recommend that the province use yearly changes to the Statistics Canada Market Basket Measure of poverty to annually adjust Ontario social assistance amounts.

The impact of rising prices and fixed OW accelerates deep poverty rates. In 2018, a single working-age adult in Toronto on OW would have been living $1,273 below the poverty line. In 2024, that person would be living $1,665 below the poverty line.

A range of adverse developments has accompanied the deepening poverty of OW recipients. Food insecurity rates have risen sharply between 2018 and 2022. More recently, food bank usage in the province was reported to have increased to record levels. Homelessness and pressures on an over-burdened shelter system also continue to mount.

Another aspect of the provincial income support system that warrants indexation is the $200 a month an individual can earn without having OW benefits reduced. For earnings above $200, OW benefits are clawed back by 50 cents per dollar. This amount has not been changed since it was established in 2013, and as such, it is providing much weaker incentives for OW recipients to work. In 2013, a person could work 19.5 hours at the provincial minimum wage and earn $200. Currently, someone would work only 11.75 hours to reach that amount. Increasing the $200 threshold in line with minimum wage changes since 2018 would result in an amount of $330, providing a significantly stronger incentive for recipients to work.

The lack of indexation of Ontario social assistance benefit levels has eroded the value of these benefits significantly and contributed to rising homelessness, hunger, and demand for social and health services. It is time to introduce a more economically efficient and fairer way of adjusting these benefits on a regular basis.

Brian Lewis is a Senior Fellow with the Munk School of Global Affairs and Public Policy and the C.D. Howe Institute. He is a former chief economist of the Province of Ontario.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.