From: Brian Lewis

To: Ontario Finance Minister Peter Bethlenfalvy

Date: October 29, 2024

Re: This is No Time for pre-Election Goodies

Ontario's forthcoming fall economic statement has garnered increased interest as speculation mounts over a potential provincial election in spring 2025. While the fall statement is traditionally a routine update on the province's fiscal and economic status, this year's seems likely to serve as a platform for early, strategic pre-election policy announcements. Look no further than the government’s plan to send out $200 cheques to every Ontarian.

Finance Minister Peter Bethlenfalvy will deliver the update on Wednesday, two weeks earlier than is legally required. Amid signs of economic and fiscal improvement, the province faces the challenge of balancing the allure of costly new policies with fiscal prudence, especially given looming risks. It would be well advised to reject the temptation of political wins at a time of economic uncertainty.

The economic indicators since the 2024 budget was delivered in March have presented a mixed picture – with both encouraging and cautionary signs.

On the surface, the economic numbers look good: Employment is up by 174,300 jobs for the year to date. Real GDP expanded in the first two quarters, outperforming original forecasts.

At the same time, while the economy has avoided a technical recession, it is struggling to keep pace with rapid population growth. Per-capita real GDP has declined in seven of the past eight quarters and is at its lowest level since the fourth quarter of 2016, excluding periods of COVID restrictions. Rising unemployment – especially among youth – paints a sobering picture. In recent months, the overall unemployment rate has been its worst (again, excluding COVID restrictions) since the spring of 2016. For youth, it has become higher than any non-COVID month since 2012.

Inflation, once the primary economic challenge, is easing significantly. The all-items Consumer Price Index saw modest year-over-year growth of 1.9 percent in September, a welcome reprieve from the near 8-percent highs experienced in mid-2022. As a result of growing incomes, easing inflation, and government measures to support affordability, overall household disposable incomes have finally pulled ahead when adjusted for living costs. With inflation coming down, the Bank of Canada is reducing interest rates. Private-sector forecasters expect economic growth to strengthen over the next two years.

The province’s fiscal situation has shown consistent signs of improvement.

Astonishingly, Morningstar DBRS upgraded the province’s credit rating in June despite the significant increase in the government’s projected deficits compared to the 2023 budget. The rationale was that, despite a weakening fiscal outlook, key financial risk metrics remained roughly in line with rating-agency expectations and supported the upgrade.

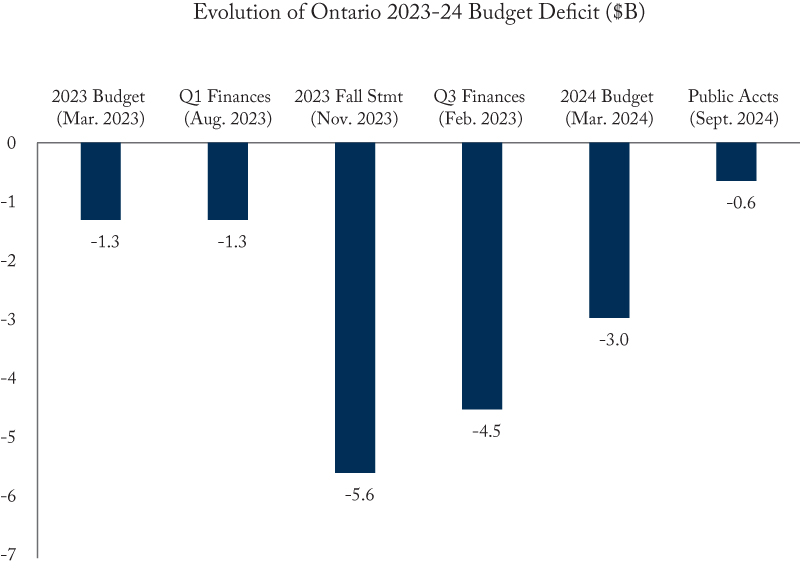

Ontario’s 2023-24 deficit was $0.6 billion, below the $3 billion estimate in the spring 2024 budget. That’s within a whisker of a balanced budget when considered in the context of $206 billion in government expenditures and a $1.1 trillion provincial economy.

This improvement may prove to be short-lived. Corporate income-tax revenues – historically volatile – have recently underperformed expectations. The significant contributions from Ontario’s community-college finances, which delivered $1 billion in profits onto the province’s books last year, are very unlikely to continue. The province also faces a broad range of geopolitical risks, as well as uncertainty related to further results from 2023 tax-return processing.

On the other hand, there may be even more debt financing cost savings as interest rates decline.

The shifting fiscal outlook during 2023-24 provides some insights into how much the picture can change between mid-year and year-end. Last fall, facing deteriorating taxation revenues and significant expense pressures (including those relating to the now overturned Bill 124 wage restrictions), the finance minister chose the prudent path and reported a significantly higher deficit in 2023-24 and a longer path back to a balanced budget. The situation improved with every subsequent update of the numbers, and 2023-24 did not end so badly after all – slightly better than the initial budget, in fact.

But now a government entering election mode looks to be adding additional financial risks. It is possible that a combination of stronger economic growth, interest on debt savings, and the prudence embedded in the 2024 budget will be sufficient to fund new largesse while keeping the fiscal plan on track. But doing so would not be the prudent approach, given how much things could change between now and the next budget. Whether the province will really unveil any significant new policy initiatives on Wednesday remains to be seen. For now, as Ontario navigates an uncertain economic landscape ahead of a potential election, a steady-as-she-goes approach seems like the best way forward.

Brian Lewis is a senior fellow at the C.D. Howe Institute and the Munk School of Global Affairs and Public Policy and former Chief Economist for Ontario.

To send a comment or leave feedback, click here.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.

Aversion of this Memo first appeared at TVO Today.