From: Colin Busby

To: Retirement savings observers

Date: September 25, 2023

Re: RRSP or TFSA? Canadians Need Help to Make the Call

A successful savings plan is the product of both how much is saved and the returns on those savings, which one could call saving efficiency. This second aspect of savings decisions is often overlooked. Given the importance of tax treatment to effective savings, how well Canadians exploit tax-preferred savings vehicles is critical. And many need help to navigate the choice.

Tax-Free Savings Accounts (TFSAs), introduced in 2009 as an alternative to Registered Retirement Savings Plans (RRSPs), offer Canadians the option to save on a tax-prepaid basis, with no taxes paid on investment income upon withdrawal. RRSP deposits, in contrast, are tax-deductible (they reduce taxable income in the year they are made) but require tax to be paid upon the withdrawal of funds.

Hence, differing marginal effective tax rates at the time of contribution and time of withdrawal profoundly affects the effective return on a dollar of savings. In particular, RRSP withdrawals count as taxable income and may reduce income-tested government benefits – Old Age Security/Guaranteed Income Supplement, child benefits, etc. – whereas TFSA withdrawals do not.

Contributions into the “wrong” savings vehicle can lower one’s effective returns on savings – potentially increasing taxes owing and/or lowering eligible government benefits, which, in turn, require more saving to meet retirement goals.

Rising Popularity of TFSAs

TFSAs have enjoyed tremendous growth since their inception. The pace of growth is such that annual median contributions into TFSAs already outstrip RRSPs, and the total value of savings in them may end up surpassing those in RRSPs in the foreseeable future.

A new Retirement and Savings Institute brief shows that older households, especially those drawing down their retirement savings, are more likely than other age groups to have a TFSA and have the least room available relative to their contribution limit. Further, low-income Canadians are starting to take advantage of TFSAs, but perhaps not as fast as expected given the steep GIS clawbacks they may face at older ages.

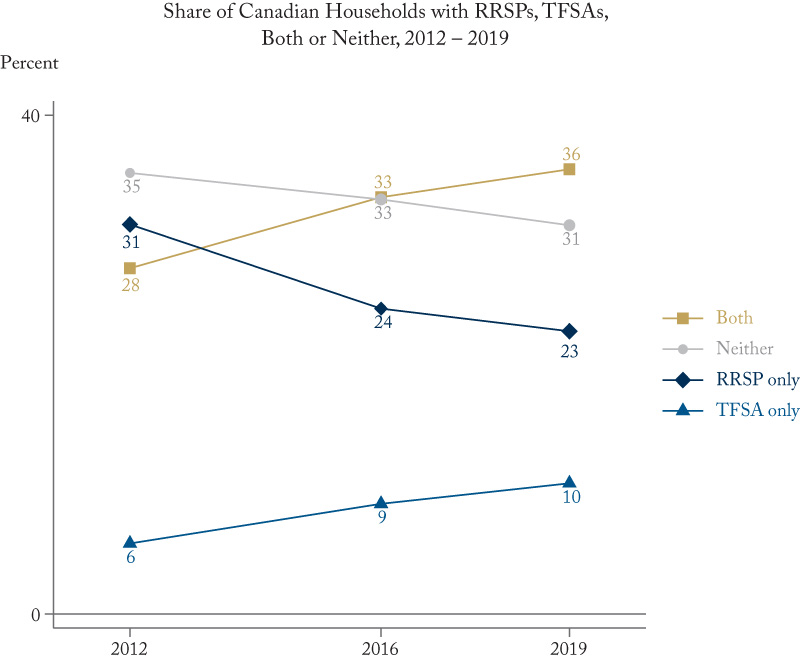

Thirty six percent of Canadian households have both an RRSP and TFSA (see figure below), and must therefore make a complex decision on where to place their next dollar of savings. Finding ways to improve financial literacy is imperative to ensure they are making good choices. Research that links administrative tax data to respondents of a financial literacy survey shows that there is a correlation between effective savings withdrawal and marginal tax rates among those with high financial literacy. Those with low financial literacy, however, show no such results. Hence, for many savers, the reality is that the decision for whether to put a dollar of savings into a TFSA or an RRSP is simply a guess.

Further, despite promising growth in usage among low to middle-income households – in 2019, 13 percent of households with annual income lower than $27,000 had TFSA accounts only (no RRSPs), the highest share among all income groups – there is much work still needed to educate Canadians on how to make the best use of these vehicles.

Educational interventions can improve the savings decisions of Canadians who do not know where to put their next dollar of savings. Hence, improved educational support should get a significant amount of attention by public and private sector decision makers.

Colin Busby is Director of Policy and Outreach at the Retirement Savings Institute with HEC Montreal.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.

Source: Statistics Canada Survey of Financial Security Public-Use Microdata File (PUMF), waves 2012, 2016, 2019. See Busby and LoRiggio (2023) for more.