From: Benjamin Dachis, Hamza Mhadi, and Jairo Pinto

To: The Hon. Charles Sousa, Ontario Minister of Finance

Date: April 12, 2017

Re: Vancouver’s Foreign Buyers Tax Meant Fewer Homes For Sale – Ontario Shouldn’t Follow Suit

Housing affordability has been a growing concern among many first-time homebuyers in Canada’s major metropolitan regions, particularly in Greater Toronto and Metro Vancouver.

In August 2016, the price for a typical home in the Greater Vancouver Region (GVR) was nearly $1 million dollars – an increase of over 30% from the year prior. In an effort to dampen housing prices, the BC government introduced a 15% property transfer tax targeted exclusively at non-resident buyers.

BC was not the first to impose a tax of this nature. In fact, Hong Kong, Singapore, and Australia have imposed similar taxes. Hong Kong’s identical 15% foreign-buyer tax lowered transaction volumes by 35%, while dampening housing price increases by a monthly pace of nearly 1% one year after implementation. Similar effects were observed in Singapore’s housing market.

In a recent study, two of us have examined the effects of the foreign-buyer tax on GVR’s housing market five months after implementation in a similar way to how this was done to examine the effect of Toronto’s Land Transfer Tax. We compare the changes in prices and volume of demand for houses in GVR, that are affected by the new tax, against surrounding regions where the tax does not apply. We utilize nearly 70,000 individual property transactions from 2015 and 2016 provided by Landcor Data Corporation.

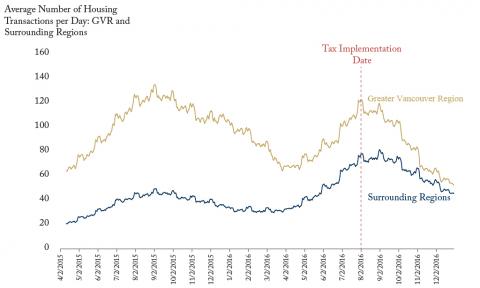

We observed a clear and significant decrease in volume of transactions for Greater Vancouver vis-à-vis surrounding regions following the implementation of the tax (see figure). After controlling for a variety of factors that affect housing prices and demand, our preliminary results suggest that the foreign-buyer tax has led to nearly 40% less transactions than would have occurred without it, accompanied by average prices that are 4.5% lower than otherwise.

As foreign buyers were estimated to comprise a mere 7% of total transactions in Metro Vancouver, it is clear the tax interfered more with local buyers. Many locals in need of moving homes were left in a harder position to sell – from families moving to neighborhoods with better schools to retirees downsizing. And who bore the economic cost of lower home prices? People who own homes now – not foreign buyers – are seeing the value of their investment fall.

The BC government’s intent was to lower prices and stabilize the market, but the drop in prices and number of sales shows that locals looking to move feel the harm of the tax. The attention now turns to Toronto’s housing market where, as of February 2017, prices increased by nearly 24% compared to the year prior. The government of Ontario should take a close look at the harm of Vancouver’s foreign buyer tax and not follow suit.

Benjamin Dachis is Associate Director of Research at the C.D. Howe Institute.

Hamza Mhadi and Jairo Pinto are senior undergraduate students both completing a dual degree in Honors Economics from Western University and HBA from Ivey Business School.

To send a comment or leave feedback, email us at blog@cdhowe.org.