To: Canadian Consumers and Taxpayers

From: Benjamin Dachis and Trevor Tombe

Date: December 5, 2017

Re: The Full Costs of Carbon Pricing to Households

Governments across Canada are getting serious about putting a price on emissions of carbon dioxide, which is the most cost-effective way to reduce greenhouse gases.

But each is taking a different approach on how to set prices and how to spend revenues. The choices they are making are critical for determining how much carbon-dioxide prices will cost Canadian households.

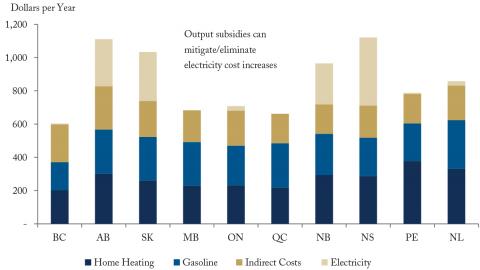

The cost of emissions pricing to households will vary across the country for many reasons. In provinces with a large share of emissions from coal-fired electricity generation, such as Alberta and Saskatchewan, a plain British Columbia-style carbon tax at $50 per tonne could potentially cost the average household more than $1,000 per year according to a recent analysis by University of Calgary economist Jennifer Winter, displayed below. In provinces where most electricity comes from non-emitting sources such as hydroelectricity or nuclear, the cost will be lower. In B.C., a $50 per tonne price will have a cost to households of around $600 to $700 per year.

Ontario and Quebec’s current approach is a cap-and-trade system, which currently prices emissions at $18-19 per tonne of emissions. But these prices will rise in the future, and there is even ongoing debate in Ontario over whether switching to the federal backstop – with its eventual $50 per tonne carbon price – makes sense. If it does, average household costs would be on the order of $700 per year.

Fortunately, there are steps that governments can take to reduce the net cost to households while still preserving emission-reduction incentives.

One approach, which Alberta pioneered and Ottawa has mimicked for its backstop policy, is an output-based subsidy. These output subsidies can mitigate the cost to businesses, which will reduce the indirect cost to households from CO2 prices. In Alberta, this will effectively avoid electricity cost increases, so household carbon costs will decline from $1,000 to just over $800. Ontario and Quebec also provide free permits to certain large emitters, though in a less efficient way.

Beyond these measures, governments can cut taxes to offset the direct impact of emissions prices on households’ net incomes. Here too, they can follow different approaches. Depending on the tax changes, some households – including low income households – may even be better off. But if governments instead use their revenues to support subsidies for energy-efficiency measures, for example, these will be regressive and economically costly ways to further reduce emissions.

The bottom-line of whether pricing CO2 emissions will leave households worse off, the same, or better off doesn’t just depend on the price on emissions; recycling the revenues wisely is critical.

Cost of a $50/tonne of CO2 price on typical household

Source: Jennifer Winter at https://www.policyschool.ca/effect-carbon-pricing-canadian-households/

Benjamin Dachis is Associate Director of Research at the C.D. Howe Institute and Trevor Tombe is an Associate Professor of Economics at the University of Calgary.

To send a comment or leave feedback, email us at blog@cdhowe.org