To: Ontario’s new Progressive Conservative government

From: Adam Found and Peter Tomlinson

Date: July 5, 2018

Re: Business Tax Cuts in Ontario: Expanding the Menu

Your party’s election platform featured business tax cuts. Yet one tax that was cut by the last Progressive Conservative government — the provincial business property tax — was left out. As we’ll show, there’s a strong case for resuming what your PC predecessors started.

In a recent report we outlined the essential background.

Here’s a brief synopsis:

The provincial business property tax originated in 1998, when the province took control of tax rates from school boards. It is still known as the Business Education Tax (BET), although the revenue is not correlated with school spending.

The government inherited a wide range of tax rates when it took control from school boards. Concurrently, a new funding formula determined each board’s revenue; tax rates on local businesses — whether high or low — no longer affected that revenue. Faced with this inequity, the government decided to gradually cut taxes where rates were high while avoiding tax increases where rates were low.

The cuts were to reach $500 million annually by 2005. Having reached $400 million by 2003, the PC government was on target when it lost the election that year.

The new Liberal government halted BET cuts until 2007, when it announced reductions projected to reach $540 million annually by 2014. Cuts had reached about $240 million by 2012 when the government put the remaining $300 million on hold, adding that it was committed to resuming them in fiscal 2017-18. Despite this commitment, fiscal 2017-18 has come and gone with no resumption of cuts. Meanwhile there is still a substantial variation of BET rates across the province.

In our report, we outlined a plan to equalize the BET rate on 99 percent of the province’s business assessment base — without tax increases anywhere. The plan would lower the current ceiling rate to the lowest rate levied in an urban municipality, i.e. the rate on commercial businesses in Halton Region. This “optimized ceiling rate”, as we called it, would benefit businesses right across the province. The largest benefit — a 38 percent reduction — would go to businesses taxed at the current ceiling rate. In this group are commercial businesses in Waterloo Region, Cornwall and Smith Falls, as well as industrial businesses in Durham Region, Dufferin County and Brockville. Businesses in many other municipalities would also see the maximum benefit.

Implementing the optimized ceiling rate would reduce provincial revenue by about $967 million a year; however, assessment growth induced by rate cuts would mitigate this reduction over time.

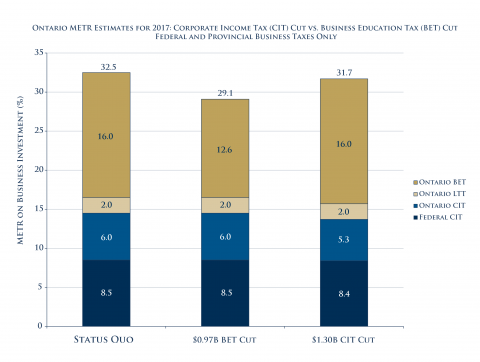

For this memo we estimated the plan’s impact on the marginal effective tax rate (METR) on investment. The figure below shows that the optimized ceiling rate would achieve a relatively large METR reduction — about four times the reduction achievable with a one-point corporate tax cut. According to the PC platform, a corporate tax cut of this size (from 11.5 percent to 10.5 percent) would reduce annual revenue by $1.3 billion.

Recent US corporate tax cuts may well require a response in kind. But a tax-cut agenda without a BET reduction won’t get as much bang for the buck as possible.

Adam Found is a Policy Fellow at the C.D. Howe Institute and Peter Tomlinson is a Sessional Lecturer at University of Toronto.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.