From: Luc Godbout and Tommy Gagné-Dubé

To: Bill Morneau, Minister of Finance

Date: June 19, 2020

Re: Lessons from Ireland on Pandemic Income Support

The similarity of Ireland's economic response to COVID-19 to Canada’s – in form, scheduling and generosity of emergency measures – makes it worthy of more attention. And it’s all the more interesting because Ireland has undertaken the modulation of its emergency benefit to reduce its disincentive effect on work.

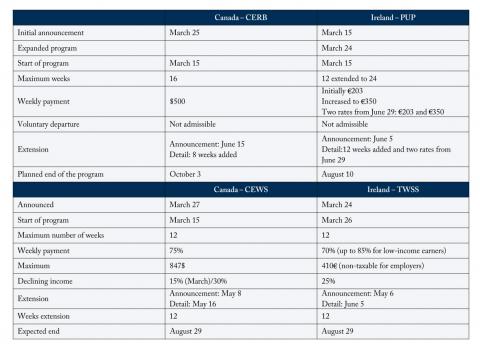

Ireland introduced the Pandemic Unemployment Payment (PUP) on March 15 for 18 to 66-year-olds, employees or self-employed, who had lost their income due to COVID-19. Initially, the PUP was designed for six weeks and a fixed amount of €203 ($300) a week. At the same time, Ireland announced the COVID-19 Employer Refund Scheme, a measure inducing employers to retain their employees and pay them at least €203 euros weekly (initial amount of the PUP), an amount fully reimbursed by the government.

Nine days later, the PUP was increased to 12 weeks and the fixed amount of the benefit increased to €350 a week, an estimate of the average salary in the sectors most affected by the crisis in the country, notably hotels and retail. The generosity of the benefit makes it, in many situations, as advantageous as working at minimum wage. As in Canada, the PUP is taxable, although no tax is deducted from the payment. In addition, employees who voluntarily leave their jobs are not eligible. Unlike the Canada Emergency Response Benefit (CERB), PUP does not allow recipients to earn income during the benefit period.

When the PUP enhancement was announced, Ireland also introduced the Temporary Wage Subsidy Scheme (TWSS). As in Canada, the program reimburses a significant portion of wages for employers who experience a decline in income.

The TWSS covers 70 percent of the salary of an eligible employee up to a maximum of €410 a week. This amount is not taxable for the employer, which gives it a value equivalent to a maximum of €500. The salary paid to an employee must not exceed the pre-pandemic level, and the subsidy is clawed back if it does. To qualify for the TWSS, the employer must demonstrate a 25 percent decrease in income.

For low-income workers, the PUP offers greater benefit than the TWSS. Along the way, Ireland amended the TWSS, raising the wage subsidy from 70 percent to 85 percent of pre-pandemic wages for those earning less than €412. And, in a further attempt to encourage work, employers can top up pre-COVID employee salaries up to €350 – equivalent to the PUP – without penalty.

On June 5, Ireland announced the extension of the TWSS until the end of August.

It also extended the PUP from June 9 to August 10, with some changes. There will be two payment levels after June 29, to link the PUP level to prior earnings. No one on the lower rate of payment will receive less than they were previously paid by their employer. This "gentle recalibration" makes PUP more tailored and equitable.

It also aims to make the labour market more attractive for recipients who only worked a small number of hours before the pandemic and, in the words of the announcement, “received significantly more in the PUP than while in employment.”

For those whose pre-COVID employment income was €200 or more per week (about 75 percent of recipients), the PUP remains at €350 per week.

For those whose previous income was less than €200 (about 25 percent of recipients), the amount of the PUP will be €203, the maximum rate of Ireland’s regular unemployment benefit.

As in Canada, in an effort to stimulate the economy, the Irish government encouraged the transition from emergency benefit to wage subsidy when possible. Early results are encouraging. At the beginning of June, the number of people who benefited from the TWSS exceeded the number of PUP recipients for the first time.

In this week’s extension of the CERB, the federal government says it is exploring ways to ensure that support measures, including the Canada Emergency Wage Subsidy (CEWS) and Employment Insurance, help "Canadians get back on their feet." In order to improve the incentive to work and encourage the transfer of CERB recipients to CEWS, the idea of linking the amount received to pre-pandemic income, as Ireland did, through CERB or a return to employment insurance, is worth considering.

Luc Godbout is Professor, School of Administration, and Chair in Taxation and Public Finance, Université de Sherbrooke, where Tommy Gagné-Dubé is Research professional, and Research Chair in Taxation and Public Finance.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.