From: James Feehan

To: Those who worry about Newfoundland and Labrador’s solvency

Date: August 14, 2020

Subject: Andrew Furey takes on a fiscal nightmare

On August 19, Andrew Furey M.D. will be sworn in as Premier of Newfoundland and Labrador. He was elected by the governing Liberal Party to succeed the outgoing premier, Dwight Ball. He inherits dire fiscal circumstances.

The immediate problem is COVID-19. The virus has led to increased spending on healthcare and significant loss in revenues due to the lockdown’s severe dampening of economic activity. For Newfoundland and Labrador, the severe blow from COVID-19, albeit transitory, comes on top of serious fiscal challenges that previous provincial governments either created or failed to adequately address.

Ball’s administration had put much hope on rising oil prices to lift provincial offshore oil royalties, combined with mild restraint in spending growth, as a relatively painless route to eventually balancing the provincial budget. COVID-19 and the oil price spat between Russia and Saudi Arabia torpedoed that optimism.

On March 20, Premier Ball wrote to the Prime Minister and warned that the province could not sell its bonds. As he put it, “our province has run out of time.” Shortly thereafter, the Bank of Canada launched a program in support of provincial borrowing, buying the province more time.

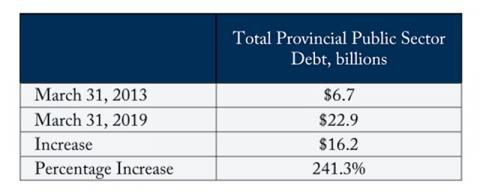

Yet, adding heavily to provincial debt, although inescapable in the pandemic, is simply not sustainable. Even before the virus’s impact, the debt was problematic. Since 2012/13 total provincial public sector debt – direct government, Crown corporation and agency debt, minus sinking funds, but not counting unfunded pension liabilities – grew 241 percent; see Table.

Source: The Estimates, Government of Newfoundland and Labrador

For an economy with a GDP of roughly $34 billion, that accumulation of debt is staggering.

Roughly half the increase in debt was due to budgetary deficits, which began in 2012/13 and worsened with the fall in oil royalties due the decline in oil prices after 2014. The other half was almost entirely due to the Muskrat Falls hydroelectric project, a construct of previous governments under premiers Danny Williams and Kathy Dunderdale. That project was ill conceived and so poorly implemented that overruns have pushed the cost from the 2011 estimate of $6.2 billion to $13.1 billion and it is still not finished.

This debt, plus the additional severe fiscal damage caused by COVID-19 and recent slide in oil prices, is what the new premier must deal with.

On a positive note, COVID-19 will be contained, soon one hopes, so economic activity can return to normal, and the oil price is unlikely to return at the low levels of March and April. However, to continue to assume rising oil royalties will ease the province out of its fiscal nightmare is foolhardy. Hope is no strategy.

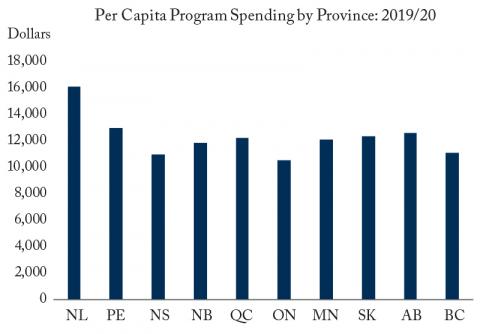

Dr. Furey does have options. On the revenue side, provincial taxes are higher than the national average, but not the highest. Indeed, some taxes, such as the levy on personal incomes, were recently eliminated or cut. Prices for some public services can be reviewed; provincial ferry fares and university tuition are often cited. There may be opportunities for one-time revenues from selling government assets. On the other hand, program expenditure per capita is the highest in Canada.

Source: RBC Economics, Canadian Federal and Provincial Fiscal Tables, July 24, 2020.

Finding the right mix of fiscal measures will not be easy. The new premier should consider the effects on vulnerable groups and any adverse short-term macroeconomic impacts, and prioritize actions that could have long-run beneficial impacts on the economy. This is no easy task for Dr. Furey, who does not have a seat in the legislature where he leads a minority government and who will have interest groups and advocacy organizations bending his ear.

If the federal government lives up to its commitments then that will help. It has promised a review the Fiscal Stabilization Payments Program, which assists provinces experiencing large year-over-year drops in revenues but its payouts are subject to an arbitrary cap and it discriminates against natural resource revenues. Reforms as proposed by Bev Dahlby would benefit provincial governments for this year, especially Newfoundland and Labrador. Also, Ottawa has pledged to help with Muskrat Falls; after all, that project was enabled by a federal loan guarantee in the first place.

Nevertheless, federal aid is no substitute for provincial action. They are complementary. The government led by Premier Furey must do its part.

James Feehan is an honorary research professor at Memorial University of Newfoundland.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.