To: Recession forecasters

From: Jeremy M. Kronick and Steve Ambler

Date: May 24, 2024

Re: Predicting (and Confirming) Business Cycles in Canada

A recent staff working paper by Temel Taskin and Franz Ulrich Ruch at the Bank of Canada uses a sophisticated model – a dynamic autoregressive (AR) probit model – and business cycle turning points published by the C.D. Howe Institute’s Business Cycle Council (BCC) to develop a methodology for predicting Canadian recessions.

Their model is interesting for several reasons. The most straightforward one is that it generates remarkably accurate predictions of Canadian recessions. Beyond that, the model sharpens some questions about what constitutes a recession. For instance, it does not flag a two-quarter downturn in 2015 – an episode the BCC debated at length before deciding it was not a recession.

The model uses a selection of Canadian and foreign macroeconomic and financial variables to estimate the probability of entering a recession. In an appropriately demanding test of their model’s predictive power, the authors estimate the model using monthly data between June 1973 and March 1989, and then generate one-month-ahead out-of-sample forecasts, updating the data set as they move through their sample, which ends in December 2022. They are therefore able to test how well their model worked in predicting the three recessions that happened after March 1989: The early 1990s recession, the Great Financial Crisis, and the COVID-19 pandemic recession.

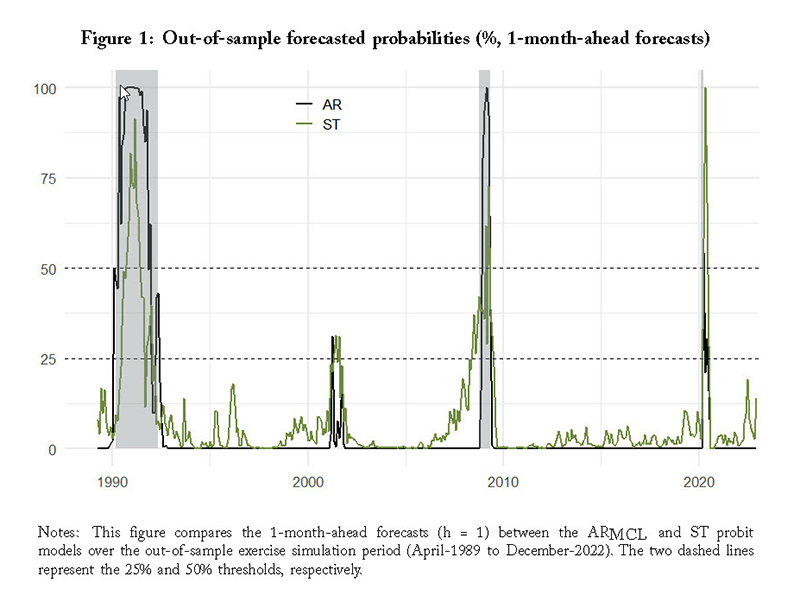

The enclosed chart (Figure 1 from their paper) shows that their AR model forecasts the beginnings and ends of the three recessions better than an alternative static probit model (ST) based on previous research.

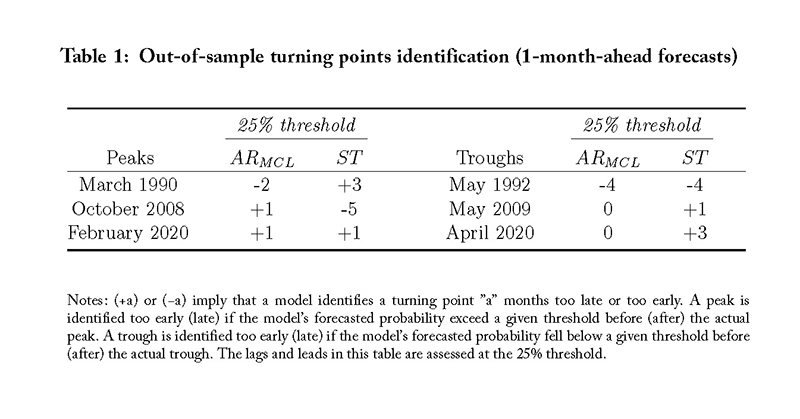

The forecast recession probability rises above 0.5 in both models at dates which coincide with the beginnings of the recessions declared by the BCC and drops below 0.5 at dates which coincide with the recession trough dates declared by the BCC. However, the AR model is more precise in signaling peaks and troughs (as shown in the following table taken from their paper).

In no case does their model’s estimated recession probability rise above 0.5 in cases without a declared recession. Not only does this mean that there are no false positives, but it also ratifies the BCC’s declared recession dates.

What about the two quarters of declining GDP in 2015? The BCC waited until December of 2018 (and the availability of revised GDP data from Statistics Canada) before deciding (on a split vote) that this episode was not a recession. The recession probability predicted by the model for this period is under 10 percent. The figure indicates that there were at least five other periods between 1990 and 2022 when the estimated probability of a recession was higher.

The low recession probability conforms with the view of the majority of BCC members that the 2015 downturn was not pervasive enough to justify a recession call. It resulted primarily from a sharp decrease in world oil prices and mostly affected industries closely linked to the resource sector and was confined geographically to Alberta (where GDP fell 3.8 and 3.5 percent in 2014 and 2015) and, to a lesser extent, Saskatchewan (where it fell 0.8 and -0.1 percent) and Newfoundland and Labrador (-1.2 and 1.5 percent). Regions with higher concentrations of manufacturing, such as Ontario (where GDP grew 2.4 and 2.1 percent) and Quebec (where it grew 0.9 and 1.6 percent), may even have benefited from lower energy prices.

The bursting of the dot-com bubble in 2001 is another interesting case study. It yields the model’s highest forecast of the probability of a recession (over 25 percent) which did not coincide with an actual recession. The likely explanation is the model’s inclusion of US economic activity and financial variables such as stock market indices as explanatory variables. While there was a very sharp downturn in equity markets, this did not translate into a major decline in real output in Canada. GDP fell in the third quarter of 2001, but by less than 0.3 percent in annualized terms.

Improvements in our ability to help forecast recessions are welcome. This Bank of Canada paper does just that through an improvement in modelling techniques. It also illustrates the productive synergy between the business cycle dates produced by the BCC and research on business cycle forecasting by researchers everywhere.

Jeremy M. Kronick is Associate Vice President, and Director of the Centre on Financial and Monetary Policy at the C.D. Howe Institute, where Steve Ambler, a professor of economics, Université du Québec à Montréal, is the David Dodge Chair in Monetary Policy.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.