From: Alexandre Laurin and Nick Dahir

To: Canadians concerned about economic growth

Date: March 14, 2024

Re: Here’s a Suggestion: A Revenue-Neutral Tax Reform for an Economic Boost

A change in Canada’s tax mix was among the ideas circulating last summer at the C.D. Howe Institute’s two-day conference on tax policy.

This country is an average-tax nation overall, but relies far more on income taxes and less on consumption levies, as a share of GDP, than most other industrialized nations. This hurts Canadian economic performance.

Every tax creates economic distortions, and some overused taxes are more economically damaging than others. Simply relying more on less economically damaging taxes, and less on more damaging ones, can improve the economy without reducing public services.

The new C.D. Howe Institute Shadow Budget reflects these insights by suggesting a simple change in the federal tax mix: a 2 percentage points increase in the GST rate accompanied by a 2 percentage points reduction in the federal corporate income tax (CIT) rate, and a reduction of the tax rate for the second federal personal income tax (PIT) bracket, ranging from $55,867 to $111,733, from 20.5 percent to 15 percent.

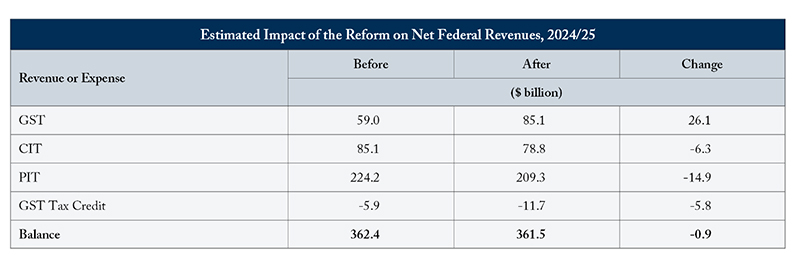

The Table shows how this reform package would be revenue neutral for Ottawa, costing largely as much as it yields in new revenues from the GST increase. For illustration purposes, calculations are shown for the upcoming fiscal year, starting April 2024. Admittedly, our revenue estimates are crude, but they include possible behavioural responses by taxpayers.

First the corporate tax cut would increase the expected after-tax return on potential business investments, making more opportunities desirable, and thus increasing the capital stock and economic activity. It may also drive some multinational profits to shift back into Canada. We use an elasticity of taxable income of -0.33, inspired from this study, to model the impact of that cut on the taxable income base.

Second, lower personal income taxes would decrease the incentive to avoid them and stimulate greater work effort and participation. Reduced personal taxes may also positively influence risk-taking and entrepreneurial activity. We simulate these positive impacts by using the Parliamentary Budget Officer’s estimate of the elasticity of taxable income that it derived by analyzing taxpayer response to the 2016 middle-income tax cut. Furthermore, we model the effects of the corporate tax reduction on the eligible dividend tax credit to preserve tax integration. We also assume that one-quarter of the rise in after-tax profits will be distributed to dividend holders as an increase in eligible dividends. Additionally, our calculations indicate that this projected increase in income will result in a 3-percent rise in GST revenues.

Third, we double the base GST tax credit amounts for individuals and families to mitigate the impact on low-income individuals who would face higher GST without receiving any income tax reduction benefits. Families in the lower income quartiles would see their relative net tax burden remain relatively unchanged. However, some couples in the third income quartile might not gain from the personal tax reduction because of the split of family income between spouses. And they may also not benefit from the enhanced GST credit, because the base credit amounts are reduced by 5 cents per dollar of family adjusted net income above $43,500 irrespective of the family composition. Adjusting the credit calculations to better reflect family composition could enhance the reform’s effect on tax burden distributions.

The tax shift reform outlined here is essentially revenue neutral. Its purpose? To enhance the welfare of Canadians by substituting taxes that harm the economy with those that have a lesser impact. Drawing on estimated marginal costs of funds, a $20 billion tax shift like ours would result in a long-term welfare improvement of $4.5 billion annually, calculated on a present value basis.

This crude analysis reveals that innovative policy design can significantly boost economic activity and incomes without cutting public services or adversely affecting the most disadvantaged. Business investment in Canada has been lackluster since 2015, leading to a decline in capital per worker, and the GDP per person is stagnating. Recent tax reforms have been largely motivated by issues of inequity and the need for redistribution. It is now imperative to tackle the adverse impacts of the tax system on Canada's economic performance. Federal tax policy can help.

Source: Pre-reform estimates based on the federal Public Accounts for 2022/23 and the projections from the Fall Economic Statement of 2023. The impact of PIT reform analysed using the Social Policy Simulation Database and Model (SPSD/M) version 30.1, incorporating taxpayer behavioural response as outlined in the text. The effects of GST reform estimated by integrating the per-point yield with SPSD/M simulations. For CIT reform, the impact is assessed using the 2023 Tax Expenditures and Evaluations report by Finance Canada, incorporating taxpayer behavioural response as outlined in the text.

Alexandre Laurin is Director of Research at the C.D. Howe Institute where Nick Dahir is a Research Assistant.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.