From: Luc Godbout

To: The Hon. Carla Qualtrough, Minister of Employment, Workforce Development and Disability Inclusion, and the Hon. Bill Morneau, Minister of Finance

Date: May 5, 2020

Re: The CERB and the CESB: Balancing work incentives against fairness considerations

Temporary income support measures responding to the COVID-19 crisis, such as the Canada Emergency Response Benefit (CERB) and, to a lesser extent, the Canada Emergency Student Benefit (CESB), are achieving their initial objective to support household income during the time of crisis. Despite this good news, questions remain on the potential impact of these income support initiatives on work incentives.

Unlike Employment Insurance, a CERB recipient has no obligation to remain available for work or to be actively looking for a job. This provision suited the emergency of the crisis, but now we need to ensure economic activity can restart. To avoid the risk of disincentivizing work for certain workers, the federal government will need to adjust certain CERB eligibility requirements.

In a recent analysis with Suzie St-Cerny, we showed that the CERB provides good income support to households that have lost their jobs, but also that its relative generosity for minimum-wage workers can have undesirable effects.

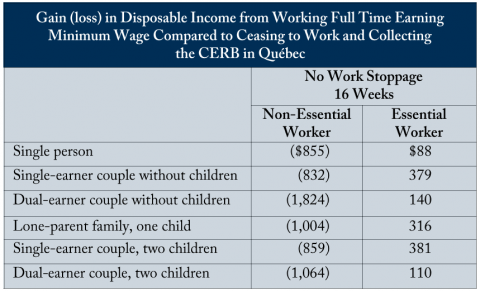

Whether for a single person, a couple with or without children or a one-parent family, it appears more financially advantageous to cease minimum-wage employment and receive the CERB for 16 weeks than to keep working full time.

For Québec households staying at work earning minimum wage and therefore not receiving the CERB, disposable incomes for 2020 will be lower by $832 to $1,824, depending on their family situation.

To counter CERB’s negative impacts on work incentives, Québec introduced an additional benefit topping up incomes for essential sector workers, thus preserving the financial gain of working. The gain, however, is modest. In the case of a single person earning minimum wage, being at work for 16 weeks compared to receiving the CERB provides a gain of $88, the equivalent of 16 cents an hour during those16 weeks.

On the CESB side, the program’s interference with students’ work incentives is even clearer, and proving to be counterproductive to the workings of provincial work incentive programs designed to attract young people (for example, Québec’s incentive for seasonal agricultural workers working at minimum wage).

Based on the current CESB parameters, a post-secondary student who is not working will be better off than a student working at minimum wage for 21 hours per week. The same is true for a student benefiting from the CESB and working part-time for less than $1,000 per month. The latter gives up only $28 for eight weeks of work compared to agricultural work of 35 hours per week.

During the debate on the adoption of the CESB in the House of Commons, we heard that government efforts would be made to ensure that the CERB and the CESB can encourage employment in all circumstances while continuing to play their role. Therefore, we can expect future adjustments to these income support programs.

This is commendable, but is also a complex exercise. Regardless of the fiscal cost, modulating a gradual reduction of these benefits for those who go back to work or take on a job would increase their incentive to work. At the same time, however, one must also take into account fairness considerations regarding the “unlucky” who have not lost their jobs. The desire to increase work incentives must be balanced against treating people equitably whether they are or not entitled to CERB/CESB.

As currently designed, the CERB and the CESB, unlike the Canada Emergency Wage Subsidy, will act to slow down the economic recovery. Fortunately, these benefits are adapted to a temporary and very specific context.

While the CERB has played its emergency support role very well, there is still time to act to minimize its negative effects on work incentives and the resumption of economic activities.

Luc Godbout is Professor, School of Administration, Université de Sherbrooke; and Chair in Taxation and Public Finance.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.