From: Miles Wu

To: Canadian consumers

Date: December 9, 2019

Re: A dollar drop likely to come with the next downturn

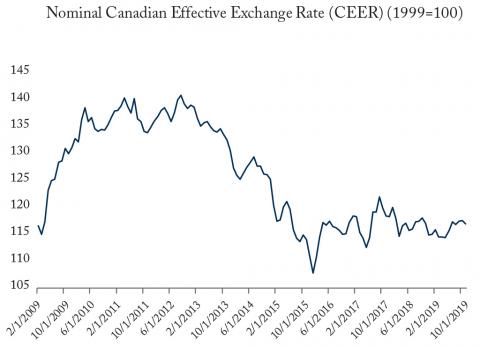

The foreign-exchange value of the Canadian dollar has been remarkably stable for more than three years. Relative to its US counterpart, it sits almost exactly where it was in mid-April of 2016. And, over the intervening 42 months, it has never deviated more than 7.3 percent from that – a highly unusual performance. However, with the current expansion already elderly and strong economic headwinds, Canadian consumers should anticipate a depreciation of the Canadian dollar and the more expensive imports it will bring.

The latest ifo World Economic Survey paints a bleak picture for Canada’s economy in the coming months. While Canada’s economy has held up admirably amidst global uncertainty, the quarterly survey of 1,200 experts in 117 nations, predicts a declining economy over the next six months driven by decreasing private consumption and exports. Many of Canada’s major trading partners face similar concerns, and the ifo survey highlights barriers to trade as being one of Canada’s biggest quandaries in the coming months.

As a market economy with large trade volumes, Canada is especially vulnerable to trade tensions and economic slowdowns among its major trading partners. Fully 65 percent of Canada’s GDP is trade-related. The ongoing trade dispute between China and America, and a slowing EU economy are creating uncertainty. The negative scores given to Canada’s major trading partners by the survey are not encouraging. Countries including China, Germany, Japan, Mexico, United Kingdom, and the United States are expected to have declining economies and shrinking imports over the next six months. These six countries took more than 86 percent of Canada’s total exports in 2018, so any slowdowns in these countries will hurt.

Canada’s resource sector has historically been an important driver of the Canadian dollar. Periods of economic growth lead to increases in resource demand and prices, as commercial and industrial sectors consume more natural gas, and minerals to fuel their growth. Strong demand for oil leads to strong demand for the Canadian dollar, and in turn a stronger dollar. With Canada’s oil and gas sector already experiencing difficulties reaching international markets, any slowdown of the world economy could provide further drag on both the sector and the dollar.

In addition to trade, we now have a minority government that faces strong political obstacles from both the provinces and their federal opposition – a significant concern to investors. Canada ranked third among 16 comparable OECD countries as having an “Unfavorable climate for foreign investors,” in the survey. A lack of political stability will discourage foreign capital from investing in Canada, putting more pressure on the dollar.

Lastly, the Bank of Canada may follow the lead of other central banks and cut its overnight rate in the coming months. So far, the bank has resisted this temptation, citing strong domestic demand, a robust service sector, and employment as signs that the economy is still resilient. However, it may not have a choice with a weakening global economy and any decline in private consumption in the near future. A depreciation of the dollar will counter the lower inflation caused by an economic downturn and benefit export companies, thus helping counter the negative impacts of lower private consumption domestically.

A depreciation of the Canadian dollar will mean a more expensive cost of living for Canadians, as consumer goods, motor vehicles, and electronics rank as Canada’s top three imports. In light of this, consumers should get ready for life in a low-dollar world as the global economy weakens.

Miles Wu is a Research Intern at the C.D. Howe Institute.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.