From: Rosalie Wyonch

To: Health Canada

Date: January 5, 2018

Re: Don’t Let the Dealer Run Dry: Legal Marijuana Supply

With the July 1 target for marijuana legalization swiftly approaching, governments across Canada have been tackling the many policy aspects associated with ending prohibition. One of the new challenges is unfamiliar: ensuring there is enough weed to meet global demand.

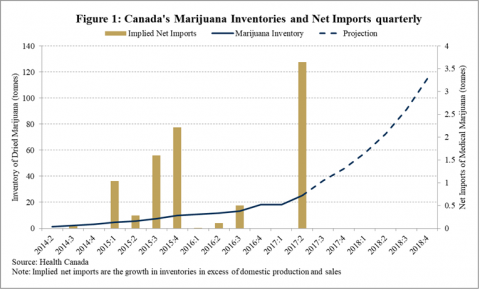

While many aspects of the new legal market involve coordination between levels of government across the country, regulation and licensing of producers to supply the recreational market is a federal responsibility administered by Health Canada. It more than doubled the number of licensed cannabis producers in the second half of 2017 for a current total of 84. There is limited information about the production capacity of individual producers so it is difficult to accurately predict how much marijuana will be available by July1. But projecting based on the exponential trend of producer inventories over time; I estimate that about 115 tonnes of marijuana will be available by the end of 2018 (Figure 1). The exponential trend accounts for the expected acceleration of growth in the market due to new recreational producers and investments by existing medical producers to increase production and inventories in preparation for recreational legalization.

There is significant uncertainty about the size of the domestic marijuana market demand, but the Parliamentary Budget Office (PBO) estimates a midpoint of about 655 tonnes in 2018. Ideally – if the entire market was to become legal on July 1 – this would translate to domestic retail sales of $3.3 billion.This means it is unlikely that there will be enough legal marijuana to satisfy much more than half of total domestic demand. This shortage leaves room for the black market to operate profitably at the expense of government revenues, legitimate business and public health and safety.

Canada will have the largest industrialized cannabis industry in the world and there is potential for significant global demand. Given the much stricter regulations on cultivation of cannabis in countries where it remains illegal, it may be easier for scientists and medical patients to import from Canada than access domestic supply. Current and proposed policy in Canada allows the import/export of marijuana for medical or scientific purposes. The three largest cannabis producers by market capitalization in Canada have strategic partnerships aimed at expanding to international markets. Canadian medical marijuana is already exported to Australia and the EU. Inventories in Canada have been growing by more than Canadian production, after accounting for sales, meaning there is likely marijuana being imported as well. As the Canadian cannabis market grows in size and efficiency it is highly unlikely that international demand will diminish. It is much more likely to grow.

Given the potential shortage of legal cannabis, Ottawa should focus speeding approvals and licensing for production, sale and international trade in cannabis. This will serve to keep the domestic legal market competitive, meet domestic market demand and allow Canadian businesses to leverage their current global advantage in marijuana production. With countries around the world buying high quality Canadian product and no shortage of demand domestically, the government should aim high when it comes to supply.

Rosalie Wyonch is a Policy Analyst at the C.D. Howe Institute.

To send a comment or leave feedback, email us at blog@cdhowe.org.