From: Rosalie Wyonch

To: The Honorable Bill Blair, Parliamentary Secretary to the Justice Minister

Date: April 10, 2017

Re: With Legal Weed the Government Must Choose Revenue or Regulated Market, Not Both

The federal government is rumored to be releasing its plans to legalize marijuana for recreational consumption this week. Budget 2017 also assured everyone that it “will take steps to ensure that taxation levels remain effective.” Projections estimate that 4.6 million Canadians will consume about 655 metric tons of marijuana in 2018. That’s a lot of marijuana for both federal and provincial governments to tax to generate a windfall of tax revenue. Due to the existence of a prolific black market, however, there is a tradeoff between public health concerns and revenue generation meaning that the government can choose a regulated market or large revenue generation but not both.

If the government taxes marijuana heavily, it will ensure the continuation of the black market and will be undermining its efforts to control the substance. If the tax rates are very low, however, then governments will generate little revenue and consumption of marijuana may increase due to low prices and a newly accessible legal supply. Lower tax rates, however, have the public health benefit of discouraging the illicit market which ensures more regulated product.

There is significant uncertainty about the future of prices and demand for marijuana upon legalization. To be competitive with the illegal market, legal marijuana must be priced similarly: a $1 premium between legal and illegal weed results in about 35 percent of the market remaining unregulated. This gives all the more reason for the government to be cautious about levels and type of taxation.

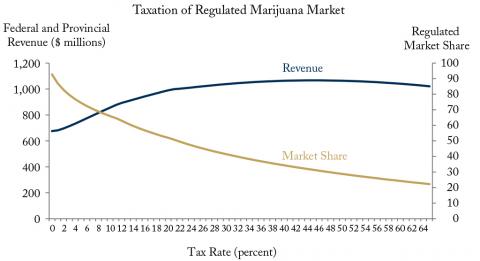

Given current prices in the legal and illicit market, adjusted for potency of active ingredients, and the willingness of consumers to pay a premium to access the legal market for marijuana, I estimate that applying only federal and provincial sales tax (GST/HST, PST) results in over 90 percent of the marijuana market being regulated and $675 million in annual revenue (Figure 1). However, if the government were to generate $1 billion in revenue, only about half of the market would be regulated, leaving over 300 metric tons of consumption in the black market. Any increase in taxes beyond this level serves to increase the share of the black market and generates little additional revenue. With the regulation of marijuana, the government has a choice to make: either legitimize the market or generate large revenues, not both.

Source: Parliamentary Budget Office, CannStandard, Author’s Calculations

Rosalie Wyonch is a Policy Analyst at the C.D. Howe Institute

To send a comment or leave feedback, email us at blog@cdhowe.org.