From: Daniel Schwanen, William B.P. Robson and Mawakina Bafale

To: Canadian Senators

Date: October 13, 2023

Re: Don’t Let the Dairy Lobby Win this Fight

Amazingly, just as cost-of-living concerns are acute for Canadians and grocery prices are in the political cross-hairs, a bill has arrived in the Senate that would further entrench the supply-management restrictions that keep prices of dairy products in Canada artificially high.

Bill C-282 would forbid any concessions in trade negotiations that would liberalize Canadian consumers’ and food producers’ access to imports of dairy, poultry and eggs. It would prevent any expansion in tariff rate quotas that let imports serve a small percentage of the Canadian market, and it would prevent reductions in the prohibitively high tariffs that apply to products beyond those quotas. These trade barriers are critical to the supply management systems that restrict food supplies in Canada, forcing Canadian households, food processors and restaurateurs to pay higher prices than they otherwise would.

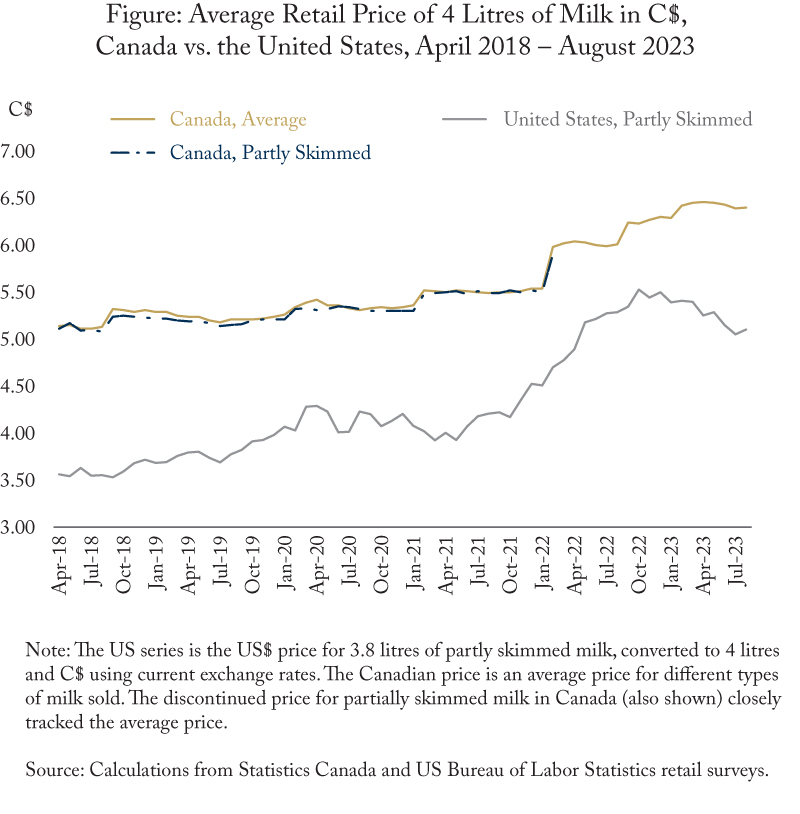

Dairy is the supply-managed sector with the largest impact on Canadians. A comparison of Canadian and US milk prices provides evidence of the cost of this system (see figure). Many US jurisdictions resemble Canadian provinces in climate, geography, and demand for hormone-free milk. The United States also regulates dairy prices, but in a way that better balances the interests of farmers, other businesses, and households.

Other elements than farm gate milk prices factor into the price that consumers ultimately pay, as the Canadian Dairy Commission points out each time it raises the minimum price of dairy products. Yet the end result is that prices in Canada ratchet steadily up – unlike in the United States, where consumers get a break from time to time.

Canadian consumers can switch among products – their efforts to control their dairy budgets account for some downward drift in the average Canadian price shown in the figure. But their main option to escape high prices is to consume less milk and dairy products – which is happening, and does not benefit dairy producers or anyone else in the long run.

Ultimately, we should transition to a system that is fairer to consumers and healthier for the industry. A more dynamic system would open the door to exporting more and encourage rather than discourage new entrants in the industry. But Bill C-282 would severely limit our ability to make such reforms by preventing changes to the external trade measures that underpin the current system.

This attempt by the supply management lobby to strengthen its grip at the express expense of the government’s ability to negotiate agreements that might benefit Canadians should be a wake-up call for Canadian legislators.

Higher dairy prices in Canada hurt people who spend the largest shares of their family budgets on dairy – typically people with relatively low incomes. They handicap value-added dairy industries such as cheese and yogurt production, as well as food processing and restaurants generally. Alongside direct transfers, they make Canadian dairy farmers among the most subsidized in the world.

There are other ways to provide income stability to farmers and a healthy return to those who are innovative in meeting consumer and industry needs. We should stop setting milk prices in ways that protect higher costs among dairy farmers, at the expense of food processors, restauranteurs and consumers.

Bill C-282 would undercut Canada’s ability to negotiate trade agreements and reinforce the supply-management system we should replace. The Senate should save us from a bad mistake.

Daniel Schwanen is vice-president, research, William B.P. Robson is chief executive officer, and Mawakina Bafale is a research assistant, all at the C.D. Howe Institute.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.

A version of this Memo first appeared in the Financial Post.