The Study in Brief

- Two years ago, the federal government ceased issuing Real Return Bonds, which are a valuable tool for Canadian savers to protect themselves from inflation.

- The government cited weak demand for RRBs as justifying the cancellation, without acknowledging that its approach to RRBs itself promoted a thin market that lessened the attractiveness of RRBs to potential investors.

- A survey of 13 institutional investors suggests that an improved RRB program, with larger issues and more diversity of terms, would help the federal government finance its debt and give Canadians better access to an asset that many would like to hold.

We thank Jeremy Kronick, David Dodge, Charles DeLand, Mawakina Bafale, Steve Ambler, Bob Baldwin, Pierre Duguay, Ashwin Gopwani, David Laidler, Angelo Melino, Eric Monteiro, John Murray, James Pierlot, and Brent Simmons, as well as members of the C.D. Howe Institute’s Fiscal and Tax Competitiveness and Pension Policy Councils, anonymous reviewers, and the respondents to our survey of institutional investors for their contributions to this report. We are responsible for any errors and for the conclusions reached.

Introduction and Overview

The federal government stopped issuing Real Return Bonds (RRBs) in 2022.The cancellation of the RRB program came as a surprise; the government’s announcement said nothing about the value of inflation-indexed securities in capital markets, either as symbols of governments’ commitment to low inflation or as tools to understand inflation expectations and value-indexed obligations such as pensions. The announcement justified the decision by referring to weak demand and illiquid markets. It did not acknowledge that the government’s management of the RRB program – notably the small amounts issued and lack of diversity in maturities – made for a thin market, in which illiquidity discouraged investors from buying and holding RRBs.

Indexed debt fills an important gap in financial markets. The government’s cancellation of the RRB program means that Canadian savers will have less access to a uniquely valuable tool to protect themselves from inflation. The pension funds and other institutions that invest on individual Canadians’ behalf will lose a key tool to help them deliver on their promises.

For most of the decade prior to their cancellation, demand for RRBs suffered not only from a thin market, but also because inflation tended to be below the Bank of Canada’s 2 percent target and the federal government was issuing relatively little debt of any kind. The recent surge of inflation and explosion of federal debt has changed that environment, making this a propitious time to launch a new and improved RRB program.

Prompted by the government’s claim that the program was cancelled because of weak demand, the C.D. Howe Institute surveyed institutional investors with a total of $2.6 trillion of assets under management, and substantial holdings of RRBs, asking them if they thought demand for RRBs was low and, if so, why they thought it was low. Their answers affirm the value of RRBs in principle, and attribute the poor functioning of Canada’s RRB market to its thinness, with small issues and lack of diversity in maturities particularly cited. Not one of the 13 institutional investors surveyed supported the government’s decision to cease issuing the bonds. The federal government should resume issuing RRBs – in greater amounts and with more diversity of terms than before.

What Are Real Return Bonds and Why Are They Beneficial for Canadians?

Surging inflation recently reminded Canadian savers and lenders of the threat of being repaid in currency that has unexpectedly lost purchasing power. This threat can prevent mutually beneficial exchanges by creating a gap between the interest rate lenders want and the rate borrowers are willing to pay.

Bonds like RRBs that are indexed to the price level – often called “linkers” because their returns are linked to prices – address this problem, ensuring that their principal retains its real purchasing power.1 Like the indexed bonds of other countries that issue them, the principal of the federal government’s RRBs changes with the Consumer Price Index (CPI), based on the difference between the CPI at the time of issue and the CPI at a reference period (typically three months before the adjustment date). The coupon payment is the stated coupon rate multiplied by the adjusted principal. The adjusted principal is repaid at maturity.2

Despite inflation protection’s attractiveness to lenders, private indexed debt of this kind is rare. Individuals and businesses do not control inflation, and notwithstanding inflation’s erosion of the real value of principal, it can hurt the financial health of private borrowers in other ways—through its interaction with taxes, for example. For a private borrower, promising to repay a purchasing-power-adjusted loan feels, and often is, risky.

Public-sector borrowers are better placed to issue indexed debt. Most national governments powerfully influence inflation through their central banks, either because they control monetary policy directly, or because they set mandates for their operationally independent central banks, as Canada does through the inflation targets jointly set by Parliament and the Bank of Canada. Importantly, changes in the price level tend to affect tax revenues one-for-one.3 Many countries began issuing indexed bonds after the 1970s inflation surge, including the UK (1981), Australia (1985), Sweden (1994), New Zealand (1995), and the United States (1997).

Canada issued its first RRBs in 1991 with a $700 million offering. Those bonds, like all their successors, had a 30-year maturity. Their coupon rate, their effective interest rate after adjustment for inflation, was 4.25 percent.

The Benefits of Canada’s RRB Program

The primary goal of federal debt management in 1991, as expressed in its Debt Operations Report (DOR) for the 1991/92 fiscal year (Canada 1992), was to raise funds at the minimum long-term cost and diversify the debt program cost-effectively.

At that time, keeping the cost of borrowing down was a critical issue for the federal government. The government had run continuous deficits since the 1960s, and the 1990 recession sent the debt and interest costs into uncharted territory, with its gross debt charges close to 30 percent of total expenses. Other debt-management changes around the same time included issuing a 30-year Government of Canada nominal bond, increasing the size of benchmark bond issues, establishing regular dates for issuing debt, and replacing syndicated issues with auctions.4 DORs and Debt Management Reports (DMRs) in the mid-1990s added the goal of developing – later maintaining – efficient capital markets, notably for government debt, through the above measures, as well as developing a diverse investor base (see, for example, Canada 1995 and Canada 1997).

RRBs offer unique protection against inflation, a serious threat to financial security. The expense and complication of selling bonds directly to individuals discouraged the government from retailing RRBs directly to individual investors, but people who save through pensions with partial or full inflation protection, purchase an indexed annuity, or receive long-term disability benefits have indirect access to RRBs.

Savers, via pension funds, insurers and other institutional investors who manage their savings, can buy other assets that appreciate in value and/or yield revenue streams correlated with price increases, such as real estate and infrastructure. Unlike the precise link between prices and the principal value of RRBs, however, the correlation between the prices of those assets and prices generally is imperfect. The recent inflation surge, for instance, accompanied a drop in revenues from commercial leases, making commercial real estate a poor hedge this time. Additionally, the stock of infrastructure investments available to private investors in Canada – such as utilities, airports, toll bridges, and highways – is limited.

Institutional investors can, and do, buy infrastructure in other countries, but that provides revenues correlated with those countries’ inflation rates, which may not perfectly correlate with Canadian inflation, and exposes the investors and the savers whose money they manage to exchange-rate risk. Other countries’ governments, notably the US government, also issue inflation-linked bonds, as we discuss below, but those are not readily available to retail investors, and owning them exposes Canadian savers not only to exchange-rate risk but to interest-rate risk as well.

RRBs are the only market instruments that offer full protection against Canadian inflation. It is reasonable to think that a thicker market in RRBs would improve pricing and promote the development of retail products that offer inflation protection. Intermediaries need not hold RRBs directly to benefit from the existence of a market for them, since the yield on RRBs allows valuations of indexed liabilities that guide the funding decisions of plan managers (CIA 2023; ACPM 2023).5 The discontinuance of RRBs will make it harder for Canadians and institutional investors to hedge against inflation.

Issuance of RRBs Compared with Nominal Bonds

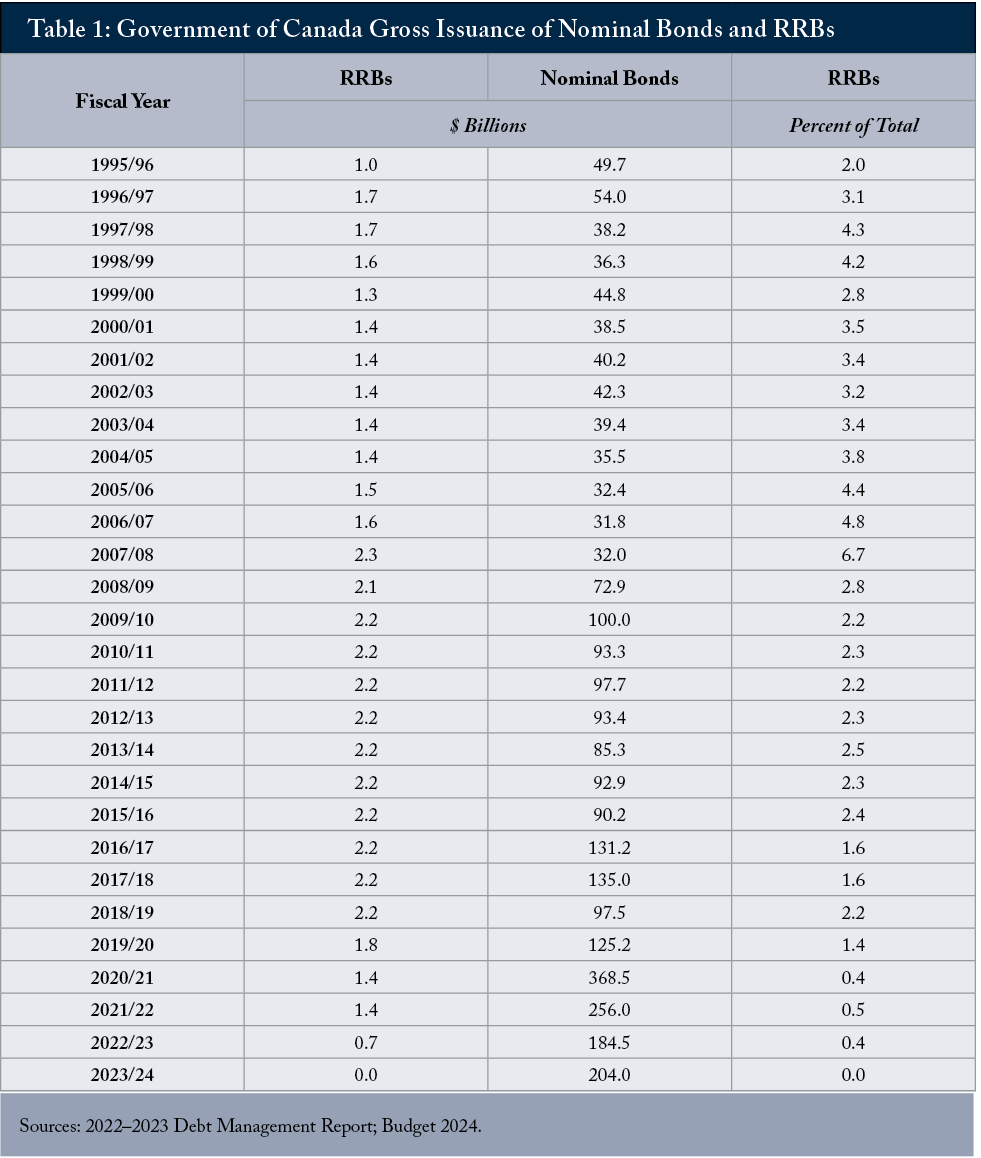

Unlike many other countries mentioned, the Canadian federal government has issued relatively small amounts of indexed debt. Balanced budgets under Prime Minister Jean Chretien and Finance Minister Paul Martin eliminated the federal government’s net financing requirement in 1997/98, resulting in fewer bonds overall and fewer RRBs. Although RRB issues picked up somewhat when the federal government again began borrowing at the time of the 2008 - 2009 financial crisis and recession, RRB issuance never much exceeded $2.2 billion annually. In 2019/20, issuance fell to $1.8 billion, and in 2020/21 and 2022/22, it further dropped to $1.4 billion despite federal borrowing’s explosion and the maturation of the first RRB issue (Table 1).

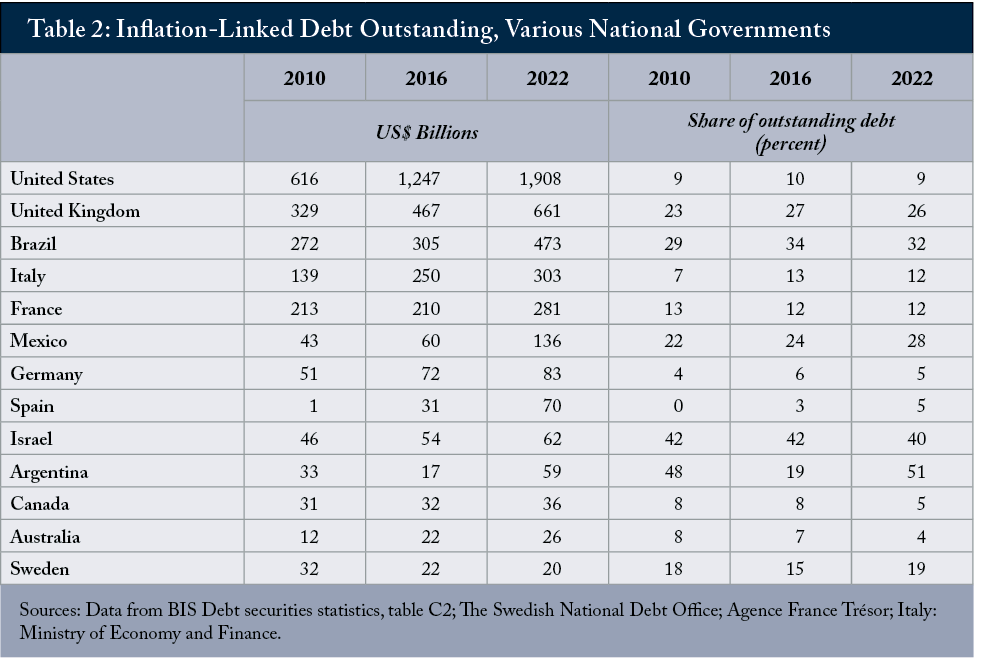

Immediately before the program’s cancellation, annual issuance was about half a percent of gross annual bond supply, resulting in a relatively small float of RRBs. The federal government’s inflation-linked debt outstanding ranks among the lowest of other countries, both in absolute value and as a percentage of total debt securities. Continued heavy government borrowing with no new issues of RRBs means that the ratio of RRBs to total bonds outstanding will continue to fall (Table 2).

How Has the RRB Program Performed and Has it Met Its Goals?

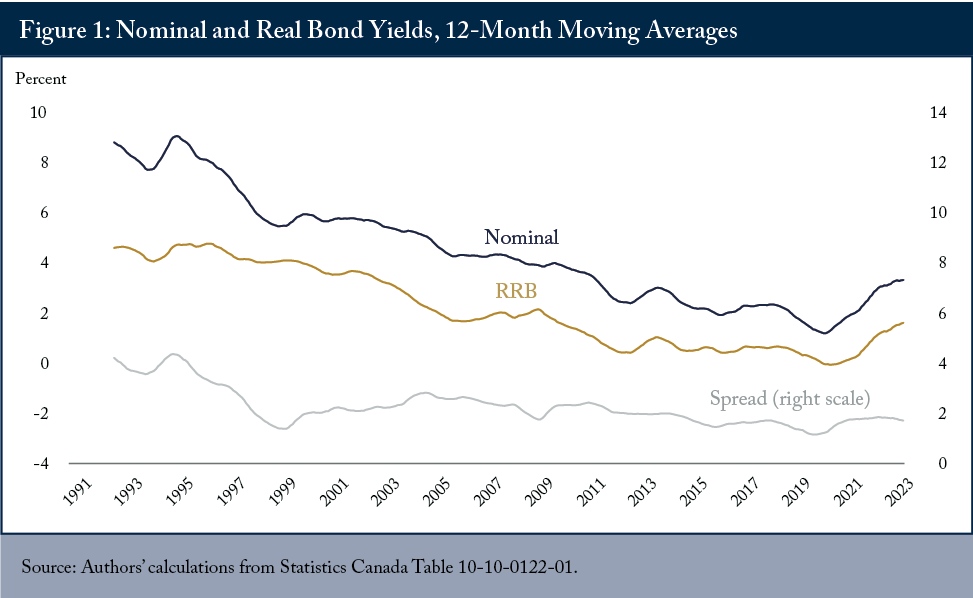

How have RRBs performed as a financing instrument for the government and as an asset for investors and capital markets? A good place to start on this question is a review of their yields relative to yields on the 30-year nominal Government of Canada bonds the government began issuing around the same time.6 Figure 1 shows the yields on both from the inception of the RRB program to the present day, as well as the spread between them.7

Since the difference between the two bonds is that the nominal bond offers no protection against inflation while the RRB offers protection against inflation, in a liquid market with prices reflecting arm’s-length trading, expectations of inflation should play a major role in determining the spread between them.

The spread between the yields on nominal and RRBs since the early 1990s is consistent with a story of increasing confidence in the Bank of Canada’s ability to achieve and maintain low inflation. Initially, investors were skeptical. After decades of high inflation, some doubted that monetary policy could engineer low inflation. Some who thought it possible doubted that politics would allow it. The disagreement between then-Bank of Canada Governor John Crow and the Liberal government that took office in 1993 regarding inflation targets led to the replacement of Crow, which raised concerns that inflation might be higher under the new government (Laidler and Robson 2004, p. 84). The spread between yields on the two types of bonds stayed around 4 percent until 1995. By then, actual experience of low inflation and the new government’s agreement to an ongoing inflation target of 2 percent past the end of 1995 changed minds. The spread fell to around 2 percent and the 12-month moving average of the spread has been within one percentage point of 2 percent ever since.

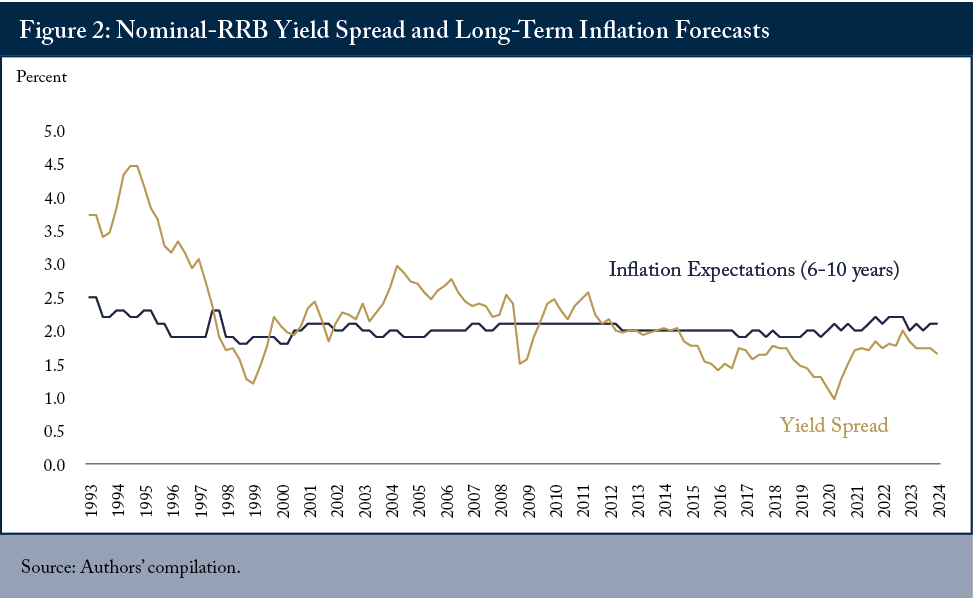

Inflation expectations have not been exactly 2 percent since the end of 1995 so, next, we look at the spread between nominal bonds and RRBs in the light of long-term inflation forecasts. Figure 2 compares the quarterly yield spread with the average of all the individual predictions collected by Consensus Economics for CPI inflation 6 to 10 years ahead in Canada.8

The behaviour of the quarterly nominal-RRB spread compared to inflation forecasts in the early 1990s is consistent with the story of low initial confidence in economists’ inflation forecasts, followed by improvement. Initially, the spread was over 1 percentage point above inflation expectations, sometimes exceeding 2 points. After the first three years of RRB issuance, it declined closer to target inflation. From late 1997 until the mid-2010s, the gap between the spread and expected inflation was usually mildly positive. As we explain in the next section, nothing is remarkable about that. What does seem peculiar is that the gap reversed after mid-2014. The yield spread was 0.5 percentage points higher than forecasted inflation on average until mid-2014, then 0.3 points lower on average after that. As explained below, the thinning of the market by inadequate RRB supply likely explains relatively high RRB yields and the reversal of the gap.

Cancellation: Inadequate Supply Hurting Liquidity and Market Reaction

The federal government’s last issue of RRBs was in the spring of 2022. In its Fall Economic Statement in November 2022, the government announced the program’s cancellation. The government justified the cancellation as a response to low market demand.

The termination surprised institutional investors. They had noted low demand, but explained it with reference to the thin market resulting from low supply in general and small benchmark sizes in particular. Respondents to government consultations in 2019 attributed the declining demand for RRBs to three main factors: the relatively low liquidity of the RRB market, diminished inflation risk, which reduced the necessity for inflation protection, and the generally low yield environment, which compelled investors to seek higher-yielding asset classes that also provide some inflation protection. None had suggested that issuance was excessive (Canada 2019a).

The 2019 consultations noted that holders of RRBs valued the inflation protection they offer – some saying they were uniquely useful in that regard, others saying that the indexed debt of other governments and assets such as real estate were also attractive. The summary also reported that when asked about longer-term trends in demand and pricing, pension funds and insurers – institutions likelier to want inflation protection to match their liabilities – saw illiquidity, lower inflation and generally low yields as making RRBs less attractive than other assets offering inflation protection (Canada 2019a).

With no new issuance, the existing stock of RRBs will shrink as the bonds mature: down 35 percent within the next 12 years, down 64 percent within the next 20 years, and eliminated in 30 years. Other domestic issuers are unlikely to fill the gap left by the federal government, which, for the reasons already noted, can issue RRBs with more confidence than provinces and far more confidence than private borrowers. The last provincial issuance of RRBs dates to 2008, while the corporate inflation-linked bond market is almost non-existent (Cook 2022). Further thinning of the market for RRBs will likely adversely affect the availability and pricing of other indexed products: indexed annuities, for example, will likely become more expensive (Normandin Beaudry 2024).

On the subject of liquidity, or its absence, the summary of the 2019 consultations reported that all participants said secondary market liquidity for RRBs was poor, and that illiquidity deterred clients and dealers from holding RRBs and discouraged the development of derivatives (Canada 2019a). A reasonable inference from these comments, as from similar comments in previous consultations, is that a larger float of RRBs could improve liquidity, demand and pricing.9 Paradoxically, that report concluded by saying that the government would reduce RRB issuance from $1.8 billion to $1.4 billion annually.

The Bank of Canada’s Fall 2022 Debt Management Strategy Consultations registered another go-round of this vicious circle of inadequate supply hurting liquidity and thereby suppressing demand: “…participants noted that there continues to be little demand for this product. This low demand reflects RRBs’ general lack of liquidity, as well as small stock and benchmark sizes.” It also noted that “Canadian investors seeking inflation protection are relying on other instruments such as infrastructure projects and US Treasury Inflation-Protection Securities (TIPS)” (Bank of Canada 2022).

The Root of All Problems: Inadequate RRB Supply

Bond yields vary inversely with bond prices. As noted already, since the difference between nominal bonds and RRBs is inflation protection, expected inflation should play a major role in determining the difference in their yields. Straightforwardly then, expected inflation should play a major role in determining the difference in their prices. In addition, there should be a premium on RRBs – their price should also be higher and their yield lower – or, coming at it the other way, there should be a discount on nominal bonds – their price should be lower and their yield higher – reflecting the value of protection against unexpected inflation. It makes sense that the gap between the nominal/RRB yield spread and forecasted inflation would typically be positive; it means that, if inflation is typically in line with expectations, the government should be able to reduce its overall debt-service costs by issuing RRBs.10

Investors’ willingness to pay for inflation protection was probably greatest in the years immediately following the first issue of RRBs. The gap between the nominal/RRB yield spread and forecasted inflation was relatively large in the early 1990s when experience had not yet proved that the 2 percent inflation target was technically achievable and politically supportable. Investors’ willingness to pay for inflation protection was probably lower during the 2010s, when inflation tended to undershoot expectations and the Bank of Canada’s target.

But it is hard to understand why investors’ willingness to pay for inflation protection would at other times be zero or even negative as it has been since 2014 (Figure 2). Why would bondholders be indifferent between nominal bonds and RRBs, valuing inflation protection at nothing? More dramatically, why would people be able to buy the asset with inflation protection at a discount? Although the spread between the yields on US nominal bonds and TIPS dropped below two percent around the middle of the last decade and during the COVID pandemic, it has averaged around 2.3 percent since July of 2021, well above the 1.8 percent spread between the yields on Canadian long bonds and RRBs over that time.11

To make sense of a gap between a nominal/RRB yield spread and forecasted inflation of zero or less than zero, we need something that makes RRBs trade at a discount. The prime suspect is illiquidity. Before the explosion of federal debt in 2020/21, which lowered the ratio of trading to outstanding in all Government of Canada bonds, the average turnover of long-term nominal bonds was in the 5-10 percent range, while the average turnover of RRBs was less than 1 percent (Canada 2019b, Chart 12). Lack of a ready market would make holders or potential holders of RRBs want a lower price – that is, a higher yield – to compensate them for the risk of not being able to sell an RRB as quickly or at as narrow a bid-ask spread as they could sell a nominal bond.

Scarcity typically raises prices, but an asset so rare that demand for it does not develop can see its value drop. Financial assets often show that supply fosters demand, while lack of supply inhibits it. For instance, if the Canadian government had issued only 100 $1 coins, the “Loonie”, its actual value to holders would have been less than its face value due to unfamiliarity and lack of infrastructure investment, with people continuing to use $1 banknotes.12 Critical mass matters in government bonds, as ensuring ample supply of certain bonds (benchmark issues) promotes liquid markets, raising prices and lowering yields.13

The federal government, consistent with its early objective of diversifying its investor base, had plans to broaden the market for RRBs. In the mid-1990s, the government set aside two $100 million tranches of RRBs for a syndicate of investment dealers to repackage as strips – separating principal from interest for retail retirement saving plans (Miller 1997). However, the federal government’s falling net financing requirement in the late 1990s coincided with a general decline in bond market liquidity after the Asian financial crisis of 1998. The government took measures to maintain liquidity for benchmark issues, such as reducing the frequency of auctions for long-term bonds and instituting a buyback program for less liquid issues (Canada 1999, 2000). This environment discouraged the issue of RRBs and other efforts to encourage wider holding and trading of RRBs. The thinner market depressed RRB prices, and the gap between the nominal/RRB yield spread and forecasted inflation turned negative from the end of 1998 to the start of 2000 and briefly again at the end of 2001.

Although the gap between the yields on nominal bonds and RRBs was positive on average for the first 15 years of the 2000s, the market for RRBs has always tended to be less liquid than the market for nominal bonds. The buyers of most nominal bonds at auction are primary dealers – market-makers who buy the bonds to trade, not long-term investors. Over the four fiscal years from 2002/03 to 2005/06, for example, primary dealers bought more than 90 percent of nominal bonds at auction, and customers – likelier to be long-term investors – rarely bought more than 5 percent. Long-term investors were far more active in auctions for RRBs. Over that same 2002/03-to-2005/06 period, the split between purchases of RRBs at auction by primary dealers and customers was closer to 50:50.

Coverage ratios – total bids relative to auction amount – were higher for RRBs than for nominal bonds during this period, all the more notable because RRB auctions limited any single buyer to 25 percent of the total available. That indicates enthusiasm from long-term investors, whose tendency to buy and hold the limited amounts on offer made traders less enthusiastic about RRBs.14 These attributes contribute to reducing the liquidity of the secondary market for RRBs. A 2011 article in Risk magazine highlighted the view of Canadian RRB investors that new issues were inadequate to meet demand (Pengelly 2011).

The problem of illiquidity was central to a C.D. Howe Institute report published in 2012 (Bergevin and Robson 2012), which noted that RRB auctions featured higher coverage ratios and greater investor interest. It also emphasized that the attractiveness of RRBs to long-term investors meant that RRBs had relatively low turnover – with much of each new issue merely matching the appetite of existing RRB holders to reinvest their coupon payments. That report recommended that the federal government issue more RRBs and add different maturities to foster a more robust market, including derivatives and other inflation-indexed products, and reduce its debt servicing costs.

Notwithstanding these arguments, the federal government continued to issue relatively small amounts (averaging about $550 million per quarter) of RRBs and stayed exclusively with 30-year maturities. Moreover, the government of Prime Minister Stephen Harper and Finance Minister Jim Flaherty eliminated the federal government’s post-2008 financing requirement by 2012/13, and the government again became a net retirer of debt – which did not dictate a reduction in RRB issues particularly, but created headwinds for any advocates of expanding the stock of any particular bond. An additional negative for the RRB market was that inflation undershot the Bank of Canada’s 2 percent target more often than it overshot it over the decade after 2008. None of these circumstances promoted trading in RRBs.

Contrary to the government’s justification for cancelling the RRB program, the negative reaction from market participants at the time, as expressed in the Bank of Canada’s Fall 2023 Debt Management Strategy Consultations (Bank of Canada 2023), and the responses to our survey (detailed below) demonstrate that the potential demand for RRBs among long-term investors remains strong. The perceived lower investor interest outside that core group, and even within it, seems to be primarily due to inadequate supply and the resulting thin market.

Responses to the C.D. Howe Institute Survey

In an attempt to better understand the conflicting views – the desire for larger, more diverse RRB issues from many RRB investors and other bond-market experts, versus the evident desire on the part of the government to limit RRBs issues and ultimately to do away with them – the C.D. Howe Institute conducted its own survey of institutional investors during 2023.

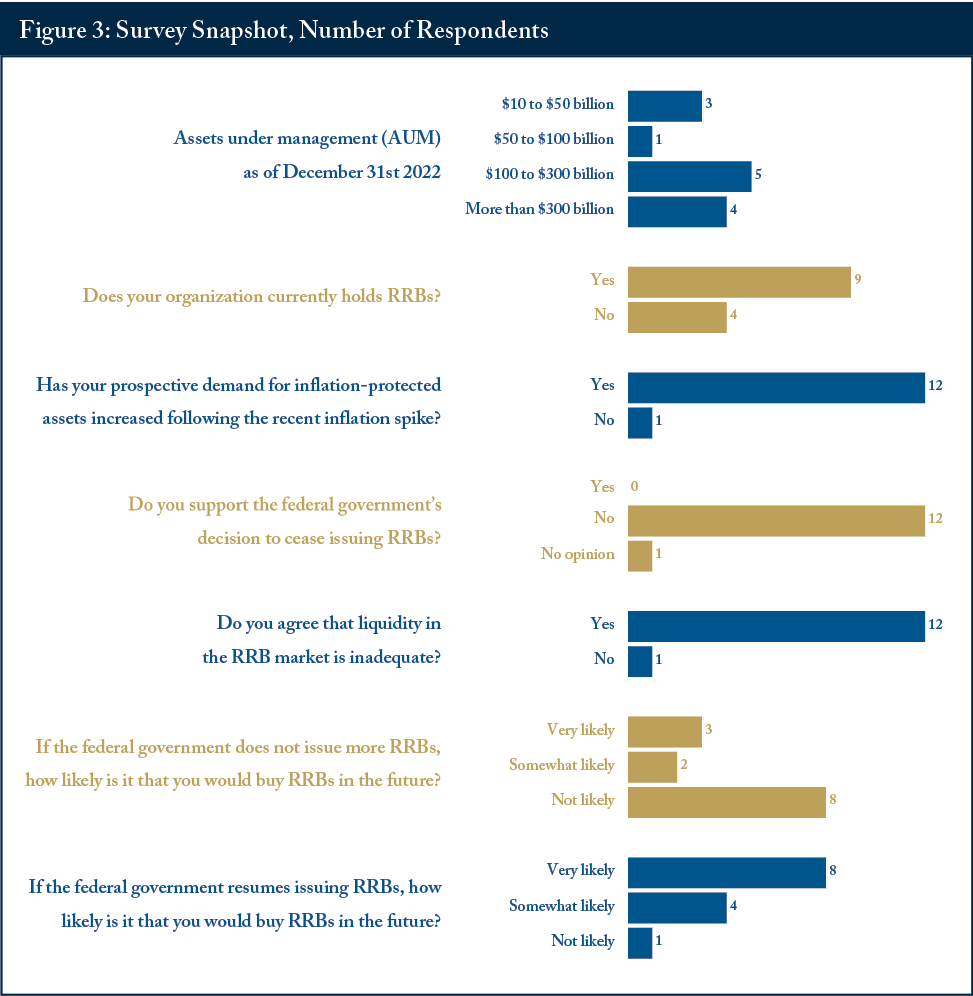

The Institute’s survey (reproduced in the Appendix) asked potential respondents to provide background information, notably on their assets under management (AUM), whether they held RRBs, and why they did or did not. It asked whether respondents supported the government’s decision to cease issuing RRBs. It asked if respondents agreed that demand for RRBs is low and that liquidity in the RRB market is inadequate. It further asked respondents who said that RRB demand is low to identify reasons for low demand. It asked respondents how likely they would be to buy RRBs in the future if the government did or did not resume issuing them, and asked about potential changes to the RRB program that might increase demand and liquidity. Finally, it asked what other assets providing protection against inflation respondents held, and whether greater availability of RRBs might reduce their demand for those alternatives. A snapshot of responses is shown in Figure 3.

Thirteen institutional investors responded to the Institute’s survey – four jointly governed employee pension funds, five public investment managers, one large insurer, and three large asset management firms. All manage pension assets. The median AUM of the 13 was around $200 billion, and the total AUM of the 13 was more than $2.4 trillion. The aggregate amount of RRBs held by the 13 was about $19 billion, or almost 40 percent of the stock of outstanding RRBs.

The respondents indicated that they held RRBs to match the liabilities of their clients, both as expressed by clients (mainly other pension funds and insurers) or in accordance with their managers’ judgements. They mentioned the unique value of RRBs in managing the exposure of pensions with indexed liabilities to Canadian inflation. Twelve of the 13 said that recent higher inflation in Canada had increased their interest in inflation-protected assets.

Among the respondents that did not hold RRBs and said why they did not, one indicated that the nature of its client’s liabilities made other inflation-linked assets more suitable, and the others indicated that the RRB market had problems, such as lack of liquidity and transparency, unattractive valuations, no commitment from the government and the Bank of Canada to support the market, and inflexible issuance.

None of the 13 supported the government’s decision to cease issuing RRBs. Twelve opposed it, and one had

no opinion.

Asked if they agreed that demand for RRBs is low, four respondents said yes, eight said no, and one had no opinion. Those who agreed that demand is low, and who expressed opinions about why it is low, cited considerations similar to those just mentioned: lack of liquidity and lack of support for the program, as well as unattractive attributes of RRBs and the availability of alternatives.

Asked if they agreed that liquidity in the RRB market is inadequate, 12 respondents said yes and one said no. Those who agreed that liquidity is inadequate and expressed opinions about why it is inadequate cited the preference of purchasers to buy and hold the bonds, the predominance of long maturities (and associated inadequate derivatives), and lack of support for the market from the government and the Bank of Canada. One respondent pointed out that growth of demand for inflation-protected assets on the part of Canadian pension plans is relatively predictable, which should help the government calibrate the program to fulfill it, and support more frequent trading and a healthy derivatives market.

Responses to the question about their likely future appetite for RRBs differed markedly between the scenario where the government does not resume issuing them and the scenario where it does. In the event that the government does not issue more RRBs, three respondents said they were very likely to buy more, two said they were somewhat likely to buy more, and eight said they were unlikely to buy more. In the event that the government does resume issuing RRBs, eight said they were very likely to buy more, four said they were likely, and one said it was unlikely. In the event that the government does resume issuing, the total amount respondents indicated they would likely buy was $7.9 billion over the next three years.

When asked what changes they would recommend if the government resumed issuing RRBs, the most frequent answer – from 11 of the 13 respondents – was creating RRBs of different maturities. Eight of the respondents suggested issuing at more regular intervals, eight suggested that the government and/or the Bank of Canada should better support the market, and six suggested issuing larger amounts. One suggested issuing a bond with a principal amount that could not fall below par.

Respondents mentioned holding a variety of assets other than RRBs that provide protection against inflation: other sovereign indexed bonds – mostly US TIPS – real estate, utilities, infrastructure, commodities, leases and inflation swaps. Four of the respondents said greater availability of RRBs would induce them to hold less of these alternatives, with two mentioning holding less US TIPS particularly. Five said they would hold the same amount of these alternatives. Three did not express an opinion one way or the other, and one underlined the importance of the design and market attributes of RRBs in a new program for making such a decision.

Two investors added comments to the survey mentioning their desire for provincial RRBs. Several respondents also noted that it is peculiar for the federal government, having recently raised concerns about Canadian pension funds investing relatively little in Canada, to stop issuing such a valuable domestic asset, and thus indirectly encourage more investment abroad.

Discussion and Recommendations

Reinforcing the Credibility of Inflation Targeting

Resuming and expanding the RRB program would strengthen the credibility of the government’s commitment to maintaining 2 percent inflation. A straightforward reason for this is that more RRBs would visibly diminish the fiscal advantages of higher inflation. From the start, signaling a commitment to controlling inflation was a clear objective of the RRB program (Johnson 1998). The government’s decision to stop issuing RRBs led to suspicions that it anticipated consistently higher inflation in the future (see Cook 2022, for instance).

More subtly, introducing RRBs with various maturities could assist the Bank of Canada in achieving its 2 percent inflation target (Bergevin and Robson 2012). An additional objective of the RRB program at the start was to create a market-based measure of expected inflation (Johnson 1998). Offering more RRBs with maturities that align with those of other nominal bonds would allow the Bank of Canada to compare nominal and real yields across a broader range of maturities. This comparison would provide more accurate information about inflation expectations than current methods such as surveys or the analysis of existing bonds (Smith 2009). It would also enable the Bank to respond more swiftly to shifts in sentiment or actions that could undermine confidence in the inflation target.

Reinforcing the government’s commitment to 2 percent inflation might appear a drawback for some. Opponents of a stronger commitment might see greater inflation as a useful tool for a fiscally troubled government, on the grounds that devaluing existing nominal debt and taxing a larger inflation component of investment income and capital gains is less economically damaging than alternatives such as higher marginal tax rates, cuts in spending or outright debt defaults. A country must be in deep trouble, however, to make inflation – which itself has major and pervasive economic and social costs – a relatively attractive option (Bergevin and Robson 2012). Canada is not in such trouble and has plenty of fiscal options to keep itself out of it.

Since containing borrowing costs is a central and appropriate goal of the government’s debt management, we emphasize that the gap between the nominal bond/RRB yield spread and inflation in Figure 2 refers to expected, not realized, inflation. There is evidence that recent actual inflation influences people’s expectations, and investors’ expectations may differ from those of professional forecasters. From 2012 to 2021, realized inflation came in below target on average, and below inflation expectations. The comparison with forecasted inflation overstates the extra amount the government would have had to pay bondholders; in other words, the government saved money from inflation being below target, making the RRBs a better deal for them after the fact. The more recent surge of inflation above the 2 percent target had the opposite effect. Over the three fiscal years from 2021/22 to 2023/24, we calculate that inflation above 2 percent cumulatively added more than $5 billion to federal expenses.

We do not know what role higher inflation adjustments on RRBs played in the government’s decisions to cancel their issuance. The government may dislike the inflation adjustment showing up in their debt servicing costs. However, the government has a natural hedge on the revenue side, since revenues tend to rise and fall one-to-one with inflation. It also has massively higher exposure to inflation on the expense side, including through the indexed pensions of federal employees. The additional exposure from issuing more RRBs would be small by comparison. Since the adverse surprises on debt servicing costs only arise if inflation exceeds the government’s target, RRBs are valuable signs of the government’s commitment to inflation control.

The government’s citation of promoting liquidity of benchmark bond issues as a reason to stop issuing RRBs is odd, given the recent explosion in the federal government’s gross debt issuance and the forecast for continued high financing requirements throughout the fiscal plan. With both gross and net bonds outstanding expected to grow, there will be ample supply of 30-year and 10-year nominal bonds.

Moreover, the government has options in issuing new RRBs, particularly a potential 10-year issue, to further mitigate the risk that introducing the new bonds will cause indigestion in the market. It can vary the pace of issue, depending on feedback from buyers and dealers, experiment with multiple-price auctions similar to those used for nominal bonds, and launch new RRBs through syndication to test demand without risking a failed auction.

A more liquid RRB market with a 10-year and/or other shorter maturities could promote the development of derivatives and more inflation-linked products, notably price-indexed annuities and vehicles providing coverage for disability and long-term care.15 As noted already, the value of inflation-linked bonds as a share of total debt securities in many other countries is much larger than in Canada.

Conclusion

RRBs are a valuable asset for Canadian savers and a valuable component of Canadian capital markets. The federal government’s decision to cease issuing RRBs will mean that Canadians, and the institutions that invest on behalf of many of them, will have less access to an asset that offers unique inflation protection.

Whatever the experience of below-target inflation and the federal government’s limited financing requirements over the decade before the COVID pandemic, subsequent inflation and the explosion of federal debt issues have changed the environment for RRBs.

The federal government should resume issuing RRBs – in greater amounts and with more diversity of terms than before.

Appendix: The C.D. Howe Institute’s Survey of Major Canadian Institutional Investors that Hold, or Might in Future Hold, RRBs

The federal government announced in its 2022 Fall Economic Statement that it would cease issuing Real Return Bonds (RRBs), citing lack of demand and liquidity. The following questions are intended to elicit information from major Canadian institutional investors that currently hold RRBs or might hold them in the future about their holdings of RRBs, if any, and about the market for RRBs and the government’s decision. Responses will be aggregated without identifying individual responders.

1. What were your organization’s assets under management (AUM) as of December 31st 2022 (Check one; please indicate if reporting date other than December 31st 2022)?

- $0 to $10 billion

- $10 to $50 billion

- $50 to $100 billion

- $100 to $300 billion

- More than $300 billion

2. Does your organization currently hold RRBs? (Check one)

- Yes

- No

2a. If you answered “yes” to question 2, what is the size of your RRB holding, in $ millions:

__________________

3. Has the recent higher inflation in Canada and elsewhere led to an increase in your prospective appetite for inflation-protected assets?

- Yes

- No

4. If your organization holds RRBs, why does it hold them? (List as many reasons, and use as much space for your answer, as you wish.)

_________________________________________________________________

5. If your organization does not hold RRBs, why does it not hold them? (List as many reasons, and use as much space for your answer, as you wish.)

_________________________________________________________________

6. Do you support the federal government’s decision to cease issuing RRBs? (Check one)

- Yes

- No

- No opinion

7. Do you agree that market demand for RRBs is low? (Check one)

- Yes

- No

-

No opinion

7a. If you answered “yes” to question 7, to what do you attribute low demand for RRBs? (Select as many as appropriate):

- lack of liquidity

- unattractive pricing

- unsuitable design/attributes of RRBs

- lack of federal government and/or Bank of Canada support for the RRB market

- availability of alternatives

- other (please specify)

_________________________

8. Do you agree that liquidity in the RRB market is inadequate? (Check one)

- Yes

- No

-

No opinion

8a. If you answered “yes” to question 8, to what do you attribute the inadequate liquidity for RRBs? (Select as many as appropriate):

- purchasers prefer to buy and hold

- design/attributes of RRBs make them unsuitable for trading

- predominance of long maturities among existing RRBs

- lack of federal and/or Bank of Canada support for the RRB market

- other (please specify)

_________________________

9. If the federal government does not issue more RRBs, how likely is it that you would buy RRBs in the future?

- Very likely

- Somewhat likely

- Not likely

10. If the federal government resumes issuing RRBs, how likely is it that you would buy RRBs in the future?

- Very likely

- Somewhat likely

-

Not likely

10a. If you answered “yes” to question 10, what amount of RRBs, in $ millions, would you anticipate buying over the next three years?

___________________

11. If the federal government were to resume issuing RRBs, what measures would you recommend to increase demand for them and liquidity in the RRB market (tick all that apply):

- issue larger amounts

- issue at more regular intervals

- structure RRBs differently

- create RRBs of different maturities

- federal government and/or Bank of Canada support for the RRB market

-

other (please specify and/or elaborate any answer above)

_________________________

12. Please list any other assets your organization currently holds that provide protection against inflation, whether the asset is formally indexed to prices (such as US Treasury Inflation-Protected Securities) or has characteristics that make it effective for that purpose (such as real estate).

_________________________________________________________________

13. Would greater availability of RRBs likely induce your organization to hold less of the other assets that provide protection against inflation? (Check one)

- Yes

- No

-

No opinion

13a. If you answered “yes” to question 13, which assets would you expect your organization to hold less of?

_________________________________________________________________

References

Association of Canadian Pension Management. 2023. “Finance Canada’s Decision to Cease the Issuance of Real Return Bonds (RRBs) – Impact on Pension Benefit Security.” Open letter to the Hon. Chrystia Freeland, Minister of Finance. February 21.

Bank of Canada. 2022. “Fall 2022 Debt Management Strategy Consultations Summary.” November. Available at https://www.bankofcanada.ca/wp-content/uploads/2022/11/fall-2022-debt-management-strategy-consultations-summary.pdf.

Bank of Canada. 2023. “Fall 2023 Debt Management Strategy Consultations Summary.” December. Available at https://www.bankofcanada.ca/wp-content/uploads/2023/12/fall-2023-debt-management-strategy-consultations-summary.pdf

Bergevin, Philippe, and William B.P. Robson. 2012. More RRBs, Please! Why Ottawa Should Issue More Inflation-Linked Bonds. Commentary No. 363. Toronto: C.D. Howe Institute.

Canada. 1991. Debt Operations Report. Department of Finance Canada.

—. 1992. Debt Operations Report. Department of Finance Canada.

—. 1995. Debt Operations Report. Department of Finance Canada.

Canada. 1997. Debt Management Report. Department of Finance Canada.

—. 1999. Debt Management Report. Department of Finance Canada.

—. 2000. Debt Management Report. Department of Finance Canada.

Canada. 2019a. Government of Canada Real Return Bond Consultations Summary. Department of Finance and Bank of Canada.

Canada. 2019b. Debt Management Report 2018-2019. Department of Finance Canada.

—. 2023. Debt Management Report 2022-2023. Department of Finance Canada.

Canada 2024. Budget 2024. Department of Finance Canada.

Canadian Institute of Actuaries. 2023. “Canada Real Return Bond Program.” Open letter to the Hon. Chrystia Freeland, Minister of Finance. January 16. Available at https://www.cia-ica.ca/publications/223019e/.

Cook, Michael. 2022. “What you Need to Know about the Recent Real Return Bond Announcement.” CIBC Asset Management. November.

Garcia, Juan Angel, and Adrian van Rixtel. 2007. “Inflation-Linked Bonds from a Central Bank Perspective.” European Central Bank Occasional Paper Series, No 62.

Jevons, Stanley W. 1875. Money and Exchange. Appleton. New York.

Johnson, David. 1998. “Final Report: An Evaluation of Canada’s Real Return Bond Program, 1991-1997.” Treasury Evaluation Program. September.

Keynes, J. M. 1927. “Evidence to Committee on National Debt and Taxation.” Minutes of Evidence. London.

Laidler, David E.W. and William B.P. Robson. 2004. Two Percent Target: Canadian Monetary Policy Since 1991. Toronto: C.D. Howe Institute.

Laurin, Alexandre, and William B.P. Robson. 2020. “Under the Rug: The Pitfalls of an “Operating Balance” Approach for Reporting Federal Employee Pension Obligations.” E-Brief No. 309. Toronto. C.D. Howe Institute.

Manulife Investment Management. 2023. “Canada brings the curtain down on real return bonds.” June 16.

Miller, Robin. 1997. “Canada: Debt Management Policy and Operating Practices.” In Sundararajan, V., Peter Dattels, and Hans Blommestein, eds., Coordinating Public Debt and Monetary Management. Washington: International Monetary Fund.

Normandin Beaudry. 2024. “Annuity Purchases in Canada in 2023: The Enthusiasm Continues.” March.

Pengelly, Mark. 2011. “Canada pressed to develop inflation market.” Risk. March 4.

Shiller, Robert J. 2003. The Invention of Inflation-Indexed Bonds in Early America. Working Paper 10183. National Bureau of Economic Research. December.

Smith, Gregor W. 2009. The Missing Links: Better Measures of Inflation and Inflation Expectations in Canada. Commentary No. 287. Toronto: C.D. Howe Institute.

Twist Financial Corp. 2010. “Evaluation of the debt auction process: nominal bonds, real return bonds, treasury bills.” Ottawa: Department of Finance.

Endnotes

4 Auctions replaced syndication in the issuing of RRBs in 1996 (Canada 1995).

14 See DMR 2006, especially Tables 5, 6 and 8.

This E-Brief is a publication of the C.D. Howe Institute.

William B.P. Robson is President and CEO of the C.D. Howe Institute.

Alexandre Laurin is Director of Research at the C.D. Howe Institute.

This E-Brief is available at www.cdhowe.org.

Permission is granted to reprint this text if the content is not altered and proper attribution is provided.

The views expressed here are those of author. The C.D. Howe Institute does not take corporate positions on policy matters.

- 1 This advantage inspired suggestions for price-level-index bonds from Jevons (1875) and Keynes (1927) among others. Irving Fisher, a lifelong advocate for inflation-indexed bonds, co-founded the Rand-Kardex Co., which issued the first such bonds in 1925 (Shiller 2003). Protecting lenders from unanticipated inflation can make financial markets more complete and improve risk sharing (Garcia and Rixtel 2007).

- 2 Many other countries’ indexed bonds, such as US Treasury Inflation-Protected Securities (TIPS) cannot fall below par in the event of deflation. RRBs do not have this feature.

- 3 See, for example, the sensitivity analysis in the federal government’s 2024 budget (Canada 2024, pp. 385, 387-88).

- 4 Auctions replaced syndication in the issuing of RRBs in 1996 (Canada 1995).

- 5 The Canadian Institute of Actuaries estimates that about $1 trillion of assets back inflation-linked benefits for about 3 million Canadians (CIA 2023). Federal employee pension benefits would be better funded – and the total cost to taxpayers of the federal government’s pension promises would be better reported – if the federal government used the RRB yield in valuing its own liabilities (Laurin and Robson 2020).

- 6 “Of special note [in 1990/91] was the introduction of new 30-year Government of Canada bonds, introduced in response to investor demand and in line with the government’s term extension objective. These bonds quickly established themselves as a new benchmark for long bonds in the Canadian market” (Canada 1991).

- 7 The yields are from Statistics Canada Table: 10-10-0122-01. We use 12-month moving averages to smooth month-to-month fluctuations.

- 8 The future return on the RRB will be a function of inflation over the entire 30-year period until maturity. We are implicitly using the 6-to-10-year forecast for the long term, assuming that inflation expectations for years 6 through 30 would likely be the same, which would give the unobserved shorter-term expectations a small weight over the entire period’s expectation.

- 9 One post-cancellation analysis (Cook 2022) stated: “One reason cited for the decision was the lack of liquidity in the RRB market which deters investors. Liquidity is the ability to transact the amount you want at a fair bid/ask spread. RRBs were by no means liquid, but that was a result of the lack of supply relative to the demand.”

- 10 A bonus – and potentially a large one, since the government pays interest on far more nominal bonds than RRBs – would arise if a larger issue of RRBs reinforced confidence in the inflation target and therefore lowered the yield on nominal bonds (Bergevin and Robson 2012). Even if greater confidence reduced the direct saving from issuing more RRBs, the government would further reduce its total debt servicing cost.

- 11 The US Federal Reserve’s target for inflation is not specified in terms of the CPI, and is less formal than the Canadian inflation target, which is jointly set between the Bank of Canada and Parliament, so the comparison is not exact. But a spread between nominal bonds and linkers that is higher than the inflation target, as exists in the United States, is what one would expect in a well functioning debt market.

- 12 A $25 banknote existed for decades, but was rare and rarely used. It ceased being legal tender in 2021.

- 13 Increasing supply of certain bonds to improve liquidity and thereby raise prices – that is, reduce yields – is a constant theme of the federal government’s DORs and DMRs. To pick an example from the mid-1990s, when oversupply of government debt was depressing its price, and raising interest rates, generally, the 1995 DOR stated: “The government has pursued a strategy to improve liquidity in Canada’s bond market through larger benchmark bond sizes. The average size of the 21 Government of Canada bond auctions during the year was approximately $1,980 million, up about $135 million per issue from fiscal 1993/94. In March 1994, target sizes for benchmark issues were increased: for two-year bonds, to $4 to $6 billion; and for five-, ten-, and thirty-year bonds, to $6 to $9 billion. All of these targets were met during the 1994/95 fiscal year. Building upon the success of its continuing quarterly cycle of two-, five and ten-year auctions, the government issued thirty-year bonds each quarter” (Canada 1995).

- 14 See DMR 2006, especially Tables 5, 6 and 8.

- 15 As Bergevin and Robson (2012) noted, the introduction of TIPS in the United States supported the emergence of new financial products such as inflation futures, inflation swaps and inflation-linked benchmark indices. US pension funds subsequently expanded their offerings of inflation-linked investment plans and annuities (Garcia and Rixtel 2007).