The Study in Brief

- With the significant decline in single-employer defined-benefit (DB) pension plans in the private sector, it’s important to understand other alternatives. One such alternative is the target-benefit plan.

- The regulation of target-benefit plans (TBPs) in all provinces across Canada can be made more straightforward and effective using lessons learned from real-life experiences. With target-benefit plans currently being more prominent in the province of British Columbia than any other province, it is useful to take a closer look at these plans to see what we can learn from them.

- This study found a diverse group of plans, with their heterogeneity having clear policy implications for their regulation. For these TBPs to effectively serve their members, they need objective-based and clear regulations that reflect their nature and how they are managed.

The author thanks Alexandre Laurin, Parisa Mahboubi, Nick Dahir, Keith Ambachtsheer, Bob Baldwin, David Gordon, Jim Keohane, James Pierlot and anonymous reviewers for helpful comments on an earlier draft. Special thanks to Barbara Sanders for input in the development of this E-Brief. The author retains responsibility for any errors and the views expressed.

Introduction

With the majority of single-employer defined-benefit (DB) pension plans in the private sector having been either closed to future accruals, completely converted to defined-contribution (DC) plans, or wound up, it’s important to understand other alternatives. One such alternative, which focusses on providing a lifetime benefit, is the target-benefit plan (TBP).1, 2 A TBP generally targets a benefit level developed from a set contribution and allows benefits to be adjusted up or down contingent upon meeting specific financial metrics. TBPs play a significant role in British Columbia, encompassing 22 percent of members in registered pension plans. They cover three times as many members as DC plans in the province. Additionally, TBPs in BC hold 45 percent more in plan assets than do DC plans.

The regulation of TBPs across Canada can be made more straightforward and effective using lessons learned from real-life experiences. The purpose of this E-Brief is to uncover lessons that can inform provinces that haven’t yet finalized their regulatory policy on TBPs and provide useful background information for advisors working with existing plans or involved in setting up new plans. This E-Brief will explore the policy implications of survey findings in BC, recognizing that the pension regulatory landscape in BC is shaped by the Pension Benefits Standards Act, its accompanying regulations, guidelines issued by the BC Financial Services Authority (BCFSA), and BCFSA’s detailed, periodic reviews of plan operations.3

Survey data were collected for 29 TBPs registered in BC.4 Completed surveys were provided by four consulting firms, whose clients provided permission for the surveys to be completed on their behalf. The surveys were brief to facilitate completion and achieve the maximum number possible responses (more details in Appendix A).5 The survey results are presented in the context of the various policy issues discussed in this E-Brief and serve to support the policy recommendations.

The Regulation of TBPs

TBPs resemble a long-established type of pension plan, specifically the negotiated cost, defined- benefit, multi-employer pension plan (DB MEPP). The regulation of DB MEPPs has traditionally occurred in lockstep with that of the traditional single-employer DB plans, even though the former often exist with no guarantee of benefits being earned, and the latter have existed with the understanding that benefits are guaranteed.

As TBPs have emerged, distinct regulations have been developed for them, separate from those applicable to DB MEPPs. BC was the first province to pass extensive TBP legislation in 2015,6 which was amended in 2022. In 2017, Saskatchewan introduced changes to its pension regulations for Limited Liability Plans (its version of TBPs). Quebec introduced target-benefit legislation at the end of 2020 (TBP legislation had already existed for some time on a limited basis for some enterprises in the pulp and paper sector). At the time of this writing, other jurisdictions are reviewing their regulatory framework for TBPs.

One of the main challenges for provincial policymakers is how best to create a regulatory environment for something that is formula-based but not guaranteed, being subject to the sufficiency of the assets available. Specifically, the issue is how regulation should address the following:

- assessing methodologies for converting contributions to targeted benefits, including the need for and magnitude of provisions for adverse deviation (PfADs7) and any requirements to provide equal treatment to different member cohorts;

- assessing the sustainability of intended benefits based on the assets and contributions that are available;

- allowing the conversion of existing programs into a TBP structure and under what conditions; and

- dealing with the potential reinstatement of benefits that had previously been reduced.

Furthermore, it’s important to develop regulations that reflect the nature of these plans and how they are managed. This can be facilitated by a clear statement of the objective of the regulations and their desired outcomes in the context of the nature of these plans. Such a statement has often been missing when legislation has been introduced.

The minimum funding rules for TBPs8 in British Columbia, as detailed in Appendix B, illustrate how current regulations fail to align with this criterion, primarily because they are formulated from a DB-centric perspective. DB plans typically make operational decisions focusing only up to the next actuarial valuation, which usually occurs every three years.9 Furthermore, with DBs operating on the premise that benefits are guaranteed, contributions are determined on an iterative process, varying from one actuarial valuation to the next taking into account short-term changes in financial position, without any real consideration of the likelihood of the benefit being delivered long-term. Meanwhile, TBPs typically operate with a long-term horizon, with fixed or stable contributions, and with a focus on the likelihood of various financial results required to deliver the desired outcome, typically a stable benefit.

In formulating regulations for TBPs, it’s important to consider that their contributions are determined entirely independently of the benefits. There is typically a buffer between benefit cost and the contributions. The key task is to determine whether that buffer is sufficient to sustain the targeted benefit. The PfAD then falls out of this exercise (i.e., the implicit buffer). It is typically not explicitly determined. With DBs, PfADs work totally differently. Once the pure cost of the DB benefit has been determined (using whatever method the actuary deems appropriate for the situation) the PfAD is explicitly determined and then added on, similar to loading on a premium in insurance.

A separate challenge for policymakers is to determine whether they want TBP regulations that support the wide breadth of plan designs that can fall into this category, or whether they want TBP regulations to dictate or drive the design into a limited number of options. The SRP (see footnote 2) is an example of a specific contingent-benefit solution (i.e., contributions and benefits can change over time based on plan financials) that has a heavily prescribed regulatory environment with limited leeway for the plan administrators.

Understanding the Makeup of BC TBPs

One thing that stands out when looking at TBPs in BC is their heterogeneity. The vast degree of difference among the plans can be highlighted in several ways, starting with how they came to be.

- Twenty-five of the plans in the study were conversions from DB MEPPs, with 24 including past service benefits in the conversion and one converting to TBP for future service only.

- Two were conversions from DC arrangements.

- One was a new start-up TBP.

- One has been a TBP since its inception over 50 years ago.

The following characteristics give further flavour to the varied nature of these plans.

- Their members work in a wide variety of industries. While the construction and resource industries dominate, members are also employed in hospitality, transportation, entertainment, and post-secondary education.

- In nine cases active membership is shrinking; in 12 cases it’s increasing; and in three cases it’s static (five cases did not provide this detail).

- The maturity10 of the plans varies widely with the proportion of inactive-member liabilities varying between 0 percent and 91 percent, averaging 60 percent.

The nature of this heterogeneity leads to some suggestions regarding policy implications.

- It is important that legislation not be so prescriptive as to restrict any particular plan’s ability to deal with its specific issues. For example, a plan that regularly experiences significant changes to its active membership groups has greater challenges in projecting expected benefit cost and expected future cash flow than a plan with a more stable base. In the former case, it is important to take projections of future membership into account in setting targeted-benefit levels and subsequently assessing benefit sustainability, where in the latter, it’s not nearly as important. Regulations need to anticipate these types of situations.

- BC has seen the successful conversions of both DB MEPPs and DC arrangements. The Association of Canadian Pension Management (ACPM)11 has made proposals for the past service conversion of DB plans. While Quebec does not allow such past service conversions, Ontario’s recent consultation document (Ontario 2023) suggests allowing them. Such conversions make sense from the perspective of operational efficiency, especially with respect to benefit administration. These conversions also provide a sizeable asset base over which to spread risk right from the plan’s set up and to allow plans to create the tools needed to manage the complexity of a TBP. Regarding the matter of requiring consent of existing members for the conversion of past service to proceed, this may depend on the nature of the existing program. The situation is very different when converting from a traditional DB plan vs from a traditional DC plan vs from a DB MEPP where the plan already has the ability to reduce accrued benefits. Further research could explore the legal dimensions of this issue.

Looking at the Stated Objectives of TBPs

In setting and meeting their objectives, it’s important for TBPs to consider aspects of risk management. CAPSA12 Principle 7 (CAPSA 2016) lays out a basic risk management framework that plans can easily follow. The BC Financial Services Authority TBP guideline (BCFSA 2022) goes even further with extensive commentary on identifying and managing risks.

The absence of a common understanding of frequently used terms presents a challenge in understanding the stated objectives of plans. For example, benefit stability and benefit security are two terms that come up frequently. However, their meaning can vary from plan to plan, and previous research (Gros and Sanders 2019) has shown that plans often do not define the terms that they do use.

Benefit security is typically used in the context of DB plans where the promise to members is a guarantee of those benefits. Benefit stability can simply mean the benefits shouldn’t vary much after they are established, but how much variation would be acceptable? Furthermore, what does it mean when a plan administrator states it wishes to minimize benefit reductions and provide benefit security?

That said, one thing that comes through loud and clear from the surveys is that BC TBPs don’t want to see reductions in the benefits once the benefits have been set. This is particularly interesting in that one of the primary criticisms levied against TBPs is that members are disadvantaged by the plan’s ability to reduce benefits. Most plans identified their primary objectives as maintaining stable benefits, minimizing benefit reductions, targeting benefit security, or a combination of these. The meaning of these statements should become clearer over time with all TBPs in BC having to regularly file their funding policy along with their actuarial valuation reports. The funding policies and plan objectives being included in public documents provide plan administrators with an incentive to ensure there is clarity to their stated objectives.

Other common objectives mentioned were maintaining stable funding requirements and maintaining equity among generations. The latter is another objective that can have multiple meanings and each plan with such an objective will have to be clear as to what it is trying to achieve. The issue of equity is of particular interest when plans are looking at improving benefits, and for whom, or have reduced benefits in the past and are now looking to restore or improve them.

Considering the TBPs in our survey express a strong reluctance toward benefit reductions, it raises questions about whether regulations in this area need to be as prescriptive as they have been. Perhaps more principles-based regulation would better serve the needs of all stakeholders. Given the heterogeneity of the plans, it might be better to let plans determine their own financial goals appropriate for their situation. This is supported by Ontario’s 2023 consultation document (Ontario 2023). In response to the consultation document, the Association of Canadian Pension Management (ACPM 2023) promotes an approach characterized by a degree of regulatory flexibility in this area: “Target-benefit plans create incentives for employers to contribute towards their employees’ retirement savings, including cost certainty. It is critical that those incentives are not undermined by an unduly burdensome regulatory framework.” I cover this matter further in the next section.

Understanding How TBPs Work

In most cases in the surveys, contributions to TBPs are set through the collective bargaining process. In one case, contributions to the pension plan are allocated by the respective union from a larger negotiated fringe-benefit amount. In another case, the contributions are set in the plan text and in yet another they are set by the board of trustees. It’s particularly important to note that in all instances the contribution amount is not determined by reference to the benefit or through an actuarial valuation process, in total opposition to how DB plans work. In all but one case, the board of trustees tasked with running the plan has no control over the contributions made to the plan.

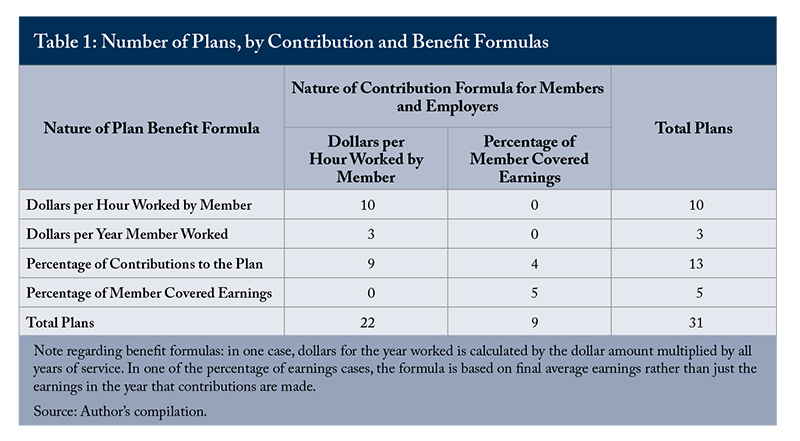

Table 1 illustrates the types of formulas that are used to determine contributions and benefits. The totals exceed 29 as some plans have multiple contribution/benefit schedules.

Knowing what contributions it can expect, every plan’s board works with its actuary to determine a corresponding benefit level, using the benefit formula adopted by the plan. But there is no universal process for converting the expected contributions into a sustainable benefit amount. Furthermore, in each valuation cycle an assessment must be made as to whether the plan assets will support benefits already accrued. Based on this assessment, the board must determine whether accrued benefits stay unchanged, whether there is any leeway to improve accrued benefits, or whether accrued benefits should be reduced.

While legislation might provide a test regarding minimum contribution requirements, no TBP legislation provides guidance on how to determine an appropriate sustainable benefit level for a given contribution level. This task is left up to the board, working with its actuary. Interestingly, there are no actuarial standards of practice of the Canadian Institute of Actuaries (CIA)13 that provide specific guidance on this matter either. One interesting observation from the surveys is that the methodology used by plans to determine benefit sustainability seems to be somewhat correlated to the consulting firm involved as advisor.

The survey also tracked the actuarial funding methods used. Similar methods were generally used for both the conversion of contributions into benefit levels and to assess the sustainability of accrued benefits, but not always the same tools for both.

- The majority of the plans use the unit credit funding method,14 primarily because this is the method implied in pension regulations regarding testing minimum funding levels. Survey responses indicate it is simply easier, and perhaps more cost effective, for plans to use this method.

- A few of the plans use an aggregate funding method.15

- Some used both the unit credit and aggregate methods.

The one noticeable exception had to do with determining whether there should be cuts to accrued benefits. All but three plans reported using the unit credit method as this is the method anticipated in the pension regulations (two use an aggregate method and one uses a combination of the two). Interestingly, none of the plans indicated having made a benefit cut (since the TBP legislation was introduced in 2015), which contrasts with the quarter of the plans that indicated having made at least one increase to accrued benefits, some having made more than one.

When it came to assessing benefit improvements, plans were more likely to include other financial metrics in the assessment, in addition to the current unit credit funded position. This position is supported by CIA 2015. Many plans that made plan improvements indicated retaining a significant margin over the statutory PfAD due to its high volatility. One responding actuary who provided surveys indicated that the aggregate method is essential to understanding whether benefit improvements should be considered; an opinion with which I totally agree.

Several policy implications arise based on how these plans set contributions and benefits.

- With stable contributions and a desire for stable benefit levels, it seems to make sense that any prescribed PfAD should similarly be somewhat stable. Otherwise, where there is a large prescribed PfAD that is highly volatile, there is little incentive for plans to do meaningful sustainability analysis, a critical part of plan management. Furthermore, when there’s a highly volatile prescribed PfAD, boards can be reluctant to make benefit improvements for fear that those improvements might have to be scaled back if in the future there is a requirement to have an even higher PfAD.

- Plans in the survey seem to place a higher emphasis on past service benefits than future service benefits, possibly due to the desire to deliver a stable benefit. Boards are more likely to reduce future benefits to fix a problem than to reduce accrued benefits (assuming they can make it work). Regulations should ensure that one set of rules isn’t applied unilaterally to past and future service benefits.

- Most plans surveyed have no benefit “levers,” e.g., ancillary benefits,16 that can be revised due to financial circumstances without having to affect base benefits. However, where plans use ancillary benefits as a lever for the sustainability of the base benefit, this should be taken into account with no requirement to have a minimum PfAD applied to those ancillary benefits. Interestingly, I received comments after survey results were submitted indicating that some plans are considering creating levers within their lifetime benefits by having a policy that considers different parts of the lifetime benefit as having different levels of benefit security.

Understanding How TBPs Are Governed

Gros and Sanders (2019) identified governance17 as one of six key factors affecting the sustainability of pension plans with contingent benefits, which includes TBPs. While the positive link between the investment performance of a pension fund and good governance is well documented (Gros and Sanders 2020), research suggests that there is an equally strong link between plan sustainability and good governance. Before getting into the survey results, this E-Brief will highlight some issues regarding governance that contain some common themes.

TBPs in Canada are typically run by boards of trustees. CAPSA’s draft pension risk guideline (CAPSA 2023) highlights risks related to gaps in the oversight of TBP operation and management that can lead to breaches of fiduciary duty. Such gaps can include board members:

- not receiving adequate orientation;

- having insufficient knowledge or skills to fulfill their duties;

- being provided with insufficient or inadequate information and materials from service providers; and

- having conflicts of interest in decision-making.

These issues are not new and have existed for some time, having been highlighted in much earlier research (Shilton 2007).

The Financial Services Regulatory Authority of Ontario (FSRA 2021)18 identified the following leading governance practices for DB MEPPs.

- A comprehensive orientation policy to on-board new trustees.

- Trustee education policies to support trustees in fulfilling their role as plan fiduciaries.

- A trustee succession plan to ensure continuity on the board of trustees and good plan administration.

- Plan enrolment policies and procedures that support members remaining connected with their pensions.

- An investment policy that considers industry-leading practices relevant to how the plan assets will be invested and how trustees will resolve conflicts of interest, shall they arise.

CAPSA (2016) highlights that, with respect to the composition of boards of trustees, TBPs are unique in that, in many cases, trustees are appointed as a result of a political process, such as an election by a participating group, or appointed by an industry association or a participating union. Considering the potential gaps indicated above, CAPSA (2023) suggests boards consider developing, where feasible and prudent:

- a trustee orientation policy, to ensure that new trustees begin their term prepared to carry out their fiduciary duty;

- a trustee education policy; and

- a trustee succession plan to ensure continuity on the board of trustees.

While the majority of the plans surveyed are run by a board of trustees there is a tremendous amount of diversity regarding their composition and appointment processes.

- Twenty-two boards have a fixed number of members, but the number varies from three to 16, the average being eight.

- Seven boards allow for a range of members, where the smallest lower limit is three (average four) and the highest upper limit is nine (average eight).

- Regarding getting onto the board, in 16 cases all members are appointed by the respective unions, and in 12 cases the appointments are split between unions and employers. In only four plans are any board members elected from plan membership.

- Regarding the board chair, in 19 cases the chair is elected by the existing trustees. In five cases the chair is assigned by their position in the union. In two cases the chair alternates between representatives of the two unions involved. In two cases there are co-chairs, one each appointed by unions and the employer. And lastly, there is one plan where the chair is appointed by the plan administrator. Only one board has a chair independent of all plan stakeholders.

- Only one board has maximum term limits for board members. None mentioned minimum terms.

Suspecting that the diversity above reflects the varying composition of stakeholders among the plans, it seems to raise more questions than it answers.

- What are the pros and cons of having appointed members vs elected members?

- Are term limits important, and are minimum term limits more important than maximum term limits given the steep learning curve lay members will encounter?

- Is there value to having independent members or an independent chair? Is there a sufficiently available pool of suitable candidates?

- Should boards be required to have a broad representation of plan members, including retired members (who often technically are no longer members of the unions involved)?

- Is there any correlation between structure and composition of boards to their effectiveness?

These are all great topics for future research as the relevant BC Act (PBSA) provides no guidance in board composition or appointment. BC PBSA Sec. 35(4) indicates that a board of trustees can be an official administrator tasked with administering the plan in accordance with the Act. Plan administrator’s responsibilities are laid out in Sec. 35.

Pension regulation has typically not been prescriptive in the area of plan governance. Given the tremendous diversity of plan situations and structures, perhaps this is appropriate and it is better that the regulation of governance be handled through BCFSA guidelines and detailed plan reviews by the BCFSA. Legislation applicable to all situations would likely be hard to develop, especially for new TBPs that do not yet exist.

That said, there is certainly room to raise the bar with respect to what’s expected from boards and their members, similar to what is required and expected of corporate boards of directors. While regulation might not be the best way to address this need, it might be more effective to implement guidelines by the regulator outlining their expectations. While not law, these guidelines would require plans to demonstrate to the regulator what they are doing and why.

Getting the Message Across

Gros and Sanders (2019) also identified member communication as a relevant factor affecting the sustainability of pension plans with contingent benefits. The BC pension standards prescribe several disclosure requirements, from providing members with a plan booklet when they join the plan, to annual pension statements and statements upon termination of membership. But disclosure is not communication. The process of engaging with plan members needs a feedback loop to qualify as true communication.

Gros and Sanders (2019) highlighted that this feedback loop is universally missing for contingent-benefit plans. This need for a feedback loop was promoted by FSRA (2021), with its suggestion under its Communications Practices section that “plans might also conduct member feedback sessions or include questions in other broader membership surveys to gauge the effectiveness of their members communications and education sessions in ensuring that beneficiaries have enough information to make informed decisions related to their pension benefits.” A subsequent C.D. Howe Institute Commentary (Gros 2022) recommended addressing this deficiency of a feedback loop by adopting a communication policy similar to other policies that plans are required to have in place; i.e., investment policy (SIPP), funding policy and governance policy.

The matter of pension plans having a communication policy has been addressed by other parties as well.

- FSRA (2021) supports, as leading communications practices for DB MEPPS, regular, ongoing dialogue between the trustees, advisors and key stakeholders involved in the plan, to support awareness, collaboration, and operational effectiveness.

- CAPSA (2023) provides a number of considerations for the development of a communication policy. However, what CAPSA (2023) doesn’t explicitly address is the need for a feedback loop to fine tune communication policies and implementation plans.

- Ontario (2023) contains a proposal to require TBPs to have and file a communication policy.

- The Multi-Employer Benefit Plan Council of Canada (MEBCO),19 in its response to Ontario proposals for TBP regulation, indicated its support for all pension plans having a communication policy (MEBCO 2023).

Interestingly, the surveyed plans reported that the objectives set by plan boards are generally not communicated to plan members and very few communicate on any regular basis the possibility of benefit reductions. Sometimes plan objectives have only been communicated at the time of conversion to a TBP. A general lack of transparency on this matter was identified in previous research (Gros and Sanders 2019).

The requirement for plans to annually issue personalized statements to plan members highlighting their entitlements creates an ideal opportunity to reach plan members on any other plan matters, and many plans seem to be taking advantage of that. Interestingly, several plans do not actively collect plan member email addresses, thereby limiting electronic communication options. And yet it is clear that some plans are going beyond their minimum disclosure requirements, as evidenced by:

- 21 plans having produced newsletters;

- 11 plans having a website;

- seven plans having used videos; and

- one plan having used podcasts and webcasts.20

When looking at who’s involved with plan communications, only seven plans have dedicated communication resources. This might be a size issue as dedicated communication resources are most likely to exist with larger plans, but the data required to confirm this were not collected. Most plans rely on an outside third party, either their actuary or their benefits administrator. Unfortunately, there is no guarantee that these parties have staff with formal communication training, or membership in a professional organization such as the International Association of Business Communicators (IABC).21

Shilton (2007) identified significant shortcomings in the then-required MEPP disclosure in Ontario regarding the nature of those benefits and the possibility that they could be reduced. This can be addressed in pension regulations but its implementation by plans must be done in an open and transparent manner that will not unduly upset plan members.

Requiring plans to develop a communication policy tailored to their situation would result in plans being better able to meet the needs of their members. For example, many plans have barriers to easy communication such as language issues, location issues, and access to online resources issues. These are examples of matters that would be dealt with directly in a communications policy.

Conclusions

TBPs play an important role in providing their members with retirement security and they have become a fixture of the BC pension landscape, where there is a tremendously diverse group of TBPs. For these plans to do their best for their members, they need regulations that are clear in their objectives and don’t impede their natural operations.

Members of TBPs deserve to receive clear and transparent communications about the nature of these plans in order to have an appreciation of how these plans operate and to build trust in those who oversee their operations. These plans need strong guidance and oversight at the board level to ensure members receive the benefits they deserve. Pension regulation and oversight can play a key role in providing guidance in these important areas of plan operation.

On the financial side, TBPs are complex financial entities. It’s important that regulations be less prescriptive than they currently are, allowing a range of acceptable methods within accepted actuarial practice for these plans to assess their financial position and to deliver the desired benefit outcomes. Limiting the methodology these plans can use benefits neither the members of these plans nor their advisors. While some might argue that plan member representation in governance justifies less prescriptive regulation, it’s primarily the complexity of these plans that warrants that flexibility. Checks and balances come when these plans are required to file their funding/benefit policies and show how they have complied with it in the required, regularly filed, actuarial valuation reports. Experience has shown that prescriptive regulations, once implemented, can be very difficult to change; it usually takes many years. Unfortunately, boards can fall into a pattern of doing what’s required by law. Having less prescriptive regulation tends to force boards to better focus on what needs to be done for the benefit of the plan rather than just what is required by the law.22

Appendix A: Data Collection Process

BC had 36 pension plans registered with a target-benefit component at the end of 2021. Surveys were completed by consulting firms for 29 of these plans, where their clients provided them with permission to complete the surveys on their behalf. The surveys were brief to facilitate completion to achieve the maximum number of responses possible. The survey questions are as follows:

- Please provide a unique identifier for reference purposes only. For confidentiality purposes, do not use anything that could identify the plan concerned.

- Please indicate whether the plan is a TBP and was a conversion, indicating whether from a MEPP or some other type of retirement plan, or whether the plan is a MEPP or single-employer plan that is eligible for conversion to TBP but has yet to take that step.

- Please indicate whether the plan has stated objectives, what they are, whether/how they are documented, and whether they are communicated to plan members, e.g.,

- Indicate any objective related to benefit preservation or sustainability.

- Indicate any objective regarding the amount and frequency of benefit adjustments/variability.

Also indicate whether there is a clear statement that the plan is a target-benefit plan and that benefits are not guaranteed.

- Please provide details of the governing body (e.g., board of trustees – the survey will use the term BoT) indicating:

- Whether it is a board of trustees or some other form of committee/board.

- The number of members, and whether they are elected or appointed, and if appointed, by whom.

- The number of positions designated to specific positions (e.g., union president).

- Whether members have term limits.

-

How the chair is determined, including whether the chair is appointed independent of any plan stakeholders.

- Please indicate the process used to set contributions, separately for members and employers.

- Are they negotiated directly? Do negotiations deal with the total contribution level or just changes from the current level?

- Are they determined by the BoT and taken from a larger negotiated contribution that is meant to cover several purposes?

- Please indicate the basis for contributions, e.g., cents per hour worked, percentage of earnings, etc., separately for members and employers.

- Please describe the basis upon which future service benefits are targeted, e.g., benefit per hour worked, benefit per year of credited service, percentage of earnings, percentage of contributions, etc.

- Please indicate the process for determining future service benefits, indicating:

- The actuarial cost method used and why it was selected.

- PfAD/margin used, and how it is determined.

- How the minimum statutory PfAD (per PBSA Regulations in effect before Dec 31, 2022) influenced the process/decision making.

- Please indicate the process for adjusting past service benefits (up or down), indicating:

- The actuarial cost method used and why it was selected.

- PfAD/margin used, and how it is determined.

- How the minimum statutory PfAD (per PBSA Regulations in effect before Dec 31, 2022) influenced the process/decision-making.

- Please indicate the various ways that the plan communicates to members, including:

- In print (e.g., plan description, annual pension statements, special announcements, etc.).

- In person (e.g., plan orientation sessions, plan annual meeting, etc.).

- Electronically (e.g., email announcements, website with key plan materials, retirement planning tools, etc.).

Also indicate which of these mediums you believe is the most effective.

- Please indicate whether the plan uses communication professionals, either internal or external, for plan communication activities.

- Please provide any additional information about unique characteristics of the plan, or how it operates, that would be useful for purposes of this study, including but not limited to:

- Demographics of active membership.

- Whether the active membership base is shrinking.

- Liability mix (i.e., actives vs inactives).

- The nature of the industry.

- The investment policy (e.g., incorporates significant liability matching).

Of the five consulting firms we approached, four provided completed surveys on behalf of 29 TBP clients. The surveys were collected from February to May 2023.

Appendix B: A Primer on Target-Benefit Pension Plans

While the term “target benefit plan” has become recognized as a general term simply referring to a plan with fixed contributions and variable benefits, the regulation of these plans depends on their specific definitions within their regulatory framework. For example, BCFSA’s 2022 pension report lists the following elements as being characteristics of a target-benefit plan.

- The amount of target pension payable to an employee is set by a formula, • Benefits may be reduced to meet funding requirements.

- Employer contributions are limited to an agreed upon amount.

- Depending on plan design, employees may contribute.

Sec. 58(2) of the BCPBSR sets the minimum funding requirements of a target-benefit component to be the sum of:

- the normal actuarial cost associated with that target benefit component;

- the prescribed PfAD, which is defined in Sec 1(2) to be a percentage times the normal actuarial cost, where the percentage equals 7.5 percent plus a supplementary percentage determined by the plan; and

- any amortization payment resulting from an unfunded liability related to that target benefit component.

The Retraite Québec website lists the following elements as being characteristics of a target benefit pension plan.

- • The contributions paid by the employer and the benefit target level are provided for in the plan’s provisions.

- • The plan’s obligations are to be borne by the members and beneficiaries. This means that these persons are responsible for subsequent deficits of the plan.

- • In the case where contributions provided for are insufficient, the benefits related to credited service, including the pensions in payment, may be reduced based on the recovery measures set out in the plan’s provisions without having an amendment made to the plan and without the consent of members and beneficiaries.

- • The surplus assets belong to members and beneficiaries.

References

Association of Canadian Pension Management (ACPM). 2012. Target Benefit Plan Paper. March 30.

______________. 2014. Target Benefit Plan Supplemental Paper. September 8.

______________. 2023. ACPM Response to Ontario’s Follow-Up Consultation Document – A Permanent Framework for Target Benefits – Revised Proposals. October 26.

British Colombia. Pension Benefits Standards Act, [SBC 2012] Chapter 30.

______________. Pension Benefits Standards Regulation, Reg 196/2022.

BC Financial Services Authority (BCFSA). 2022. Report on Pension Plans Registered in British Columbia. Vancouver. October.

______________. 2022. Guideline: PfAD for Pension Plans with a Target Benefit Provision. Vancouver. December 21.

Canadian Association of Pension Supervisory Authorities (CAPSA). 2016. Guideline No. 4: Pension Plan Governance Guideline. December.

______________. 2023. Consultation Draft Guideline: Pension Plan Risk Management. May 24.

Canadian Institute of Actuaries (CIA). 2015. Report of the Task Force on Target Benefit Plans. Ottawa. June.

______________. 2023. Standards of Practice. Rev. June 30.

Financial Services Regulatory Authority of Ontario (FSRA). 2021. Defined Benefit Multi-Employer Pension Plans- Leading Practices. Identifier: No. PE0224INF. March 16.

Gros, Barry, and Barbara Sanders. 2019. The Quest for Sustainability in Contingent Pension Plans. Commentary 533. Toronto: C.D. Howe Institute. September.

______________. 2020. The Link Between Governance and Sustainability in Contingent Pension Plans. plans & trusts. March/April (pages 8-13).

Gros, Barry. 2022. The Challenges Facing Target-Benefit Plans: Changes Are Needed to Provincial Pension Standards. Commentary 618. Toronto: C.D. Howe Institute. March.

Multi-Employer Benefit Plan Council of Canada (MEBCO). 2023. Mebco – Multi-Employer Benefit Plan Council of Canada | A Permanent Framework for Target Benefits: Second Follow-Up Consultation Response by MEBCO. October 10.

Ontario. 2023. Follow-Up Consultation Document: A Permanent Framework for Target Benefits: Revised Proposals. Toronto. August.

Shilton, Elizabeth. 2007. Current Issues Concerning Multi-Employer Pension Plans in Ontario. Research Report Submitted to the Ontario Expert Commission on Pensions. October 31.

- 1 Strictly speaking, the BC Pension Benefits Standards Act defines a “target-benefit provision” as opposed to a “target-benefit plan.” For facility, the term target-benefit plan is used here for plans where the principal feature of the plan is its target-benefit component.

- 2 A similar alternative is the shared-risk plan (SRP) common in New Brunswick and other Atlantic provinces. We acknowledge that these operate in a similar fashion to TBPs but are quite different in that they were established specifically to transform large public-sector pension plans in those provinces.

- 3 For a foundational understanding of target-benefit plans (TBPs), please refer to Appendix B.

- 4 BC had 36 pension plans registered with a target-benefit component at the end of 2021.

- 5 See Appendix A for a complete list of the questions.

- 6 Alberta passed TBP legislation in 2014 but it did not allow for the conversion of past service under DB MEPPs. As a result, there was no take up and Alberta continues to have no TBPs.

- 7 Provision for adverse deviations is the difference between the actual result of a calculation and the corresponding result using best estimate assumptions (CIA 2023).

- 8 BC PBSR 58(2).

- 9 Pension standards require pension plans to have actuarial valuations prepared at least every three years.

- 10 The maturity of a pension plan is often indicated by the proportion of plan liabilities associated with plan members who are no longer active participants; i.e., that proportion indicates how “old” the plan is.

- 11 The ACPM is the leading advocacy organization for retirement plan sponsors and administrators in Canada who manage plans for millions of plan members.

- 12 Canadian Association of Pension Supervisory Authorities (CAPSA) is a national association of pension regulators whose mission is to facilitate an efficient and effective pension regulatory system in Canada.

- 13 The Canadian Institute of Actuaries (CIA) is the sole qualifying and governing body of the actuarial profession in Canada.

- 14 The unit credit funding method views each period of service as giving rise to an additional and equal unit of benefit entitlement and measures each unit separately to build up the final obligation and determine the cost of benefits for the ensuing year after the actuarial valuation.

- 15 Rather than just looking at what has occurred to date, the aggregate funding method takes into account current assets and expected future contributions along with benefits earned to date and expected in the future. The method can also incorporate assumptions about changes in plan membership.

- 16 Ancillary benefits are additional benefits that may be provided by a pension plan. This may include: disability benefits, bridging benefits, supplementary benefits, certain death benefits, indexing and certain early retirement benefits.

- 17 Pension plan governance refers to the structure and processes in place for the effective administration of the pension plan to ensure the fiduciary and other responsibilities of the plan administrator are met (CAPSA 2016).

- 18 Financial Services Regulatory Authority of Ontario is an agency of the Government of Ontario that regulates pensions in that province.

- 19 MEBCO is a federal no-share capital corporation, operating on a not-for-profit basis. MEBCO represents the interests of Canadian multi-employer pension and benefits plans with provincial and federal governments regarding proposed or existing legislation and policies affecting these plans.

- 20 The perceived effectiveness of each of these various activities, which was not probed, is a good topic for further research.

- 21 The IABC is the only global communication association. It strives to advocate for the profession, represent best practices, define the global standard and live by a code of ethics.

- 22 It will take some time to understand the impact of the most recent changes to the BC regulations for TBPs. I suggest revisiting some of this research in four to five years after plans have had a chance to deal with the new PfAD regulations that came into effect on January 1, 2023.