The Study in Brief

- While Canada’s skilled immigration system has been the envy of the world for decades, the post-pandemic years have seen policy prioritize plugging “holes” in lower-skilled labour markets, which is consistent with popular notions that some types of labour are “essential” to production. Instead, Canada’s economic-class immigration system should return to its successful roots by prioritizing highly skilled newcomers based on expected earnings levels.

- The goal should be to maximize GDP per capita in the full population, including newcomers. Standard models of economic growth teach us much about the potential for heightened immigration to boost Canada’s GDP per capita. A key insight of the theory is that an economic immigration program that is designed to simply expand the labour force without raising the average human capital, or skill level, of the population is unlikely to increase GDP per capita in the long run.

- In addition, physical capital accumulation and productivity growth are critical variables mediating the impact of immigration on per capita income. However, weak capital investments and productivity growth suggest that Canada is not well-positioned to leverage heightened immigration to raise either the level or the growth rate of per capita GDP. We argue that these data caution against large-scale increases in economic immigration rates in the near term due to absorptive capacity issues.

- The preferred approach is to gradually increase immigration rates by starting with a high threshold level for expected immigrant earnings and gradually lowering it towards the overall population average. This would prioritize the applicants with the highest human capital levels and expected earnings, whose contributions to the Canadian economy are likely to have the largest positive impact.

The authors thank Parisa Mahboubi, William B.P. Robson, Tingting Zhang, Charles Beach and anonymous reviewers for comments on an earlier draft. The authors retain responsibility for any errors and the views expressed. This publication is based on the authors' forthcoming article in Canadian Journal of Economics.

Introduction

When pollsters ask, an overwhelming majority of Canadians agree with the statement: “Overall, immigration has a positive impact on the Canadian economy.”1 However, a significant majority also agree that Canada should limit the number of immigrants it accepts.2 These views reflect a broad and longstanding Canadian consensus that while immigration can boost average economic living standards in the population, there are limits to this potential. While nearly all Canadians believe a closed-door immigration policy would harm our economic well-being, few support a true open-door policy.3

If immigration has the potential to boost the Canadian economy but must be limited to realize that potential, what is the optimal level? Between 2000 and 2017, Canada’s annual immigration rate – the number of new permanent residents as a percentage of the population – fluctuated between 0.70 percent and 0.83 percent. In 2017, the government announced expansionary targets, which served to increase the rate over the following two years to 0.87 percent and 0.91 percent. While COVID-19 travel restrictions forced a reduction in 2020 to 0.49 percent, 2021 saw the rate increase to 1.12 percent, its highest since 1957. If the federal government meets its most recent targets – 485,000 new permanent residents in 2024 and 500,000 in 2025 – the rate will reach 1.21 percent and 1.24 percent, respectively. Canada has not seen consecutive years with rates above 1.2 percent since 1928-1929.

The policy challenge to meeting these targets is not attracting enough immigrants. As of January 2024, Immigration, Refugees and Citizenship Canada (IRCC) had a processing backlog of 308,900 applications for permanent residency4 and an additional 215,726 principal applicants for economic-class immigration in its Express Entry pool for skilled workers.5 Assuming one accompanying dependent per applicant on average, this implies a queue of more than one million prospective immigrants.6 The Canadian reality is that the supply of prospective immigrants far exceeds current targets. While immigration rates above one percent are seen as ambitious, much higher immigration rates would be attainable if entry requirements were sufficiently relaxed and investments in IRCC’s application processing capacity were sufficiently increased.

This means that Canada’s immigration rate is a policy choice which the federal government has wide discretion to adjust.7 Whether one percent is too high or too low depends entirely on what the objective of immigration is. If it is to maximize our population or the overall size of the economy, perhaps in the hope of boosting Canada’s geopolitical influence, limiting annual inflows to one percent would be sub-optimal. But if the objective is to leverage immigration to boost average economic living standards in the population, it is far less clear whether one percent is too low or too high.

Section 3(1) of the Immigration and Refugee Protection Act (2002) lists 12 distinct objectives of immigration. This complicates matters when it comes to picking a policy priority. As a general principal, policy is most effective when there is one policy instrument for every policy goal. When there are more objectives than levers, and objectives are not well aligned, policy risks doing more harm than good.

When it comes to economic immigration, the crux of the policy choice is whether immigration should be aimed at meeting current labour market needs or raising the average human capital of the population. With job vacancies overwhelmingly concentrated in low-skill local labour markets, governments face tremendous pressure from business lobbies to focus on current labour needs, but this objective is poorly aligned with raising the skills of the workforce. With two misaligned objectives and one policy lever, governments, including Canada’s, need to commit to a single objective.

In our view, the objective of economic immigration should be to leverage immigration to boost growth in Gross Domestic Product (GDP) per capita in the full population, including newcomers. In this way, immigration has the potential to benefit all Canadians. Indeed, a growing body of evidence, mostly from the US, identifies beneficial effects of immigration on entrepreneurial activity (Azoulay, Jones, Kim and Miranda 2022), innovation (Kerr and Lincoln 2010; Hunt and Gauthier‐Loiselle 2010), trade balances (Ortega and Peri 2014), and the wage rates of native-born workers (Ottaviano and Peri 2012). However, there are clearly limits to the economic growth potential of immigration. More is not always better. Failure to recognize the absorptive capacity of economies ultimately risks undermining public support for immigration, as we have seen to a degree in Canada.

We begin this Commentary with our rationale for preferring the GDP per capita objective. We then examine the potential of heightened Canadian immigration rates to boost growth rates in GDP per capita based on what we know about economic growth from standard textbook models. We end by presenting a policy rule for identifying the optimal immigration rate to achieve this potential.

The Objective of Economic-Class Immigration

Defining an optimal immigration rate is impossible without first defining the policy objective. The objective of Canada’s economic immigration is presumably economic in nature, but what kind of economic objective? Is the goal to boost the profits of Canadian businesses, lower business failure rates, maximize the employment rate, or increase the productivity and wages of Canadian workers? And is the goal solely about benefiting the existing population, or should it also include the economic well-being of the newcomers?8

Net Gains and the “Immigration Surplus”: The economic rationale for leveraging immigration to boost the economic well-being of the preexisting population is theoretically straightforward. Consider a simple economy where markets are highly competitive, the amount of capital (like machinery and buildings) is fixed in the short run, and all workers have the same skills and productivity. When more workers come into this economy through immigration, they compete for a limited number of jobs because the capital stock can’t quickly increase. Since all workers have identical skills, they compete by accepting lower wages. This puts downward pressure on wages, making it cheaper for employers to hire more workers. Depressed wages, in turn, incentivize employers to hire more workers, increasing the employment level and the amount of output produced.

In this case, any economic loss to workers from their lower wage is a gain in firm profits, assuming firms own their capital. The effect of immigration is, however, more than a zero-sum redistribution of income from labour to capital, since the expansion in output means the gain to firms exceeds the loss to workers. Borjas (1995) refers to this net gain as the “immigration surplus.” If the surplus can be transferred from firms to workers at no cost, through corporate taxes for example, immigration has the potential to boost the economic welfare of everyone in the preexisting population.

In reality, of course, not all workers are perfect substitutes for one another in production. The immigration surplus, however, stays relevant under this assumption. While some workers in the preexisting population will experience economic losses due to heightened competition for jobs, immigration necessarily produces a net surplus within the preexisting population if immigration alters the mix of skills in the full population.9 As in the simpler case, workers who lose out can be compensated via redistributive public policies.

One may be concerned about the economic well-being of the newcomers, but if immigrants continue to arrive, their migration choice (“revealed preference”) is arguably evidence that they, too, are better off. From this perspective, it is difficult to see why anyone would be opposed to expansions in immigration levels on economic grounds.

Lower-skilled Immigrants and Inequality: But what does maximizing the “immigration surplus” look like? The surplus hinges on immigrants engaging in tasks that complement the productive activities of the workers in the preexisting population. For countries with highly educated workforces, like Canada, this implies optimal policy is to target admissions of lower-skilled immigrants. As Basso, Peri, and Rahman (2020) show, downward pressure on wages in the low-wage service sector has the added benefit of incentivizing preexisting workers to move into relatively skilled jobs, thereby further boosting productivity and earnings in this population. If policymakers also seek to maximize newcomers’ welfare gains from moving to Canada, targeting unskilled migrants from the poorest countries in the world will be optimal.

What is the effect of large inflows of unskilled labour in the full population including the new immigrants? On the one hand, we expect occupational segregation and economic inequality to increase as skilled natives are pushed into high-value-added professional and technical jobs while unskilled immigrants are concentrated in low-wage service tasks. Economics research suggests that interpersonal comparisons among the people with whom we most closely associate matter more in determining satisfaction with our personal income than comparisons with ourselves in the past (Clarke, Frijters and Shields 2008). This suggests that with time in the host country the relative deprivation of newcomers in the host country may be more important in determining their sense of economic well-being than their economic gain from migration. The rise in economic inequality within the full population becomes especially concerning if it persists across generations. Using Canadian Census data, Aydemir, Chen and Corak (2009) identify immigrant source countries, mostly Caribbean, where the earnings disparities of immigrant fathers are evident in the adult earnings of their sons and daughters two decades later. Similarly, Skuterud (2010) finds evidence of persistent wage gaps across generations of black Canadians.

If the earnings disadvantages of immigrants are significant enough, not only is economic inequality likely to rise, but average economic well-being in the full population may fall, no matter how strong the complementarity between the skilled and unskilled labour inputs is. The intuition is that with one labour input fixed, adding more of the other labour type always runs into the diminishing marginal product of labour problem.

In our view, no economic policy is socially optimal if it simultaneously increases inequality in the population and makes the population poorer on average. What is too often overlooked in appeals to the “immigration surplus” is that it rests critically on the exclusion of the newcomers when we measure inequality and average economic well-being in the economy.10 This might be justifiable in the context of a guest-worker program, such as that in the United Arab Emirates, but it is in our view anathema to the ethos of Canadian immigration and egalitarianism and the reality that new Canadian permanent residents have full access to all the rights and privileges of individuals in the preexisting population, including citizenship.

The Relevance of GDP per capita: While no single metric can capture a nation’s economic welfare perfectly, the advantages of targeting GDP per capita are well established. Differences in per capita income are strongly correlated with life satisfaction across countries and between individuals within countries (Easterlin 1995). More contentious is whether increases in per capita GDP within countries over time produce gains in average happiness. Evidence is, however, accumulating that economic growth, even within rich countries, is associated with increases in average levels of subjective well-being (Stevenson and Wolfers 2008). In addition, income growth has been shown to be associated with improvements in longevity, health, education, knowledge, and other beneficial outcomes for individuals and society, regardless of any effect on subjective well-being. And perhaps most significant in the immigration context, differences in countries’ levels of per capita GDP have been shown to be highly influential in determining migrants’ own choices about where they choose to settle (Mayda 2010; Ortega and Peri 2013).11 Last, there is nothing keeping Canadians from allocating the gains from increases in per capita GDP to efforts to reduce economic inequality since tax and transfer policies, for example, can influence who benefits most from increased average incomes.

In the light of these considerations, our view is that the most reasonable economic objective of Canadian economic-class immigration is to boost per capita GDP in the full population.

Determinants of Per Capita Income

At the most abstract level, the list of possible drivers of growth in per capita income is relatively short.12 It typically includes inputs such as labour, physical capital, and human capital,13 as well as factors that increase the productivity of these inputs, such as new innovations and discoveries that increase the productive capacity of the economy’s inputs and increase the efficiency with which existing inputs are employed.

We use the term “productivity” to refer to what economists call total factor productivity (TFP) – a measure of how efficiently an economy uses all its resources to produce goods and services. An economy with higher TFP will produce more output than an economy with lower TFP when both economies have the same input levels. This is important because the term productivity can also refer to labour productivity. An important difference between these two notions of productivity is that labour productivity is affected by the accumulation of other factor inputs, whereas TFP tells us how much an economy can produce with a given set of inputs. An economy that experiences a surge in new capital, for example, would be expected to see an improvement in labour productivity, even if there were no increase in the efficiency of its production methods.

Economists do not view simple increases in the size of the labour force as plausible drivers of either higher per capita income levels or growth rates if the economy’s other inputs, such as the stock of physical capital and technological level, are fixed. This is due to the diminishing marginal product of labour. The marginal product of an input, be it labour, capital, or human capital, is the additional amount of output produced when the quantity of that input increases by one unit, holding all other inputs constant. That the marginal product of labour is diminishing means the additional output generated by increases in the labour input of the economy, holding the other inputs constant, gets smaller as more labour is added. Put more simply, each worker added to the economy contributes a smaller increase to overall output than the previous worker did, which means that average output per worker must decrease. Hence, GDP per worker falls.

Work Intensity: Increases in population via immigration would increase output per person in the case where immigrants are more likely to work than the domestic population. This would happen if, for example, immigrants are more likely to be employed or spend a larger share of their lives working, at least while living in Canada, than the domestic population. If the “work intensity” of immigrants is higher than the domestic population, an increase in the share of the population that are immigrants could offset decreases in output per worker resulting from the diminishing marginal product of labour and, in turn, raise the level of output per person. This would not, however, increase the long-run growth rate, except in the unrealistic case where the difference between immigrants’ and non-immigrants’ average work hours continuously increases with every subsequent cohort of new immigrants.

Population Aging: A related view is that immigration can address the deleterious effects on the economy of an aging population by mitigating increases in dependency ratios (the share of the population not working). This idea rests on the notion that immigrants are younger than the existing population on arrival. However, evidence suggests that immigration does in fact little to change the age distribution of the Canadian population (Robson and Mahboubi 2018). And to the extent that there is a short-run demographic dividend to increasing labour force participation rates through immigration, it is important to realize that immigrants age too and eventually retire. As with work intensity, leveraging this demographic dividend to produce ongoing gains would require a strategy of continually increasing the immigration rate to undo the increasing size of the retirement-age population.

The importance of physical capital as a driver of economic growth is more nuanced.14 To see why, consider the dynamics of capital accumulation, supposing, for a moment, that productivity is constant. When the ratio of capital to labour is low, capital is scarce, and the marginal product of capital is high. In this situation, the economy is not only able to accumulate capital rapidly, but the incentive to do so is high. As the capital stock increases, capital becomes abundant relative to labour, which causes the marginal product of capital to fall. Eventually, additional investments in capital produce only enough additional output to cover the cost of replacing the depreciation of the existing capital stock and growth stops.

Capital accumulation does have a role to play in economic growth in the more reasonable case where productivity grows over time. In this case, growth in productivity offsets the decrease in the marginal product of capital by making all inputs more productive. Consequently, the economy will continuously accumulate more capital per worker along its growth path.

Capital Stock and Population Growth: Given this background, we can evaluate the impact of an increase in the population through immigration, while allowing for the capital stock to adjust in response to the population increase. The immediate impact of an increase in the population is to mechanically reduce the capital to labour ratio and, in turn, reduce the marginal product of labour. However, the abundance of labour increases the marginal product of capital and incentivizes new capital investments. In the long run, the capital stock increases along with the population. In the case where the aggregate production function is constant returns to scale, output increases by the same proportion as the population, so that immigration has neither a beneficial nor adverse effect on per capita income.

It is important to realize that a one-time increase in the population size is not the same as a permanent increase in the population growth rate that results, for example, from an increase in the Canada’s annual immigration from 0.8 percent of the population to 1.2 percent, as the federal government is currently planning. With a higher population growth rate, we must consider an additional mechanism known as capital dilution. A higher population growth rate means that a larger proportion of the economy’s output must be allocated to saving, that is, new capital investments, to maintain the existing capital-to-worker ratio. The permanently higher savings rate reduces the amount of output available for consumption in each period, resulting in a reduction in the steady-state level of per capita income.

The contrasting results for labour and physical capital show that the effect of immigration on per capita income is strongly influenced by whether there is an increase in the physical capital stock. Hence, Canada’s ability to accumulate new capital goods is a critical factor that should inform immigration policy.

Human capital, by which we mean the education, training, and skills of the workforce, is another important determinant of per capita income. Like physical capital, the average level of human capital in the economy can increase over time via investment in education and skills. Unlike physical capital, the composition of the labour force, and therefore the average level of human capital in the economy, is directly affected by immigration policy. Hence it is worth examining how immigration can affect growth through its influence on the human capital stock.

Upskilling the Labour Force: An increase in the population and labour force that leaves other factors unchanged, including average human capital in the population, will result in decreased per capita output due to the diminishing marginal product of labour. However, by selecting immigrants who have a high level of human capital relative to the domestic population, immigration can increase the average level of human capital in the economy at the same time as it increases the population size. This upskilling of the labour force serves to offset the tendency for the marginal product of labour to diminish. This means that an inflow of immigrants with a higher average level of human capital than the domestic population can, in principle, generate increases in per capita income even in the absence of physical capital accumulation.

There are, however, limits to the potential for human-capital oriented immigration to generate longer run growth in per capita income. First, this channel requires that, on average, immigrants have a higher level of human capital than the domestic population. However, as people with higher human capital levels are continuously added to the population, the average human capital of the population continuously increases. Hence, increasing the average human capital of the population requires an immigration policy that becomes increasingly selective over time. This may be infeasible or may conflict with other goals of immigration policy, such as international obligations to meet humanitarian objectives. Second, adding human capital does not in itself scale up the production side of the economy. In the absence of investment in other inputs, such as physical capital, the diminishing marginal product of human capital will cause growth to ebb over longer time horizons.

A common interpretation of the growth theory literature is that in the long run, economic growth in per capita income is largely driven by the fact that new ideas, discoveries, and innovations increase our ability to produce and distribute goods and services within an economy. The growth literature has largely focused on two related channels. The first channel is innovation that arises from purposeful R&D investments, resulting in either new types of products being created, improvements in the quality of existing products, or new methods of production.15 A second channel that has received significant attention is innovation that arises as a byproduct of other economic activity.16 This mechanism is sometimes referred to as “learning by doing.” The central idea is that new discoveries arise in the process of producing goods and services, during the construction of new capital goods, or as households and individuals acquire human capital through training and education.

Immigration and Productivity Growth: The above discussion suggests that there is scope for immigration policy to influence productivity growth, for example by an immigration policy focused on attracting scientists, inventors, and entrepreneurs. There is, however, an important caveat to keep in mind. Innovation primarily takes the form of new ideas. Ideas are public goods in the sense that a person’s decision to use an existing idea does not preclude others from using the same idea. Furthermore, by their very nature, ideas cross national boundaries relatively easily. Canada is highly integrated into both the North American and global economies and has a highly educated work force and a well-developed system of universities, and therefore has access to the global pool of new ideas and discoveries. This suggests that domestic productivity growth in Canada is likely to depend more strongly on the global than on the domestic rate of innovation. As Jones (2021) argues: “We do not believe that Luxembourg or Singapore grows only because of ideas invented by the researchers in those small countries. Instead, essentially all countries eventually benefit from ideas created throughout the world.”

Canadian Immigration and the Broader Economy

The literature on economic growth suggests that population growth through heightened immigration is unlikely to increase per capita income on its own. To understand how immigration policy is likely to impact per capita income and its growth rates, it is critical to consider the interaction of immigration with the factors that drive increases in per capita income. These factors include physical capital accumulation, human capital accumulation, and productivity growth. They are, however, not central to the design of immigration policy in Canada as it is today.

Current Policy Focus: Plugging Holes

While Canada’s skilled immigration system has been the envy of the world for decades, the post-pandemic years have seen policy prioritize plugging “holes” in lower-skilled labour markets, which is consistent with popular notions that some types of labour are “essential” to production. This thinking implies that the production of output requires inputs to be used in fixed proportions. There is an earlier growth literature, based on the contributions of Harrod (1939) and Domar (1946), that employed this view of production. These models have been abandoned by the modern literature, as they imply economies will exhibit perpetual growth of unemployment or idle machinery, neither of which is consistent with real-world data of any country (Barro and Sala-i-Martin 2003). The real-world importance of labour-saving technological changes in many sectors of the economy is also inconsistent with the fixed proportions view of production.

Proponents of high levels of economic immigration might counter this argument by asking `who will do the jobs that Canadians don’t want to do if we restrict the sample to such high-skill immigrants?’ Our response is that admitting immigrants to work in low wage jobs pulls down average earnings and GDP per capita, and any benefits from these individuals working in these jobs would need to be weighed against this negative effect. Also, if there is excess demand for workers in these lower skill jobs, economic theory predicts that wages will tend to rise to attract workers in the preexisting population and firms will be incentivized to invest more in capital equipment to reduce the need to rely on low-skilled workers that are difficult to recruit.

Estimating the overall size of a country’s capital stock on a regular basis, which includes everything from the value of a country’s housing stock to the value of intellectual property underlying new products and services, is infeasible. Instead, national accounts rely on information on capital investments, which when combined with estimates of capital depreciation can be used to infer growth rates in the capital stock and, given an initial value, the current size of the capital stock. By examining the recent trajectory of investment activity and the per capita capital stock, we can gauge Canada’s economic capacity to absorb the acceleration in population growth it is planning.

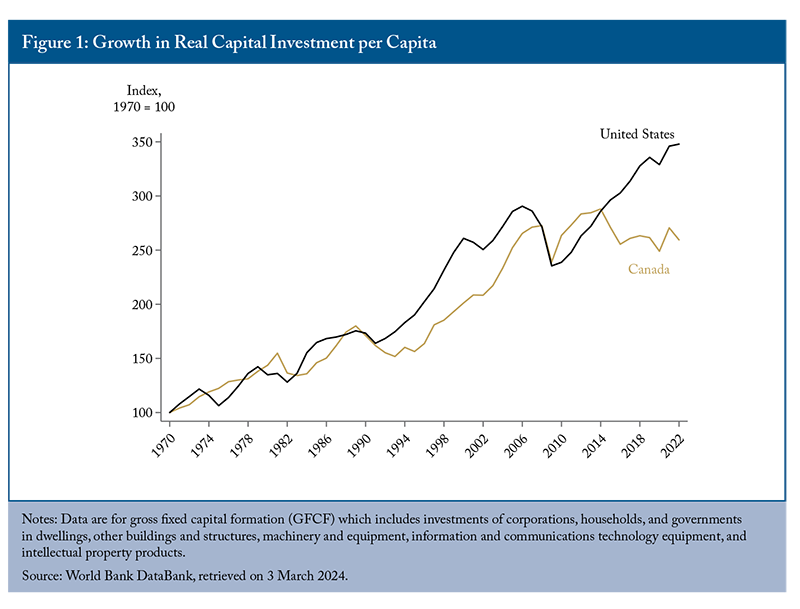

We begin by examining a measure of investment in physical capital known as gross fixed capital formation (GFCF), which the OECD publishes annually on a comparable basis for their member countries. GFCF includes new capital formation and the replacement of depreciating capital stock by corporations, households, and governments in dwellings, other buildings and structures, machinery and equipment, information and communication technology equipment, and intellectual property. In Figure 1, we graph growth in annual real GFCF per capita in Canada and the United States since 1970.

The data reveal four distinct periods. Canadian and US investment per capita grew at similar rates through the 1970s and 1980s. However, with the onset of the recession of the early 1990s, Canadian investment began to grow more slowly than US investment, a phenomenon that persisted throughout the 1990s. Canadian investment grew faster than US investment throughout the early 2000s and fell less precipitously during the financial crisis of 2007-2008. However, Canadian and US investment has diverged dramatically since 2010. While real per capita investment in the US increased by 39 percent between 2010 and 2021, Canadian investment has been flat.

Canada does not just fare poorly relative to the United States. In recent decades, Canadian non-residential investment per job has been towards the bottom of the OECD (Robson and Bafale 2022; Deslaurier, Gagné and Paré 2022). More alarmingly, the OECD forecasts Canada’s growth in capital formation per worker over the next four decades to be at the bottom of all OECD countries (OECD 2021).

The causes of Canada’s poor performance on this measure are not well understood. Regardless, of what accounts for Canada’s weak investment activity in the past 15 years, the absence of any growth, or perhaps even a decrease, portends concerning absorptive capacity challenges for immigration.

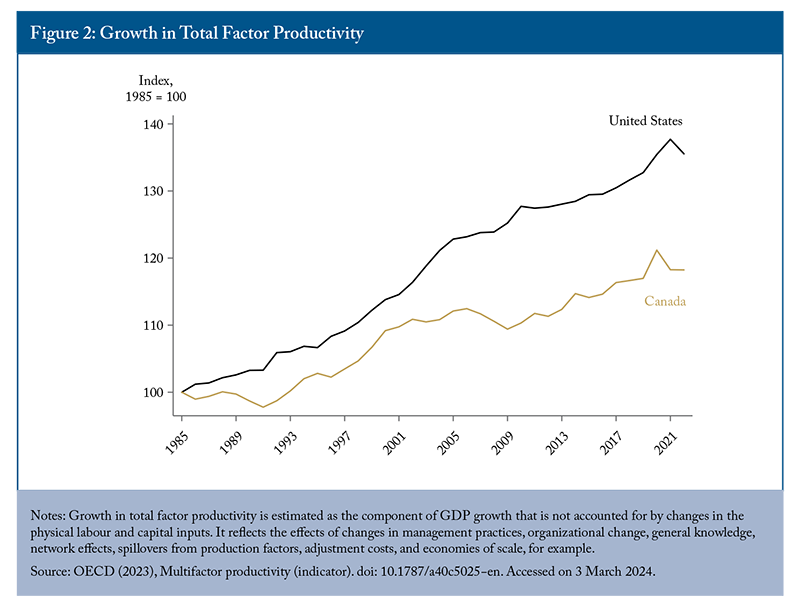

From the national accounts data of their member countries, the OECD produces and publishes annual estimates of total factor productivity going back to 1985. Their publication describes TFP as the component of GDP growth that is not accounted for by changes in physical labour and capital inputs, such as the effects of management practices, organizational change, general knowledge, network effects, spillovers from production factors, adjustment costs, and economies of scale. In Figure 2, we graph growth in Canadian and US TFP since 1985. Canadian TFP growth averaged 0.53 percent over the 37-year period, while US TFP growth averaged 1.01 percent.17

The shortfall in Canadian productivity growth was especially large over the period from 2001 to 2011, a period during which Canada’s annual immigration rate was on average more than twice the US rate. In fact, the Canadian immigration rate exceeded the US rate in every year between 1985 and 2021 and was more than twice as high as the US rate in 31 of the 37 years. While there remains a lot we do not know about the causes of Canada’s sluggish productivity performance, these data do not provide us with much confidence that simply increasing Canada’s immigration rate will be a tonic to Canada’s ongoing productivity challenge.

Recent research examining US data from the late 18th and early 19th centuries and German data in the period after WWII finds evidence linking immigration-driven population growth and growth in GDP per capita that appears to be due to the creation of new ideas and expansions of the efficient frontier (Arkolkais, Lee and Peters 2020; Peters 2021). More relevant analyses using up-to-date US data on patents created per capita provides evidence of the potential of local inflows of skilled immigrants to raise local innovation activity, suggesting expansion of the US efficient frontier (Hunt and Gauthier-Loiselle 2010). Moreover, Kerr and Lincoln (2010) provide evidence that the skilled immigration inflows driving these gains are coming through the H-1B employment visa program, which allows US employers to cream-skim the foreign talent pool in the country’s top universities.

However, evidence for other countries is much less clear. Using data for Canada, Blit, Skuterud and Zhang (2020) find that increasing the university-educated immigrant share has only modest effects on patenting rates and any effect is clearly smaller than the impact of skilled immigrants on patenting activity in the US.18 They find evidence of larger effects of Canadian immigrants with STEM degrees, but this effect is limited because only one-third of Canadian STEM-educated immigrants are employed in STEM jobs. In contrast, two-fifths of the Canadian-born and one-half of US immigrants who have STEM educational degrees are employed in STEM jobs. STEM skills are widely believed to be central to innovation and productivity growth (Council of Canadian Academies 2015). We interpret these findings as indicating that expansions of economic immigration under the current selection system are unlikely to have a significant impact on Canadian productivity. However, any potential effects of immigration on innovation and technology levels are more likely to be driven by selecting highly skilled immigrants.

Policy Prescription

As we have argued, the goal of economic immigration policy should be to raise GDP per capita of the full population (including both preexisting residents and new immigrants) in the receiving country. To achieve this, the selection of economic immigrants should proceed based on human capital in descending order from the highest until the marginal immigrant admitted has human capital equal to the average in the full population. This approach provides a natural way to set the level of immigration each year since it will be the number of immigrants who satisfy this criterion. Future targets can be set based on the expected number of economic immigrant applicants in those years who will possess human capital at or above the average level in the full population.

Since human capital cannot be observed directly, expected annual earnings can be used as a proxy for human capital. Due to difficulties adapting to the new labour market, perhaps due to short-term credential recognition problems and weak language fluency, we propose that economic immigrants should be given 10 years to adapt. Therefore, any models of earnings should be based on data from previous cohorts of economic immigrants who have been in the country at least 10 years. In other words, prospective immigrants should be admitted to Canada if their expected incomes at least 10 years after arrival are at or above the average of the full Canadian population.19

Simulations: We have carried out simulations based on individual level data on the 2005 landing cohort of economic immigrant principal applicants to Canada. These simulations use the Longitudinal Immigration Database (IMDB) which is comprised of immigrant landing records linked at the individual level to subsequent income tax records. We also use the IMDB data linked to the 2016 Census of Canada confidential master file. These data allow us to examine the earnings of these immigrants 10 years after arrival.20 Our simulations involve taking the sub-sample of 2005 economic principal applicants in the 2016 Census and then dropping those who either had earnings below the full population average that year or were expected to have lower earnings than that average based on regression models estimated over the IMDB-Census data. The simulations suggest that imposing the restriction that earnings 10 years after arrival are at least as great as the population average could require reducing the level of immigration by 25 percent or more but would result in substantially higher immigrant earnings (11 percent higher in the preferred specification).21 22However, there are reasons to believe that implementing our policy rule coupled with a richer prediction model and richer information on the immigrant data employed would require a less drastic reduction in admissions.23

How might a richer prediction model work? Over the past decade, Canada has seen a significant shift towards “two-step immigration” in which migrants arrive initially in Canada with a temporary work or study permit and subsequently apply for, and if successful, transition to permanent residency (Hou, Crossman, and Picot 2020). Two-step immigration provides policymakers with a richer information set to predict immigrants’ future Canadian earnings. We know, for example, that the best predictor of immigrants’ future earnings are their past earnings (Picot, Hou, Xu, and Bonikowska 2022), yet applicants’ pre-landing Canadian earnings levels are not used in the current Comprehensive Ranking System (CRS) calculator.24 As for foreign students, information on the post-landing earnings of former international students who graduated from the same Canadian post-secondary institution could be used. If the data show, for example, that STEM graduates from University X consistently outperform Humanities graduates from University Y, we would want to exploit that information in the selection system.

Takeaways: All of this suggests that large gains in average immigrant earnings and potentially GDP per capita growth can be achieved by imposing the restriction that each economic principal applicant admitted must be expected to have earnings 10 years after arrival that are at least as large as we expect average earnings in the full population to be in that year.

However, it is worth noting that our simulations were based on the 2005 landing cohort, a period when the immigration rate was 0.81 percent, which is much lower than the current expected immigration rate of 1.21 percent based the 2024 immigration target. The current federal government has set ambitious economic immigration targets and has shifted selection from prioritizing the human capital of applicants to addressing labour shortages in the lower skill labour markets. These two developments represent policy deviations from our selection policy recommendation.

There are limits to the economic growth potential of our policy rule. The compositional gains are likely to affect the long-run level of per capita income, rather than its growth rate. A growth effect would require ongoing improvements in the quality of the applicant pool, which would require that Canada become a more desirable destination for migrants over time. This would require either increased capital investments or that improved selection also produces greater human capital externalities and, in turn, ongoing productivity gains.

An important additional consideration is whether our policy rule is likely to improve or exacerbate earnings inequality in Canada. We expect that admitting economic immigrants with the highest expected future earnings would tend to reduce earnings inequality because the supply of high-human-capital individuals would put downward pressure on wages at the top end of the earnings distribution. Also, the supply of low-human-capital workers would be smaller, which should serve to tighten low-wage labour markets and, if anything, put upward pressure on earnings at the bottom end of the earnings distribution.

Last, our analysis primarily focuses on economic principal applicants, as they are directly assessed based on their skills and qualifications. The Canadian economic selection system historically does not consider spouses’ and children’s characteristics and earnings in immigrant selection. While incorporating spouses into the selection system is important, only limited spousal characteristics are included due to complexity. Considering the future economic outcomes of immigrant children is important; however, quantifying these benefits involves discounting future outcomes to present value terms, which can reduce immediate policy relevance. Historically, children of immigrants in Canada have achieved significant success in the labour market, likely influenced by their parents’ education levels. This correlation underscores the importance of selecting highly educated immigrants for future success in Canada.25

Conclusion

In a country like Canada, where governments work to reduce inequality and immigrants are de facto citizens, economic immigration should aim to maximize GDP per capita in the full population, including newcomers. Standard models of economic growth teach us a great deal about the potential for heightened immigration to boost Canada’s GDP per capita. A key insight of the theory is that an economic immigration program that is designed to simply expand the labour force without raising the average human capital level of the population is unlikely to increase GDP per capita in the long run. In addition, physical capital accumulation and productivity growth are critical variables mediating any positive impact of immigration on per capita income.

Unfortunately, the Canadian data on capital investments and productivity growth do not suggest that Canada is well-positioned to leverage heightened immigration to raise either the level or growth rate of per capita GDP. These data caution against large-scale increases in economic immigration rates in the near term due to absorptive capacity issues. Absorptive capacity can be thought of as how quickly the economy can expand private and public capital investments to prevent declines in the capital-labour ratio and public service provision per capita.

In our view, a preferred approach is a gradual ratcheting up of immigration rates starting from a high minimum level of expected immigrant earnings, and then gradually lowering that earnings threshold each year towards the overall population average. This would initially prioritize the applicants with the highest human capital levels and expected earnings whose contributions to the Canadian economy are likely to be the largest, and allow the immigration target to converge, over perhaps several years, to the optimal level for economic immigration.

Given the current high immigration levels, exceptionally high temporary migration levels and strains on the housing and healthcare sectors, the federal government should apply the insights from our analysis and reassess immigration and temporary migration targets. The federal government has cut the intake of international students, but this may well prove insufficient. We have also seen a freezing of the target for immigrant intake between 2025 and 2026 at 500,000 due to concerns related to absorptive capacity. Unless significant steps are taken to improve the system used to screen applicants for economic-class immigration, our analysis suggests that actual cuts to the level of economic immigration are likely needed.

Improving selection criteria in Canada’s economic-class immigration system can boost average earnings of new immigrants and, in turn, GDP per capita. Our empirical analysis indicates that this would likely lead to a reduction in the level of economic-class immigration relative to historical levels due to the fact that immigrants selected have had expected earnings that were lower than the average in the full population. Nonetheless, the gains from improved earnings of immigrants admitted in the economic class could allow the government to expand immigration under programs intended to achieve other non-economic objectives, such as humanitarian objectives.

References

Acemoglu, Daron. 2009. Modern Economic Growth, Princeton University Press.

Aghion, P., and P. Howitt. 1992. “A Model of Growth Through Creative Destruction,” Econometrica 60(2): 323–351.

Amior, Michael, and Alan Manning. 2022. “Monopsony and the Wage Effects of Migration,” CEP Discussion Paper, CEPDP1690.

Arkolakis, Costas, Sun Kyoung Lee and Michael Peters. 2020. “European Immigrants and the United States’ Rise to the Technological Frontier,” unpublished manuscript.

Aydemir, Abdurrahman, Wen-Hao Chen and Miles Corak. 2009. “Intergenerational Earnings Mobility Among the Children of Canadian Immigrants,” Review of Economics and Statistics 91(2): 377-397.

Azoulay, Pierre, Benjamin F. Jones, J. Daniel Kim and Javier Miranda. 2022. “Immigration and Entrepreneurship in the United States,” American Economic Review: Insights 4(1): 71-88.

Barro, Robert J., and Xavier I. Sala-i-Martin. 2003. Economic Growth, MIT Press.

Basso, Gaetano, Giovanni Peri, and Ahmed S. Rahman. 2020. “Computerization and Immigration: Theory and Evidence from the United States,” Canadian Journal of Economics 53(4): 1457-1494.

Blit, Joel, Mikal Skuterud, and Jue Zhang. 2020. “Can skilled immigration raise innovation? Evidence from Canadian Cities,” Journal of Economic Geography 20(4): 879-901.

Borjas, George J. 1995. “The Economic Benefits from Immigration,” Journal of Economic Perspectives 9(2): 3-22.

Clark, Andrew E., Paul Frijters, and Michael A. Shields. 2008. “Relative Income, Happiness, and Utility: An Explanation for the Easterlin Paradox and Other Puzzles,” Journal of Economic Literature 46(1): 95-144.

Council of Canadian Academies. 2015. “Some Assembly Required: STEM Skills and Canada’s Economic Productivity,” Ottawa (ON): The Expert Panel on STEM Skills for the Future, Council of Canadian Academies.

Deslauriers, Jonathan, and Robert Gagné and Jonathan Paré. 2022. “Canada’s Lagging Productivity: Could the Problem Be Insufficient Competition,” Centre for Productivity and Prosperity, HEC Montréal.

Domar, Evsey D. 1946. “Capital Expansion, Rate of Growth, and Employment,” Econometrica 14: 137-147.

Doyle, Matthew, Mikal Skuterud and Christopher Worswick. 2024. “The Economics of Canadian Immigration Levels,” Canadian Journal of Economics, forthcoming.

Easterlin, Richard A. 1995. “Will Raising the Incomes of All Increase the Happiness of All?” Journal of Economic Behaviour and Organization 27: 35-47.

Fleurbaey, Marc. 2009. “Beyond GDP: The Quest for a Measure of Social Welfare,” Journal of Economic Literature 47(4): 1029-1075.

Grossman, G.M., and E. Helpman. 1991. Innovation and Growth in the Global Economy, Cambridge MA: Cambridge University Press.

Harrod, Roy F. 1939. “An Essay in Dynamic Theory,” Economic Journal 49: 14-33.

Hou, Feng, Eden Crossman, and Garnett Picot. 2020. “Two-step Immigration Selection: An Analysis of its Expansion in Canada,” Economic Insights, Statistics Canada, Catalogue 11-626-X — 2020010 - No. 112.

Jones, Charles I., and Peter J. Klenow. 2016. “Beyond GDP? Welfare Across Countries and Time,” American Economics Review 106(9): 2426-2457.

Jones, Charles I. 2021. ”The Past and Future of Economic Growth: A Semi-Endogenous Perspective,” NBER Working Paper, no. 29129.

Jorgenson, Dale W. 2018. “Production and Welfare: Progress in Economic Measurement,” Journal of Economic Literature 56(3): 867-919.

Kerr, William R., and William F. Lincoln. 2010. “The Supply Side of Innovation: H-1B Visa

Reforms and U.S. Ethnic Invention,” Journal of Labor Economics 28(3): 473-508.

Hunt, Jennifer, and Gauthier- Loiselle, Marjolaine. 2010. “How Much Does Immigration Boost Innovation?” American Economic Journal: Macroeconomics 2(2): 31–56.

Lucas, Robert E. Jr. 1988. “On the Mechanics of Economic Development,” Journal of Monetary Economics 22(1): 3–42.

Mayda, Anna Maria. 2010.“International Migration: A Panel Data Analysis of the Determinants of Bilateral Flows,” Journal of Population Economics 23: 1249-1274.

Mahboubi, Parisa. 2024. Quality Over Quantity: How Canada’s Immigration System Can Catch Up With Its Competitors. Commentary, No. 654. Toronto: C.D. Howe Institute.

OECD. 2021. “The Long Game: Fiscal Outlooks to 20160 Underline Need For Structural Reform,” OECD Economic Policy Paper, no 29.

Ortega, Fracesc, and Giovanni Peri. 2013. “The Effect of Income and Immigration Policies on International Migration,” Migration Studies 1(1): 47-74.

______________.2014. “Openness and Income: The Roles of Trade and Immigration.” Journal of International Economics 92(2): 231–51.

Peters, Michael. 2021. “Market Size and Spatial Growth: Evidence from Germany’s Post-War Population Expulsions,” NBER Working Paper, no. 29329.

Picot, Garnett, Feng Hou, Li Xu, and Aneta Bonikowska. 2022. “Immigration Selection Factors and the Earnings of Economic Principal Applicants,” Economic and Social Reports, Statistics Canada, Catalogue no. 36-28-0001.

Ramsey, Frank P. 1928. “A Mathematical Theory of Saving,” Economic Journal 38(152): 543-559.

Robson, William B.P., and Parisa Mahboubi. 2018. “Inflated Expectations: More Immigrants Can’t Solve Canada’s Aging Problem on Their Own,” E-Brief. Toronto: C.D. Howe Institute.

Robson, William B.P., and Mawakina Bafale. 2022. “Decapitalization: Weak Business Investment Threatens Canadian Prosperity,” Commentary no. 625. Toronto: C.D. Howe Institute.

Romer, Paul M. 1986. “Increasing Returns and Long-Run Growth,” Journal of Political Economy 94(5): 1002- 1037.

___________. 1990. “Endogenous Technological Change,” Journal of Political Economy 98(5): S71–S102.

Skuterud, Mikal. 2010. “The Visible Minority Earnings Gap Across Generations of Canadians,” Canadian Journal of Economics 43(3): 860-881.

Solow, Robert M. 1956. “A Contribution to the Theory of Economic Growth,” Quarterly Journal of Economics 70(1): 65-94.

Stevenson, Betsey, and Justin Wolfers. 2008. “Economic Growth and Subjective Well-Being: Reassessing the Easterlin Paradox,” Brookings Papers on Economic Activity 39(1):1-102.

Swan, Trevor W. 1956. “Economic Growth and Capital Accumulation,” Economic Record 32: 334-361.

Weil, David. 2012. Economic Growth (3rd edition), Routledge.

- 1 Environics Institute poll conducted in September 2021, reported in Alec Regino, “New immigration minister inherits backlogs, migrant worker issues,” Toronto Star, October 27, 2021.

- 2 Results of a Leger poll from June 2019 reported in Teresa Wright, “Poll suggests majority of Canadians favour limiting immigration levels,” CBC News, June 16, 2019.

- 3 To be clear, we define a closed-door policy as one where no immigrants are admitted and an open-door policy as one where the sole requirement for obtaining permanent residency status is arrival in Canada.

- 4 Retrieved on March 14, 2024 from https://immigrationnewscanada.ca/new-ircc-backlog-update-2024/.

- 5 In comparison, the number of applicants in the Express Entry pool was 71,087 on January 3, 2018, 94,950 on January 3, 2019, 141,281 on January 29, 2020, 146,495 on January 4, 2021, 193,148 on January 4, 2022, and 239,415 on February 1, 2023 (https://www.canada.ca/en/immigration-refugees-citizenship/corporate/pub…).

- 6 According to Mahboubi (2024), about half of economic-class immigrants are principal applicants.

- 7 For ease of discussion, we focus on the role of the federal government, but we recognize that immigration is a shared federal-provincial jurisdiction under the Canadian constitution, so a role for the provincial governments in setting these targets for Canadian immigration levels is important.

- 8 While Canadian immigration seeks to achieve both humanitarian and economic objectives, we make no normative claims regarding the optimal level or composition of humanitarian immigration. It may well be that the 20 percent allotment to humanitarian immigration in the government’s most recent targets is socially suboptimal.

- 9 See Amior and Manning (2022) for both the theory and evidence from US Census data.

- 10 Alternatively, one could argue that the newcomers should be considered (by including them in the Social Welfare Function)both before and after their migration. But which prospective migrants should a country’s policymakers include in these considerations? Without knowing who will arrive in Canada, ex ante, the only option is to include the world’s population, but this, once again, implies that optimal policy is mass immigration from the world’s poorest countries, since this is where the welfare gains from migration to Canada will be largest. This may be consistent with the objectives of a humanitarian class immigration program but given the obvious implications for both economic inequality and average economic living standards in the host country, it is clearly not an appropriate objective for an economic-class immigration program.

- 11 We recognize the limitations of GDP as a way of measuring societal welfare, especially its neglect of non-market production and environmental destruction, and the existence of alternative measures of well-being, such as the UN’s Human Development Index (HDI). Despite advances in the ``beyond GDP” research, there remains much debate about the best alternative (Fleurbaey 2009; Jones and Klenow 2016; Jorgensen 2018) and correlations of alternative metrics with per capita GDP are consistently high. We also fully recognize that immigration may achieve many non-economic objectives, including humanitarian goals and increasing cultural diversity, but our analysis is concerned with optimal policy where the policy objective is economic.

- 12 The extensive literature informs this section on the determinants of economy growth. Textbook treatments of standard growth theory include example, Weil (2012) at the intermediate undergraduate level, and Barro and Sala-i-Martin (2003) and Acemoglu (2009) at the graduate level.

- 13 One can think of labour as the number of workers employed and human capital as the average skills of those workers. Immigration can add to the total number of workers in an economy and either raise or lower the average level of human capital in the labour force.

- 14 The following ideas were developed through a branch of the literature known as neoclassical growth theory, which originates with Ramsey (1928), Solow (1956), and Swan (1956).

- 15 See, for example, Romer (1990), Grossman and Helpman (1991), and Aghion and Howitt (1992).

- 16 See, for example, Romer (1986) and Lucas (1988).

- 17 As was the case for capital formation, Canada does not just fare poorly relative to the United States. For example, Deslaurier, Gagné, Paré (2022) show that Canada tends towards the bottom of the OECD on a number of measures of R&D and innovation activities. Furthermore, the OECD forecasts Canada’s productivity growth over the next four decades to be at the bottom of all OECD countries (OECD 2021).

- 18 For more information, see Doyle et al. (2024).

- 19 While expected annual earnings provide a snapshot of an individual’s human capital at a specific point in their life cycle, using expected remaining lifetime earnings that account for expected lifetime human capital can be a more appropriate measure. However, the present discounted value of earnings requires a much longer time horizon and would necessitate focusing on an arrival cohort much earlier than the 2005 cohort.

- 20 It is important to note that our analysis primarily uses employment earnings as a proxy for an immigrant candidate’s human capital and their potential contribution to GDP per capita. While GDP encompasses both employment earnings and the gross profits generated for businesses, our intuition is that including economic profits in GDP is unlikely to significantly impact the type and number of economic principal applicants admitted.

- 21 We have explored various regression models to predict future earnings and assess how effectively our approach can select immigrants with better labour market performance in Canada based on traditional selection factors like age, language fluency, and education. Our preferred specification, which is the most comprehensive and best-fitting among those tested, uses controls for language fluency, education and field of study and employs the 2015 IMDB-2016 Census linked data.

- 22 Our sensitivity analysis of other cohorts around 2005 using the 2016 Census shows no significant changes in results. Similarly, our research using the 2021 Census with different arrival cohorts shows no qualitative changes. Therefore, we are confident that our results are not sensitive to the choice of cohort year.

- 23 The goal of this study is to demonstrate how immigration can affect economic growth. While we do not claim that our analysis is the best method for predicting the future earnings of economic principal applicants, it does show that applying our selection rule can lead to higher earnings for these applicants. We believe the model can be improved and recommend that the government refine it further before implementing our model for immigrant selection.

- 24 Interested readers can view the CRS criteria set and calculate their own scores using the online CRS calculator tool here: https://www.cic.gc.ca/english/immigrate/skilled/crs-tool.asp.

- 25 For more information, see Doyle et al. (2024).