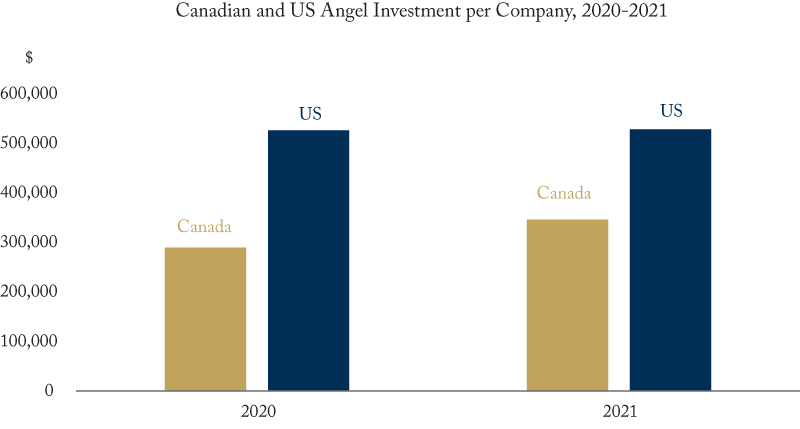

According to the National Angel Capital Network (NACO 2022), angels affiliated with regional angel networks collectively invested $262.1 million in 635 firms in Canada in 2021 up from $102.9 million in 416 firms in 2020. These investments averaged $346,024 per company in 2021 up from $289,792 in 2020. In the US, using data from Angel Market Analysis Reports, Center for Venture Research, University of New Hampshire, 69,060 companies collectively obtained US$29 billion of angel financing in 2021 compared with 64,480 companies and US$25 billion in 2020. Using Canada/US exchange rates for those years, this works out to $528,191 per company in 2021 and $526,364 per company in 2020, noticeably higher than here in Canada. While all estimates of angel activity are imprecise, the difference is significant.

In Scaling Up Is Hard To Do: Financing Canadian Small Firms, the authors provide a series of policy recommendations with the goal of ensuring smooth capital flows to young firms with growth potential. Among those recommendations, to address the gap in the supply of angel and seed/early stage VC financing in Canada, the authors recommend a national co-investment fund that would invest alongside angels or early stage VCs to leverage their investment and expertise. One approach might be through expansion of existing programs such as the National Research Council of Canada’s Industrial Research Assistance, the Venture Capital Action Plan and the Venture Capital Catalyst Initiative programs.