A previous Graphic Intelligence showed that oil sands production will continue if the expected price doesn’t dip persistently below C$40. Even then, some producers will continue to produce at any expected price above the C$15-C$20 range. How does that compare to other competing production?

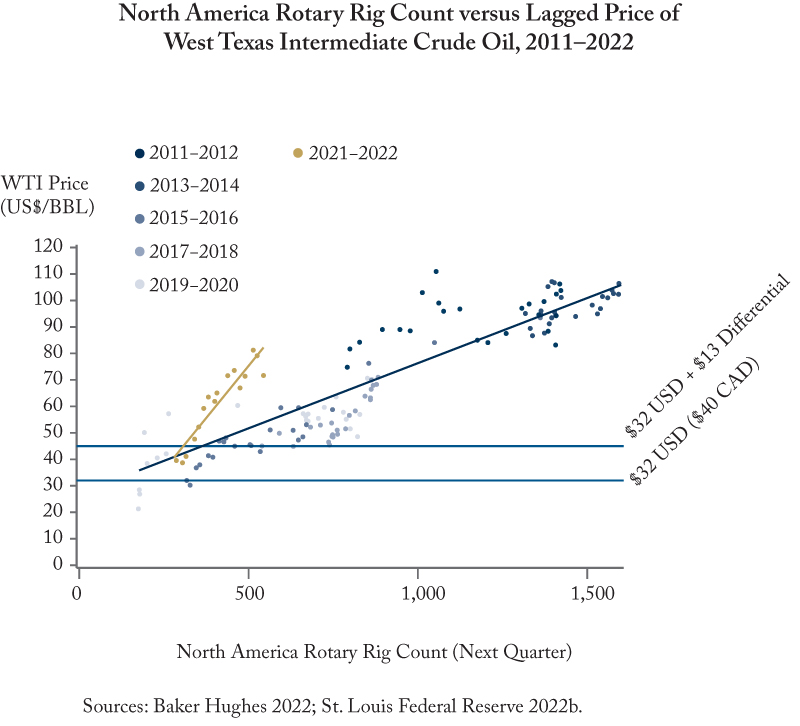

We can gain significant insight into the average costs of conventional production by comparing new investment to prevailing crude oil prices. The North America Rotary Rig Count serves as a useful proxy for new investment. The count indicates the number of rotary drilling rigs that were actively exploring for or developing for oil or natural gas during at least four of the previous seven days. A simple scatter plot of the Rotary Rig Count against the lagged West Texas Intermediate (WTI) price shows a strong positive relationship between the two variables.

There is an important quality difference between WTI crude oil and WCS crude oil. WTI is traded closer to a larger demand market in the US gulf coast and it is easier to refine as it is a light sweet crude oil vs the heavier and more sour WCS. (Sour crude includes higher levels of sulfur, which is an impurity.) Previous research indicates that this quality and location difference accounts for a roughly $13 price differential absent pipeline constraints. Because of this, a C$40 WCS price broadly corresponds to a US$45 WTI price (C$40 ≈US$32. US$32 + a $US13 quality and transportation differential = US$45).

From the scatterplot we can see that as the price drops below US$45 (WTI) (which is analogous to a WCS price in the C$40 range), the rig count drops, indicating a significant depression of new investment in conventional production. Another pattern of note is that the relationship between rig counts and the WTI price has strengthened in recent years (compare the gold line of best fit for 2021-2022 to the blue line of best fit for all prior years).

The conclusion is that Canada’s oil sands will continue to produce oil even after most other North American production is no longer profitable. As global demand for oil, and therefore prices, falls along with emissions, Canada’s oil sands are poised to be the last barrel standing in North America.