Alberta’s 2019 budget, released yesterday, promises a return to a balanced budget by 2022/23 and reductions in spending after having the highest spending per capita of any province in 2017, spending 15 percent above nationwide average without delivering demonstrably superior outcomes. This is a budget that confronts hard choices and follows through on tax reduction to propel economic growth.

In this edition of Graphic Intelligence, we hone in on one of the big-ticket items being eliminated starting 2020 as per the 2019 budget: tax credits.

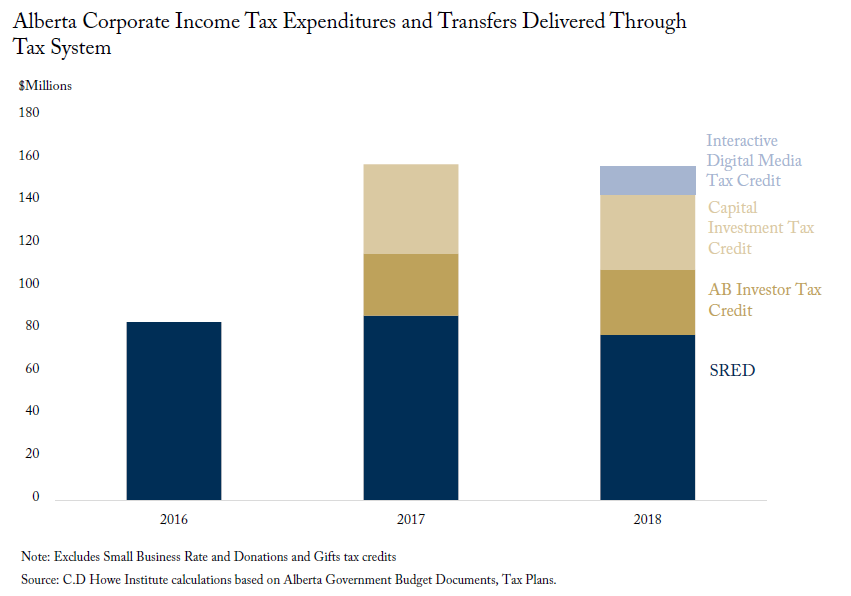

The budget proposed eliminating five business tax credits that had grown significantly in past years. These include the Scientific Research and Experimental Development Tax Credit (SR&ED), the Alberta Investor Tax Credit, the Capital Investment Tax Credit, and the Interactive Digital Media Tax Credit. These were selectively available and targeted to specific industries. A broad-based tax cut that encourages new investment and leverages market forces to identify comparative advantage is a better way to promote diversification without picking winners, as boutique tax credits do.

To learn more about Alberta’s 2019 budget and 2019-2023 fiscal plan, read “Alberta budget 2019 plots a bold path to rebalance provincial finances” and Decision Time: The Alberta Shadow Budget 2019 by Grant Bishop.