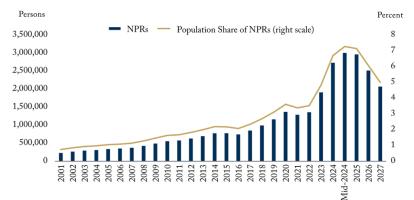

When the year-over-year increase in the CPI rose above the top of the Bank of Canada’s 1-to-3 percent target band a year ago, disrupted supply chains for specific products and base effects received a lot of attention. Since then, it has become clear that rapid price increases are much more widespread, and much less transitory. The Bank of Canada, for the first time in two decades, raised the overnight rate by more than 25 basis points. In its latest Monetary Policy Report, the Bank of Canada showed (Chart 11) that in February 2022 more than two-thirds of items in the CPI registered increases greater than 3 percent.

Unhappily, March’s inflation data reinforce this grim picture. Not only was the CPI up 6.7 percent year-over-year, but almost 70 percent of items in the CPI registered increases greater than 3 percent. If that isn’t alarming enough, this Graphic Intelligence shows that almost half the items registered increases greater than 6 percent.

Price increases in Canada are pervasive, not the result of specific circumstances affecting specific goods and services. High inflation is a faster decline in our money’s purchasing power.

Only the Bank of Canada can tame inflation. The tightening cycle has only begun.