In this edition of Graphic Intelligence, we show how the average amount of taxes paid and benefits received differ by age group.

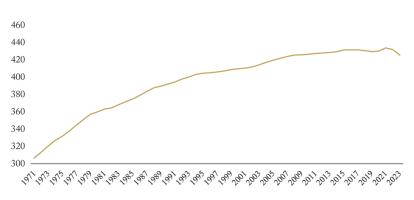

Individuals pay and receive various types of taxes and benefits over the course of their lives. Taxes and contributions (e.g., EI and CPP contributions) are highest for those in the working-age category, particularly among those aged 40 to 44. Taxes trend downward as people get closer to retirement. In contrast, the main beneficiaries of age-specific government benefits are younger and older individuals. While Education spending is solely concentrated on younger age groups, health spending, government benefits, and transfers are skewed towards older people.

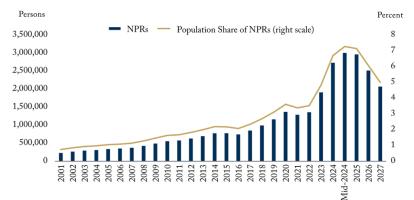

Demographic shifts toward an older population can therefore have a substantial impact on government finances and budgets, and in turn affect their fiscal policies.

To learn more about how demographic shifts and fiscal policies affect the lifetime tax burden on different age groups, read “Intergenerational Fairness: Will Our Kids Live Better than We Do?” by Parisa Mahboubi.

For the French version of this report, see "L’équité intergénérationnelle : Nos enfants auront-ils une meilleure vie que nous?"