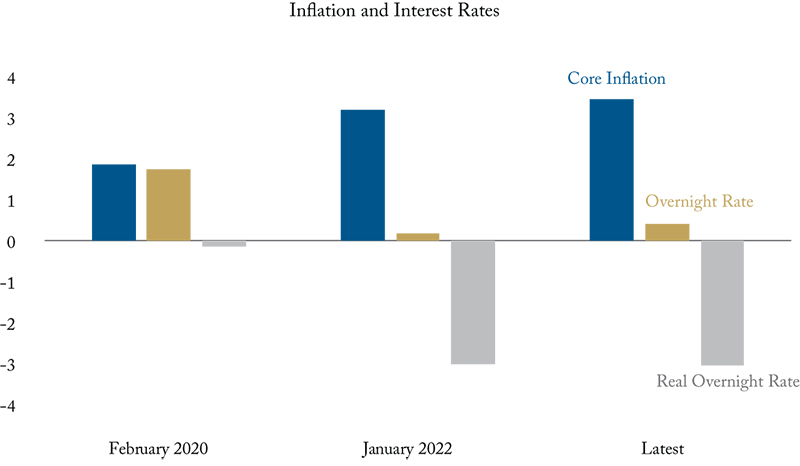

In late February, an Intelligence Memo by Bill Robson warned that expectations of interest-rate hikes by the Bank of Canada might be lagging expectations about inflation. Using the Bank’s three favoured measures of core inflation as proxies for inflation expectations, Robson argued that the Bank’s overnight rate had become strongly negative in real terms. Reining inflation in, he said, would require the Bank to get the rate back close to zero – as it was during the year before the pandemic struck – or even above it. This Graphic Intelligence shows that, even after the Bank raised its target for the overnight rate in March, the latest CPI numbers imply that the real overnight rate has not budged. If the Bank’s core measures are reasonable indicators of inflation expectations, the overnight rate needed to get inflation back to target may be 3.4 percent or more – higher than forecasters and financial markets expect.

Inflation Surprises, Interest Rates Should Not

March 23, 2022