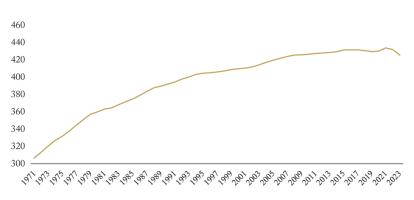

In this edition of Graphic Intelligence, we highlight the slow growth in Canada’s money supply, namely M1+, which is one of the Bank of Canada’s measures of money supply.

Measures of money supply – currency plus various types of deposits – are growing at their slowest rates since the financial crisis a decade ago.

Considered a leading indicator of the state of the economy and inflation in the 1970s and 1980s, the money supply no longer receives much attention from central banks. This change in focus largely reflects the role financial innovations and low interest rates have played in loosening the links between money, spending and inflation. However, recent data suggest perhaps it is time to pay attention to monetary aggregates again.

Growth in M1+ (which measures currency and “transactions” money in chequing accounts) picked up in the couple of years leading into 2017, reaching a high of 11.4 percent in the second quarter of that year. Consumption followed suit leading to robust economic growth. Since the spring of 2017, however, money growth has cratered, with M1+ growing at a mere 4.3 percent by the end of the third quarter of 2018. Not surprisingly, consumption growth has slowed as well.

The question we ask is: does the continued slow growth in money signal further sagging consumption growth, and a weaker outlook for the Canadian economy in 2019?

To learn more about money supply and its link to the economy and inflation, read “Money Growth in Canada is Ominously Weak” by Bill Robson and Jeremy Kronick.