The Alberta government introduced its latest budget the very same day as Russia launched its invasion of Ukraine. Oil prices spiked immediately afterwards, bringing an unplanned fiscal windfall to Alberta taxpayers. Managing this responsibly for the long-term benefit of Albertans will be critical.

If current oil markets forecasts hold the three-year windfall to the province may exceed $25 billion beyond what the government forecast in its 2022 budget. Managing this responsibly for the long-term benefit of Albertans will be critical. Alberta needs a plan for saving these windfall revenues.

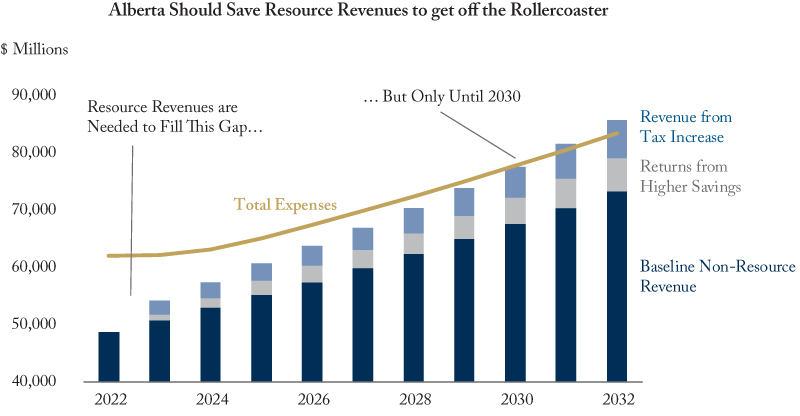

The minimum bar of a savings plan should be Alberta saving every dollar of windfall resource revenues over-and-above what it forecasted in the 2022 budget (rather than paying down relatively low-cost debt). And by spending no more of resource revenues than was originally planned in Budget 2022, and saving the excess, Alberta might be able to not only lower net debt levels but also save half of all resource revenues by roughly 2028. Investment returns on these higher savings add up, and fast. By the mid-2030s we could save 100 percent, assuming expenses grow only at population growth plus inflation.

All without new taxes.

While these three objectives would build a solid foundation, a truly farsighted policy would move us off the rollercoaster even faster.

New tax revenues of $2-3 billion per year would allow for Alberta to achieve zero net debt by 2030 and save 100 percent of resource revenues from that point forward. Alberta would also maintain a roughly $12 billion tax advantage relative to the second-lowest tax province of Ontario.

To learn more, please read "A Plan to Secure Alberta's Fiscal Future" by Trevor Tombe.