The higher a country’s stock of business capital, the better its workers are equipped to produce, earn and compete. Countries with abundant capital relative to their workforces earn higher incomes, and countries that add to their capital stocks faster can anticipate faster growth of living standards.

Unfortunately, recent comparisons to other developed counties in the OECD show Canada in a bad light. The countries with higher capital stocks are widening their edge with more robust investment. Countries with lower capital stocks are falling further behind – with Canada being an outstanding example.

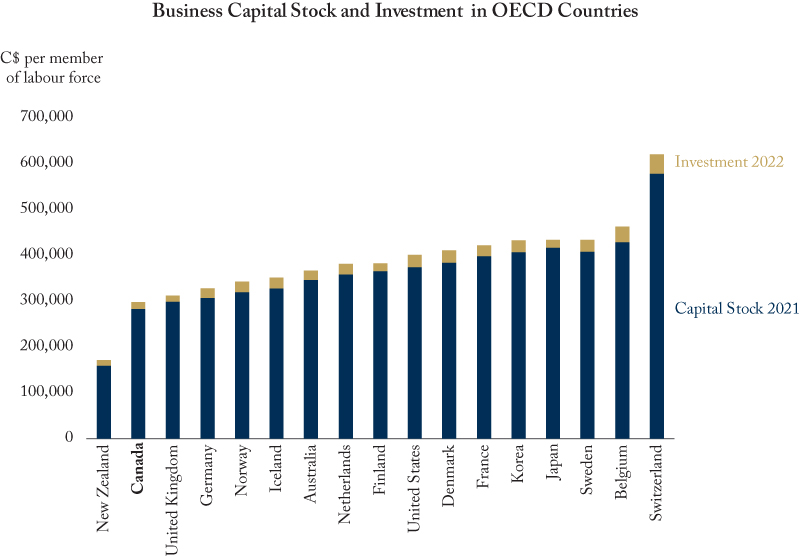

Canada’s capital stock per potential worker in 2021 was second-worst among the countries with comparable data, ahead of only New Zealand. Canadian capital per worker stood around $283,000, only three-quarters of the US level, and only half the level in wealthy Switzerland. The gaps will widen this year. The OECD’s projections for gross investment in 2022 put the tally of new capital per worker at $14,800 in Canada, only about half the US tally, and about one-third the tally in Switzerland.

Canadian firms are either unaware or unconcerned about the opportunities and threats that would prompt them to undertake productivity-enhancing investment projects. Canadian governments should use tax, regulatory and trade policies to enhance the rewards for investment and the penalties for falling behind. Canadian workers need better tools to enhance their productivity, their earnings, and their competitiveness.

To learn more about Canada’s troubling decapitalization and our policy recommendations, please read “Decapitalization: Weak Business Investment Threatens Canadian Prosperity” by William B.P Robson and Mawakina Bafale.