Should Canadians worry about the level of government debt when interest rates are so low? Yes. But the primary danger doesn’t come so much from Canada. Instead, it comes from the fiscal behavior of the US government.

Government debt levels have risen to historically high levels in all major industrialized countries, including Canada and the US. Meanwhile, interest rates and long-term bond yields have been steadily declining to historically low levels.

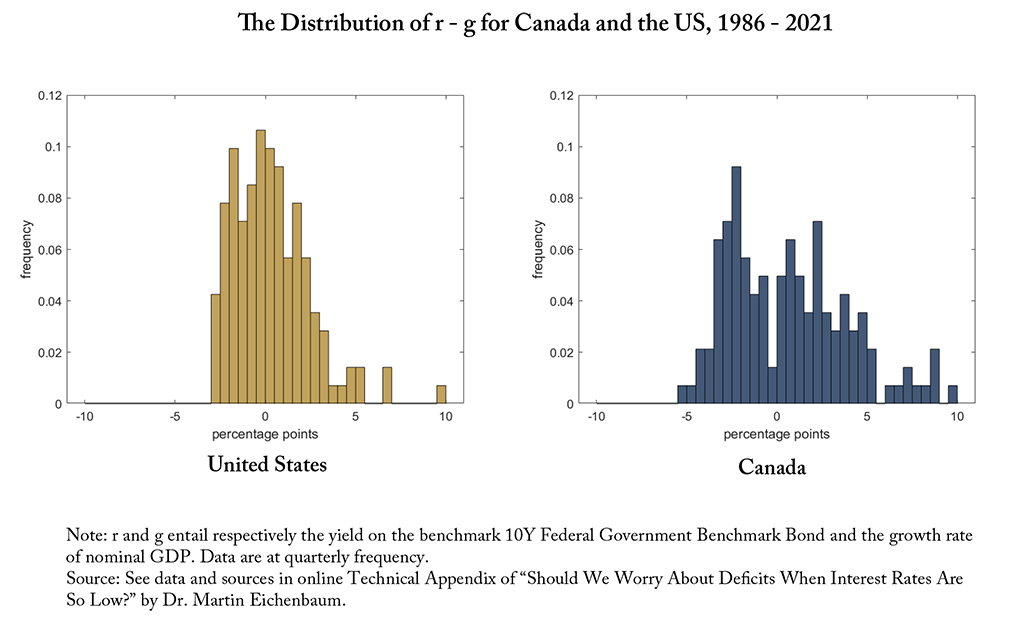

A critical determinant of debt sustainability is the interest rate on government debt r, minus the GDP growth rate, g. In broad strokes, government debt is easier to manage when GDP growth is larger than the interest rate, i.e., when r - g is negative. Canada and the US are highly correlated with respect to r - g, and both have enjoyed negative average values of r - g since 2000.

It is entirely possible that r - g will remain low and that the Canadian and US governments will run reasonably balanced budgets in the future. But we cannot take either of these conditions for granted. First, if r - g was equal to its average value over the period 2000-2019, Canada could run modest budget deficits and keep the ratio of its debt-to-GDP stable. In sharp contrast, US deficits would have to be substantially smaller than their pre-COVID levels to prevent a fiscal crisis. It would be irresponsible for Canadians to assume that US policymakers will behave responsibly in the future. Second, we cannot count on r - g remaining at its low average value. A wide range of outcomes have occurred in our recent past and cannot be ruled out in the future.

Based on these considerations, we cannot dismiss the possibility that markets might, at some point, conclude that the US is on an unsustainable fiscal path. In the wake of such a crisis, the growth rate of Canadian GDP would surely fall and the interest on Canadian debt would rise. The resulting rise in r - g would have dire consequences on Canada’s debt to GDP ratio. For better or worse, our fiscal fate is linked to developments in the US.

So, yes, Canadians should worry about the deficit, and our policymakers should plan for a rainy day. A good plan involves reverting to Canada’s virtuous pre-COVID fiscal policy. It also involves locking in current low long-term interest rates. That, in turn, requires a speedier end to quantitative easing.

To learn more, please read “Should We Worry About Deficits When Interest Rates Are So Low?” by Dr. Martin Eichenbaum.