The Study in Brief

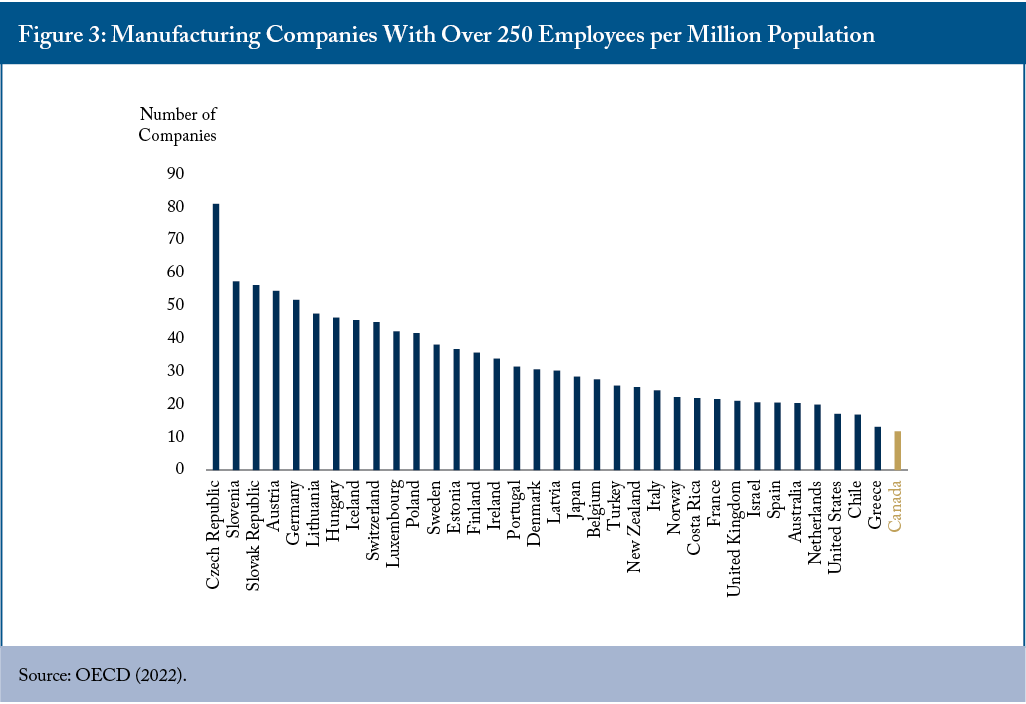

- Solving Canada's perennial productivity problem will partially be addressed by creating companies that scale from start-up to world-class status. Canada has been challenged at scaling companies and, in fact, has the lowest number of manufacturing companies with over 250 employees per one million in population in the 35 countries with employment data available from the OECD (OECD 2022). While some of this might reflect our comparative advantage traditionally being in resource extraction, this last place is puzzling given the economy’s good access to large sophisticated markets and its natural and human assets.

- To investigate further, this paper asks: How are Canada’s scaling companies performing in terms of size achieved, capital raised, and growth rates? We define scaling companies as those acquiring external equity capital or capital that is convertible into equity in order to grow. Comparing similar companies, how do our scaling companies perform in comparison to US scaling companies? In order to scale effectively, companies need access to markets, capital, and personnel. Do we have enough of these resources to foster strong growth? Can we learn anything by an examination of our record at scaling and can we identify issues that governments should be addressing to improve our capabilities?

- This paper performs a detailed analysis across these dimensions. We find that the Canadian government focuses too much on programs related to research and innovation, and not enough on the lack of resources, experience, and talent for commercialization. This underweighting is keeping our firms smaller and growing slower. Essentially, the issue is a lack of managerial know-how. Existing and new programs could shift their alignment towards the marketing and sales development needed to grow young companies in Canada.

The author thanks Jeremy Kronick, Charles DeLand, Daniel Schwanen, John Armstrong, Miwako Nitani and anonymous reviewers for helpful comments on an earlier draft. The author retains responsibility for any errors and the views expressed.

Productivity – or the Lack Thereof

Our national “productivity gap” has spurred analyses, reports, and media articles for decades. More than 40 years ago, on January 24, 1979, the Globe and Mail reported on statistics from the now-defunct Economic Council of Canada. The statement made on Canada’s productivity performance rings true even today:

Canada’s productivity performance leaves much to be desired. This country’s average annual rate of productivity increase – as expressed by the growth rate of output per hour in manufacturing – is among the lowest of all industrialized nations. (The Globe and Mail, 1979.)

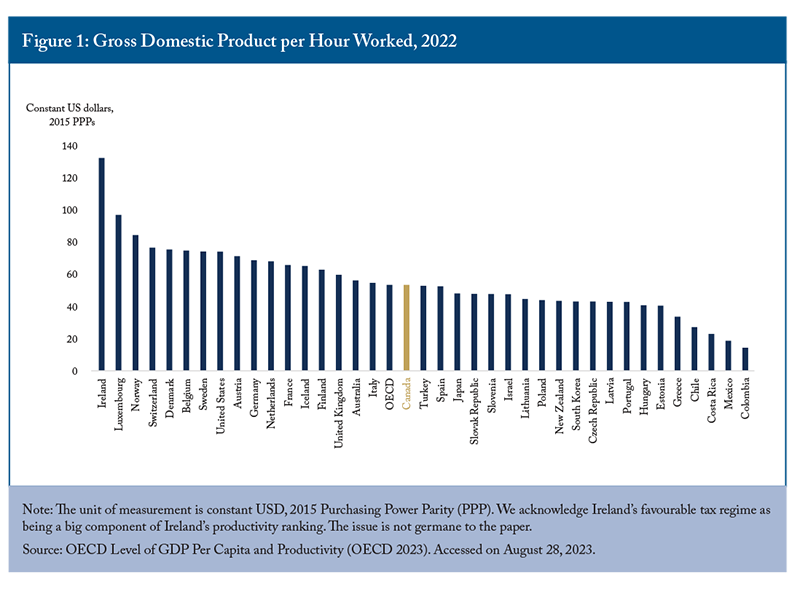

While public discourse has focused on productivity improvement for over 50 years, we have made limited progress. According to the Organisation for Economic Co-operation and Development (OECD), Canada sits 18th out of 38 countries in terms of GDP per hour worked (Figure 1).

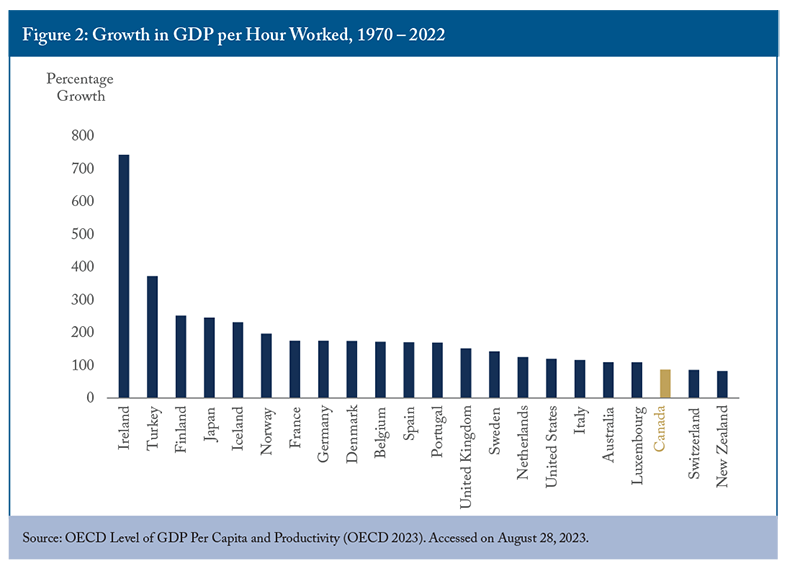

Perhaps more problematic is our productivity growth since 1970. Ranked against 22 OECD countries for which data are available since 1970, we rank 20th in growth (Figure 2). Canada also sits last in the G7 in terms of growth since 1970.

Relative to low-productivity jurisdictions, a highly productive economy produces more goods or services with fewer resources. For businesses, increasing productivity increases profits. For workers, it can result in higher wages. For governments, it translates into higher tax revenue.

Innovation is one of the principal sources of productivity growth (Therrien and Hanel 2009). This connection between innovation and productivity has driven much of Canadian government policymaking over the last 50 years.

Innovation is also connected to firm size. “Empirical evidence seems to suggest that various efficiency-enhancing activities such as the use of information and communication technology (ICT), labour training, the level of research and development (R&D), and the introduction of innovation are positively related to size” (Leung, Meh, and Terajima 2008).

What we have then is a link between innovation and productivity and a link between firm size and productivity. In other words, we have three linked factors: innovation, firm size and productivity. We must ask the question, which comes first? Federal government policy has focused on innovation leading to productivity. However, what if the equation is slightly different; that firm size leads to innovation which leads to productivity?

If there is a valid link between firm size and productivity, Canada has an underlying structural problem that is getting in the way of continued productivity improvement. Canada has proportionately fewer large firms than other countries.

This Commentary will look at how larger firms are created in Canada to foster a discussion about the role of innovation and other factors in productivity improvement. It will examine how we compare against the US, what is holding us back, and what the government is and can be doing to improve our record at scaling companies.

Canada’s Progress at Scaling Companies

In this section, we look at Canada’s progress in turning small companies into large companies, as well as our record of further growing those large companies once they reach this level. We then compare this progress to that of our largest trading partner, the US.

While previously reported OECD stats on growth in companies with over 250 employees showed only manufacturing firms, LinkedIn provides access to data for firms of all types. As a point of caution, LinkedIn data are self-reported by employees, not firms, and may not accurately represent all industries. These data are used here as a proxy for company growth rates and to enable a comparison of companies on a consistent basis. LinkedIn is the only source of data readily available that shows employment at a firm over the last two years, and because of this, is an invaluable tool for research into firm growth.

While Statistics Canada shows that Canada has 1.3 million companies with at least one employee (Statistics Canada, 2022), LinkedIn has records that we can access for 950,000 firms, of which about 4,400 have more than 200 employees.

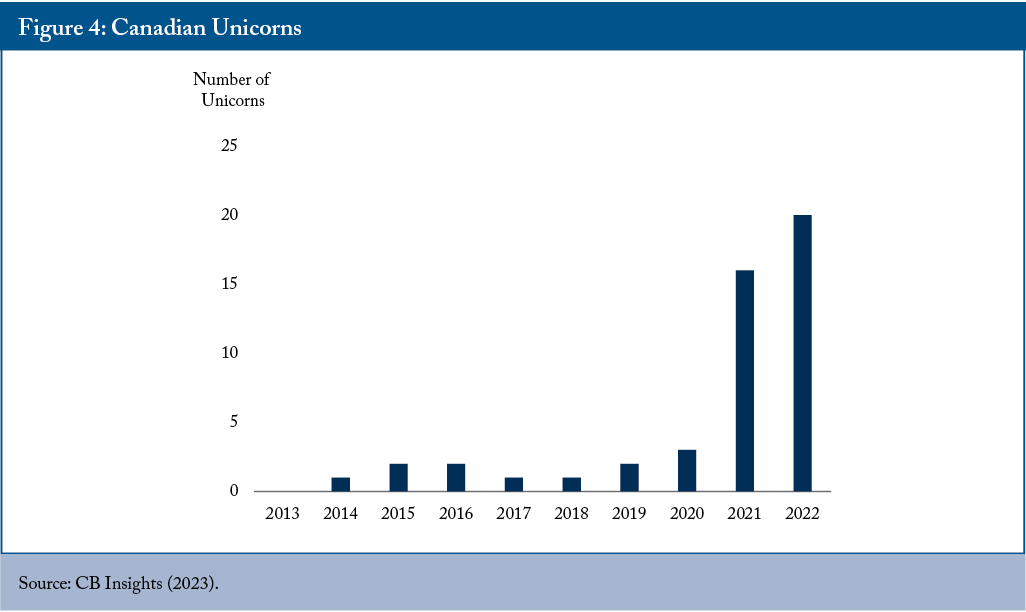

One indicator of success in growing companies is in looking at Unicorns, those private companies with venture capitalist assigned valuations over $1 billion (Figure 4).

Until 2020, Canada ranked last in the world in producing Unicorns when measured by number of Unicorns relative to the amount of venture capital invested (Plant 2019). Significant recent success in Unicorn creation shows that we are making some progress at growing small firms into larger ones. But, as we saw above with respect to Canada’s last place ranking in number of large manufacturing companies (Figure 3), we need to dig deeper.

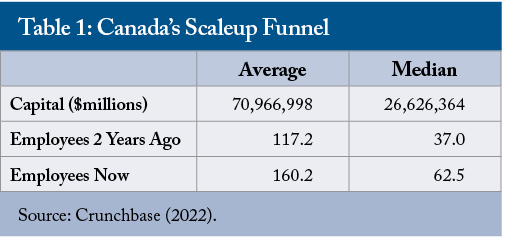

To evaluate how Canada is doing, we created a Scaleup Funnel. This funnel tracks the progress of all active private firms in Canada with capital greater than $10 million (Crunchbase 2022). The $10 million cut-off was established to represent the approximate level where companies start scaling. Keeping a funnel such as this enables analysts to measure results over time and spot issues worthy of investigation. Data for this funnel were obtained from Crunchbase, a San Francisco-based provider of business information, and include 887 companies. Complete data were available for 754 of these (see summary of the data in Table 1).

Two years ago (in 2020), 71 of these companies had over 250 employees. As of the end of 2022, total employment among this group increased by over 30,000 to 120,000 employees. Of the group, 36 companies added enough employment between 2020 and 2022 to surpass the 250-employee cut-off that defines a large firm to the OECD. In total then, 107 companies on the list had over 250 employees.

But, how do our results compare with our largest trading partner, the United States? We focus on comparing Canada to the US because companies from both countries rely first on North American markets.

Canada Compared to the United States

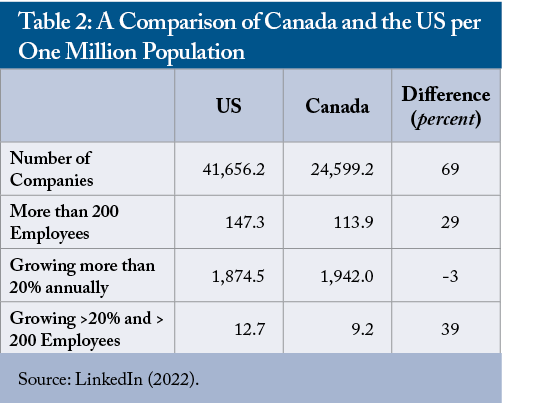

A look at figures extracted from LinkedIn shows how well Canada is doing compared to the US at scaling companies (Table 2).

Per capita, the US has 69 percent more companies and 29 percent more companies with more than 200 employees. It has 3 percent fewer companies overall that are growing at greater than 20 percent but 39 percent more companies of greater than 200 employees that are growing at greater than 20 percent.

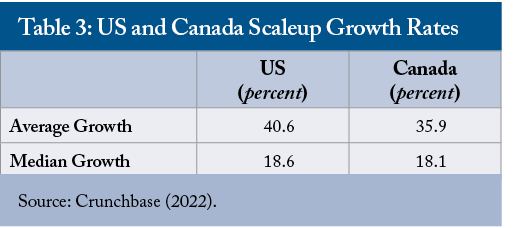

Turning again to the Scaleup Funnel, we compare companies in the Canadian funnel with over 15,000 US companies that had also raised more than $10 million in funding. A sample of 1,000 US companies was picked for comparison. The average growth rate in the study of US firms in the last two years was 40.6 percent, while Canada’s was 35.9 percent (Table 3).

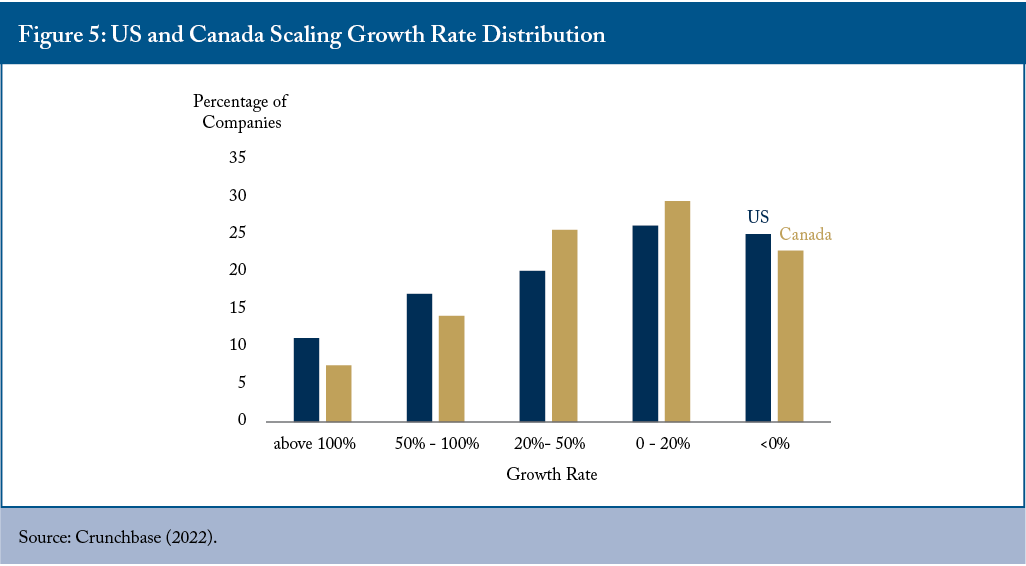

Canada has fewer companies growing at greater than 20 percent but also fewer with negative growth rates. This fact supports the “go big or go home” US attitude toward growth. Canada, by comparison, is a country with middling performers (Figure 5).

A direct comparison of this type may distort the true picture since the distribution of companies in the US and Canada is different, with a more significant number of Canadian oil and gas firms, for instance. A better comparison would be, for example, to contrast the 190 software companies in the Canadian sample with the 212 in the US sample. The average yearly growth among US software firms in the study is 39.7 percent, and for Canadians, it is 35.2 percent, a differential that becomes a bigger concern when compounded over 10 years. The difference is starker in biotech, with the 105 US biotech firms growing at an average rate of 43.1 percent versus Canadian biotech firms, which grew at 21.4 percent in 2022.

Finally, regarding employee numbers, the average US firm in the study was founded in 2011 and had 174 employees, whereas the average Canadian firm was founded in 2009 and had 160 employees. Thus, US firms are adding 15.8 employees a year on average and Canadian firms are adding 12.3 employees a year. In addition, in the software sector US firms are adding 22.3 employees a year while Canadian firms are adding 13.6 a year.

What are we left with? Compared to the US, Canada has fewer large companies, and even once they get to the stage where they are large, they grow more slowly. In other words, Canadian firms are not scaling as well as American firms. In the next section, we examine the reasons why.

Factors Necessary to Drive Scale

In this section, we investigate a series of factors necessary to achieve scale, with a focus on Canada, and how we fare relative to our neighbours to the south. To scale, a company needs:

- access to markets;

- access to capital;

- access to personnel; and

- the right balance between support and spending on research and development and sales and marketing.

We examine each of these issues in the following sub-sections.

A critical component in creating large companies is access to a large market: larger markets result in larger-sized companies (Campbell and Hopenhayn 2005) (Kumar, Rajan, and Zingales July 1999). This may be stating the obvious. However, it is particularly problematic for Canada in that we have a relatively small population across a diverse and extensive landscape. The first challenge faced by firms in Canada may be the fact that we have a much smaller market than those that can be accessed by firms started in many other countries, including those that are part of economic unions such as the EU.

Our small population would not be a problem if Canadian firms started with an “export first” mentality. However, anecdotally, it has been reported by advisors within the Canadian startup ecosystem in conversation with the author that Canadian firms prefer to gain initial traction in Canada before tackling export markets. Whether there is some merit to this approach or not, given the smaller markets in Canada, this initially results in slower growth of companies. There are challenges for a firm to start with an export first mentality though, as a lack of market knowledge, connections, regulations, and costs make starting locally first easier.

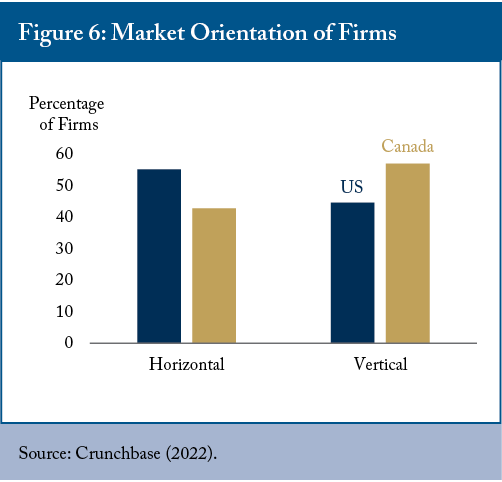

Another challenge to scaling is that Canadian firms tend to start vertical market companies instead of horizontal market ones (as we see in Figure 6). Vertical market companies such as Textura, a payment software company that serves the construction industry only, focus on a specific good or services and serve a small niche in a market. Horizontal market companies, such as Microsoft, serve all businesses or all consumers. Typically, horizontal markets are larger than vertical markets. A review of all software IPOs in the last ten years from a database maintained by the author, shows the differences in market sizes. Horizontal markets serving businesses have an average total addressable market (TAM) of $90 billion, versus $43 billion for vertical markets.

While the data examined in this Commentary have been, to this point, for all sectors, it is helpful to drill down to a single sector within which firms are comparable across borders. Software is the largest sector for which this can be done in Canada and the US. Other large homogeneous sectors include biotechnology, where Canadian firms do not have nearly comparable growth rates, and the energy sector, much of which is involved in commodity sales.

Using the Scaleup Funnel, we can classify software firms as serving horizontal versus vertical markets (Figure 6). Canadian firms favour vertical markets over horizontal markets, while the reverse is true in the US. As a result, the average Canadian firm would be entering a smaller market than the average US firm.

Not only is the growth of Canadian companies delayed when they start selling in Canada first before exporting, but they predominantly enter smaller vertical markets, thus limiting their growth and long-term potential. This choice to enter vertical markets over horizontal ones is generally perceived as a way to lower the risk inherent in starting a firm.

Capital is an essential ingredient in creating company growth. Indeed, in the early days, when many companies are losing money and lack the hard assets required for collateral, it is critical. Many Canadian firms have successfully bootstrapped (with the owner using personal funds), but these firms are the exception to the rule. If Canadian firms receive less capital than US firms, this may contribute to our large company deficit. A review of the Scaleup Funnel shows that the average Canadian firm receives 24 percent less funding than the average American firm, with the problem most acute in biotechnology where the average Canadian firm receives 59 percent less than the average US one. In this subsection, we dig deeper.

We focus on firms created over the last decade, looking at 2,100 US firms founded in 2013 and 870 Canadian firms from 2011–2014. The wider time span for the Canadian selection was required to be able to have enough data for valid comparison. There are risks in using different time spans for comparison, but it was felt that this period was relatively stable so that a valid comparison could be made. On average there would be 217 Canadian firms in each year studied. This compares on a population adjusted basis to the 2,100 US firms. The average US firm reported receiving $70 million of capital, while the average Canadian firm received $43 million. The difference between the two figures largely stems from firms that had received more than $100 million in capital, with 11 percent of US firms financed at this level versus 7 percent of Canadian ones (Crunchbase 2022).

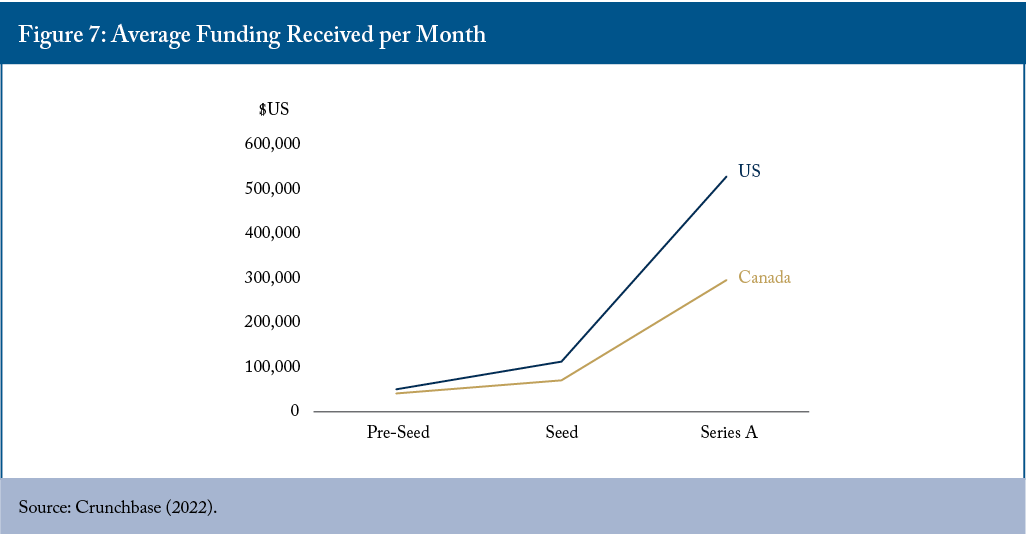

One factor that may be limiting growth is the timing of funding. Firms that wait longer to raise a first round or wait longer between rounds, may experience reduced growth. To examine this potential effect, this Commentary looked at all Pre-Seed, Seed, and Series A rounds done by Canadian firms since January 1, 2021, and to balance the sample size, all US deals done from July 1, 2021, to June 30, 2022. Pre-Seed rounds might include angel and some venture capital investors and typically be under $1 million in size. Seed rounds would average around $3 million and involve smaller venture capitalists. Series A rounds are typically above $5 million and might involve larger venture capitalists. The data show that US firms receive pre-seed funding on average 651 days after founding, whereas Canadian firms receive it in 808 days, a 24 percent delay. As a result, by the time they reach a Series A round, Canadian firms are ten months behind their US counterparts.

The problem is compounded when one calculates the average funding per month of development. By the time the US firm reaches a Series A round, it has received $528,000 of funding per month of existence, while the Canadian firm has received only $295,000, a little over half (56 percent) of that amount.

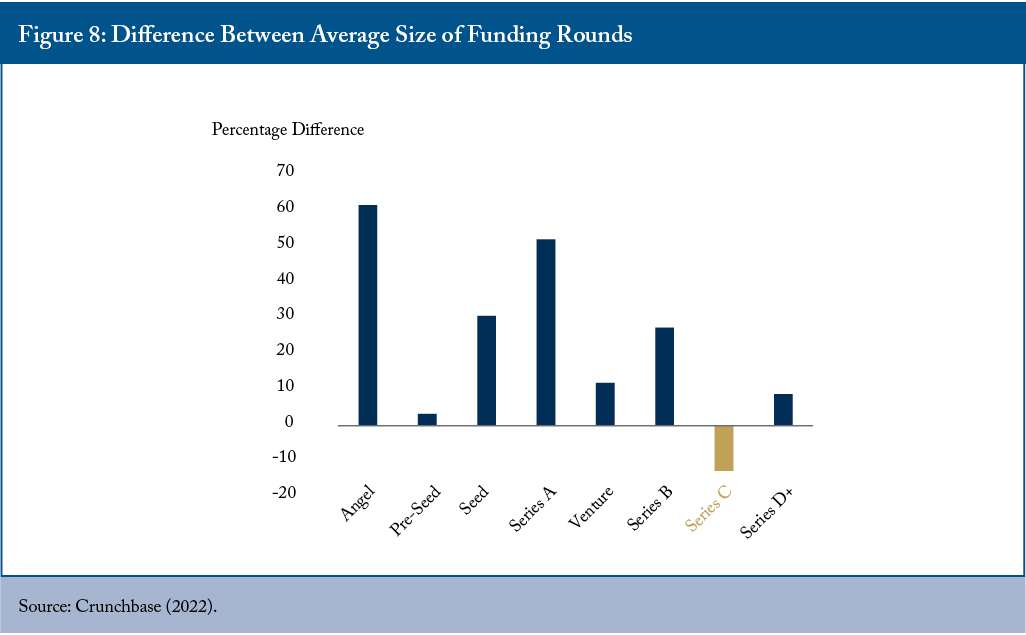

Also important is average funding per round to determine whether certain funding rounds are causing Canadian firms to receive less funding than their US counterparts. This factor was examined by comparing the over 21,000 US firms that have received funding since January 1, 2021, to those 1,490 in Canada in the same time-frame. US firms receive more on average in every round except Series C in this time-frame. (Figure 8)

Canadian firms wait until later to raise capital, raise smaller rounds, and raise less than US firms. However, is this due to a lack of access to capital or some other factor?

Canadian firms wait until later to raise capital, raise smaller rounds, and raise less than US firms. However, is this due to a lack of access to capital or some other factor?

Numerous commentators have claimed that lack of local access to capital is one of the main reasons that Canadian firms have scaling challenges. Canada’s Advisory Council on Economic Growth identified Canada’s limited access to value-added capital as an impediment to growth (ACEG 2017). The federal government’s Venture Capital Catalyst Initiative is just one of the many ways governments have sought to address this challenge (ISED 2022). Canada’s Economic Strategy Tables frequently mentioned limited access to capital as one of the impediments to growth (CEST 2018). If there is a problem, it could be due to relatively fewer investors or smaller investments.

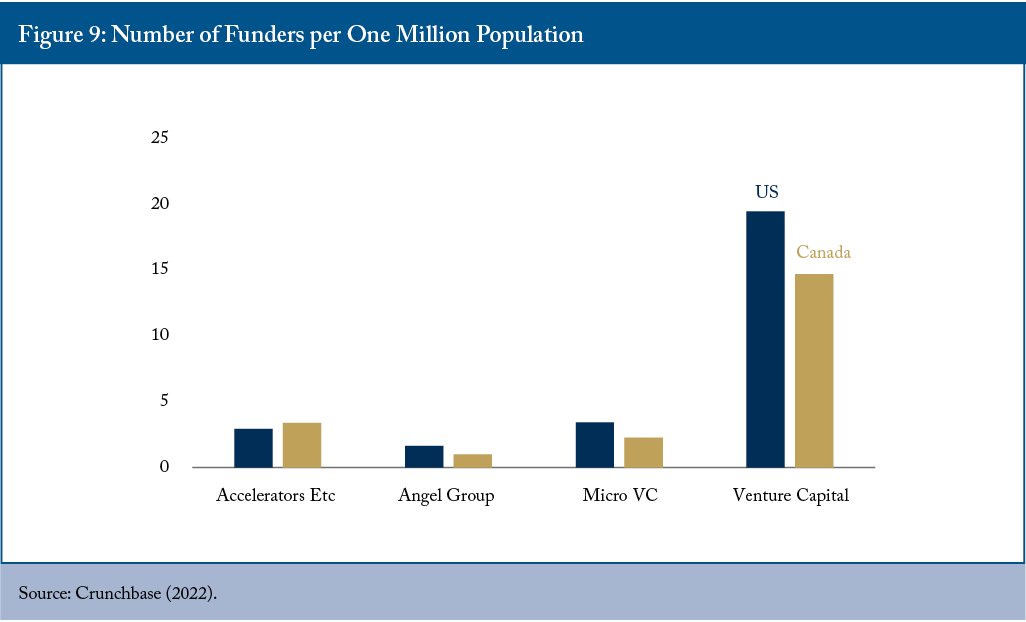

To compare the number of investors in Canada to that of the US, this Commentary examined the number of funders per one million population in the two countries.

Except for the funding group that includes accelerators, incubators, government programs, and university programs, the US has more funders per one million population than Canada (Figure 9).

While this Figure looked at formal investor groups, the same analysis can be done for individual angels. The US has 53.9 angel investors per one million population, 133 percent more than Canada’s 23.1 (Crunchbase 2022).

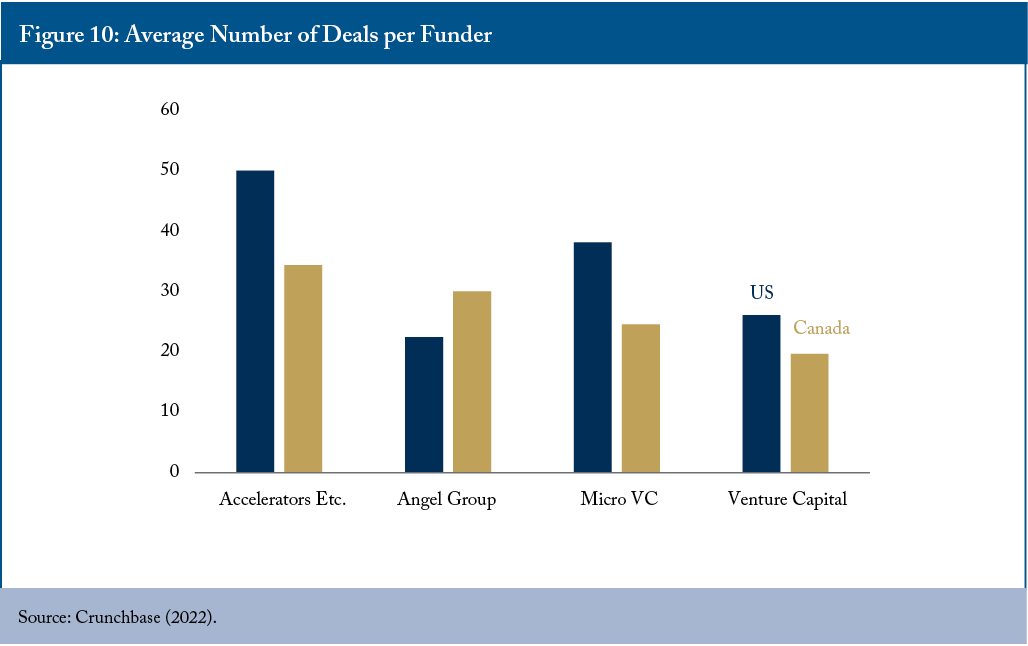

Another factor that could influence Canadian funding challenges is the number of deals done per funder. Except for angel groups, funders in the US do more deals on average than Canadians (Figure 10).

Governments have a significant influence in venture capital investing in Canada. The top 25 Canadian-based investors by the number of investments made include nine government-controlled or exclusively government-funded venture capital investors (Crunchbase 2022). They are responsible for 47 percent of the 4,678 deals done by this group. While data on the 16 private VC funds are difficult to obtain, from Crunchbase it appears that the leading firms are Georgian with $2.5 billion, Innovia with $2.1 billion, and OMERS Ventures with $1.9 billion. By way of comparison, the top 10 US-based investors all have more than $7 billion of capital (Crunchbase 2022).

What we end up with is a relatively lower number of VC investors in Canada, fewer deals per investor, and limited funds from Canadian VCs. Yes, some of this might be attributed to the quality of the businesses themselves, but more likely is indicative of limited access to Canadian-based capital for our companies looking to scale. However, do they have access to capital outside of Canada instead?

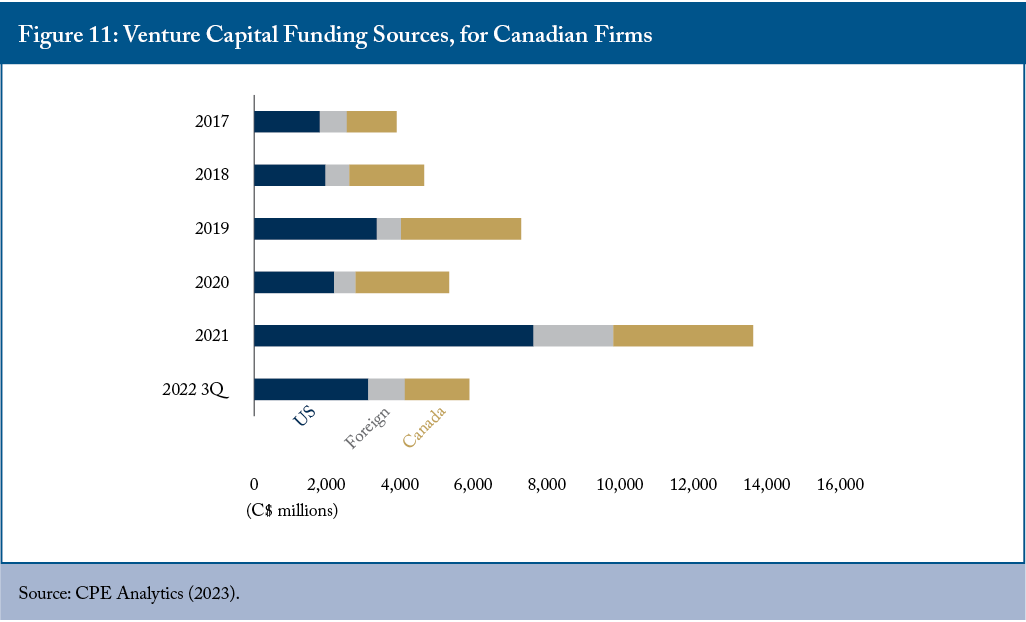

For the last six years, there has not been a year in which Canadian-based VCs have provided more than 50 percent of the funding to Canadian companies. Canadian funding grew as a percentage of total investment dollars from 2017 to 2020. However, it fell to 28 percent in 2021 as total funding – in particular from the US – increased dramatically due to frothy markets, and stayed low in percentage terms in 2022 (Figure 11).

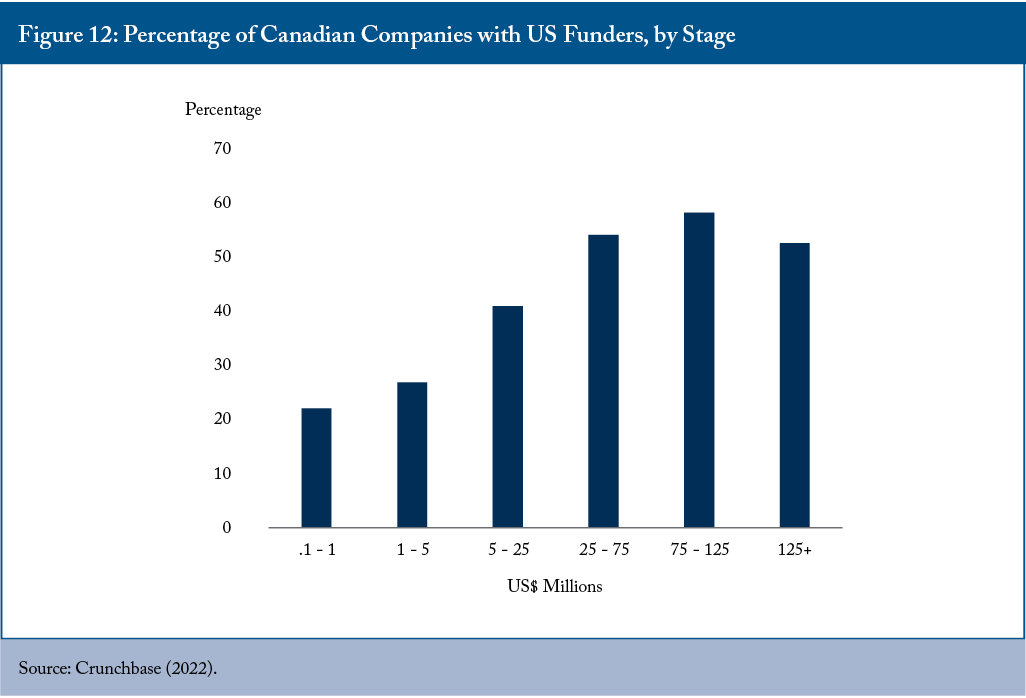

We can also examine the stages at which foreign investors are active. We look at the number of US investors who had invested in Canadian companies that had received over $100,000 of capital.

We see that US investors are active at all stages of investing. While only 22 percent of companies that raise less than $1 million have US-based investors, by the time they reach a series B round, more than 50 percent of the companies have US-based investors.

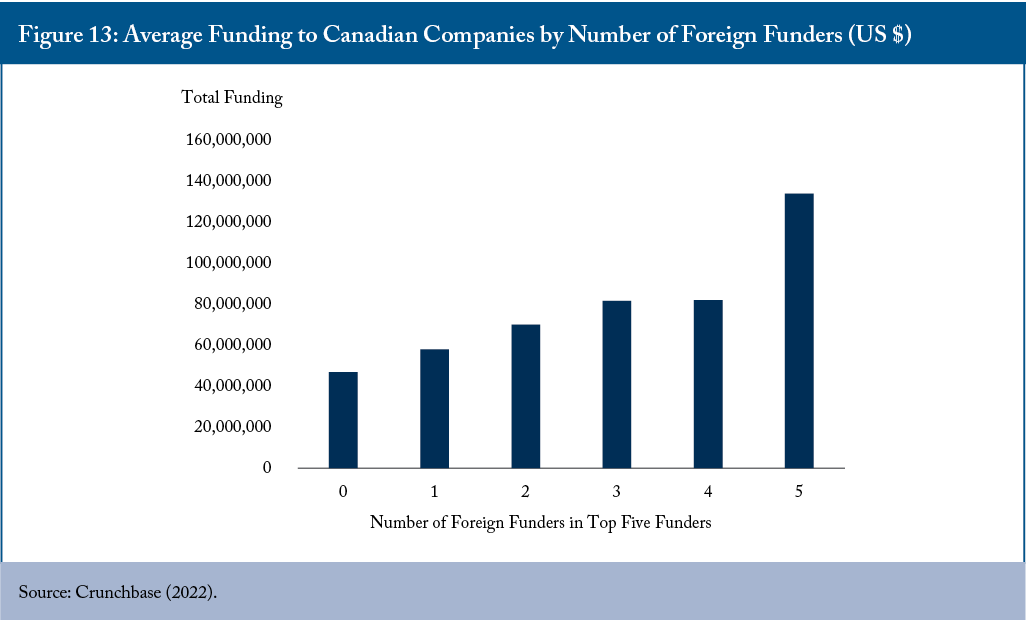

We then calculate how many foreign-based funders were in the top five investors in each of the 886 companies in Canada’s Scaleup Funnel to determine the effect foreign-based investors have on Canadian firms. The data show that those companies with five foreign funders have 2.85 times the amount of capital available than those with no foreign funders.

This data could be seen as distorting the effect of foreign funding in a “which came first, the chicken or the egg?” sort of way, were it not for the fact that data show that US investors are active in every stage of company growth, even in the earlier stages. Because foreign funders have more capital, they invest more per round. As a result, Canadian firms that have more foreign investors get more funding per round, so the more foreign investors backing the business, the more total dollars they will get.

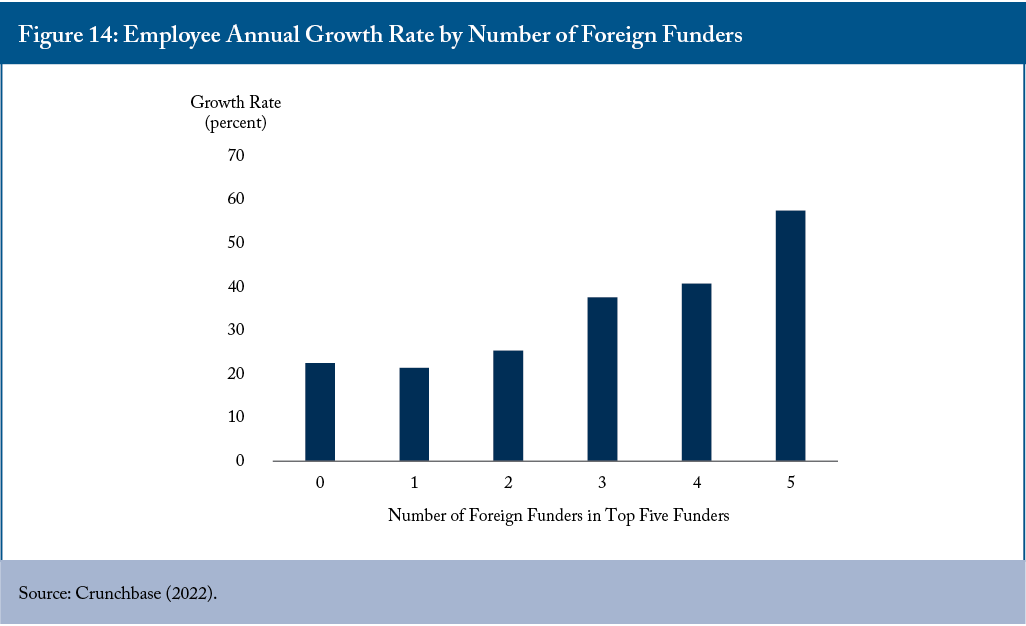

There is also a similar pattern as to who invested and how fast companies grow. The more foreign investors a firm has, the faster it grows. Companies with five foreign investors grow at an average of 57 percent per year, and those with no foreign investors grow at 22 percent (Figure 14).

What are the implications of these findings? While there is a lack of access to Canadian capital for Canadian firms, there doesn’t seem to be a problem accessing foreign capital. Crunchbase shows that of the 8,836 US-based VCs, 1,323, or 15 percent, have investments in Canada, so it is critical for firms to meet foreign investment hurdles.

What is problematic, though, is that Canada has an underperforming VC community. Either Canadian VCs do not have the same access to the top-ranked Canadian deals as US investors scoop them up, or firms with investments by Canadian VCs are not performing as well as firms with foreign investors.

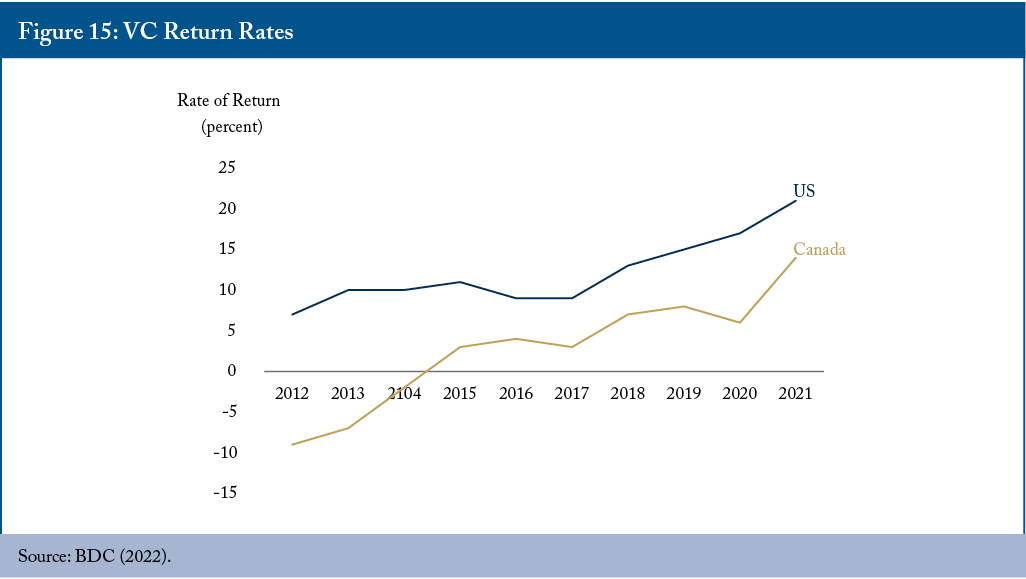

The net result is that Canadian VCs are dramatically underperforming US VC firms (Figure 15). While Canadian returns improved in 2021, prior to that they ranged from 3 percent to 7 percent for the six years prior, well below that of the US. The improvement in 2021 is likely a result of the frothy funding market in 2021 and return rates will likely decline in 2022 and subsequent years.

Given the data on return rates by Canadian VCs and the availability of foreign capital, one must ask whether it is worthwhile for governments in Canada to be supporting this industry, given its association with sub-optimal growth rates. Furthermore, government investments appear to be creating slower-scaling firms, which is not contributing to the creation of the large companies Canada needs.

Capital is about the money necessary to take an idea and turn it into a product that is scalable and can be commercialized. But the capital is of little use if the talent isn’t there to manufacture the good, provide the service, manage the funds, run the marketing and sales team, etc.

The Advisory Council on Economic Growth identified that Canadian firms need help finding the talent they need to scale, and this gap is most acute among technology firms. Among their recommendations to deal with this is the suggestion that Canada should use the immigration system to facilitate entry for individuals with this kind of talent/skillsets (AECG 2016). The five Economic Strategy tables identified where the shortage of skilled talent exists, which was most notable in executive ranks (CEST 2018). However, none looked deeper to see exactly what skills are in the shortest supply.

To determine where the skills shortage is the greatest, we look at the employment location for all personnel at Canada’s leading 50 software companies. The software sector was chosen since it is the largest of Canada’s scaling sectors, and it represents one where international sales are essential for success.

The 50 companies studied have total employment of over 16,000. In total, 68 percent of their employees are located in Canada. Over 2,000 of these employees are at a senior management level, according to LinkedIn data and 64 percent of them are located in Canada. Of the non-management employees then, 69 percent are located in Canada. Getting senior personnel in Canada is challenging but not much more challenging than getting more junior personnel.

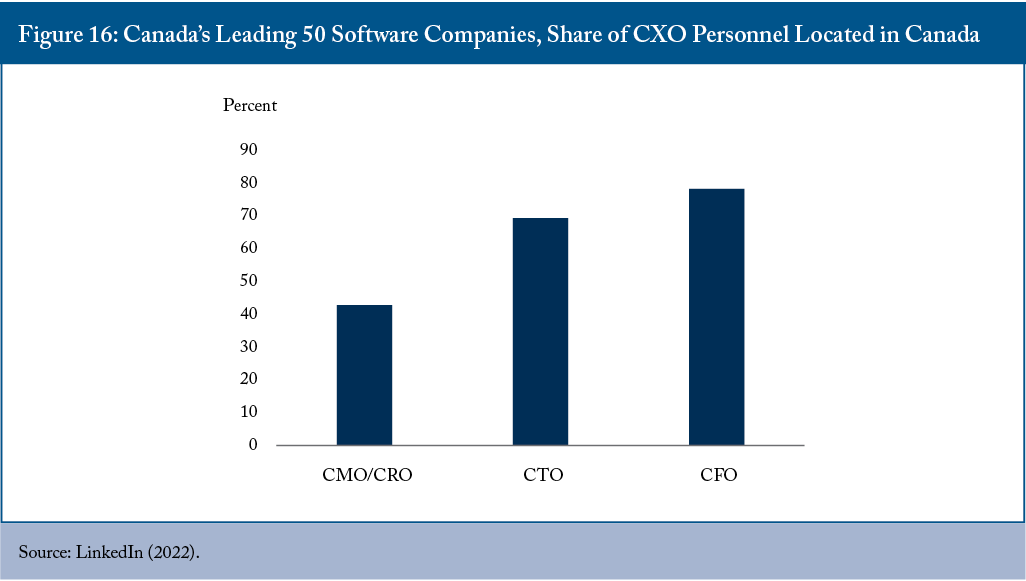

We can break management skills down further into three key roles to determine the shortage of Canadian based roles for the chief marketing officer (CMO) or the chief revenue officer (CRO), the chief technology officers (CTO), and the chief financial officer (CFO) (Figure 16).

Finding CFOs in Canada is easier than the other critical roles, as 78 percent are sourced from within Canada. CTOs do well too with 69 percent of them located in Canada. Compared to CFOs, CTO roles are more difficult to fill as they are more specialized. However, Canada has grown this skillset internally through the many programs focusing on STEM education. In addition, Canada has further improved access to junior technical talent through immigration. We have been helped by the fact that the US has made it challenging to obtain a work visa.

For CMO/CRO roles, however, only 43 percent of these executives are located in Canada. In marketing and sales (M&S), Canada has a permanent structural problem at all levels.

- The country has a weak history of selling goods internationally (Bank of Canada 2017), so it does not have a cadre of experienced personnel that it can repurpose, even if this were possible.

- Immigration from the US will not work to make up the difference with other senior roles as the pay and taxation differences are so significant that it will be difficult to attract an M&S leader from the US to move to Canada (BDC 2020).

- Foreign companies do not employ Canadians to sell internationally. If they employ Canadians in M&S roles, it is to market to Canadians exclusively. After all, what would be the use of moving from the US to Canada only to spend most of one’s time in the US, where most clients reside?

What we are left with is a country that potentially has a limited local supply of marketing and sales executives from which to draw.

What about the Brain Drain? Despite the fact that much is made about the tech brain drain to the US, our research suggests this phenomenon is overblown. Overall, we found that 43,575 of the Canadian tech graduates who chose to be on LinkedIn reported working in the US. US-based Canadian tech grads represent less than 10 percent of the over 440,000 grads whose data were included. The trend has declined from 13.7 percent in the 1990s to less than 10 percent today (Plant, Debunking Canada’s Brain Drain Myth, 2021).

In Canada, we have a habit of only talking about STEM jobs. However, this conversation misses that there are more jobs in tech companies for non-tech people than for tech employees, and this is where there is a problem. There are 59 percent more graduates from Canadian universities in the US who are working in roles to commercialize technology than there are in roles to create technology. If there is a brain drain, it is a loss of M&S talent rather than R&D talent.

To conclude this section, we find the shortage of skilled employees is most acute in areas like M&S. International recruiting is more of a problem for earlier-stage firms as US employees, in particular, tend to be more expensive, and younger firms have less capital available. As a result, the growth of very early stage firms is constrained by the difficulty accessing experienced M&S personnel.

Spending on Research and Development

Government policy has focused on the link between research and development (R&D) and productivity, the idea being that the innovation that comes from the former makes it cheaper to produce goods and services, leading to a boost in the latter.

In looking at R&D and the relationship between it and growth, it is essential to separate the effect that R&D has on GDP and what it has on firm growth. Academic research has shown a positive association between industry R&D and economic growth among G7 countries but not among a larger set of 20 OECD countries (Sylwester 2001). Other research has found that the nature of the relationship between R&D and economic growth differs from country to country (Pessoa, 2010).

Academic research is mixed on whether there is a link between R&D expenditures and growth at the firm level. Mario Kafouros in The Journal of Business Research cites numerous papers that show conflicting results: he writes “…it is often unclear why some organizations profit from their R&D, yet others fail to do so” (Kafouros 2008). Many academic studies have found positive relationships between R&D and firm size, “but others found either non-linear or statistically insignificant relationships, or suggested that firm size and R&D are independent of each other” (Lee and Sung 2005).

Practitioner research into the same subject by Booz Allen Hamilton shows no relationship between R&D spending and such measures as growth, profitability, or shareholder return (Jaruzelski, Dehoff, and Bordia 2005).

We can look at Canadian versus US spending on R&D to see if there is a correlation with the growth of firms. For that, we look at data from public software companies. We obtained data from recent company records of all 17 software companies that went public on the TSX since 2013, for which expenditure data were available. (Shopify was not included in this group as its revenue was almost twice that of all other firms combined.) The data on these firms were compared to similar IPO data from 2013 to 2022 for 160 companies that went public on the NASDAQ or NYSE. The comparison should be viewed with some caution as it is limited to software companies; there are only 17 firms for which Canadian data could be obtained, the firms are of different sizes, and the periods are different. However, despite those data issues, a clear pattern emerged.

The average software firm going public in the US had revenue of $341 million compared to $130 million for Canadian firms. The average growth rate for the US firms was 57.8 percent, and for the Canadians was 52.5 percent. With a smaller size, all other things being equal, we might have expected a higher growth rate for Canadian firms. The fact that they do not is more evidence that Canadian firms grow slower than US ones.

The growth rates are close enough to examine expenditure patterns, particularly in M&S and R&D. Canadian firms in this study spend more on R&D than do US firms. Canadian firms spent 29.6 percent of revenue on R&D versus 25.2 percent in the US. (SEC 2022) and (SEDAR 2022). So, Canadian firms in this study spend more as a percent of revenue on R&D than US firms and yet they grow more slowly. These data support the Booz Allen Hamilton survey, which found no relationship between R&D spending and growth. At a minimum, the evidence that R&D spending directly drives the growth of firms is weak.

While much government policy focuses on R&D spending, many programs promote the role of patenting in economic growth. Is there a link that we can see between patenting and the growth of firms when Canada is compared to the US? The relationship between patents and firm performance has been mixed from an academic perspective, and researchers have reached different conclusions (Artz, Norman, Hatfield, & Cardinal, 2010). The problem with patents as a performance measure and driver of performance is that not all firms choose to patent even when they can. Patents also often fail to provide valid information about innovation output as some companies may have few patents with high impact, and others may have many patents with minor impact (Chang, Chen, & Huang, 2012).

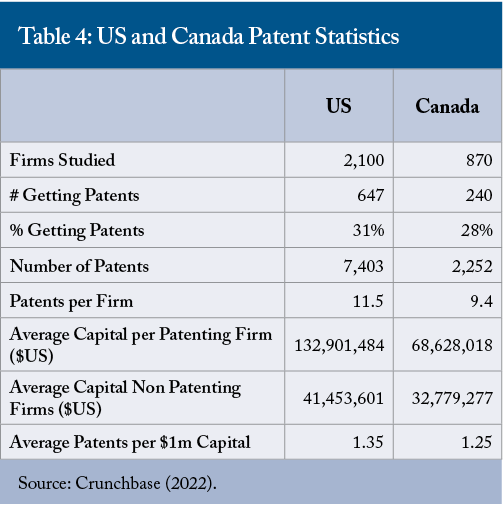

Nevertheless, it is helpful to look at patents (granted by the US patent and trademark office) to compare Canadian activities to those of the US in case a significant difference could contribute to our scaling challenges. To perform this analysis, this paper used Crunchbase, and obtained the US history of patent data and funding on the 2,100 US firms with more than $1 million of capital that were founded in 2013. This year was chosen to give a firm enough time to develop IP, apply for, and be granted patents in sufficient numbers to make the analysis meaningful. The Canadian firm population founded in 2013 comprised only 143 firms, so for Canada, we accessed the years 2011 – 2014, giving us 870 firms to analyze (Table 4).

The data show that US firms are somewhat more likely to take out patents, have a higher number of patents per firm, and have a higher number of patents per $1 million of capital raised.

In the study, the average capital per US firm that patented was $133 million – Canada $69 million. So, the difference in patenting rates may not result from patenting itself. The more a firm has raised in capital, the more likely they are to have received patents. Thus, the US, which has a larger average amount of funding per firm, may have more patents solely because of their level of funding.

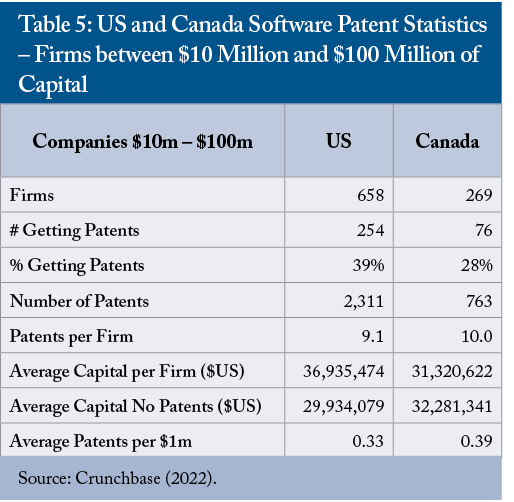

To examine the effect that large firms may have on these results, we performed an analysis on all companies in the study with between $10 million and $100 million of capital (see Table 5).

While more US companies were active patenting (39 percent US versus 28 percent Canada), the Canadian firms took out more patents per firm (10.0 Canada versus 9.1 US) and more patents per $1 million of capital (0.39 Canada versus 0.33 US). With the sample caveats in place, the implication is that Canadian firms’ growth is not necessarily constrained because they spend less than US ones on patenting. If we want more patenting, we need to invest greater amounts of capital and grow larger firms.

Overall, given that Canadian scaleups spend more on R&D than US ones, as a share of revenues, R&D spending levels are likely not the cause for slower growth. In addition, when comparing large firms of similar size, data show that Canadian software firms have higher patenting rates than those in the US, so patenting alone is likely not a factor in our slower growth. Lastly, the data do indicate that higher funded firms generate more patents, and, here, Canada is behind.

Spending on Marketing and Sales

The final area to expand on is marketing and sales (M&S). With a strong business idea, funding obtained, and personnel acquired, while a firm is developing its product or service, it must engage in M&S. To compare spending on M&S in Canada to the US, this Commentary looked at the same public software companies as were examined regarding R&D expenditures.

On average, Canadian software companies have losses equal to 42.2 percent of revenue while US firms lose 28.3 percent. With Canadian firms thus having higher expenditure levels as a percent of revenue, one might expect higher expenses on M&S. However, they only spent 35.8 percent of revenue on M&S versus 46.8 percent in the US (SEC 2022) (SEDAR 2022). Canadian firms substantially underspend US firms in M&S, as a share of revenues.

It is also possible to compare spending on M&S versus on R&D. While Canadian firms spend more on M&S than R&D (134 percent), the difference is much less than it is for US firms (214 percent) (SEC 2022) (SEDAR 2022).

What is driving this difference? Marketing and sales expenses are wide and varied. They include amounts for personnel, advertising, trade shows, Search Engine Optimization, content, market research, and a wide variety of services and products to drive revenue. The question then is whether we can determine what expenditures make up the difference. We deployed the Scaleup Funnel to examine the number of personnel in an M&S function between the two countries. We obtained the data for this test by examining the classifications of employees shown on LinkedIn.

The results show that the average Canadian software company has 31.8 percent of its employees in M&S, whereas the average US software company has 33.5 percent. While not huge, larger dollar differences may result from pay levels, exchange costs, and, most likely, spending on M&S activities such as trade shows, advertising, and the like. Overall, our findings suggest that a re-focus on M&S spending is in order.

With the federal government responsible for setting the enabling conditions to nurture innovation, it is worthwhile to explore how current programming is focussed. This Commentary reviews of over ten years of federal government budgets and documents prepared by Innovation, Science, and Economic Development Canada (ISED) and its predecessor, Industry Canada.

The federal government invests significantly in “innovation” and related activities. For example, ISED has a budget of over $5 billion in 2023 – 2024. In addition, the Scientific Research and Experimental Development (SRED) tax incentive program, administered by Revenue Canada, is worth just over $4 billion annually. Together these two programs constitute a commitment of over $9 billion per year to boost the innovation economy.

Three terms were used to express ideas over the entire period under review. From the 2004 budget with its more detailed explanations:

Creating a knowledge advantage begins with a commitment to research excellence. Not only is leading-edge research a key source of new knowledge and ideas, but it also helps develop the highly qualified personnel that Canada needs. (Government of Canada Budget 2004, p. 133.)

An equally powerful approach is to invest in innovation. Innovation—new ideas—can improve how existing goods and services are produced and allow new goods and services to be introduced. The critical ingredients for innovation are research and development, which also require highly skilled individuals and the latest equipment. (Government of Canada Budget 2004, p. 157.)

Commercialization is the process through which research discoveries are brought to the marketplace, and new ideas or discoveries are developed into new products, services, or technologies that are sold around the world. (Government of Canada Budget 2004, p. 133.)

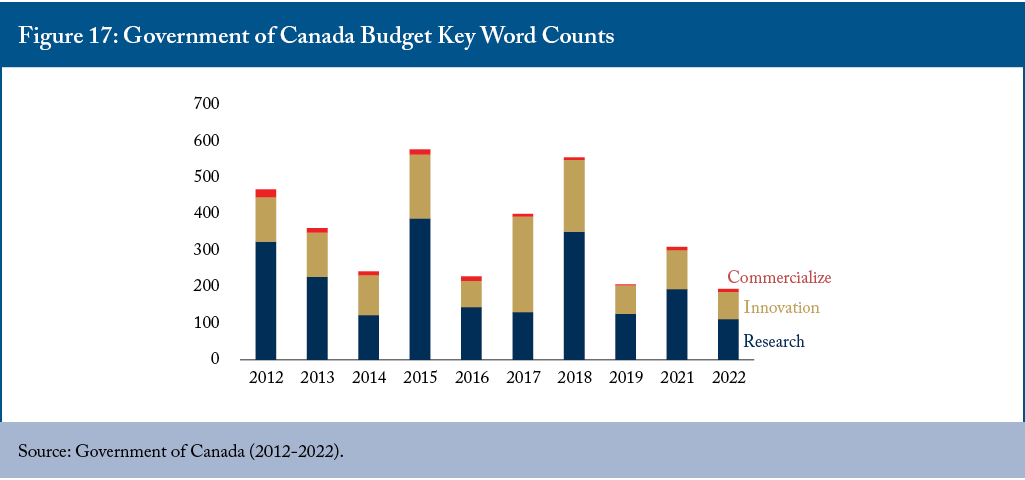

Following the government’s terms, research results in new ideas or knowledge. The boundaries between innovation and commercialization are not distinct, but we can interpret innovation as creating new products, and commercialization as bringing that product to market. With that logic in mind, we can examine how the government has emphasized these activities over time. We conducted word counts in all government budgets between 2012 and 2022. (There was no budget in 2020.)

This analysis of federal budgets shows that research and innovation are mentioned 34 times more often than commercialization. The difference in emphasis indicates governments focused on supporting activities that create new ideas and turn them into products rather than on activities that bring these new products to market.

Mirroring this usage, there are no mentions of programmes to support marketing and sales in ISED’s 2022-2023 Departmental Plan (ISED 2022). The term marketing is never once used. Although marketing and sales are essential in getting a technology accepted in the market, the discussion about science and innovation in Canada has paid little attention to this part of the innovation formula. This thinking is analogous to the myth of the better mousetrap: a better product is all that is needed for commercial success.

It could be argued that ISED has no responsibility for the development of marketing and sales programs in response to an unclear market failure, as opposed to innovation which requires massive upfront costs. Moreover, development of marketing and sales programs could be covered by other programs such as the Trade Commissioners Service, which operates CanExport, other departments such as agriculture, other entities such as EDC or BDCT, or the provinces themselves. However, arguing that ISED has no responsibility for assisting companies to take the innovations that ISED has supported to market makes no sense. First, it would show a major lack of coordination to expect other entities to bear responsibility for marketing innovations arising out of ISED programs. Second, if M&S is linked to potential improvements in productivity, then M&S should be the responsibility of whoever is responsible for productivity – an issue central to ISED’s mandate. As their name suggests, they are responsible for developing the economy, including improving productivity, which will involve growing smaller firms into larger ones, where Canada is performing poorly, and which involves robust M&S.

The topic of productivity and its growth is a continued matter for discussion in Canada. It is a focus of government, business, the press and it has been a major topic of discussion for over 50 years. What then are the government’s objectives? Unfortunately, those listed by the government are quite nebulous. For instance, the objective of the Scientific Research and Experimental Development Investment Tax Credit (SRED) is to “encourage the performance of scientific research and experimental development” (Government of Canada 2023). The objectives do not mention increasing productivity or creating large firms. The rationale for the program is similarly indistinct, focussing on spillovers or externalities.

ISED’s departmental plan for companies, investment, and growth contains three objectives:

- A clean and sustainable economy – There is no explanation of how this fits within planned results for companies and does not further deal with the issue of sustainability.

- Businesses and industries that are innovative and growing – There is no explanation of scale, so any result is acceptable.

- Businesses, investors, and consumers are confident in the Canadian marketplace, including the digital economy – How would one measure confidence and is this a reasonable objective when there could be so many concrete ones?

Without clearer objectives, it is not surprising that we end up with hodgepodge of metrics of success. In terms of results for expenditures at ISED, this hodgepodge covers:

- Sales of clean technologies and employment in the sector but nothing relating to the software or health tech sectors. (It also tracks reductions in GHG emissions.)

- Value of Business Expenditures on Research and Development by firms receiving ISED funding.

- Scores on world indexes.

- IP filings.

- Percentage of Canadians who shop and bank online.

On the other hand, there are no metrics covering the following:

- Growth in the number of large companies.

- Growth in employment in the tech sector.

- Growth rates of leading firms.

- Growth in productivity.

The most interesting and telling metric shows the revenue growth rate of firms supported by ISED programs. For the last years measured (2018 – 2019), the average growth rate of firms supported by ISED was 6.7 annually. This weak growth rate is well below a reasonable level in terms of growth rates needed to drive large companies. For example, the average scaling firm in Canada is growing at 35 percent annually, even though this is not high enough to drive the results US firms see.

Fundamentally, this result indicates that marginal companies, not high-growth ones, are relatively big users of ISED programming. The relative lack of relevance to high-growth firms means that the programming is not contributing optimally to the growth in productivity.

A lack of concrete and measurable results-oriented objectives renders government programming a process of “choose your own adventure.” Programs can be developed and rolled out to meet political instead of economic needs without the government ever focusing on serious problems. The further selection of a hodgepodge of random metrics means that the government will never be held to account.

Policy Discussion

Indicators show that while Canada’s productivity and the creation of larger enterprises are improving, there is a long way to go – in particular if we compare ourselves to the US. We trail the US in high-growth companies and the average rate our companies scale. The fundamental factors for the differences between Canadian and US results appear to be the following:

- Our companies enter smaller markets than those entered by US firms, thus limiting their rate of growth and potential long-term size.

- Firms founded in Canada wait until later to raise capital, raise smaller rounds and raise less than US firms and, as a result, grow more slowly.

- Firms have significant access to foreign capital even at earlier stages of development but receive less money when accessing Canadian funders and grow slower when invested in by Canadian investors.

- Canadian firms have difficulty finding local M&S executives and must hire for this role internationally.

- Our scaling firms spend more on R&D than US firms as a percent of revenue, but this has yet to result in higher growth despite often being touted as the most critical factor in driving growth.

- The data do not show that patenting is a factor, as Canadian software firms of similar size that engage in patenting take out more patents per firm and more patents per dollar invested.

- Canadian firms spend less on M&S than US firms as a percentage of revenue. At the same time, these companies are spending more than US ones on R&D, yet, as discussed, Canadian firms are growing slower.

While the Canadian government focuses programs on research and innovation, it is the lack of resources, experience, and talent for commercialization that is keeping our firms smaller and growing slower. Our challenges in market size, M&S personnel, and M&S spending are all related to marketing as a function. This is not a new point, as it was highlighted by the government’s Expert Panel on Commercialization in 2006 (see Expert Panel on Commercialization 2006). Furthermore, academic research has shown that marketing capabilities drive revenue growth (Morgan 2009). And we know that larger companies are more productive than smaller ones.

As anyone running a firm will know, when one creates forecasts for the next year, one builds them around an inexorable link between M&S and revenue. While R&D results in new products that will enable increased sales, the mechanism for the increased revenue is M&S. Spending on M&S drives leads, evaluation by customers, trials, proposals, and sales. The product must be available, but the R&D spending does not drive the eventual increase in revenue. R&D is necessary but not sufficient to scale companies.

M&S is a significant factor for companies in driving growth and thus helping create large firms. Moreover, the creation of more large firms improves productivity. However, M&S is the area in which Canada has its most significant challenges, making the biggest area for policy to play a role.

Perhaps after years of focusing on R&D and not seeing expected changes in productivity, the government might experiment with improving the ability of firms to compete on the international stage with enhancements to programing for M&S. The following are recommendations that would alter the government’s focus from R&D to M&S to grow larger companies and thus improve productivity.

- Setting Objectives and Metrics

Canadian observers have bemoaned the country’s weak productivity growth for over 50 years, yet this does not appear concretely as a policy objective in federal budgets or departmental plans. As written now, objectives and metrics are functionally immaterial to Canada’s success and warrant much improvement. The Government of Canada would benefit from developing comprehensive objectives and ways to measure outcomes. In particular, metrics would be valuable if they addressed productivity and large venture growth.

- Attitudinal Changes and Training

By focusing so heavily on STEM, R&D, and IP protection, the government is signalling what it thinks drives success. It creates situations where firms spend mainly on R&D and relatively less on M&S, not only in earlier years but along the whole continuum of company development. Programming provided through regional innovation centres, like the ones we see in Canada, that are meant to enhance the exposure to the needs and practices required to market and sell successfully might change our perennial focus on R&D and enable technology-based startups to acquire the necessary skills for export-based expansion.

- STEM Careers

There are more careers in Canada in M&S than in R&D. However, one would never guess this by government’s continued focus on STEM. Furthermore, this is an area where Canada is challenged with hiring employees and where there may be a brain drain to the US. A set of programs could be developed with a robust design that focuses on humanities grads and the need for M&S. This could reverse how humanities programmes have been denigrated and potentially increase the supply of M&S personnel.

- SRED Grants

The ability of a firm to obtain SRED funding to improve productivity as opposed to new product development has created a nation of efficient small companies. We should reorient funding to focus on developing new products and markets by reducing credits for research and development, taking the funds generated from those savings, and applying them to funding M&S activities. In this way, a firm that is competing internationally would be more encouraged to devote expenses to M&S than focussing more on R&D.

- Program Development

There are numerous programs dealing with IP creation and protection. Funding for these could be streamlined, and programs developed that focus on M&S. For instance, one significant cost barrier to smaller firms is exhibiting at trade shows. If a program were created to fund firms for this purpose, and have it linked to the money ISED is spending on innovation, it could help increase the amount spent by firms on M&S.

Conclusion

This paper’s analysis makes clear that Canada’s record at scaling companies is lagging behind other countries, most notably the US. And, as a result, our productivity is lagging behind as well. After years of marginal improvements to productivity, it is time to change our thinking. Instead of focusing only on R&D, we should acknowledge the role that M&S plays in creating large firms and experiment with policies and programs that focus on this long-neglected area.

References

ACEG. 2017. Unlocking Innovation to Drive Scale and Growth. Ottawa, ON: Advisory Council on Economic Growth.

_______2016. Attracting the Talent Canada Needs Through Immigration. Ottawa, ON: Advisory Council on Economic Growth.

Artz, K., Norman, P., Hatfield, D., and Cardinal, L. 2010. “A Longitudinal Study of the Impact or R&D, Patenets, and Product Innovation on Firm Performance.” Journal of Product Innovation Management, 725-740.

Bank of Canada. 2017. How Canada’s International Trade is Changing with the Times. Sept. 18. Retrieved from Bank of Canada: https://www.bankofcanada.ca/2017/09/how-canada-international-trade-changing-with-times/?_ga=2.51408937.125990147.1526487884-82356367.1526487884

BDC. 2020. Ottawa, Ont.: Business Development Bank of Canada. Sept. Retrieved from Executive Compensation at VC-Backed Tech Firms: https://www.bdc.ca/globalassets/digizuite/25234-canada-us-compensation-gap-in-the-technology-sector.pdf

______2022. Canada’s Venture Capital Landscape. Ottawa, ON: The Business Development Bank of Canada.

Campbell, J., and Hopenhayn, H. A. 2005. “Market Size Mattters.” The Journal of Industrial Economics 53 (1):, 1-25.

CB Insights. 2023). The Complete List of Unicorn Companies. Jan. 7. Retrieved from CB Insights: https://www.cbinsights.com/research-unicorn-companies

CEST. 2018. Report from Canada’s Economic Strategy Tables. Nov. 5. Retrieved from Government of Canada - ISED: https://ised-isde.canada.ca/site/economic-strategy-tables/en/report-2018

Chang, K.-C., Chen, D.-Z., and Huang, M.-H. 2012 . “The relationships between the patent performance and corporation performance.” Journal of Informetrics, 6(1): 131-139.

CPE Analytics. 2023. Various Pages. Jan. Retrieved from CPE Analytics: https://cpeanalytics.ca/

Crunchbase. 2022. Dec 15. Companies. Retrieved from Crunchbase: https://www.crunchbase.com/search/organization.companies/712d7955514d65aaf6326401c7276015.

Expert Panel on Commercialization. 2006. . People and Excellence: The Heart of

Commercialization. Prepared for the Minister of Industry, Government of Canada.

Government of Canada. 2012,-2022. Government of Canada - Budgets. Retrieved from Archived Budget Documents: https://www.budget.canada.ca/pdfarch/index-eng.html

___________________. 2023) February 15. Report on Federal Tax Expenditures - Concepts, Estimates and Evaluations 2023: part 7. Retrieved from Government of Canada: https://www.canada.ca/en/department-finance/services/publications/federal-tax-expenditures/2023/part-7.html#Scientific-Research-and-Experimental-Development-Investment-Tax-Credit

ISED. 2022. Departmental Plan 2022 - 2023. Ottawa: Innovation, Science, and Economic Development Canada.

____. 2022,. Intellectual Property Strategy. Aug 4. Retrieved from Government of canada - ISED: https://ised-isde.canada.ca/site/intellectual-property-strategy/en

____.2022. Venture Capital Catalyst Initiative. Oct. 14. Retrieved from Government of Canada - ISED: https://ised-isde.canada.ca/site/sme-research-statistics/en/venture-capital-catalyst-initiative

Jaruzelski, B., Dehoff, K., and Bordia, R. 2005. Money Isn’t Everything. Booz Allen Hamilton.

Kafouros, M. 2008. “Economic returns to industrial research.” Journal of Business Research 868-876.

Kumar, K. B., Rajan, R. G., and Zingales, L. 1999. What Determines Firm Size? July. Cambridge, MA: National Bureau of Economic Research.

Lee, C.-Y., and Sung, T. 2005. “Schumpeter’s Legacy: A New Perspective on the Relationship between Firm Size and R&D.” Research Policy, 34(6): 914-931.

Leung, D., Meh, C., and Terajima, Y. 2008. “Productivity in Canada: Does Firm Size Matter?” Bank of Canada Review, 7-16.

LinkedIn. 2022. Sales Navigator. December. Retrieved from LinkedIn: www.linkedin.com

Morgan, N. A. 2009. “Linking Marketing Capabilities with Profit Growth.” International Journal of Research in Marketing, 284 - 293.

OECD. 2008. OECD Factbook 2008. Paris, France: OECD Publishing.

____. 2022. Enterprises by Business Size. December. Retrieved from OECD Data: https://data.oecd.org/entrepreneur/enterprises-by-business-size.htm

Pessoa, A. 2010. “R&D and Economic Growth: How Strong Is the Link?” Economics Letters, 152-154.

Plant, C. 2019. Canadian Venture Capital Sufficiency: Does Canada Have Enough Venture Capital Funding? Toronto, Canada: The Impact Centre, University of Toronto.

Plant, C. 2021. Debunking Canada’s Brain Drain Myth. Waterloo, ON: Communitech.

SEC. 2022. Edgar - Search and Access. Oct. 31. Retrieved from US Securities and Exchange Commission: https://www.sec.gov/edgar/search-and-access

SEDAR. 2022. Search for Company Documents. December. Retrieved from Sedar: https://www.sedar.com/search/search_form_pc_en.htm

Statistics Canada. 2022. Canadian Business Counts, with Employees. June. Retrieved from Statistics Canada: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3310056801

Sylwester, K. 2001. R&D and economic growth. , . Knowledge, Technology & Policy 13(4): 71-84.

The Globe and Mail. 1979. The Hard Part Is Easier. Jan. 24.

Therrien, P., and Hanel, P. 2009. “Innovation and Establishments’ Productivity in Canada: Results from the 2005 Survey of Innovation.” Groupe de Recherche en Économie et Développement International, 16-25.