Introduction and Overview

With the worst of the COVID-19 pandemic behind us, a concerning trajectory of federal spending has become clear. The economic rebound and higher inflation have boosted federal revenues, and the government is spending almost all the new money.

While some new spending is arguably effective in improving Canadian wellbeing, most is not. Federal compensation costs are ballooning, while the government’s ability to make policy and deliver services is static or declining. Too many of its commitments do not respect long-term budget constraints – indeed, many threaten to aggravate those long-term constraints by distorting economic activity and requiring tax increases that will discourage work, investment and innovation.

This 2023 Shadow Budget changes course. Canadians need a federal government that spends less and better, taxes more intelligently, and sets a fiscal course that will avoid tax increases driven by excessive spending and borrowing.

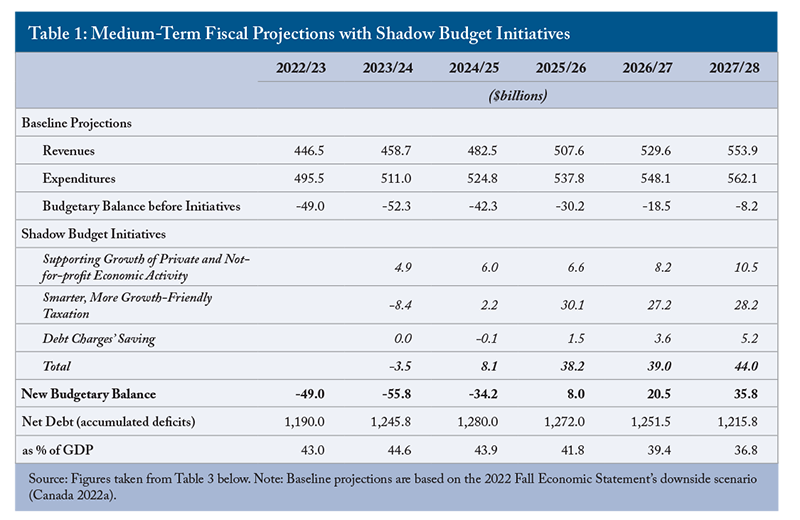

Recent federal budgets have buried the key numbers – the government’s financial position and projections for revenues and expenses, deficits and net debt – in annexes after hundreds of pages of repetition and political messaging. To promote transparency and emphasize the seriousness of the government’s fiscal thinking and commitments, this 2023 Shadow Budget puts those numbers up front. Table 1 presents our outlook based on the government’s 2022 Fall Economic Statement (Canada 2022a), with the projected impact of this Shadow Budget’s measures and the resulting new trajectories for the bottom line and the federal government’s accumulated deficit.

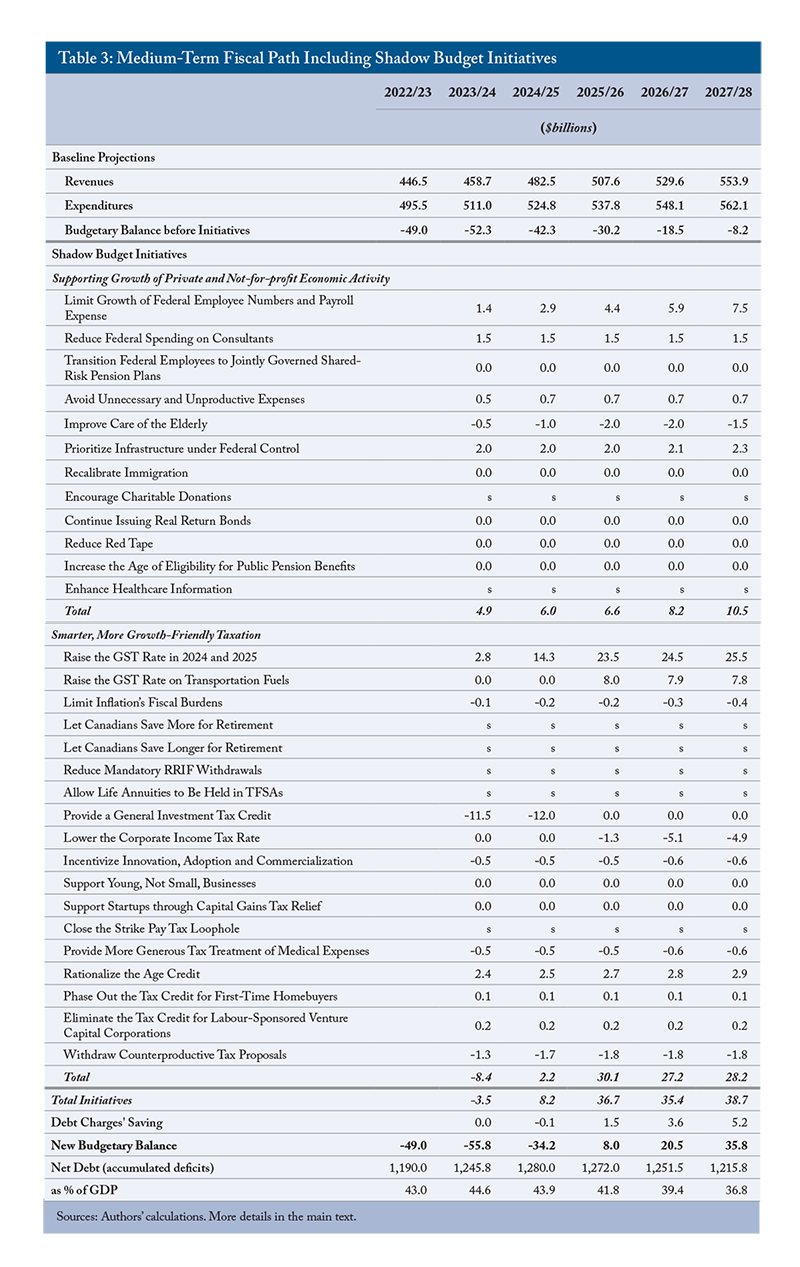

Table 3 at the end provides the full list of this Shadow Budget’s measures.

Key features of the Shadow Budget are changes to government operations to reduce reliance on outside consultants and limit growth in federal payroll. It proposes higher taxes on consumption, partially offset by investment incentives, to support economic growth, environmental goals, and intergenerational fairness. It contains measures to improve Canadians’ ability to finance healthcare expenses and retirement.

Critically, it ensures a sustainable path for federal and national finances. After small increases in 2023, reflecting temporary net impacts of budget initiatives and a weak economy, the deficit and the ratio of net debt to gross domestic product (GDP) will decline decisively. Deficits will give way to surpluses in fiscal year 2025/26. The combination of growth-enhancing and fiscally prudent policies will redress the damage COVID has done to federal fiscal capacity, and provide more resources Canadians will need to address an ageing population, climate change and the energy transition, subsequent pandemics, and challenges we do not yet foresee.

We thank Daniel Schwanen, John Lester, Nick Pantaleo, Jeffrey Trossman, Tom Wilson, anonymous reviewers and members of the C.D. Howe Institute’s Fiscal and Tax Competitiveness Council for helpful comments on an earlier draft. We are also grateful for reviewers of previous Institute Shadow Budgets, which prefigured many of the ideas presented in this one. Responsibility for any errors and the views expressed is ours.

The Fiscal Framework

A Commitment to Transparency and Accountability

To further aid transparency, this Shadow Budget commits to presenting spending estimates that match budget projections. The Main Estimates for the 2023/24 fiscal year will follow Public Sector Accounting Standards, and will appear before the start of the fiscal year, after appropriate vetting by the Treasury Board. The 2024/25 Main Estimates will appear by mid-February of that year, simultaneously with the 2024 federal budget. This Shadow Budget also clarifies its presentation of revenues and expenses and the costs associated with pension plans for federal employees.

A Commitment to Reliable Projections

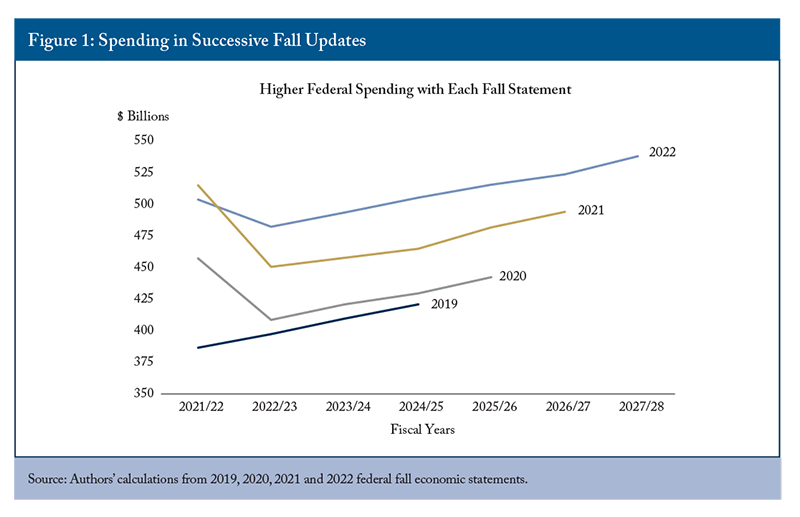

Successive fiscal updates from the federal Minister of Finance since 2019 have shown projected federal spending growing by leaps and bounds, even after COVID-related measures drop out of the projections. The government’s last pre-COVID projections, in its 2019 Fall Economic Statement, ended with the 2024/25 fiscal year. In that year, the projections showed expenses of $421 billion. Ottawa produced no budget in 2020, an unprecedented failure, but the 2020 fall statement showed spending at $429 billion in 2024/25.

We underline that these successively higher projections for spending in 2024/25 are not because of COVID. By then, pandemic-related measures are done. These increases reflect higher transfers to every type of recipient, higher wages and pensions of federal employees, and higher interest payments on the government’s ballooning debt. While one-third of the higher amount now projected for 2024/25 reflects the higher prices produced by inflation not anticipated in 2019, the federal government’s overstimulation of demand is a key reason for those higher prices. This Shadow Budget commits to projections that Canadians can trust.

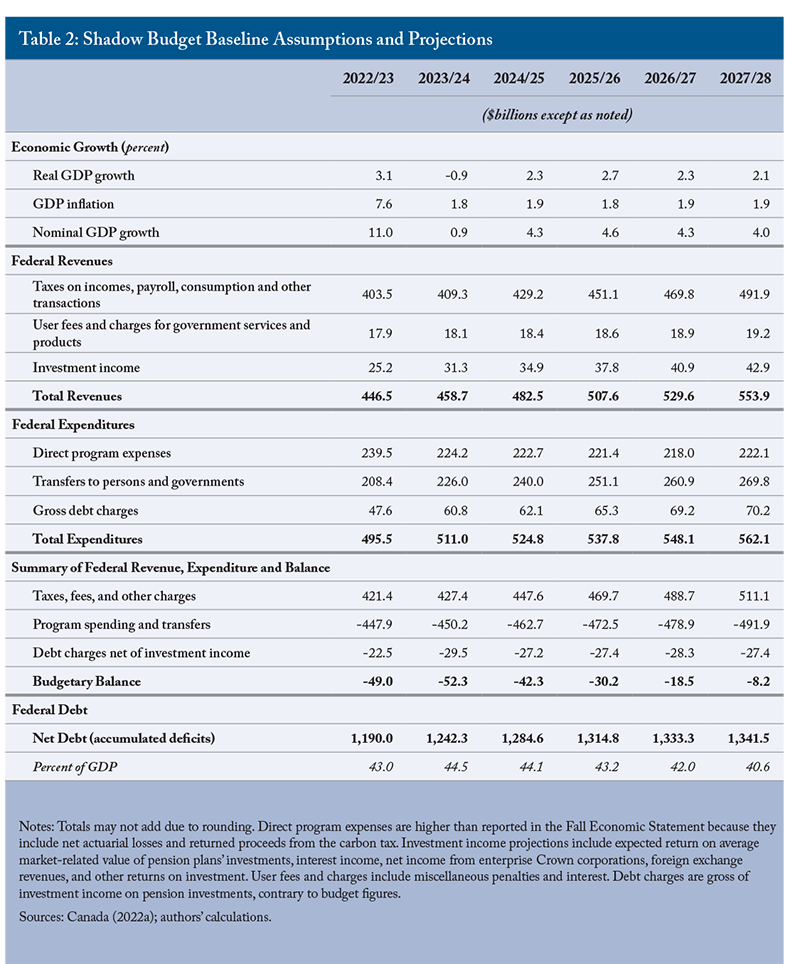

A key element of trustworthy projections is a baseline that is resilient to setbacks. The 2022 Fall Economic Statement presented a downside economic scenario in addition to its main outlook. That scenario assumed more persistent inflation, further tightening in monetary policy, and a weaker economy (Canada 2022a). To allow for the widely expected recession in 2023, this Shadow Budget uses the downside scenario as its baseline. In that baseline, the deficit is $49 billion in fiscal year 2022/23, $52 billion in 2023/24, and $42 billion in 2024/25. Deficits continue through the end of the projection period (Table 2). The federal debt-to-GDP ratio declines only slightly, from 43 percent of GDP to 40.6 percent in 2027/28.

The Importance of Economic Growth

The 2022 federal budget acknowledged Canada’s long-term structural economic growth challenge. It cited the OECD’s 40-year long-term projection scenario, which showed Canada having the lowest per-capita GDP growth among member nations (Canada 2022b). But that acknowledgement was the end of the 2022 budget’s foray into the long-term challenges.

Some new federal spending, such as childcare subsidies and targeted investment tax credits, have potential to boost the supply side of the economy. But most of it is oriented toward consumption – by the recipients of transfer payments, by federal government employees, and by providers of services to the federal government. The 2022 budget missed the opportunity to engage Canadians in a serious discussion about raising private investment and productivity.

Beyond the short-run risks reflected in our conservative baseline, serious long-run risks loom. Notwithstanding the federal government’s rhetorical emphasis on global warming as an existential threat that requires costly curtailments of fossil fuel production and consumption, the purported economic costs of warming do not figure in its projections, nor do the fiscal costs of adapting and fixing the damage. COVID brought forward in time the fiscal squeeze of demographic change, which both curtails labour supply and increases healthcare costs. Geopolitical conflict and aggressive adversaries may impede access to goods and services Canadian consumers and businesses desire, and require Canada to devote more resources to defending itself at home and abroad.

Reducing the downside risks requires bolstering long-term growth. The 2022 budget assumes 1.7 percent average annual growth from 2027 to 2055.

This rate looks unrealistically high (Laurin and Drummond 2021). Growth in the labour force is slowing, notwithstanding higher immigration. Business investment per person in Canada’s labour force has been declining relative to such investment in the United States and other developed countries since the middle of the past decade (Robson and Bafale 2022). The response to global warming is likely to be a drag on economic growth (Canadian Climate Institute 2022).

Strengthening long-term growth will require stronger productivity growth and much higher levels of business capital investment. The federal government must establish a policy mix that supports work, investment and innovation, and that mix must include a credible path to budget balance and competitive taxation.

The Importance of Fiscal Sustainability

Future generations of Canadians will need a federal government with restored capacity to deliver services sustainably. A key sign of that restored capacity would be a rapid return to a federal debt-to-GDP ratio around 30 percent – the level that permitted robust responses to the 2008/09 financial crisis and the COVID-19 pandemic

A persistently higher debt ratio puts the burden of the income supports triggered by the pandemic, not on the cohort that benefited, but on future cohorts

Notwithstanding the debt ratio’s value as an indicator of fiscal health and sustainability, past and more recent experience has taught that it is not an effective constraint on budget makers.

First, focusing on the debt ratio appears to justify wishful thinking – notably, projections in which interest rates are forever lower than growth rates. Canada’s problems in the 1990s had roots in the 1970s, when the average interest rate on new federal borrowing was lower than GDP growth and deficits looked manageable. When that differential reversed, the Mulroney and Chrétien governments had to raise taxes and cut spending: between fiscal years 1987/88 and 2007/08, Canadians paid 16.8 percent of GDP in federal taxes and received only 13.9 percent of GDP in programs. This Shadow Budget would produce a surplus by fiscal year 2025/26, protecting Canadians from a repeat of that painful episode.

Second, the debt ratio sanctions ongoing borrowing, relieving spending advocates of the need to justify their proposals against alternative programs or required taxes, and it sanctions ongoing deterioration in the federal government’s net worth, a key indicator of its capacity to deliver services. A debt-ratio fiscal constraint also turns out to be asymmetrical: when the economy booms, it allows larger deficits; when the economy slumps, the government abandons it.

To set the stage for the measures that follow, we emphasize that the federal government should scrutinize potential new spending more rigorously than in the past. It recently raised Old Age Security (OAS) payments, benefiting a group that has a lower poverty rate than non-seniors. It is supporting childcare programs irrespective of need. COVID-related deaths in long-term care are prompting flows of more resources into institutions, rather than into home care and community-based living. Past general increases in transfers to the provinces appear to have raised costs throughout their healthcare systems rather than improved services.

When new spending is justified, this Shadow Budget does not pass the bill forward. It is fairer to future Canadians to pay for new spending and debt reduction with new revenue – either by increasing the Goods and Services Tax (GST), as proposed in this Shadow Budget, or by using additional proceeds from the carbon tax, which is due to rise steeply. Although a resurgence of the pandemic might justify delaying a return to surplus, the logic of intergenerational fairness holds: any increase in borrowing relative to this fiscal plan should be small enough to ensure that the debt ratio continues to fall.

Supporting Growth of Private and Not-for-profit Economic Activity

The Canadian economy suffers from no deficiency of demand that would require more transfer payments and consumption spending by governments. Inflation far above the Bank of Canada’s 2 percent target – a target recently reconfirmed by the federal government – clearly indicates that demand has outstripped supply. The primary focus of the economic program in this Shadow Budget is reducing the pressure of the federal government’s spending and consumption on the rest of the economy, easing the pressure on demand directly, and boosting supply by increasing the labour force, supporting investment and raising productivity.

Limit Growth of Federal Employee Numbers and Payroll Expense

Treasury Board figures show that, after reductions in the first half of the 2010s, the core public service began growing after 2015, and that its growth accelerated through to 2021. Federal full-time equivalent employees increased 4 percent a year on average from 2017/18 to 2021/22. Perversely, this expansion of the public service has coincided with a now notorious expansion in government contracting for work public servants can or should be doing, and some well-publicized cases of reduced provision of important services. Successive forecasts of federal employment have shown an end to the hiring binge that has never materialized. This Shadow Budget would reduce federal departmental operating budgets for wages and salaries to their 2022 levels and hold them there for five years. Managers would have latitude within their budgets to reward high performers and reduce less valuable positions. This approach could achieve a better balance between federal public and private sector compensation (Lahey 2011), and curtail the growth of the federal payroll. The freeze would reduce federal spending by at least $1 billion in fiscal year 2023/24, growing to $7.5 billion annually over the projection period.

Reduce Federal Spending on Consultants

Outsourcing costs on professional and special services have increased 75 percent since 2015/16, from $8.4 billion to $14.6 billion. It is concerning that both professional service contracts and internal costs have risen sharply. Outside consultants may bring expertise not found within the public service. But the increase coincided with a rapid expansion of the public service over the same period, which should have increased internal capacity. This Shadow Budget will reduce annual spending on consultants by 10 percent.

Transition Federal Employees to Jointly Governed Shared-Risk Pension Plans

This Shadow Budget would initiate a transition of federal employees’ pension plans – notably including the plans for federal members of Parliament – to shared-risk plans in which taxpayers bear less cost and risk, and a joint governance structure gives employees a voice in the long-term sustainability of the plans. This change would have no fiscal cost, but over time it would reduce exposure to costs that are adding to federal debt with no benefit to current and future taxpayers.

Avoid Unnecessary and Unproductive Expenses

Expensive initiatives the government has talked about but not reflected in its fiscal framework would set back the quest for a more effective, affordable and sustainable federal government. This Shadow Budget would stop work on these initiatives.

One such initiative is a national pharmacare program. The enhanced medical expense deduction in this Shadow Budget would alleviate some of the pressures Canadians experience from healthcare costs. Governments could enhance drug coverage and affordability through more strategic and less costly initiatives (Wyonch and Robson 2019).

This budget resists the pressure to increase the Canada Health Transfer, which is already growing strongly due to its link to nominal GDP. It does not incorporate the $46 billion of incremental funding over 10 years for healthcare the Prime Minister offered premiers on February 7th, 2023. That funding is subject to future discussion, and is inconsistent with the approach underlying this Shadow Budget. A national effort to improve health outcomes and healthcare should not begin with spending commitments and arguments about which level of government spends what. It should begin with a focus on the desired outcomes and how to achieve them. Better health information is one such outcome, and this Shadow Budget contains measures to support it. This Shadow Budget also contains measures to support the development of home care. It does not sink more money into the larger quagmire of federal-provincial-territorial squabbles over funding and accountability.

This Shadow Budget also would not introduce a basic income, loosen eligibility for EI or increase the share of earnings that EI covers. Such measures would add to federal spending and debt, and discourage workforce participation – especially inappropriate when demography and the lingering effects of COVID-19 are impeding growth.

This shadow budget would not cut Canada Mortgage and Housing Corporation mortgage insurance premiums. The government already encourages borrowing and lending for residential housing, and increasing that subsidy would further distort credit markets toward housing rather than business lending, when households are already overextended.

Canada’s long-term growth prospects critically depend on productivity improvements. The federal response has concentrated on subsidizing industries and projects it regards as promising. For example, Budget 2022 announced the creation of the Canada Growth Fund (CGF) to be capitalized with $15 billion to investments in private projects that would further Canada’s climate policy goals. Budget 2022 also announced $1 billion to launch a new Canadian Innovation and Investment Agency, which will similarly provide funds to startup firms. Industrial policies of “picking winners” have a terrible track record. Bureaucrats are worse than private investors at finding the best opportunities, but promoters are adept at finding government support. This Shadow Budget contains better measures to support investment. It will not go forward with these initiatives.

This Shadow Budget responds to concerns about lack of clarity and certainty with respect to the government’s measures to combat climate change. The carbon levy, or comparable provincial programs, will be the main tool deployed. The schedule for the levy to reach $170 per tonne will be released before the end of 2023. Also, before the end of this year the government will provide greater clarity on how it will respond to the US approach of targeted subsidies. There may be areas where such an approach will require Canada to respond strategically. But large and ongoing subsidies are not sensible, either for governments or for business plans, and a focus on carbon pricing means they will not be necessary in Canada. Decreases in other program spending will fund any incremental subsidies in this area.

Moreover, the government will not introduce ad hoc measures to offset the impact of monetary restraint in Canada and abroad on economic activity. Too much spending by government has been a key contributor to the overheated economy that pushed inflation well above target. It would be perverse to respond to central banks’ efforts to bring demand back into line with productive capacity with extra spending.

The ageing of the Canadian population, in particular the doubling over the next two decades of the cohort age 75 and over, will push healthcare spending up. To date the main approach to caring for the elderly has been long-term care. But most seniors would prefer other – and cheaper – options. While elderly care falls mainly in provincial and municipal jurisdictions, the national importance of the challenge leads the federal government to offer to work with the provinces, including if appropriate funding assistance, to develop a better homecare and community-living system. Provinces will need time to build a better homecare system. This Shadow Budget ramps up funding to $2 billion per year over three years, starting this year, for this purpose. Recognizing that once new programs and facilities are in place, the programs should become cheaper to run, the Shadow Budget starts phasing out funding in the last year of the projection horizon.

Prioritize Infrastructure under Federal Control

This Shadow Budget would prioritize funding for infrastructure projects under direct federal control, principally added capacity for marine, rail, and air transportation assets. The second phase of the Invest in Canada Plan, which began in fiscal year 2018/19, envisioned about $8.9 billion in grants for provincial and local projects in 2023/24, rising to an extraordinary $11 billion in 2027/28. Budget 2022 shifted some of this spending from the medium term to later years by extending the program to 2033/34. This extension reduces planned amounts by a total of $6.2 billion over the budget horizon. This Shadow Budget would replace about one-quarter of the remaining planned amounts with direct federal investments. This change reduces annual planned expenses over the budget horizon by around $2.1 billion per year on average.

Higher immigration will raise the growth rate of GDP but a more appropriate, and tougher, objective is to raise living standards per person. While higher numbers of immigrants are desirable over the medium and long term, rapid increases in the near term will further stress Canada’s shortage of housing, and make the government’s targets for greenhouse gas emissions harder to reach. More important than higher gross numbers are improvements in selection criteria, to ensure people with the appropriate skills and experience are coming to Canada. This Shadow Budget initiates a process to emphasize the economic stream of immigration entering under the points system, and to ensure that principal applicants become a larger share of that stream.

Encourage Charitable Donations

Canadian charities are under pressure – fewer donations and greater demands for their products and services. Recent changes to the Income Tax Act increased charities’ disbursement requirements. Now, charities need help to raise the resources they are disbursing. More consistent tax rules related to charitable donations can help. While donors of publicly traded shares that have appreciated in value pay no capital gains tax when they donate the shares, donors of private company shares and non-environmentally sensitive land must pay capital gains tax on the gain accrued to the donation date. This Shadow Budget proposes to amend the Income Tax Act to relieve more donations of the private company shares and real estate from capital gains tax (Aptowitzer 2017). Although the impact of this measure on charitable donations will likely be large, no donations of this kind occur at present, and little of the capital gains that would be realised on these assets is producing tax, so the measure will have a modest immediate fiscal cost.

Continue Issuing Real Return Bonds

The 2022 Fall Economic Statement announced that the federal government will no longer issue Real Return Bonds (RRBs). The Statement cited low demand for RRBs. Since then, actual and potential holders of RRBs have made clear that this assessment was wrong. RRBs are popular among financial intermediaries such as pension funds, because they offer uniquely valuable protection against inflation. And for Ottawa, issuing more RRBs could actually lower debt-service costs – not just because of their typically lower real yield, but also because more RRBs would underline the government’s commitment to low inflation (Bergevin and Robson 2012). It would be doubly perverse if institutional investors bought US inflation-indexed bonds instead – a worse inflation hedge for them, and an assist for the US government to raise debt more cheaply. The government will continue to issue RRBs, and improve the functioning of the RRB market by issuing bonds with various terms, rather than 30 years exclusively.

The 2023 Shadow Budget renews the federal government’s commitment to ensuring that regulations achieve their objectives at the lowest practical cost to Canadians and to their businesses. Excessive red tape – regulatory costs beyond those necessary to achieve a given benefit to health, safety or consumer protection – hurts consumers and makes businesses uncompetitive.

Increase the Age of Eligibility for Public Pension Benefits

Life expectancies improved considerably since the Old Age Security (OAS) age of eligibility fell from age 70 to age 65 in the 1960s. Low fertility rates and the ageing of the babyboom will strain the sustainability of our retirement income system (Brown and Aris 2017). The 2016 cancellation of a planned increase in the age of entitlement for Old Age Security to 67 that would have started in 2023 was a mistake that this Shadow Budget will rectify. A good recipe for sustainability is to calibrate the age of benefit eligibility to stabilize the proportion of an average person’s adult life spent in retirement. To do that, the normal age of eligibility for Old Age Security and the Canada Pension Plan would need to rise from 65 at the beginning of 2023 to 66 in 2033, and then to 67 between 2048 and 2050 (Brown and Aris 2017). This Shadow Budget would make that change. The same actuarial adjustments that penalize or reward early and later commencement of benefits would apply from the new age. This flexibility would ensure that people who cannot work past the current earliest age of eligibility could still collect reduced benefits, while further encouraging later receipt by people who wish and are able to work and save for longer. This change would have no implications over the budget-planning horizon. The improvements in the tax treatment of retirement saving and income outlined below will help seniors manage this transition.

Enhance Healthcare Information

To provide a better foundation for improving the efficacy and efficiency of healthcare this budget provides an additional $30 million per year to improve health and healthcare information. The funds will go largely to the Canadian Institute for Health Information (CIHI) and Statistics Canada, which will work with provincial and territorial partners on implementation. Among other things, the new resources will address data gaps in health outcomes, health human resources, mental health and pediatrics, establish direct data links to hospitals and other sources, and improve information connection with the private sector, including insurers.

Smarter, More Growth-Friendly Taxation

Ensuring that the budget returns to balance and that federal debt grows more slowly than the economy will require important adjustments to major tax and spending programs.

Consumption taxes such as the GST hurt investment and growth less than taxes on capital and personal income, and are more stable and reliable revenue sources (Dahlby and Ferede 2011). To reiterate, a key motive underlying this Shadow Budget is ensuring that Canadians who benefited from the massive pandemic-related federal spending should help pay for it. Higher corporate income taxes would be counterproductive, reducing investments and future economic opportunities. Higher personal income taxes would drive out the talent and wealth we need to move from recovery to expansion. Either would raise modest revenue in comparison to their economic costs. This Shadow Budget would therefore raise the GST rate by two percentage points – one point in 2024 followed by another point in 2025, restoring the rate to its level before July 2006.

Raise the GST Rate on Transportation Fuels

The federal government has committed to increase the carbon tax from the $50 per tonne planned for 2022 to $170 by 2030. In the meantime, an increase in the GST rate applied to transportation fuels would reduce carbon dioxide emissions and bolster federal finances. Credits for GST paid on inputs mean that this measure raises fewer concerns about international competitiveness than a higher carbon tax does. This Shadow Budget would increase the GST on transportation fuels by ten percentage points, starting in fiscal year 2025/26. This measure would generate about $8 billion initially, and less later as demand adjusts.

Limit Inflation’s Fiscal Burdens

Even if the Bank of Canada succeeds in reining inflation back to its 2 percent target by the end of 2024, Canadians’ money will still have lost about 8 percent of its purchasing power since inflation first rose above target in early 2021. The federal government indexes personal income tax thresholds, benefit payments and most tax credits to the CPI – for 2023, the adjustment will be 6.3 percent. But some thresholds that would be easy to index remain unindexed.

Examples include the federal government’s pension income credit and the maximum education and tuition credits that tax filers can transfer to spouses or parents. Since 2020, the Guaranteed Income Supplement for low-income seniors has exempted up to $5,000 of employment earnings, and half of the next $10,000 of earnings, from its calculation, but lack of indexation of these thresholds is subjecting more seniors and more of their incomes to 50 percent to 75 percent clawbacks. The $30,000 small-supplier threshold for the GST has not changed since 1991, when GST began. After more than 30 years, inflation has cut its real value almost in half. Another egregious example is the $10,000 foreign employee exemption in the Canada-US tax treaty. After more than 40 years, inflation has cut its real value by almost three-quarters – a major hassle for people who do minimal amounts of work in Canada.

Old examples foretell the problems newer examples will create. The federal government recently imposed extra taxes on cars and aircraft costing more than $100,000 and boats costing more than $250,000. Inadequate thought about how to apply these taxes has made them a major headache for many retailers and businesses. Inflation and cost-increasing regulations on motor vehicles will push many more (including many zero emission vehicles) above the $100,000 threshold in future. This Shadow Budget would index all of the above-mentioned thresholds to inflation starting in 2023, and institute an exhaustive review of the federal tax system with the objective of identifying and indexing all relevant thresholds to inflation. This measure will reduce federal revenues by $0.1 billion in the first year, rising to $0.3 billion annually by the end of the projection period.

Let Canadians Save More for Retirement

Current limits on saving in defined-contribution pension plans and RRSPs assume that the cost of providing a dollar of income in these plans is nine times the rate at which benefits accrue in a typical defined-benefit pension plan. But increases in life expectancy and lower yields on safe investments have dramatically increased the cost of providing a dollar of income in retirement since those limits were established. A more realistic equivalency measure would now be around 15 (Robson 2017). To reduce the disadvantage this tax provision creates for savers in defined-contribution plans and RRSPs relative to participants in defined-benefit plans, this Shadow Budget would raise the limit for contributions to these plans by three percentage points of income per year – from the current 18 percent to 30 percent of earned income – over four years. The fiscal cost of this measure, on a present-value basis, would likely be small.

Let Canadians Save Longer for Retirement

Canadians must stop contributing to, and start drawing down, tax-deferred saving in the year they turn 71. This age limit is too low. It discourages Canadians who would like to work and/or save longer, and increases the likelihood that retirees will exhaust their savings in these accounts. This Shadow Budget would raise the age at which contributions to tax-deferred retirement saving schemes must end to 72, beginning at the start of the next calendar year. The age will increase one further month at six-month intervals thereafter. The resulting reduction in federal revenue will be small on an annual basis, and negligible on a present-value basis.

Reduce Mandatory RRIF Withdrawals

This Shadow Budget would lessen the requirements for older Canadians to draw down tax-deferred savings. The 2015 federal budget’s reduction of mandatory minimum withdrawal amounts from RRIFs and similar tax-deferred accounts reduced the risk that many Canadians would outlive their savings. Since then, however, longevity has increased further, and real yields on safe investments have fallen. The mandatory minimum withdrawals put many Canadians at risk of running out (Robson and Laurin 2015). This Shadow Budget would institute an immediate one-percentage-point reduction of minimum withdrawals mandated for each age, beginning with the 2023 taxation year. The reductions in federal revenue will be small on an annual basis, and negligible on a present-value basis.

Allow Life Annuities to Be Held in TFSAs

This Shadow Budget would make it possible to buy annuities within a Tax-free Savings Account (TFSA). Annuities are a valuable tool for people who have saved for retirement to insure against outliving their savings. When an RRSP holder buys an annuity with savings in an RRSP, the investment-income portion of the annuity continues to benefit from the tax-deferred accumulation that applied to the RRSP. But TFSA holders cannot buy annuities inside their TFSAs, which means that they end up paying tax on money intended to be tax free. This difference disadvantages people who would be better off saving in TFSAs, and discourages a much-needed expansion of the market for annuities in Canada (Laurin 2019). This Shadow Budget proposes to allow purchases of annuities – including the advanced life deferred annuities introduced in the 2019 budget and variable payment life annuities (VPLAs) – within a TFSA. In addition, VPLA providers, in particular, should be allowed to structure VPLAs as a standalone financial product in which critical scale could be achieved through pooled investments from different saving vehicles, including smaller DC plans and group RRSPs. The cost implications of this measure would be small.

Provide a General Investment Tax Credit

Canada’s stock of machinery and equipment and intellectual property (IP) products has been growing more slowly than the labour force for years (Robson and Bafale 2022), undermining productivity and wages, and causing forecasters, including the Bank of Canada and the OECD, to mark down their growth projections. This Shadow Budget would implement a temporary general investment tax credit, applying to all investments in depreciable assets, including intangibles, at a rate of 5 percent. It would come into effect on April 1, 2023, and run until April 1, 2025. Its temporary nature would encourage early investment and its neutrality means managers themselves would decide on what types of capital they need and what types of activities they pursue. Its net cost over the projection period would be some $23.5 billion.

Lower the Corporate Income Tax Rate

Canada is losing its competitive edge in business taxation, particularly against the United States following the sharp reduction in US corporate tax rates in 2018 (Bazel and Mintz 2017; McKenzie and Smart 2019). These lower US rates not only encourage businesses to locate more of their profit generating activity in the US, but also provide an incentive to allocate more profit to the US and less to Canada. A series of recently enacted and proposed new Canadian tax rules, such as overly broad restrictions on the inter-corporate dividends-received deduction and proposed limits on the deductibility of interest and financing expenses by large firms exacerbate this problem. This Shadow Budget takes a different tack. It would reduce the corporate income tax rate by two percentage points, from 15 percent to 13 percent, starting in 2026, after the impact of the temporary investment tax credit outlined in the previous section has faded.

Incentivize Innovation, Adoption and Commercialization

This Shadow Budget would lower the corporate tax rate on income from patents and other intellectual property generated by activity in Canada. This “IP Box” regime would encourage commercialization of innovation in Canada (Goguen 2020, Pantaleo, Poschmann, and Wilkie 2013; Parsons 2011). It would also discourage the migration of IP income to lower-tax jurisdictions, including the many countries that have introduced IP Box regimes.

Support Young, Not Small, Businesses

Canada’s corporate income tax provides a Small Business Deduction (SBD) that reduces the effective tax rate on small firms. While the rationale for the deduction – recognizing that younger and smaller firms do not benefit from some economies of scale available to larger firms – is attractive, the lower tax rate discourages businesses from growing past the point where their taxes would increase. At the same time, the Small Business Deduction encourages self-employed individuals to incorporate to access the lower tax rate. Dachis and Lester (2015) point out that the government, in effect, finances the lower small business tax rate with lower spending or higher taxes elsewhere. If the tax burden on large firms is higher as a result, the SBD is expanding the small-business sector at the expense of large businesses. Since small firms, in general, are less productive, and unambitious firms are almost by definition less productive, this distortion damages Canada’s overall economic performance.

A better approach would be to provide the Small Business Deduction for young, growth-oriented firms rather than simply all businesses that are small. Targeting such young firms would help mitigate the growth-disincentive tax effect (Howitt 2015). Accordingly, this Shadow Budget proposes to tie the Small Business Deduction to firms’ age. At five-year intervals the threshold level of capital assets that qualifies for the Small Business Deduction would rise and the level of the deduction fall, regardless of firm size, until the standard corporate tax rate is reached. These changes would not include previously claimed Small Business Deductions. At the outset of the policy change, mature small businesses will be evaluated on the same terms as newly created firms, providing time to adapt. Safeguards to ensure that businesses cannot roll over their assets to a new company at regular intervals, and to limit fragmentation of business activities or other artificial arrangements using subsidiary or agent companies, will accompany this change. Because this change will require consultations and care to avoid complicated rules, the Shadow Budget anticipates no fiscal impact through the projection period.

Support Startups through Capital Gains

Tax Relief

In addition, to support access to capital for small business growth, this Shadow Budget will exempt from taxation capital gains realized on the sale of certain publicly traded small business shares. Similar to provisions of the US Small Business Jobs Act, investors will qualify for the capital gains tax exemption if they hold qualified small business shares for at least five consecutive years, encouraging the kind of patience needed to grow small and medium-sized enterprises. The holding period will not be retroactive, so this initiative has no fiscal impact during the projection period.

Close the Strike Pay Tax Loophole

An anomalous feature of Canada’s tax system allows some income to escape income tax and to subsidize strikes – likely to be a bigger problem in the next few years, since high inflation fosters labour disputes. Union dues paid by employees are deductible from their taxable income; any returns on those funds invested by the unions escape tax, and amounts paid out in strike pay are not taxable. This tax-free treatment subsidizes activity that harms the Canadian economy (Alarie and Sudak 2006; Kesselman 1999). This Shadow Budget proposes that the government introduce legislation to make strike pay taxable as ordinary income. The revenue impact of the measure would be about $10 million annually.

Provide More Generous Tax Treatment of Medical Expenses

The current medical expense tax credit applies only to expenses exceeding 3 percent of net income or $2,635, whichever is lower, and is calculated at the bottom tax rate. This unfair approach leaves people who pay tax on income they need to cover non-discretionary costs with lower after-tax discretionary income than people without such costs – a key reason why employer-paid health premiums are exempt from tax. In view of the extra health-related costs many Canadians now face, the current credit is also inadequate. This Shadow Budget would lower the threshold on such expenses to 1.5 percent of net income, or $1,318, whichever is lower. This change would help people who cover medical costs directly or through health-related insurance premiums. The estimated fiscal cost of this measure is $500 million per year.

The income tax regime’s age credit is an arbitrary measure – a younger person might have needs as great as, or greater than, those of an older person with a similar income – and the looming increase to OAS for older seniors bolsters the case for rationalizing it. The increase in the medical expense tax credit in this Shadow Budget would help older Canadians who face medical expenses. This Shadow Budget would also reduce the base amount of the age credit from $8,396 to $4,000. This measure would save about $2.5 billion annually.

Phase Out the Tax Credit for First-Time Homebuyers

This Shadow Budget would phase out the tax credit for first-time homebuyers. This subsidy increases house prices and induces households to take on excessive debt. Phasing it out would save about $130 million annually.

Eliminate the Tax Credit for Labour-Sponsored Venture Capital Corporations

The tax credit for labour-sponsored venture capital corporations (LSVCCs) distorts saving and investment, and is an inefficient way of spurring innovation (Fancy 2012). The Shadow Budget would eliminate the LSVCC, which would improve the federal government’s bottom line by about $200 million annually.

Withdraw Counterproductive Tax Proposals

Equally important to growth and fiscal stability is avoiding counterproductive initiatives. This Shadow Budget would withdraw three.

The federal government proposes to limit the deductibility of interest and financing expenses incurred by large firms in computing their income for tax purposes (the so-called “EIFEL” proposals). A consultation draft of the legislative proposals for these extremely complex rules was released in November 2022, with comments due January 6, 2023. Tax experts identified a host of anomalies and other problems based on an earlier draft of these proposals.

Limits on interest deductions will generally raise the cost of capital to the firms affected, deterring investment (Mintz 2020). The proposed rules would also distort investment decisions, exacerbating an existing tilt in favour of assets that depreciate rapidly, and against assets with longer lives (Bazel and Mintz 2021).

Furthermore, with regard to inbound investments, the limits on interest and financing expenses effectively duplicate already existing tax rules that protect the Canadian tax base, such as the “thin capitalization” rules, the “foreign affiliate dumping” rules and Canada’s transfer pricing rules (the government is already studying potential enhancements of these rules). The EIFEL rules would limit the ability of Canadian tax-exempts, such as pension funds, to strip income out of taxable entities through interest charges, but this could be addressed through a much more targeted rule. This Shadow Budget would withdraw the proposed EIFEL rules.

The government has recently introduced two special taxes on large financial institutions. These industry-focused taxes are bad in principle – driven by populist impulses rather than economic logic. Their costs will fall mainly on Canadian consumers of financial services, and they will distort activity, putting Canadian financial institutions at a competitive disadvantage (Kronick and Robson 2022). They also make no practical sense – what do Canadians gain by increasing the costs of financial services such as mortgages and health insurance when economic and post-pandemic challenges are already pushing costs up? This Shadow Budget will cancel these taxes.

The 2022 Fall Economic Statement announced that the government would introduce a tax on share buybacks in the 2023 budget. This proposal also reflects populist impulse rather than economic logic. It is modelled on a US tax that has generated enormous regulatory uncertainty and complexity during the six months it has been in place. The equity in companies belongs to shareholders: imposing a charge on withdrawals of equity will make investors reluctant to put equity in, which will raise the cost of capital and discourage investment. This Shadow Budget will not proceed with this measure.

Tying It Up

Supporting economic growth and restoring fiscal capacity are critical and complementary tasks. This Shadow Budget addresses both, with measures that will support the private and not-for-profit sectors immediately and in the long run, and reduce the likelihood that future fiscal pressures will force unfair and growth-suppressing tax hikes.

Table 3 shows the impact of the measures in this Shadow Budget out to fiscal year 2027/28. These measures would put the federal government on a path to budget balance within two years and, extrapolating past the five-year budget horizon, on a path to restore its debt-to-GDP ratio within ten years to its pre-pandemic level, when Canada boasted relatively strong public finances. A lower debt ratio would instill confidence in Canadian governments’ creditworthiness, limiting upward pressure on interest rates and payments. A prompt end to budget deficits would end the erosion of the federal government’s service capacity, and encourage greater discipline in fiscal decisions.

This Shadow Budget’s combination of measures to limit the federal government’s claims on the economy and make Canada’s taxes less damaging will enhance the performance of the economy in the medium and longer term. It shows fresh respect for fiscal transparency, and for the ability of Canadian households and businesses to manage their affairs and make sensible choices. It will restore the federal government’s fiscal capacity to manage short-term setbacks and provide sustainable services over the long term. We encourage federal legislators to support the measures in the C.D. Howe Institute’s 2023 Shadow Budget.

REFERENCES

Alarie, Benjamin, and Matthew Sudak. 2006. “The Taxation of Strike Pay.” Canadian Tax Journal (54)2.

Aptowitzer, Adam. 2017. “No Need to Reinvent the Wheel: Promoting Donations of Private Company Shares and Real Estate.” E-Brief 265. Toronto: C.D. Howe Institute. September.

Bazel, Philip, and Jack Mintz. 2017. “Tax Policy Trends: Whether It Is the U.S. House or Senate Tax Cut Plan – It’s Trouble for Canadian Competitiveness.” Calgary: University of Calgary, School of Public Policy. November.

______. 2021. “The Surprising Investment Impacts from Limiting Net Interest Deductibility.” Intelligence Memo. Toronto: C.D. Howe Institute. June.

Bergevin, Philippe, and William B.P. Robson. 2012. More RRBs, Please! Why Ottawa Should Issue More Inflation-Indexed Bonds. Commentary 363. Toronto: C.D. Howe Institute. September.

Brown, Robert L., and Shantel Aris. 2017. Greener Pastures: Resetting the Age of Eligibility for Social Security Based on Actuarial Science. Commentary 475. Toronto: C.D. Howe Institute. April.

Boadway, Robin, and Thorsten Koeppl. 2021. The “Demand Stabilization Mechanism”: Using Temporary GST Cuts as Automatic Fiscal Policy. Commentary 612. Toronto: C.D. Howe Institute. November.

Boadway, Robin, and Jean-François Tremblay. 2016. Modernizing Business Taxation. Commentary 452. Toronto: C.D. Howe Institute. May.

Canada. 2022a. “Fall Economic Statement.” Ottawa: Department of Finance. November.

______. 2022b. “Budget 2022.” Ottawa: Department of Finance. April.

Canadian Climate Institute. 2022. Damage Control: Reducing the Costs of Climate Impacts in Canada. Ottawa. September.

Dachis, Benjamin, and John Lester. 2015. Small Business Preferences as a Barrier to Growth: Not so Tall After All. Commentary 426. Toronto: C.D Howe Institute. May.

Dahlby, Bev, and Ergete Ferede. 2011. What Does It Cost Society to Raise a Dollar of Tax Revenue? Commentary 324. Toronto: C.D. Howe Institute. March.

Fancy, Tariq. 2012. “Can Venture Capital Foster Innovation in Canada? Yes, but Certain Types of Venture Capital Are Better than Others.” E-Brief 138. Toronto: C.D. Howe Institute. September.

Goguen, Siobhan. 2020. “Canada’s Post-Pandemic Tax Policy: Encouraging Growth Through Innovation in Canada.” Perspectives on Tax Law & Policy 1(3). Toronto: Canadian Tax Foundation. September.

Howitt, Peter. 2015. Mushrooms and Yeast: The Implications of Technological Progress for Canada’s Economic Growth. Commentary 433. Toronto: C.D Howe Institute. September.

Kesselman, Jonathan R. 1999. “Base Reforms and Rate Cuts for a Revitalized Personal Tax.” Canadian Tax Journal 47 (2): 210–41.

Kronick Jeremy, and William B.P. Robson. 2022. “The Economic Perils of Federal Tax Hikes on Banks and Insurers.” C.D. Howe Institute Intelligence Memo, October 4.

Lahey, James. 2011. “Controlling Federal Compensation Costs: Towards a Fairer and More Sustainable System.” In How Ottawa Spends, 2011-2012, eds. Christopher Stoney and G. Bruce Doern, 84–105. Montreal; Kingston, ON: McGill-Queen’s University Press.

Laurin, Alexandre. 2019. “TFSAs: Time for a Tune-Up.” E-Brief. Toronto: C.D. Howe Institute. December.

Laurin, Alexandre, and Donald Drummond. 2021. “Rolling the Dice on Canada’s Fiscal Future.” E-Brief. Toronto: C.D. Howe Institute. July 29.

Lester, John. 2021. Who Will Pay for the Economic Lockdown? Commentary 594. Toronto: C.D. Howe Institute. March.

______. 2022. “An Intellectual Property Box for Canada – Why and How?” E-Brief 326. Toronto: C.D. Howe Institute. April.

Mahboubi, Parisa. 2019. Intergenerational Fairness: Will Our Kids Live Better than We Do? Commentary 529. Toronto: C.D. Howe Institute. January.

Mintz, Jack. 2020. “Adjusting to Reality: As Proposed, Restricting Corporate Interest Deductibility is Ill- Advised.” E-Brief. Toronto: C.D. Howe Institute. April.

Pantaleo, Nick, Finn Poschmann, and Scott Wilkie. 2013. Improving the Tax Treatment of Intellectual Property Income in Canada. Commentary 379. Toronto: C.D. Howe Institute. April.

Parsons, Mark. 2011. Rewarding Innovation: Improving Federal Support for Business R&D in Canada. Commentary 334. Toronto: C.D. Howe Institute. September.

Robson, William B.P. 2017. Rethinking Limits on Tax-Deferred Retirement Savings in Canada. Commentary 495. Toronto: C.D. Howe Institute. November.

Robson, William B.P., and Alexandre Laurin. 2015. “Drawing Down Our Savings: The Prospects for RRIF Holders Following the 2015 Federal Budget.” E-Brief. Toronto: C.D. Howe Institute. July.

Robson, William B.P., and Mawakina Bafale. 2022. Decapitalization: Weak Business Investment Threatens Canadian Prosperity. Commentary 625. Toronto: C.D. Howe Institute. August.

Wyonch, Rosalie, and William B.P. Robson. 2019. Filling the Gaps: A Prescription for Universal Pharmacare. Commentary 544. Toronto: C.D. Howe Institute. June.