The Study in Brief

-

A surging population of seniors. A surging demand for their care. And constrained government financial resources. That is the conundrum Canada faces in the years ahead. Solutions are needed quickly to increase capacity and services for seniors, especially those most in need.

-

This Commentary examines the availability of different housing and care options for seniors, the costs of providing care in different settings, and government policies that subsidize support services in homes, retirement communities, and long-term care.

-

Across the country, more than $1 of every $4 of provincial government healthcare spending goes to caring for people over 75 years of age. Despite significant growth in total healthcare spending on seniors, per capita spending has declined in some provinces, showing that there is extremely limited fiscal capacity to increase spending per senior.

-

Gaps exist in current policies. Notably, seniors with below-median incomes and those who rent rather than own their homes face affordability challenges that are a potential barrier to accessing retirement homes and other support services. Further, there is unmet need for home care across Canada, which invests less in home and community care than other OECD countries.

-

Among the key recommendations: (i) provinces should invest in public home and community care while also considering mechanisms to expand the private provision of these services; (ii) Ontario and other provinces should consider similar policies to Quebec, which provides a refundable tax credit for senior renters to access retirement homes services and, more generally, use tax credits and other market mechanisms for increasing the supply of retirement home spaces; (iii) current capacity and fiscal constraints mean that expanding both publicly and privately funded options along the continuum of care will be necessary to ensure that seniors can maintain a high quality of life.

The author thanks Tingting Zhang, Gherardo Caracciolo, Mawakina Bafale, Don Drummond, Fred Horne, John Yip and anonymous reviewers for helpful comments on an earlier draft. The author retains responsibility for any errors and the views expressed.

Introduction

As Canada’s aging population continues to grow, there are concerns about the financial and physical capacity to meet its growing care needs. Seniors’ need for housing and care is a complex issue involving many government policies and, therefore, government has many avenues for the exertion of control and adjustment over the issue. Much room for improvement is evident in the quality of, capacity for, and financial support for meeting these needs. This analysis provides a summary of the challenges and gaps in the current state of senior support policies and provides insights to inform future policy.

This Commentary examines the household spending patterns of seniors, the availability of different housing and care options, the costs of providing care in different settings, and government policies that subsidize support services in homes, retirement communities, and long-term care. The results show that the availability and costs of different services and types of care vary significantly across the country. In particular, seniors with below-median incomes face affordability challenges related to shelter costs, with these costs becoming a potential barrier to access to retirement homes and other support services if not publicly available. Further, there is unmet need for home care across Canada, which invests less in home and community care than other OECD countries.

To ensure there is adequate capacity to provide care for high-needs seniors, provinces should invest in expanding home and community care and prevention. Previous research has shown that about 30 percent of entries to long-term care homes (LTC) could be delayed or prevented (CIHI 2017). Investing in expanded home and community support services and providing financial supports for low-income seniors to access the care they need where it is most appropriate, can reduce the demand for more intensive (and expensive) LTC or hospital care. There are waitlists for LTC, and “alternate level care” seniors occupying hospital beds, which contributes to higher costs, lower hospital capacity for other treatment, and lower quality of life and declining health for the affected seniors. In addition, a significant proportion of below-median-income seniors face housing affordability challenges. Ensuring housing needs are appropriately met can improve the quality of life of seniors and prevent premature entry into higher levels of care. Differences in the availability of services and how they are funded across the country can inform strategies to improve accessibility and capacity. Notably, Quebec has more seniors’ care spaces, lower vacancy rates and lower rent charges than other provinces, while providing comparatively more support to senior households through tax credits.

Overall, limited fiscal capacity, growing demand due to demographic aging, and the growing costs and complexity of care needs for aging seniors all present a significant conundrum for policymakers. There is a daunting challenge in determining the appropriate level of support, ensuring it is well targeted, and allowing for seniors to choose what is best for them. Government policies should encourage seniors to remain independent as long as possible, but also ensure they have adequate financial resources and access to support services if they are required.

There are multiple options for housing accommodations as seniors age, and the choice will depend on their preferences, families, level of need, and the affordability and accessibility of the various options. This section discusses the different care needs that seniors might have as they age. It also illustrates the continuum of care: seniors choosing assisted/supportive living accommodations or receiving home care will have a range of needs, and care must be flexible enough to suit an individual’s needs.

Activities of Daily Living (ADLs) are a set of essential everyday tasks and activities that individuals typically need to perform to live independently and maintain their overall well-being. These activities are often used in healthcare and long-term care settings to assess an individual’s functional abilities and to determine their level of independence. When someone experiences limitations in one or more of these areas, they may require varying degrees of assistance or care, ranging from minimal support to full-time care. Health professionals use ADL assessments to develop care plans and tailor assistance to meet an individual’s specific needs and promote their overall quality of life. The specific ADLs may vary slightly in different contexts, but the core activities are as follows.

-

Personal hygiene and grooming: including bathing/showering, caring for teeth, medication management, etc.

-

Dressing: choosing appropriate clothing and putting it on independently.

-

Eating: feeding oneself and preparing simple meals.

-

Mobility and transferring: being able to walk, get in and out of bed, or independent transferring from one surface to another (such as from a bed to a wheelchair).

-

Toileting and continence: The ability to get on and off the toilet, maintain personal hygiene, and manage incontinence, if necessary.

-

Medication management: the ability to follow medical care plans without the need for assistance or reminders to take necessary medications.

-

Instrumental Activities of Daily Living: activities that are not essential to basic self-care, but are crucial to independent living in a community such as managing finances, planning and preparing meals, doing laundry, going shopping for essential items, etc.

Notably, most of the ADLs have little to do with direct healthcare needs. Instead, they are a set of daily activities that could be provided by different types of support services including meal delivery, housekeeping, laundry services, and social activities. Seniors requiring support with some ADLs could benefit from one or more support services, even if they do not have advanced healthcare needs. Healthcare is an important component of supporting seniors to remain independent, however, many of the activities that are required for independence fall outside the traditional scope of healthcare.

The options for support available to seniors are directly related to their care needs. Those who are able to live independently can choose their accommodations based on lifestyle and preferences. Those requiring occasional or minimal assistance can remain in their homes and receive help from family, other informal caregivers, and possibly publicly funded home and personal care services, or they could choose to privately pay for some services such as regular housekeeping or food delivery services. They might also choose to move to a retirement home or community where meals and other services are provided, as well as ongoing opportunities for socialization. As care needs become more intensive, seniors may require ongoing or live-in support from a combination of public or private home and nursing care services, family, or an informal caregiver at home. In the retirement home setting, there are many options to address increasing care needs. However, as care needs become greater, affordability plays a factor in how long a senior might stay in a retirement home before moving to LTC where care needs are generally fully subsidized by government, and room and board charges are limited by regulations.1

At home, those requiring hands-on or total assistance require significant and ongoing care. At this stage, a caregiver must be available at all hours to assist with many basic ADLs, and the options for care become more limited. Those without an available caregiver in the home will likely be best served by residing in long-term care homes that have health providers on site at all times of day. Depending on their health conditions, hospice and palliative care might also be appropriate for end-of-life care. Increasing numbers of retirement homes are offering heavy care and dementia care services, and publicly funded home care can be accessed to supplement some of the costs. This still, however, presents a significant financial burden to seniors. Often, even though a retirement home can safely and appropriately meet the care needs of a senior, LTC becomes the preferred option. Most often, this is because of the cost differential between what the government will subsidize in a LTC setting versus the limited home-care services available to offset privately paid retirement home care costs.2

Availability and Options for Care Based on Needs

The options for care and assistance with ADLs reflect progressive levels of need. As care needs become more intense, the options become more limited (and/or costly). Those requiring ongoing care can choose to live in a long-term care home, or might be able to remain in a residential setting – home, retirement home, assisted living facility – if they and their families have the resources to supplement publicly provided services, and if the appropriate services are available privately. Of course, those that are independent have a full range of choices for where they might want to live, except those places reserved for people with higher care needs. More than three-quarters (78 percent to 91 percent) of Canadians would prefer to receive care while continuing to live in their homes as they age, but only one-quarter (26 percent) expect that they will be able to do so (Sinha 2020, March of Dimes 2021). The different types of seniors’ accommodations and short-term respite care programs are described in Box 1. It is important to note that there is overlap between many care options and levels of need – two seniors with similar care needs might use different combinations of services. This is particularly the case for people with minimal to moderate needs for support. Similarly, the options will vary in terms of availability and costs depending on the location, the ownership and operation models of the different residences, and the level of public coverage and involvement in different levels of care. The next section provides a summary of the availability and costs of various seniors’ living arrangements across the country, focusing on provinces with larger populations (BC, Alberta, Ontario and Quebec).

There are 2,076 long-term care homes in Canada. At first glance, LTC in Canada appears to have a comparable amount of beds and financial resources in comparison to international peer countries. Canada has close to the average number of LTC beds relative to the size of the senior population, but still fewer than countries such as New Zealand, Finland, Germany, and Switzerland. It also has a comparable proportion of the senior population receiving LTC care and homecare, relative to international peers (Wyonch 2021). It spends more per capita than the OECD average on funding LTC but spends less than other OECD countries as a proportion of GDP. The GDP proportion of health spending for inpatient LTC is above average (Wyonch 2021).

Despite higher-than-average spending, there are long waitlists for LTC in many Canadian provinces. In Ontario, there were, as of Oct. 2022, almost 40,000 seniors waiting for LTC, and 76,000 receiving care; this means the waitlist currently exceeds 50 percent of care capacity (OLTCA).3

The median wait time was 130 days in 2021/22 (213 days for entrants from the community, and 80 days for hospital entrants) (HQO). In Quebec, the waitlist is much smaller (4,235 as of June 2023). However, seniors might still wait up to two years for a placement (Bonjour Résidences).

The cost of long-term care varies across provinces, but charges payable by the resident to cover room and board are generally standardized by regulation within each province. For example, in Ontario the maximum monthly co-payment for LTC is $1,986.82 – $2,838.49 depending on whether the room is shared or private. In Quebec, room and board charges for public and contracted private long-term care homes (CHSLD or centre d’hébergement et de soins de longue durée) are $1,294.50 - $2,079.90, depending on the type of room. Quebec also has unsubsidized (uncontracted) private CHSLD, where the average monthly costs are between $5,000 and $8,000, depending on resident’s needs (Bonjour Résidences).4More than half of LTC homes (54.4 percent) and the majority of retirement homes are privately owned and operated. There is no consistent ownership pattern across the country: in five provinces, the majority of LTC homes are privately owned and operated, with the other provinces having majority public ownership. All LTC homes in the Territories are publicly owned. Both publicly and privately owned LTC homes provide ongoing care for some of the most vulnerable members of society. At both public and private LTC homes, healthcare is publicly funded and most support services will be included in room and board rents. Seniors must require significant care to qualify for LTC.5

Individuals requiring support who don’t have a caregiver in the home are much more likely to be admitted prematurely to LTC homes. Indeed, about one in nine new entrants could potentially have been cared for at home or in a retirement home setting. These new residents are more likely to have previously lived alone or in a rural area where formal and informal supports are less likely to be available (CIHI 2020b).

Retirement homes offer a wide variety of services and programs targeted at different client types. These include those who are fully independent and wish to live in a congregate setting for the lifestyle and social benefits, those with mild to moderate care needs, those with heavier care needs, and those who require specific dementia care programs and supports. In Ontario, for example,15 percent of homes provide dementia care, 34 percent provide assistance with feeding, and the majority provide services to assist with other ADLs (Roblin et al. 2019). Prices of retirement home care vary significantly by location, as well as by amenities and services offered as they are market driven (and are not generally directly government subsidized). Various provinces have senior rental accommodations that provide care needs: in Quebec the services are called “seniors’ residences”; in BC “assisted living”; in Ontario “retirement homes”; and in Alberta, “supportive living.”

Many retirement homes offer more extensive health and personal care services. These additional services increase costs for seniors since they are either charged as additional services or will be incorporated into higher room and board costs. In Ontario, if these additional services are provided by the retirement home, the additional services are not directly publicly subsidized. In some cases, residents in retirement homes might also receive home care or assisted living support that is provided by a separate agency, either publicly or privately. Most retirement homes are privately owned and operated. Their activities and levels of care provision are regulated by provinces, but prices will be determined by market factors and the amenities and services offered in each location.

In Ontario, retirement communities are regulated by the Retirement Homes Act, 2010 (RHA), and are licensed and inspected by the Retirement Homes Regulatory Authority (RHRA).6Each retirement community can offer up to 13 care designated services, for example, assistance with dressing and personal hygiene, medication management, and providing meals. Services might also be publicly provided through home care. About half of seniors currently living in retirement homes have care needs that would qualify them for publicly provided home and community care. Home care services supplement the care services in the retirement home at no cost to the resident and assist with affordability of the retirement living option for seniors with care needs.

In Quebec, private seniors’ residences are rental facilities that are mainly occupied by people over 65, and offer various services such as nursing care, meal services, housekeeping, and recreation. Private seniors’ residences must hold a certificate of compliance from the Government of Quebec ensuring they comply with health and safety rules. Similarly, in Alberta, the provincial government sets accommodation standards for supportive living facilities. Supportive living operators require a licence if they provide accommodation and support services to more than three people, provide meals or housekeeping services, and arrange for safety and security services. Alberta also has Designated Supportive Living where access is determined by an assessment by a health professional, room and board charges are determined by the Alberta government, and accommodations provide 24-hour publicly funded health and personal care services on site.

In British Columbia, retirement homes are divided into categories: independent living, and assisted living.7Assisted living is divided into three classes: i) seniors and persons with disabilities who have chronic or progressive conditions, ii) mental health care, and iii) substance use care. Assisted living residences provide housing, hospitality services and support services, and they may be privately paid, publicly subsidized, or a combination of both. Independent living seniors’ residences are essentially retirement homes targeted to seniors who need minimal assistance and are not generally publicly subsidized. For seniors requiring assistance, assisted living spaces are publicly subsidized based on income: a maximum of 70 percent of after-tax income goes to housing and support services in assisted living. However, there is a minimum fee of $1,093.50 per individual ($1,665.60 per couple) and maximum monthly rate for publicly subsidized assisted living is based on market rates for rent and hospitality services in the same geographic area.

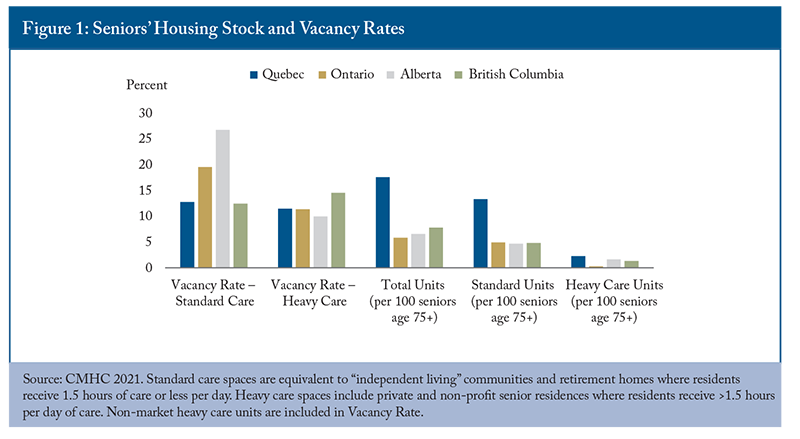

Though individual retirement homes and assisted living facilities might have waitlists, there are fewer concerns about overall capacity. Across provinces, both standard and heavy care spaces are at least 10 percent vacant (Figure 1).

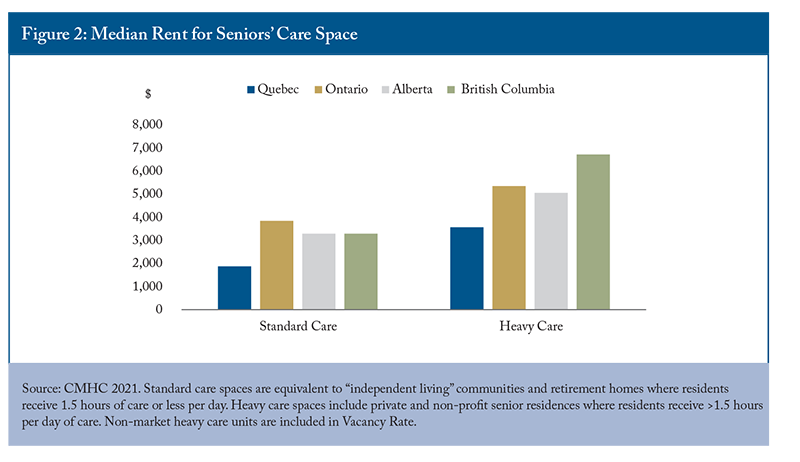

Alberta has the highest vacancy rate for standard care spaces (26.8 percent) and the lowest vacancy rate (10 percent) for heavy care spaces, suggesting a need to transition some standard spaces to heavy care spaces as the population continues to age and care needs intensify across the senior population. Ontario notably has the fewest seniors’ care spaces relative to the size of the senior population, particularly for heavy care units (3.0 spaces per 1,000 seniors over age 75). A long waitlist for LTC and few spaces for seniors with less intensive – but still significant – care needs suggest a need to expand the number of spaces available for seniors across the care continuum. Notably, British Columbia has the highest vacancy rate for heavy care spaces, despite having relatively few spaces (14.4 per 1,000 seniors over 75). It also has the highest rent among provinces for heavy care spaces ($6,726/month) and the largest increase in rent between standard care and heavy care spaces (Figure 2).

Quebec has more than three times the amount of seniors’ housing spaces in comparison to other provinces, relative to the size of the senior population. It also has the lowest median rent for both standard and heavy care spaces by a large margin. Median rent for a standard care space ($1,873/month) is about half the cost of other provinces, and a heavy care space in Quebec ($3,566/month) costs less than a standard care space in Ontario ($3,845/month).8Quebec having triple the supply but similar vacancy rates to other provinces suggests that lower prices are a result of a significantly higher supply of seniors’ care spaces.

Demand is also likely to be higher in Quebec due to policies that indirectly support private seniors’ residences and LTC through medical expense and home care tax credits.

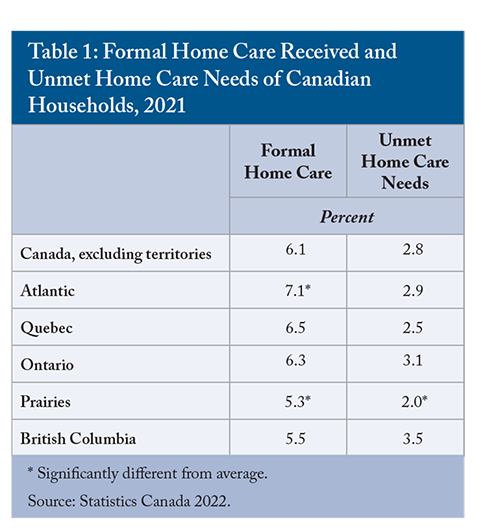

Home care covers a broad range of services, including personal support for ADLs, homemaking services such as housekeeping, laundry services and meal preparation, and can include professional services such as nursing, occupational therapy, or social work. Across Canada, about 6.1 percent of households receive home care services and 2.8 percent of households have unmet home care needs (Table 1). Unmet need is highest in British Columbia and Ontario, and lowest in Quebec and Atlantic Canada. Notably Quebec and Atlantic Canada also have the highest proportion of households receiving home care.

In Ontario, publicly covered services are generally tailored to an individual’s needs and delivered in their residence (a home in the community or retirement home), following an assessment by a case manager or health professional. Services are delivered by third-party agencies that can operate on a non-profit or for-profit basis. In Quebec, seniors can access discounted home help through the Financial Assistance Program for Domestic Health Services program. After approval, seniors receive a discounted hourly rate for various home care and support services provided by qualifying domestic help and social economy businesses.9 Many services provided by home care agencies and domestic help businesses can also be purchased directly through the private market. This option gives a completely free choice of services, without the need to qualify for government assistance, but must be paid for out-of-pocket. In BC, home support services can be purchased privately, or can be publicly subsidized, based on eligibility. If publicly subsidized, home care recipients are charged a daily rate for services, based on their income.1010 In Alberta, home care is narrowly defined as providing medical support for people so they can live in their homes. After an eligibility assessment, services are provided under Alberta Health Care Insurance meaning that if a service is not insured, it is not publicly funded.

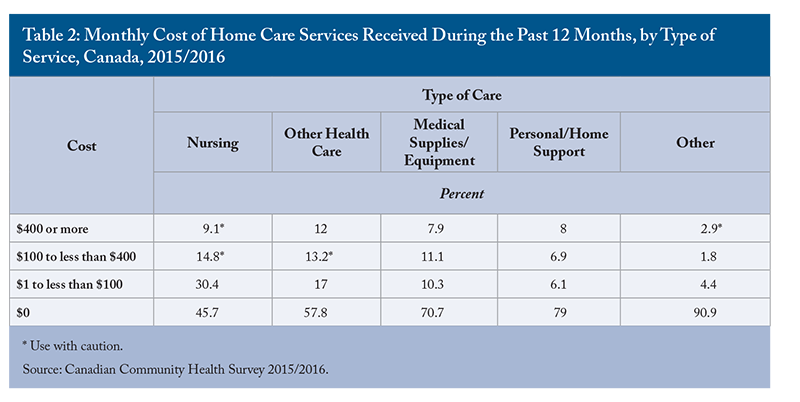

Over half of home care services are paid from government sources (52.2 percent), and 7.3 percent are covered by insurance. More than a quarter (27 percent) are paid for out of pocket (Gilmour 2018). Government sources are more likely to cover health home care services than support services. In 2015/2016, more than half of nursing care services (54.3 percent) and 42 percent of other healthcare services had a monthly cost (Table 2).

In many cases, seniors receiving home care will also receive help from informal caregivers (for example, family members, neighbors, and adult children). Informal care reduces the direct public costs of supporting a senior to maintain their independence in their home, but it can represent economic deadweight loss if informal caregivers reduce their hours of paid work.11In addition to formal in-home services, there are also seniors’ day-programs to provide care throughout the day, and respite care beds for when informal caregivers might need additional support or if the senior needs additional care for a short period of time.

Depending on the jurisdiction, “assisted living” services overlap somewhat with home care and retirement home services, but generally target those with higher care needs.

Assisted living programs are defined differently across the country. In Quebec, “Resources intermediaries” provide housing and access to support services for individuals with minor to moderate loss of autonomy. In British Columbia, Assisted Living provides housing, hospitality, and social and recreational services to adults requiring a supportive environment due to physical and functional health challenges. In Ontario, Assisted Living Services provide support for people with special needs who require services at a greater frequency or intensity than home care, but without the medical monitoring or 24/7 nursing supervision that is provided in long-term care. Services are provided by third-party agencies that operate on a not-for-profit basis. In Alberta, Designated Supportive Living is broken down by levels of service, ranging from 24/7 provision of health and personal care services for those living independently, to providing specialized residential dementia care (AGO 2021).

Assisted living services are generally publicly funded, with limited room and board co-payments when housing is included in services. They are targeted to cover gaps in the continuum of care between independent living options and long-term care, and the services provided can overlap with both to ensure appropriate levels of support are provided and seniors are not prematurely admitted to long-term care.

Inappropriate Care Setting: ALC Patients in Hospitals

Alternate Level of Care patients are people occupying an inpatient bed, but whose needs no longer require acute level care. ALC patients occupy 12.7 to 27.5 percent of beds in acute-care centres across the provinces and represent 15.5 percent of all acute-care bed-days in Canada (excluding Quebec) in 2021-2022 (CIHI 2023). ALC patients are most often admitted to acute care as a result of an injury or illness, but subsequently cannot be discharged home as their clinical condition requires new additional support and/or care services such as home care, transfer to a long-term care facility, or another form of specialized care (rehabilitation, psychiatric or complex). In some cases, ALC patients might be admitted for predominantly social reasons: no acute or rapidly accelerating medical condition is present, but certain circumstances force patients and caregivers to turn to emergency departments (for example, real or perceived failing of social services or lack of adequate community supports) (Durante et al. 2023).

ALC patients represent a complex health system challenge with many contributing factors. Lack of access to preventative and primary care services, or to home care and other social services, can result in patients going to emergency rooms when an alternate level of care would be more appropriate. Similarly, a lack of capacity in home care or long-term care can result in ALC patients remaining in hospitals for extended periods of time. Both scenarios represent an inefficient use of limited (and expensive) hospital resources and constrain capacity to provide acute care. From a financial perspective, each ALC patients represent a cost of $730 to $1,200 per day to Canada’s healthcare systems (Whatley 2020).12

While inefficient spending is concerning, preserving limited acute care bed capacity is necessary to prevent bed shortages and ensure accessibility for Canadians. Canada has fewer hospital beds relative to the size of the population than most OECD countries, and high occupancy rates in acute care beds show that the system is strained. While there is no agreed upon “optimal” occupancy rate, 85 percent is often considered the maximum rate to reduce risks of bed shortages. The average across OECD countries was 69.8 percent in 2021. Canada was one of three countries to have a rate over 85 percent and had the fewest beds per capita in the high-occupancy group (OECD 2023).13If Canada reduced the number of ALC patients and the number of days an ALC patient spends in hospital, it could significantly reduce acute care capacity concerns. A 13 percent reduction in ALC days would be sufficient to bring acute care occupancy down to below the 85 percent occupancy threshold to prevent hospital bed shortages, since ALC patients currently occupy 15.5 percent of capacity.

There are opportunities to reduce ALC patient days, both from within the hospital setting and by improving and expanding community and support services. Increasing the number of seniors’ care spaces, increasing the scope and provision of home care, improving primary care access and ensuring that necessary support services are accessible and affordable for seniors would all alleviate the strain on hospitals by preventing admissions and allowing for more rapid discharge of ALC patients to alternate levels of care. Within hospitals, incentives for physicians, families, and the hospital generally encourage longer than optimal stays. Front-line clinical staff (especially physicians) have strong incentives to avoid conflict and risks resulting from acute-care discharges (Chidwick et al. 2017).14Hospitals in some provinces charge a daily fee to recoup the costs resulting from ALC hospitalizations. The fees are generally equivalent to the daily rates for room and board in LTC, not the full cost of an acute care bed. This means that there is little incentive for seniors or their families to prefer one care setting over the other if a patient is destined for long-term care. The hospital, however, cannot charge patients this fee unless they need continuing or chronic care – destined for more or less permanent institutional care.15Hospitals, therefore, have an incentive to designate ALC patients as chronic and in need of long-term care, so that they can recoup costs. In Quebec, hospitals do not charge fees related to ALC. In that case, seniors and their families have an incentive to prefer hospital care over home care, a retirement home or a long-term care home since these options do have financial costs. Provinces should examine their hospital fee policies related to alternate level care to ensure that clinicians, hospitals, and seniors are not incentivized to provide or receive more advanced healthcare services than are necessary to meet the needs of the patient. Hospitals should also evaluate policies and guidance for clinicians and front-line workers on making discharge decisions to reduce referral to long-term care when it can be avoided.

Addressing the unmet care and housing needs of seniors could significantly reduce the number of ALC patients and their lengths of stay in hospitals. Reducing ALC days and admissions would likely be sufficient to reduce the strain on acute care capacity to levels more comparable to international peers and reduce the risk of bed shortages.

Costs of Providing Seniors’ Care in Different Settings

Different settings and types of service provision, with different public programs and levels of subsidization, make comparison across provinces challenging. In this section, I compare public costs of seniors’ healthcare across the country and provide estimates of the public costs of care provision across different settings in Ontario and Quebec.16

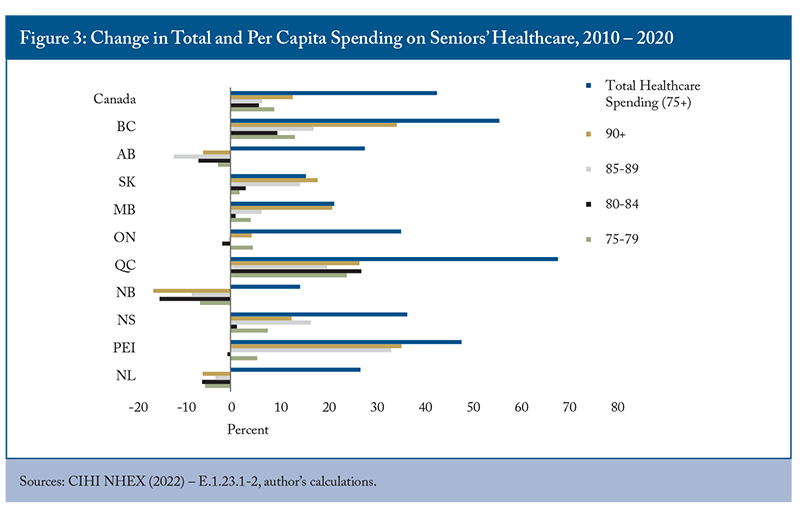

Rather unsurprisingly, per capita health expenditure increases with the age of the population, since older and frailer individuals have increasingly intensive healthcare needs. There is some variability between provinces, with New Brunswick and British Columbia having lower spending per capita on care for seniors. Across the country, more than $1 of every $4 of provincial government healthcare spending goes to caring for people over 75 years of age. From 2010-2020, total provincial and territorial government spending on healthcare for the population over 75 increased by 40.5 percent to $52.77 billion, while total government spending on healthcare increased by 56 percent. In some provinces, increases in seniors’ healthcare spending have been driven by growth of the senior population (ON, NS) (Figure 3). Some provinces have contained these increasing costs by reducing per capita spending on seniors’ healthcare (NB, AB, NFL). In others, both increasing senior populations and increased per capita spending contribute to spending growth (QC, PEI, MB, SK and BC). Only in PEI and BC has spending on seniors’ care kept pace with overall increases in healthcare spending.

Meanwhile, seniors are spending more on their own healthcare and living expenses. In 2019, the average senior household (75+) spent $14,440 on housing and $3,260 on healthcare (Table 2). Healthcare costs have stayed relatively constant in real terms from 2010 to 2019, and increased less than total consumption, though private insurance premiums have increased by 117 percent. Food and shelter costs, however, have become more expensive. Seniors who rent their homes are facing challenges in addition to affordability, with more than half of those in unsubsidized rental units having inadequate, unsuitable, or unaffordable housing (Table 3). As needs increase with age, the cost and availability of options will factor into the lifestyle choices seniors make about where they live.

In Ontario, a senior with high care needs would likely qualify for long-term care or assisted living. If those services aren’t readily available, they might require a stay in hospital as they wait for an assisted living or long-term care bed to become available. Regardless of the care setting, the personal costs are similar.17

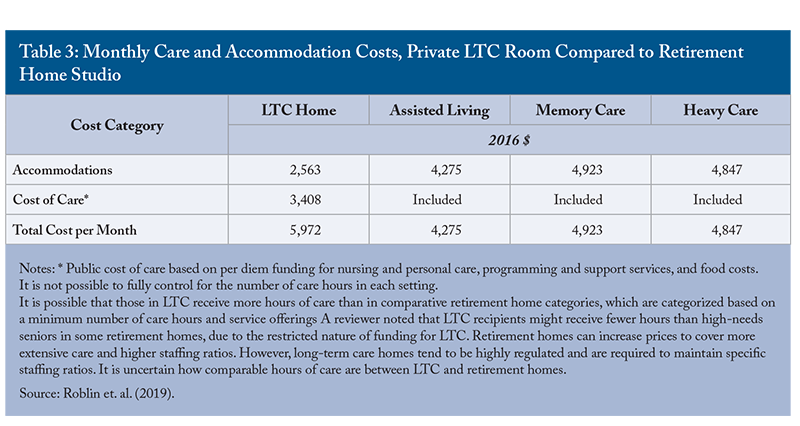

From a public finance perspective, however, there are different costs associated with different levels of care. A hospital stay for someone over 80 years of age ranges in cost from $4,306 to $11,361 per episode of care. Long-term care costs the province $5,870.70 per month per patient, and the average cost of assisted living is about $1,494 per month per patient.18Previous analysis has shown that the total cost of care is lower in heavy care retirement spaces than in LTC, and that public costs are significantly lower due to residents paying privately for services in retirement homes (Table 3). Public spending is lower if people receive advanced care services at home, or in retirement homes, than in long-term care. Hospitals are the worst option. They have the highest public cost and are also a limited resource. Every hospital bed occupied by an alternate level care patient (ALC) carries an opportunity cost and makes the bed unavailable for acute or critical care, or surgical rehabilitation and monitoring.

The picture for high needs patients in Quebec is similar to that in Ontario, but with notable distinctions. There are no private costs for a hospital stay in Quebec, and room and board charges for public LTC range from $1,294.50 per month to $2,079.90. Quebec has private LTC homes that cost residents $5,000 to $8,000 per month, depending on level of care need.19The public cost of a hospital stay for a patient over 80 years of age is higher in Quebec than in Ontario ($5,627-$14,488), as is the level of subsidization of public LTC ($5,837.73 – 9,379.60 per month per client, depending on type of room). There are similar public costs associated with a hospital stay or a month in LTC in Quebec, but the need to preserve scarce hospital resources remains, meaning that from a public cost perspective, the preference would be for high needs patients to be in LTC homes. If the senior can afford it, a heavy care bed in a private retirement home or private LTC home is most beneficial, from a public finance perspective. Research has shown that the government pays 79.7 percent of residential care costs and 81.7 percent of nursing home costs, or about $53,500 per user of a residential care facility and $82,400 per user of a long-term care facility. Comparatively, home care is estimated to cost $7,140 to $23,634 per client, depending on level of care need (Clavet et al. 2022).20

For mild to moderate needs, seniors can depend on informal caregivers, public or private homecare services, nursing services, or they can choose to live in retirement homes offering the services they need. In many cases, some combination of services is required. Home care services in Quebec can be heavily discounted depending on the level of assistance qualified for under the “Domestic Help” program. In Ontario, those qualifying for public homecare services don’t have out-of-pocket costs.21 In both provinces, homecare services can also be acquired privately, in which case there is no direct public cost.22 In both provinces, retirement homes are generally privately owned and operated and offer a variety of services across a spectrum of care needs. In Ontario, the average rent for a retirement home is $3,845 per month, representing a less affordable option when compared to average household costs.23 In Quebec, retirement homes represent a slight savings compared to the average senior household’s expenses.24Quebec has many more senior living spaces than Ontario, relative to the size of the population. It also has a much lower vacancy rate. As discussed in detail in the next section, different tax credits in each province provide different levels and types of support which likely affect both the accessibility of different types of support services and the distribution of seniors’ receiving care in each setting.

Tax Credits to Support Seniors’ Care

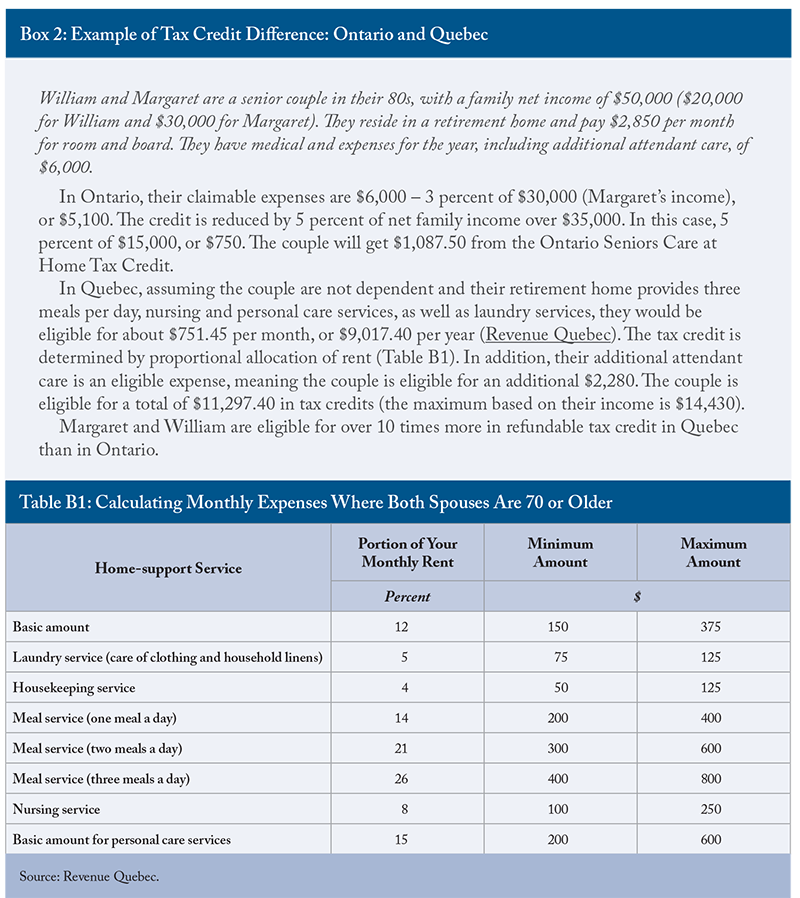

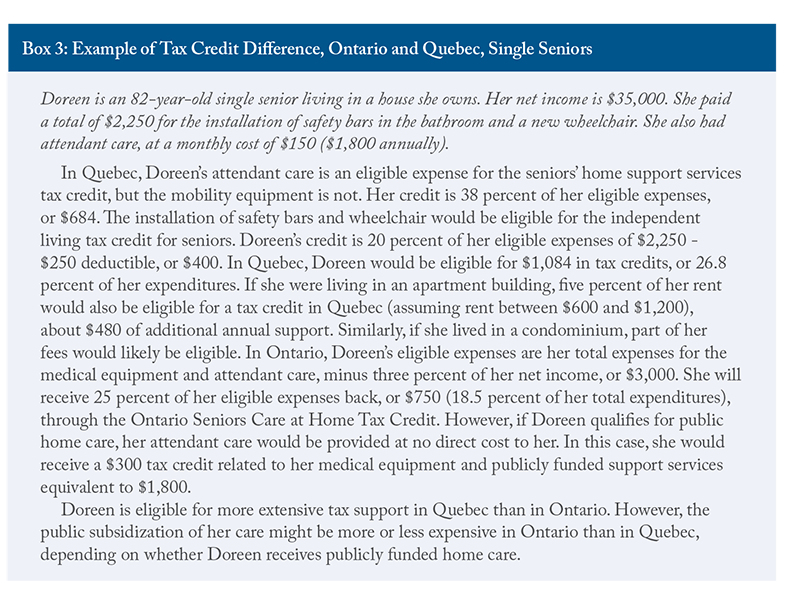

In addition to publicly provided services and subsidies on home and health care services, there are also tax credits that reduce the cost of support services and equipment for seniors. Quebec makes more expansive use of tax credits to support seniors remaining in their homes as they age than Ontario. People over 70 years of age in Quebec can claim up to 38 percent of eligible expenditures through the refundable tax credit for home support services.25 Services eligible for the tax credit include meal preparation or delivery services, nursing care services, home and personal care services (such as housekeepers, landscapers, or aides to assist with bathing, dressing, feeding etc.). For homeowners, only eligible services can be refunded. For tenants, however, a portion of rent can be considered if it includes eligible home support services. Similarly, retirement home residents can claim the portion of their rent that relates to meal preparation and home care services. The total amount that can be refunded takes into account total income, level of dependence, family structure, and the eligible expenses incurred throughout the year. An independent senior could qualify for a maximum of $7,020 in refundable credits based on the maximum service spending of $19,500. Dependent seniors can be eligible for up to $9,180 in refundable credits. The credit is reduced when family income exceeds $69,040.26

In Ontario, residents over 70 years of age can claim up to $1,500, or 25 percent of eligible expenses up to a maximum of $6,000, through the Ontario Seniors Home Care Tax Credit. Eligible expenses fall into several categories including walking aids, hearing devices, wheelchairs, hospital bed for home use, oxygen, vision, dental, or home nursing care. The maximum tax credit is reduced by five percent of family net income over $35,000, meaning about a quarter of households with a member over the age of 75 will qualify for the maximum credit. Claimable expenses are amounts over 3 percent of net income. The Ontario home care tax credit covers both services and equipment but does not allow for rent deductions, while the Quebec credit is for eligible service expenses only. Notably, the level of support provided by the Ontario tax credit is lower than that in Quebec. It covers a smaller proportion of the population and refunds a significantly lower amount. See Boxe 2 for examples of the difference in refundable tax credits for a senior couple in each province.

The federal government and Quebec also offer tax credits for improving home accessibility. The federal home accessibility tax credit is available to people 65 years of age or older, or those with a disability. Eligible recipients can claim up to $10,000 related to renovations or purchasing equipment that improves the accessibility and safety of the home. The renovations must be of an enduring nature and could include wheelchair ramps, walk-in bathing installations, and support bars. Quebec’s tax credit is similar to the federal credit. The Quebec Independent Living tax credit for seniors covers 20 percent of eligible expenses over $250.

There are also tax credits to support informal caregivers. At the federal level and in Ontario and Quebec, immediate family members can claim a tax credit for providing care for a disabled relative. Quebec also offers a refundable tax credit of 30 percent of total expenses for caregivers paying for respite services that provide a short-term replacement for care and supervision of a disabled relative.27

The tax credits available to help seniors stay in their homes are quite expansive, and generally consider age and household income levels. In some cases, the tax credits have restrictive criteria, such as requiring the person receiving care to have a disability, making them more targeted to the population requiring more intensive and ongoing care. In Quebec, the home support tax credits go a step further than in Ontario by including a portion of rent related to services, making retirement home care partially eligible, and by separating tax credits related to devices and services. The tax credits are also available to different age groups: tax credits for home equipment become available at age 65 under federal and Quebec subsidies and are available to those 70 and older in Ontario. Both Ontario and Quebec have reserved tax credit eligibility for home nursing care and other home care services to those age 70 and over. The timing of the availability of tax credits loosely follows the progression of care needs as people age and is targeted at the population in need of assistance – without requiring medical assessments and case managers to determine eligibility.28

However, there is a significant difference in the level of support provided between Ontario and Quebec. As the examples in Boxes 2 and 3 show, the question of whether a senior lives in an owned home or rented accommodations (including retirement homes) significantly changes the level of tax subsidization received in Quebec, but not Ontario. In either case, seniors are likely to qualify for more refundable tax credits to support independent living in Quebec than in Ontario.

Senior Households and Spending Patterns

Developing public policies to support seniors as they age should be informed by seniors’ preferences and levels of need. Some senior households requiring lifestyle or healthcare services have the financial resources to invest in adapting their homes, or to pay for services.

Many seniors are homeowners and have the ability to downsize or transition to a retirement home or other rented accommodations using the unlocked equity to pay for their accommodations or supplement publicly provided healthcare and lifestyle support services. A significant number of senior households, however, face affordability challenges and are in inadequate or unsuitable housing. This section provides a brief overview of the household spending patterns of seniors and their housing needs, with the aim of informing policies that best provide targeted support to seniors most in need.

The Household Spending Survey from Statistics Canada provides insights into the number, composition, and spending patterns of households across the country. According to the 2019 survey data, there were about 1,991,750 households with at least one person over the age of 75, representing 13.5 percent of the total.29 Nova Scotia has the highest proportion of households with seniors (15.24 percent) and Alberta has the lowest (10.77 percent). The data show that while the majority of households with seniors are living within their means, senior households with below-median incomes, and those who rent, are more likely to face affordability challenges or have difficulty accessing adequate and suitable housing.

Most seniors live alone or as a couple (42 percent and 35 percent, respectively). The distribution of seniors among housing types is similar to the rest of the population; a majority live in single detached houses (54 percent) and about 3 in 10 live in apartments or condos. The majority of senior households own their home without a mortgage, and seniors are more likely to own a second property than the population average. The majority of households with seniors depend on government transfers as their main source of income (52 percent), followed by other forms of income (27 percent) and employment earnings (17 percent).30In general, 75+ households have lower spending and consumption than the average household and spend a lower proportion of their income.31 Senior households spend less than the average in all categories except healthcare and custodial services (though they still spend less on household operations overall). Examining average income and consumption patterns across provinces shows that the average household with at least one person over the age of 75 can meet its needs and still reserve about 30 percent of income as savings, a similar rate to households overall.

Averages, however, can mask more worrisome spending and consumption patterns at the lower end of the income distribution. Households with below-median income have consumption expenditures that exceed their incomes.32 Shelter and food costs represent about 46 percent of consumption expenditures across lower-income households in general, and 53 percent for lower-income households with seniors. Shelter costs exceed the 30 percent affordability threshold for below-median-income households with seniors.33 It is difficult to determine the level of need from these data alone, since many seniors have significant savings to support their consumption. Lower-income seniors who do not have significant savings would be more likely to face affordability challenges. Ontario has the lowest spending on shelter for lower-income households with seniors ($8,862), and those households have significantly lower shelter costs than the average across lower-income households in the province.34 In Quebec and Alberta, shelter costs exceed 35 percent of consumption expenditure for senior households. In British Columbia, seniors who rent spend 46.1 percent of their income on shelter.

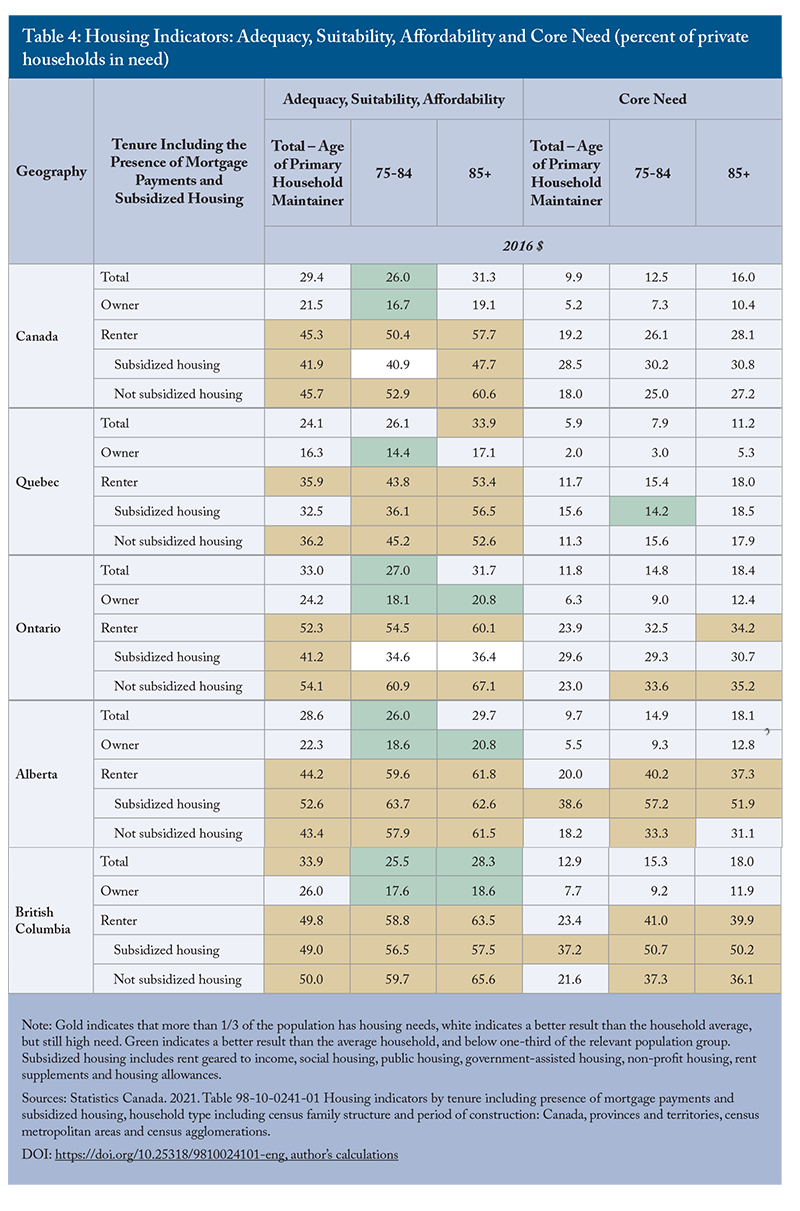

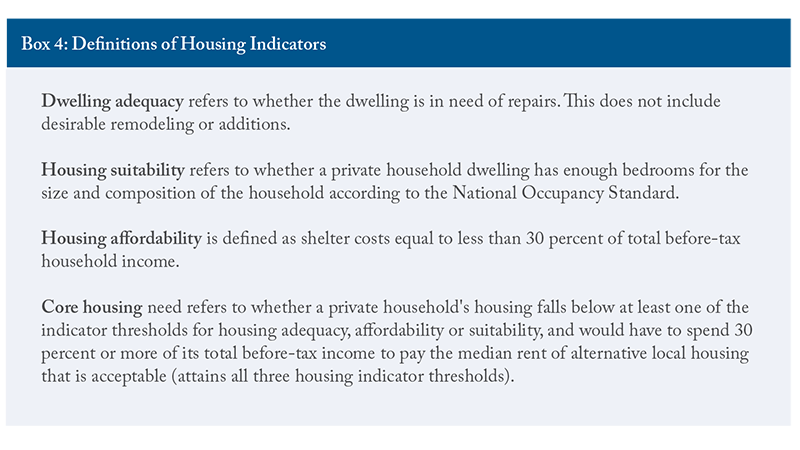

The importance of shelter costs to seniors’ expenditures, particularly below-median income households, warrants further investigation. Statistics Canada’s housing indicators provide further details. Households where the primary maintainer is over the age of 85 generally have higher rates of housing inadequacy, unaffordability, and unsuitability than the average across all households (Table 4). Seniors show higher rates of “core need” housing than the general population (see Box 4 for definitions of housing indicators).

In all major provinces, more than a third of renters are in housing that is inadequate, unsuitable, or unaffordable. There are some challenges related to housing indicators for homeowners. Rates of inadequacy, unsuitability, or unaffordability are generally lower for seniors 75+ than for the overall household average. Those who rent are more likely to face difficulties. Notably, more than a third of senior renters in ON, BC and AB cannot afford to move into more suitable housing.35 Quebec, comparatively, has lower rates of core housing need than the other provinces, suggesting that a higher proportion of households could afford to move to adequate or suitable housing. This implies that Quebec has fewer affordability challenges relative to the other provinces, particularly for renters and seniors, despite similar levels of inadequate, unsuitable, or unaffordable housing.

As seniors age, it becomes more likely that they will downsize housing to unlock equity and/or move to more appropriate housing. Similarly, they might choose to transition to renting accommodations in seniors’ care spaces. Between 2016 and 2021, 36 percent of over-75 households sold their homes (CMHC 2023).36This rate has declined over time, showing that more and more seniors are remaining independent for longer and choosing to remain in their homes as they age. Older seniors are more likely to transition to rented accommodations (including private market rental units, retirement homes and LTC) and are also more likely to require supportive services. Declining rental rates and a higher proportion of seniors owning their homes shows a preference for aging-in-place and shows that many seniors can maintain their independence for longer than seniors in previous cohorts. Most seniors would prefer to age in their homes, but many are concerned that they won’t be able to afford to do so. Some seniors are pooling their resources and investing in shared accommodation and care services (Sylvestre-Williams 2024).

There are also “naturally occurring retirement communities” when the majority of inhabitants of a multi-unit dwelling are seniors, or seniors choose to purchase housing in close proximity to each other. These naturally occurring communities could provide opportunities to improve the efficiency of home and community care services. They also reveal the preferences for housing and support services of seniors with adequate financial resources to be strategic and plan for their desired retirement. This could provide insights for new models of seniors’ care that reduce costs by supporting the independence of lower-wealth seniors and encouraging seniors with means to contribute to the costs of their support services.

Overall, the data on household spending and income show that the average household is able to afford its needs, although spending patterns change with age and require higher healthcare expenditures. In general, 75+ households have lower spending and consumption than the average household.37 Seniors that have below-median incomes, however, are facing affordability challenges similar to other households in the category, particularly with regard to shelter. These insights suggest two important factors to consider in developing seniors’ care and support policies. First, many senior households have sufficient resources to fund some lifestyle support and healthcare services, meaning there could be opportunities to develop markets for seniors’ support services to supplement the under-provision of publicly provided home care. Second, some seniors are facing affordability challenges, meaning targeted support policies that holistically consider housing, support, and healthcare needs could reduce the likelihood that these seniors will prematurely enter long-term care or become ALC patients in hospitals.

Discussion and Policy Implications

A nuanced picture of senior households and the financial, healthcare, and lifestyle supports that encourage their independent living for as long as possible emerges from the foregoing analysis. As Canada’s aging population continues to swell, there are concerns about the financial and physical capacity to meet their growing care needs. The need of seniors for housing and care is a complex issue involving many government policies and, therefore, government has many avenues for action. Much room for improvement exists regarding the quality and capacity of seniors’ care and the financial supports for meeting their needs. This analysis provides a summary of the challenges and provides both insights into the current status of senior’s support policies and facts to inform future policy.

Across the country, more than $1 of every $4 of provincial government healthcare spending goes to caring for people over 75 years of age. Despite significant growth in total healthcare spending on seniors, per capita spending has declined in most provinces, showing that there is extremely limited fiscal capacity to increase spending per senior.

Addressing capacity concerns while limiting the growth in spending will require reconfiguring seniors support policies to encourage maintaining independence as long as possible. At present, there are gaps along the continuum of care that result in under-provision of lower levels of care and support services. This contributes to excess demand on more expensive and capacity-constrained acute care and LTC beds. Having ALC patients waiting in hospitals reduces acute care capacity and increases the risk of bed shortages and, while this represents a significant public cost, it is also not the most appropriate or beneficial place for the person to receive care. Addressing the prevalence of ALC patients in hospitals requires addressing wait lists in LTC, which in turn, requires addressing the complex factors that contribute to early entry to LTC.

Many provinces have goals related to building more LTC beds.38 However, given existing capacity constraints, there will not be enough beds to meet the needs of the growing senior population. Provinces should invest in the continuum of care by investing in home and community care, improving financial supports to low- and middle-income seniors, and encouraging investment in seniors’ care spaces. Canada already spends more per capita on LTC than the OECD average and has a similar number of beds.

Canada spends significantly less than comparable countries on home and community care. Though individual retirement homes and assisted living facilities might have waitlists, there are fewer concerns about overall capacity compared to LTC. Across provinces, both standard and heavy care spaces are at least 10 percent vacant. Across Canada, about 6.1 percent of households receive homecare services and 2.8 percent of households have unmet homecare needs. One in nine new entrants to LTC in Canada could potentially have been cared for at home. These new residents are more likely to have previously lived alone or in a rural area where formal and informal supports are less likely to be available (CIHI 2020b). About one in five (22 percent) seniors who entered residential care between 2011 and 2016 had low-to-moderate priority levels and might have been supported at home (Nuernberger, Atkinson and MacDonald 2018). After identifying subpopulations of seniors for whom community-based supports could have helped delay or avoid admission to long-term care, the ratio increases to about one in three (30 percent) (CIHI 2017).

Meanwhile, many households with seniors face affordability challenges. The analysis of household spending patterns shows that the average senior household can afford its needs. However, seniors that have below-median incomes are facing affordability challenges similar to other households with below-median incomes, particularly for shelter. More than a third of renters are in inadequate, unsuitable, or unaffordable accommodations, and rates of “core need” housing are higher for seniors. As seniors age and their care needs increase, the choice between various options to meet their needs will depend on family structure, wealth, income (which might be a fixed income), and the availability of local services.

Collectively, these observations provide a clear picture of the current challenge. There are capacity constraints in hospitals and LTC, and there is a pressing need for investment in home and community care and other policies to support senior independence. Governments will need to be creative and strategic with their limited funds in order to grapple with the scope of the challenge.

The comparison of costs and policies in Ontario and Quebec provides some lessons for policymakers in providing support along the continuum of care, while also considering fiscal sustainability. Quebec has lower rents and triple the number of senior care spaces compared to Ontario. It also subsidizes retirement home accommodations and home care services through tax credits. It has a shorter waitlist for long-term care than Ontario and a higher proportion of the population receives home care.

Two features of Quebec’s tax subsidies for seniors’ care are particularly beneficial. First, the tax credit is available monthly, meaning it provides ongoing support for managing costs throughout the year, instead of an annual lump-sum payment. Second, it subsidizes the services provided by retirement homes and reduces rent for seniors who do not own their homes. This is important as the analysis of senior household spending and housing patterns shows that seniors who rent are much more likely to face affordability challenges related to shelter costs. The tax credit is generous, covering 38 percent of eligible expenditure, and is sufficient to make retirement homes affordable for most senior households. The maximum credit is $18,870 (for two dependent seniors spending the maximum of $51,000 in eligible expenses), less than half the public cost of a residential care bed. One feature of Quebec’s tax policy that is less desirable concerns the differential subsidy rates for services, compared to home retrofits, mobility aides and medical devices. Research suggests that Quebec’s policy encourages higher use of retirement homes compared to home care (Clavet et al 2022).39 Ontario, by comparison, treats services and devices similarly, but provides a low level of subsidy compared to Quebec. Since homecare and LTC are publicly covered and rents are standardized, but retirement homes are not subsidized, there is a funding gap in the continuum of growing care needs as seniors age. Both a low number of heavy care spaces, and high rents for retirement homes, mean that they are inaccessible to low-and many middle-income seniors.

The public costs of different options, as well as the capacity to provide additional care, need to be considered when forming a policy strategy to meet the current needs of seniors and grow capacity. Ontario and other provinces should consider similar policies to Quebec, which provides a refundable tax credit for senior renters to access retirement homes services that are adapted to their individual needs. Limiting eligibility based on age, household income, and ownership allows for targeting benefits to those that are most in need of financial, health, and personal support.40 British Columbia uses a combination of market factors and subsidies based on income to improve the accessibility and affordability of assisted living residences for lower income seniors while ensuring that assisted living facilities have adequate revenue to operate by linking maximum rent to local housing and service costs. Tax credits and other market mechanisms could be useful tools for increasing the supply of retirement home spaces (particularly heavy care spaces that provide many services similar to publicly funded LTC homes), for boosting capacity to provide more advanced services as the population ages, and for reducing LTC waitlists.

Similarly, provinces should invest in public home and community care while also considering mechanisms to expand the private provision of home care and support services. Most seniors would prefer to remain in their homes as they age. However, both the affordability and availability of services can limit accessibility. Supporting the seniors that are most likely to face these challenges (those who rent or have lower-incomes and assets) improves affordability for many. While this will increase demand for limited home support services, over time the market will respond with increasing supply and improve the total capacity for senior care and support. Since tax credits can differentiate levels of subsidy based on incomes, they provide a flexible framework to target support to those most in need. Home care policy is generally focused on addressing medical and health needs, particularly in Alberta where it is narrowly defined. However, many of the services that support independent living do not require healthcare providers or specialized public programs including meal delivery, housekeeping, and laundry services. Considering the full scope of potentially beneficial services that support seniors’ independent living shows opportunities to expand capacity by leveraging service provision from outside the traditional scope of home care and healthcare services.

Beyond direct tax and subsidy policies, provinces should also holistically consider incentives for providers and seniors along the continuum of care, and modernize policies and risk management practices to favour a “home first” strategy. Presently, various policy mechanisms subtly favour institutional care that is more expensive for government and less desirable for seniors. While controversial, hospital copayments for ALC patients could possibly be extended to include those that can be discharged home, thereby reducing the incentive for hospitals to designate a higher level of care to recoup costs. Administratively, bed-to-bed transfers are simpler than linking patients to community care providers and organizing the various supports. The beds also have similar costs for patients in most cases. Improving the linkages between hospitals and community care organizations, and encouraging front-line providers to consider the full range of potential options in making discharge recommendations – including privately procured home care – could reduce the time ALC patients spend in hospitals and reduce demand for LTC.

Overall, there is a need to balance public costs with providing high-quality care. The solution is to adapt the system to be more efficient while also providing more of the types of care that seniors want. As much as possible, we should design the system to maintain autonomy, provide appropriate levels of support, and be accessible to all seniors. Current capacity and fiscal constraints mean, first, that provinces will have to be creative and strategic with their support and, second, that expanding both publicly and privately funded options along the continuum of care will be necessary to ensure that seniors can maintain a high quality of life as the population continues to age.

References

Clavet, Nicholas-James, Réjean Hébert, Pierre-Carl Michaud, and Julien Navaux. 2022. “The Future of Long-Term Care in Quebec: What Are the Cost Savings from a Realistic Shift toward More Home Care?” Canadian Public Policy 48: 35-50.

Canadian Institute for Health Information. 2017. “Seniors in Transition: Exploring Pathways Across the Care Continuum.” Available at https://www.cihi.ca/en/seniors-in-transition-exploring-pathways-across-the-care-continuum

_____________. 2023. Inpatient Hospitalization, Surgery and Newborn Statistics, 2021-2022. Available at https://www.cihi.ca/en/hospital-stays-in-canada-2021-2022

Canadian Mortgage and Housing Corporation. 2023. Housing Market Insights. https://assets.cmhc-schl.gc.ca/sites/cmhc/professional/housing-markets-data-and-research/market-reports/housing-market-insight/2023/housing-market-insight-canada-m11-en.pdf

Chidwick, Paula, Jill Oliver, Daniel Ball, Christopher Parkes, Terri Lynn Hansen, Francesca Fiumara, Kiki Ferrari et. al. 2017. “Six Change Ideas that Significantly Minimize Alternate Level of Care (ALC) Days in Acute Care Hospitals.” Healthcare Quarterly 20(2): 37-43.

Durante, Stephanie, Ken Fyie, Jennifer Zwicker, and Travis Carpenter. 2023. “Confronting the Alternate Level Care (ALC) Crisis with a Multifaceted Policy Lens.” Briefing Paper. University of Calgary School of Public Policy 16(1). Available at https://journalhosting.ucalgary.ca/index.php/sppp/article/view/76748

Nuernberger, Kim, Steve Atkinson, and Georgina MacDonald. 2018. “Seniors in Transition: Exploring Pathways Across the Care Continuum”. Healthcare Quarterly 21(1): 10-12.

Office of the Auditor General of Ontario (AGO). 2021. Value-for-money audit: assisted living services. December. Available at https://www.auditor.on.ca/en/content/annualreports/arreports/en21/AR_AssistedLiving_en21.pdf

Gilmour, Heather. 2018. Formal home care use in Canada. Statistic Canada. September 19. Available at https://www150.statcan.gc.ca/n1/pub/82-003-x/2018009/article/00001-eng.htm#archived

Organisation for Economic Co-operation and Development (OECD). 2023. Hospital Beds and Occupancy. Health at a Glance 2023: OECD indicators. Available at https://oecd-ilibrary.org/sites/bdd23022-en/index.html?itemId=/content/component/bdd23022-en

Roblin, Blair, Raisa Deber, Kerry Kuluski, and Michelle Pannor Silver. 2019. “Ontario’s Retirement Homes and Long-term Care Homes: A Comparison of Care Services and Funding Regimes.” Canadian Journal on Aging / La Revue canadienne du vieillissement 38(2): 155–167.

Statistics Canada. 2022. Home care use and unmet home care needs in Canada, 2021. Available at https://www150.statcan.gc.ca/n1/daily-quotidien/220826/dq220826a-eng.htm

Statistics Canada. 2019. Survey of Household Spending. public use microfile.

Sylvestre-Williams, R. 2024. Don’t want to end up in a nursing or retirement home? Some seniors are finding creative solutions – on their own terms. Toronto Star. March 18. Available at https://www.thestar.com/business/personal-finance/dont-want-to-end-up-in-a-nursing-or-retirement-home-some-seniors-are-finding/article_1253a964-d26f-11ee-964a-c71e7e78215f.html

Whatley, Shawn. 2020. “Patient Hotels: An Established Transitional Solution to Overcrowding.” The Hill Times. February 3. Available at https://www.hilltimes.com/2020/02/03/ patient-hotels-an-established-transitional-solution-to-overcrowding/233033.

Wyonch, Rosalie. 2021. Ounce of Prevention is Worth a Pound of Cure: Seniors Care in Canada After COVID-19. Commentary. C.D. Howe Institute. Available at https://www.cdhowe.org/public-policy-research/ounce-prevention-worth-pound-cure-seniors-care-after-covid-19

- 1 There is some variation among provinces. For example, in Quebec, residents of private LTC homes do not receive government subsidized care services from the LTC home and rent levels are not set by government regulations. In public LTC homes, rents are limited by regulations and can be further subsidized, and healthcare services are government funded.

- 2 See Table 4 for a comparison of user fees. Though policies and capacity for different types of care services vary between provinces, room and board charges are generally limited by regulations and government subsidized in long-term care. The subsidization of private retirement homes and long-term care facilities is more likely to be limited to insured health services. Room and board charges vary and are determined by market factors. Public LTC homes represent a cost-reduction for seniors or families supporting accommodation costs of older seniors with high care needs in most provinces.

- 3 In 2015, there were 27,500 people on the long-term care wait list and approximately 77,000 beds. The wait list exceeded capacity by 36 percent (Roblin et al. 2018).

- 4 Nursing home expenses are tax deductible in Quebec as a qualifying medical expense. See Medical Expenses (IN-130-V) for more information

- 5 The public costs of care are discussed in more detail in the following sections.

- 6 As defined by the Ontario Retirement Homes Act (RHA), 2010, a retirement home in Ontario is a building that is occupied primarily by persons who are 65 or older, is occupied by at least six people not related to the operator and makes available at least two of the thirteen care services set out in the Act. These include providing meals, assistance with bathing, personal hygiene, dressing or ambulation, providing a dementia care program, administering medicine, providing incontinence care or making available the services of a doctor, nurse, or pharmacist.

- 7 Assisted living residences are subject to the Community Care and Assisted Living Act and the Assisted Living Regulation.

- 8 For more information about the number of seniors’ care spaces, rents, and vacancy rates by type of residence in each province see the online Appendix.

- 9 See https://www.ramq.gouv.qc.ca/en/citizens/aid-programs/domestic-help for more information about the program.

- 10 If the daily rate is higher than the costs of care, seniors will be charged for the cost of care.

- 11 This would only be the case for informal caregivers who are in the labour market and would reduce hours of work to provide care. If the informal caregiver is not in the labour force, for example, they have retired, then their care hours would not represent economic losses.

- 12 This figure represents the total cost per day, not relative costs compared to the patient receiving an alternate level of care. Comparatively, LTC costs $225 to $253 per day.

- 13 Canada had 87 percent occupancy and 2.6 beds per 1,000 population.

- 14 If a patient has complications after being discharged home, providers could be open to complaints or accusations of malpractice, making them less likely to recommend discharging a patient unless there is certainty about the availability of support and health care services.

- 15 In Ontario, chronic care/complex continuing care is defined as being more or less permanently resident in a hospital or another institution, including long-term care. Patients in hospital can be charged the hospital chronic care co-payment. In Alberta, patients waiting for designated supportive living or long-term care can be charged an Alternate Level of Care Accommodation Charge. In British Columbia, the policy is less clear-cut. All patients that are assessed as eligible for access to long-term care home services can be charged the daily rate, even if they are awaiting discharge to their home and will receive home and community care services, according to internal hospital policy documents (Interior Health).

- 16 Focusing on two provinces allows for a more granular comparison of different provincial approaches to subsidizing care directly and indirectly via tax credits. Though there will be some variation in costs and subsidization between provinces, Ontario and Quebec were chosen due to the differences in their healthcare systems and population sizes.

- 17 $1,986.82 per month, or less if they qualify for low-income subsidies. Or, in the case of assisted living provided where the senior resides. The personal cost would include shelter and food costs associated with normal daily living and the additional healthcare provision would have no added cost.

- 18 Assuming 30-day month at the per diem rate.

- 19 Until recently, private LTC homes in Quebec were not subsidized by the province. As part of a broader effort to harmonize quality of care, Quebec is providing public funding to select private long-term care homes. The government has committed to nationalizing all private LTC homes in Quebec by 2025.

- 20 n residential and long-term care, costs associated with housing are partially subsidized. In home care, residential costs are borne by clients (subsidies available for mobility aides, medical equipment, and making changes to the home to support independent living are not included in these cost estimates).

- 21 Though they might also access discounted medical equipment for their personal or home use to improve independence and functioning, at personal cost.

- 22 There could be implied public costs in the form of medical expense tax credits.

- 23 The average senior household spends $1,400 per month on shelter and $759 per month on food. An additional $432 for household operations and equipment brings the total room and board cost for a senior household to $2,591 per month.

- 24 The average senior household has shelter costs of $954 per month and food costs of $666 per month. With household operations and equipment in addition to room and board costs totaling $1,907.42 per month. Retirement homes in Quebec average $1,873 per month.

- 25 The tax credit for home support services for seniors will increase by 1 percent per year until 2026, reaching 40 percent.

- 26 Notably, this amount is more than the average income of a household with at least one 75+ member, and roughly equivalent to the average income of a senior couple residing in Quebec. This means that more than half of households with seniors are eligible for the full value of the tax credit. The maximum household income to qualify for a refund is $222,320.00, meaning most senior households in Quebec would qualify for at least some credit if they have eligible expenses.

- 27 Quebec did have a tax credit for volunteer respite services, but cancelled is as of January 1, 2021 (Revenue Quebec).

- 28 There are pros and cons to this approach. Low barriers to eligibility ensure that the tax credits are accessible to those who need assistance, and requiring medical assessments and case managers increases the public costs of administration. Conversely, low barriers to entry mean that some people in the target age group can qualify for tax subsidization for services that exceed their immediate needs. Using higher ages of eligibility reduces this risk.

- 29 Typically, being age 65 years or older is considered “senior.” However, to focus on the intersection of housing, healthcare, and lifestyle consumption, this analysis focuses on older seniors. As seniors age, their care needs are likely to increase but the majority of people 65-75 years of age do not require assistance with the activities of daily living or more advanced healthcare related to aging.

- 30 Having employment earnings as the main source of income likely indicates cohabitating with younger people who are still in the labour force or, in some cases, could indicate that a senior has remained in the labour force. The remaining 3.6 percent of households with someone over 75 years of age depend on investment income as their main source of funds.

- 31 See the online Appendix for data tables on household spending patterns.

- 32 Median income for all households is $79,000, and for households with at least one person over 75, median income is $48,000.

- 33 See the online Appendix for provincial data on household consumption and spending patterns. This data is from 2019, meaning it does not account for recent increases in housing costs.

- 34 The average shelter cost for a below-median income household was $15,785 and was $14,193 for below-median income households that rent in Ontario.

- 35 In the case of Ontario, seniors in unsubsidized rentals face higher rates of inadequate, unaffordable, or unsuitable housing, and higher core housing need than the general population or seniors living in subsidized rentals.

- 36 Households 75-79 had a sell rate of 21.5 percent, while households 95-99 years of age had an 83.5 percent sell rate.

- 37 For data tables on household spending, see the online Appendix.

- 38 A recent projection factoring in the increased costs of upgrading and expanding LTC infrastructure, increasing staffing levels, and caring for a growing aging population estimates that spending on institutional care will increase to 4.2 percent of GDP by 2041, from 1.26 percent in 2018 (Drummond, Sinclair and Bergen 2020). To put this increase into context, if healthcare spending were to continue to grow relative to GDP at a similar rate to the past 20 years, it would increase from about 11.5 percent of GDP in 2019 to 14.6 percent in 2040 – 3.1 percentage points. Even with healthcare spending growing at historical rates, nearly every dollar of new spending would need to be directed toward seniors’ care for the next 20 years to achieve the projected infrastructure and staffing goals. In addition, following the COVID pandemic, many LTC homes require investment to modernize facilities to reduce multi-resident rooms, and invest in infrastructure improvements to improve infection control and air quality. These investments, though necessary and advisable, do not increase the number of beds.

- 39 Whether or not this is a desirable outcome is a matter of perspective. Residential care is more expensive than home care, but it can be efficient from a housing market perspective to have seniors downsize and move to retirement communities. Similarly, owning a home reduces financial risks for seniors with respect to shelter, but selling a home can unlock resources to fund support and care services as they age.

- 40 For example, the tax credit age threshold could be set at 80-85 years of age, targeting seniors more likely to need support and also even later ages when savings are more likely to be depleted.