November 10, 2021

Bottom Line: Canadian Governments’ Budget Overshoots Mean Higher Spending and Taxes

- Over the course of 20 fiscal years, Canada’s federal, provincial and territorial governments routinely overshot their annual budget targets, says a new report from the C.D. Howe Institute.

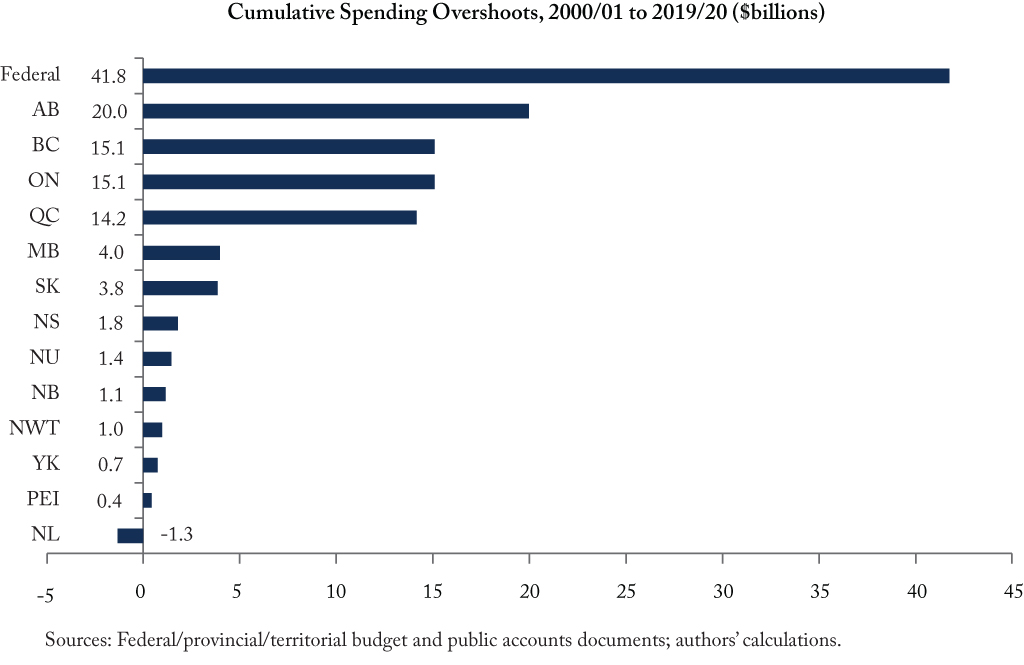

- Authors William B.P. Robson and Miles Wu find that since 2000/01, Canada’s senior governments have overshot budgeted expenses by a cumulative $119 billion and overshot budgeted revenue by $143 billion. They went into the COVID-19 crisis spending $3,100 more per Canadian, and taxing $3,800 more, than they would have if they had met their past budget commitments.

- The authors note that annual revenue and spending overshoots tend to coincide. That would not happen if governments responded to booms and busts with normal stabilization policies. It suggests that governments reacted to accidental or engineered revenue overshoots with in-year spending, or otherwise manipulated their reported numbers to achieve a predetermined bottom line.