The Study in Brief

- The Canadian housing market is experiencing an unprecedented crisis. One solution being explored is the adoption of demand-side measures like Vancouver’s 2017 empty-homes tax. This E-Brief evaluates the tax’s impact on housing affordability and availability, helping policymakers balance efficient property use with ensuring a steady supply of new homes.

- We use the difference-in-difference (DID) method to see the effect of the empty-homes tax in Vancouver. We compare how things changed before and after the tax, using data from similar areas without the tax to estimate what would have happened if Vancouver hadn’t had the tax. This helps us find out the tax’s real impact.

- We show that the tax effectively reduced the number of empty homes without impacting new housing construction. However, it did not affect average rent. This shows that while the tax improved housing availability, it did not address affordability, indicating a need for further measures to address the wider housing crisis.

The authors thank Jeremy Kronick, Alexandre Laurin, William B.P. Robson, Benjamin Dachis, Curtis Gergley, Brian Johnston and anonymous reviewers for helpful comments on an earlier draft. The authors retain responsibility for any errors. The views expressed in this paper are those of the authors and do not necessarily reflect those of the Bank of Italy or the Eurosystem.

1. Introduction

The Canadian housing market is experiencing an unprecedented crisis. Over the past two decades, demand has rapidly increased due to net migration, a gradual easing of credit conditions and several demographic factors such as an aging population and smaller household sizes, on average. This surge in demand has not been matched by a corresponding increase in supply due to the lack of effective supply-side policies.1

While acknowledging the extensive improvements needed on the supply side of the housing market, policymakers are increasingly alarmed by the coexistence of high rents, high property prices and homelessness juxtaposed with vacant homes.

Supply-side policies typically focus on building more properties and are notoriously long run. To tackle this issue in the short run, policymakers have explored and proposed a number of different actions. These proposals range from imposing taxes on vacant properties to repurposing empty buildings into shelters and social housing projects. Taxes on vacant properties seem to have become increasingly popular, as several cities and countries around the world have recently adopted demand-side policies in the form of additional taxes on empty homes.2

France was the first country to introduce a vacancy tax, in 1999. The UK put in a similar policy in 2015, with Spain’s Catalonia province and the city of Jerusalem following in 2015. Currently, New York, Hong Kong and Los Angeles are contemplating introducing second- and empty-home vacancy taxes to alleviate their housing market pressures (Wu 2018, The Economist 2019). Canada has adopted similar measures, with Vancouver implementing an empty-homes tax in 2017, Toronto in 2021 and the federal government in 2022.

As the interest in these tax schemes increases, there remains a significant gap in evaluating their actual impact on the housing market. The literature on optimal taxation3 has long highlighted the potential existence of an efficiency trade-off when policymakers intervene in an economy to alter the allocation of resources. In simple terms, taxes always produce both intended and unintended consequences.

A key question is whether empty homes are a sign that the housing market is not working properly, or if they are just a natural part of how the market balances itself. Merlo and Otalo Magne (2004) contribute to this debate by showing that market challenges, such as difficulties in finding or sharing information regarding available properties and relative prices, is the primary culprit responsible for vacancies. As these challenges are a form of market failure, the conclusion is that, in a tight housing market, government policies like vacancy taxes aimed at increasing housing availability, and affordability, are desirable.

General literature on the topic also suggests that the presence of unoccupied housing may result in undesirable social outcomes due to negative externalities. For example, concentrations of empty houses or foreclosures decrease property values in the surrounding area (Lee 2008, Fitzpatrick 2012, Glaeser et al. 2018). Additionally, an increase in the perception of housing insecurity is linked to the clustering of vacant houses, potentially leading to a rise in crime rates and harm to social cohesion (Immergluck and Smith 2006, Ellen et al. 2013).

Consequently, the rationale for government intervention to reduce vacancies arises from both the potential redistributive impact of using existing housing more efficiently, as well as from the mitigation of negative externalities associated with vacant properties.

However, empty-home taxes have drawn many criticisms, with some claiming that these measures may produce the undesired effect of discouraging property developers and investors from undertaking new construction projects.4 The argument is that increased costs associated with holding vacant properties might reduce the overall return on investment, creating a disincentive for new developments. There is also the argument that this is an example of government overreach, telling private property owners what they can and cannot do with their properties.

Despite their popularity and the fervent political debate around the topic, there is, to the best of our knowledge, very little existing literature evaluating and quantifying the impact of taxes on vacant homes. Blossier (2012) and Segu (2020) make this calculation for France, but there is none assessing this question in Canada. Shedding further light on the topic is crucial in helping policymakers strike the right balance between encouraging the productive use of existing properties and ensuring a steady supply of new homes in response to growing housing demand. The aim of this E-Brief is, therefore, to fill the aforementioned gap, in particular for Canada, by evaluating the effects of Vancouver's 2017 empty-homes tax on housing affordability and availability.

The E-Brief follows the approach of Segu (2020) and uses an econometric technique called “difference-in-difference,” which compares two different groups where one group experiences a change (like being subject to a new policy) and the other does not. By looking at how the groups’ outcomes change over time, we can see if the change had a real effect. In a difference-in-difference design, it is important to ensure that before a policy change (the treatment), the trends in outcomes for the treated and untreated groups are similar. This helps attribute changes in outcomes after the treatment to the treatment itself. If this assumption does not hold, it can make it hard to know if the treatment actually caused the change in outcomes. For this reason, we choose to use Census data on “dissemination areas” and to focus on neighbourhoods situated within an average distance of eight hundred meters from Boundary Road, the threshold between the municipality of Vancouver, which has a vacant-homes tax and the control municipality of Burnaby, which doesn’t.

Consistent with the results of Blossier (2012) and Segu (2020), we find that the tax on empty homes in Vancouver eased housing the city’s market tightness by reducing the total vacancy rate, since more people found apartments to rent by almost 1.5 percentage points. Indeed, in absolute terms there were 5,355 fewer vacant units in Vancouver from 2016 to 2021 than there would have been without the tax implementation.

This result is not affected by pre-treatment trends and is robust to the addition of various structural and demographic controls. Our analysis also indicates that the tax did not significantly affect the construction of new buildings.

While the previous findings certify the tax's efficacy in improving housing availability, the same cannot be said about affordability, as we find no impact whatsoever on the average rent. Standard economic theory suggests that an increase in available housing should cause the price of that housing – in this case the rent – to fall. We posit two explanations why this is not happening here (beyond homeowners falsely declaring the status of their property). One possible explanation is that cities like Vancouver and Toronto might be stuck in a bad equilibrium of high rental prices. In these cities, landlords are essentially assured that their properties will eventually be rented at the current market price, regardless of the new supply on the market. Another possibility is that the marketplace adjusts rents upward to reflect the possibility of homeowners having to pay the tax in the future if their property becomes vacant.

2. Tax and Data Description

2.1 Vancouver’s tax on empty homes

The city of Vancouver approved its Empty Homes Tax at the end of 2016, and the measure came into effect in 2017. Different from other taxes on housing, such as the foreign buyer’s tax and the speculative vacancy tax,5 which apply respectively to the whole Vancouver Regional District and all of BC, the Empty Homes Tax applies uniquely to the city of Vancouver. Property owners there are required to declare the status of their property each year, indicating whether it is their principal residence, a rented property or if it is vacant for more than 180 days in a calendar year. In the latter case, the property acquires the status of empty.6

The empty-homes tax rate is a percentage of the property's assessed taxable value, and it has been modified several times since its inception. In the first year, 2017, the tax rate was 1 percent; subsequently, in 2020, the city council increased it to 1.25 percent and to 3 percent for 2021 and 2022. In May 2023, the current city council decided not to increase the rate any further, voting against a previously proposed increase that would have taken the rate to 5 percent.

We exploit Census datasets containing information on dwellings and households at different aggregate geographical levels. Data are aggregated according to seven different geographical units: Province, Census District, Census Metropolitan Area, Census Subdivision, Census Tract, Dissemination Area and Dissemination Block. We aim to maximize the granularity of our data by focusing on the smallest possible geographical unit that one can analyze – i.e., Dissemination Areas.7 These areas are defined as small and relatively stable geographic units composed of one or more adjacent dissemination blocks with an average population of 400 to 700 persons, based on data from the previous Census of Population Program.8

Census data are available from 1995 to 2021, taken every five years, and we use the three findings from 2011 to 2021. (Some of the variables in our analysis are not available prior to 2011.) The dataset, created by Statistics Canada, covers: population demographics such as age, gender, ethnicity and language; socioeconomic factors like education level, employment status and income distribution; and housing-related metrics including dwelling types, tenure and housing affordability.

We focus on a specific subset of variables related to housing characteristics and socioeconomic indicators: 1. number of dwellings; 2. number of households; 3. average number of rooms per dwelling; 4. average rent; and 5. average income per household.

Since the dataset does not directly provide a variable indicating whether dwellings are occupied, we need to construct one. We do this by subtracting the number of households from the total number of dwellings in each dissemination area.9 We subsequently define a vacancy-rate variable by dividing the number of empty homes by the total number of dwellings. We focus on a total of 130 dissemination areas, the ones that are, on average, within 800 meters (or no more than three dissemination areas) from Boundary Road, which is the threshold between Vancouver and Burnaby.

3. Empirical Strategy

We implement a difference-in-difference (DID) estimation strategy exploiting the fact that only the city of Vancouver is subject to the 2017 empty-homes tax. The DID strategy consists of creating a counterfactual outcome for the treatment group where a tax applies using the outcome of the control group where it doesn’t. The treatment group for the DID approach includes all of Vancouver’s dissemination areas, while the control one is composed of Burnaby’s dissemination areas.10 Crucially, the decision to introduce the tax was made by the Vancouver city council, ensuring that the dissemination areas could not self-select into or out of the treatment group. In total, 67 dissemination areas were subject to the tax.

The DID strategy’s main advantage is that it allows for the treatment and control group variables (i.e., vacancy rate, total number of dwellings and average rent) to start from different levels, provided it can reasonably be expected that they would have experienced a similar change over time without the treatment (i.e., the empty-homes tax). In other words, the evolution of the vacancy rate, average rent and number of dwellings in the Vancouver dissemination areas would have been the same as in Burnaby, had they not been taxed. This is called the common trend assumption.11 We also assume that there were no anticipation effects, meaning the tax did not produce any effect before its actual introduction (or announcement). This assumption is plausible since the owners of vacant units could not have predicted the tax before its first public announcement in late 2016.12

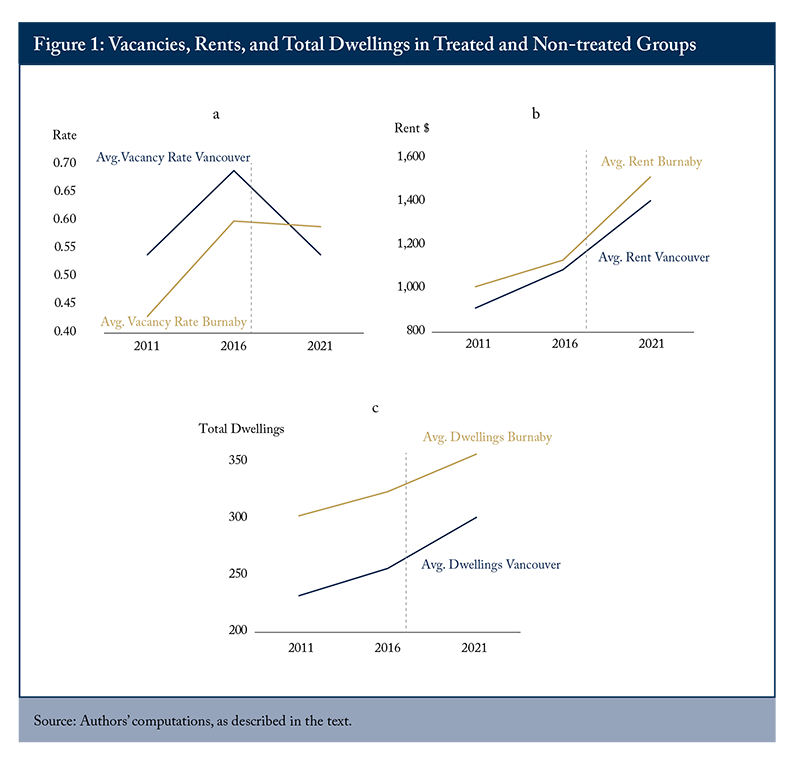

For the selected time period, we gather data from at least two periods prior to the tax’s introduction. This is essential to properly assess the common trend assumption. We can compare the point immediately before the treatment with a point in time after the tax is implemented, allowing us to quantify its causal effects. In the dataset, we have two points in time before the implementation: 2011 and 2016, and one after – 2021. Figure 1 shows the evolution of the variables for both the taxed areas (Vancouver) and the non-taxed ones (Burnaby), with the red dashed line indicating the beginning of 2017 when the tax was officially implemented.

In Figure 1, panel (a) indicates that the 2011 starting vacancy level for the areas affected by the tax (treatment group) is higher than in the areas not affected by the tax (control group), and well above 5 percent. The panel also allows us to visually check the common trend assumption by looking at the changes in the vacancy rates between 2011 and 2016. Vacancy rates in both areas were increasing at approximately the same rate from 2011 to 2016, which makes the common trend assumption plausible. From 2016 to 2021, the vacancy rate remains almost constant for non-taxed dissemination areas (just below 6 percent), whereas, in the same period, it decreases significantly in the taxed ones, dropping from almost 7 percent to slightly less than 5.5 percent and reaching a level below the control group. Turning to the average rent and the number of dwellings, panels b) and c) show how the two variables seem to have followed a very similar path in both the treated and the control groups before the implementation of the tax, meaning the common trend assumption is again plausibly satisfied.

4. Results and Policy Discussion

We analyzed the impact of the new tax on empty homes by comparing areas where the tax was applied to areas where it was not, both before and after the tax was introduced. Our main focus was on three aspects: the vacancy rate (the percentage of empty homes), the number of dwellings and the average rent.

Our findings (see the Appendix for the technical details, including the results in Table 1) revealed that the tax significantly reduced the number of empty homes. Specifically, the vacancy rate dropped by 1.5 percentage points. To put this in perspective, the average vacancy rate in the taxed areas was 7 percent in 2016 so a reduction of 1.5 percentage points represents a 21 percent decrease in the number of empty homes. In real terms, this means that out of the 1,078 empty homes in these areas in 2016, approximately 226 homes became occupied as a result of the tax.14

However, the tax did not affect the average rent or the number of new dwellings being built. Our analysis showed no significant change in these aspects, suggesting that while the tax effectively reduced the number of empty homes, it did not influence rental prices or the incentives to construct new homes. This is important because it indicates that the tax successfully targeted the issue of empty homes without causing unintended negative effects on the housing market such as increased rent prices or reduced housing construction. However, it also means that while the empty-home tax appears to have been an effective tool for improving housing availability, it did not improve housing affordability.

Beyond homeowners misreporting their property status, two possible explanations for this seemingly contradictory economic result are:

-

Vancouver’s status as a superstar city being stuck in a bad equilibrium, whereby landlords, confident that their vacancies will eventually be rented at the current market rent, do not lower prices despite the increased availability; and

-

Landlords, who might leave their properties vacant in the future, pre-emptively passing potential future tax costs onto current tenants.

This implies the need to look at other measures to tackle affordability issues more effectively. Previous C.D. Howe Institute’s research underscored the importance of supply-side measures that increase building. As but one example, Dachis (2023) calls for provinces to set mandated minimum targets for municipal housing construction and to reform upfront development charges on new housing.

The current housing crisis is a complex issue, and only when we act on a comprehensive suite of policies will we tackle it promptly and effectively.

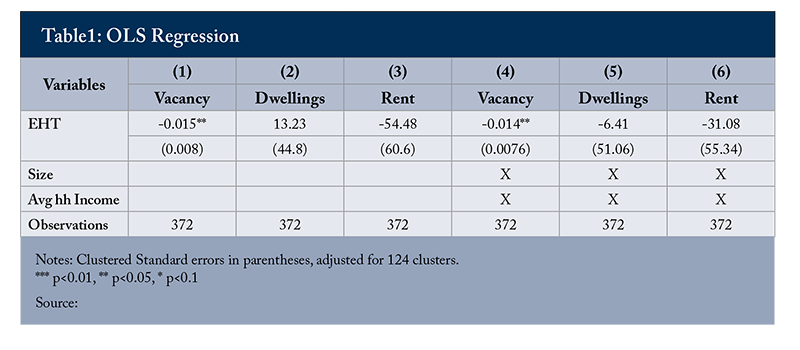

Table 1 presents the main results from our DID strategy on the effect of the empty-homes tax on the vacancy rate. We compare the vacancy ratio, the number of dwellings and the average rent for taxed and non-taxed dissemination areas before and after the introduction of the tax. The first three columns and the last three columns present results from two different Ordinary Least Squares (OLS)15 specifications. Even though the before-tax trends look similar, the two groups may still feature systematic differences. The possibility that the groups displayed demographic and/or dwelling size differences before the tax implementation could raise doubts about the common trend assumption. To address this, we included two controls in the last three columns: the average number of rooms in the dwellings and the average household income.

The tax on empty homes coefficient (EHT) represents the average impact of the tax on those dissemination areas where it was implemented. The effect on the vacancy ratio (Columns (1) and (4)) is negative and statistically significant in both specifications. Coefficients are to be interpreted as percentage points; i.e., the tax resulted in a vacancy rate reduction of 1.5 or 1.4 percentage points, depending on the specification.

Columns (2) and (3), and (5) and (6) present the results of the DID strategy on tax’s impact on, respectively, average rents and number of dwellings. The effect is not statistically significant in any of our specifications. In a regression, coefficients that are not statistically significant suggest that the true coefficients are likely close to zero. Non-significant coefficients indicate that the variables are not meaningfully related to the dependent variable. Therefore, in this case we can conclude that the tax did not affect incentives to build or the average rent paid.

Technical Appendix

References

Andrews, D. 2010. “Real House Prices in OECD Countries: The Role of Demand Shocks and Structural and Policy Factors.” OECD Economics Department Working Papers, No. 831.

Blossier, F. 2012. “Is Taxing Inhabitation Effective? Evidence from the French Tax Scheme on Vacant Housing.” Ecole Polytechnique, Ph.D. Thesis.

Ellen I.G., J. Lacoe, C.A. Sharygin. 2013. “Do foreclosures cause crime ?” Journal of Urban Economics 74(1): 59-70. https://doi.org/10.1016/j.jue.2012.09.003

Fitzpatrick, T. 2012. “What Impact Do Anti-vacancy and Anti-blight Ordinances.” Working Paper, Federal Reserve Bank of Cleveland.

Glaeser, E. K. 2018. Computer Vision and Real Estate: Do Looks Matter and Do Incentives Determine Look? NBER.

Immergluck, D., and G. Smith. 2006. The External Costs of Foreclosure: The Impact of Single-Family Mortgage Foreclosures on Property Values. Housing Studies. 21.

Lee, D. S. 2008. “Randomized experiments from non-random selection in U.S. House elections.” Journal of Econometrics 142 (2): 675-697.

Merlo, A., and F. Ortalo-Magne. 2004. “Bargaining over Residential rRal Estate: Evidence from England.” Journal of Urban Economics 56(2): 192-216.

Mirrlees, J. 1971. “An Exploration in the Theory of Optimum Income Taxation.” The Review of Economic Studies.

Okun, A. 1975. “Equality and Efficiency: The Big Tradeoff.” The Brookings Institution, Washington.

Segu, M. 2019. “The Impact of Taxing Vacancy on Housing Markets: Evidence from France.” Journal of Public Economics 185:104079

The Economist. 2019. “Proposals-to-tax pieds-a-terre-in New York-are Gaining-Ground.” https://www.economist.com/united-states/2019/03/14/proposals-to-tax-pieds-a-terre-in-new-york-are-gaining-ground

Wu, V. 2018. “Pricey Hong Kong set to impose vacancy tax on empty new flats.” Reuters.

- 1 The C.D. Howe Institute has produced many papers highlighting this concern, including but not limited to Dachis (2018, 2020, 2023).

- 2 We define supply side in the sense of creating more homes; i.e., increasing the stock of properties. We define demand side as, among other things, policies where the housing stock doesn’t change, but existing homes become accessible and, in theory, more affordable.

- 3 Mirrlees (1971) and Okun (1975).

- 4 https://www.bloomberg.com/news/features/2021-08-16/taxing-the-rich-do-h…

- 5 Foreign buyers’ tax: 15 percent tax on residential purchases by foreign buyers in BC. Speculative tax: varying rate tax on vacant or underused properties in BC.

- 6 There are several situations that lead to exemption from the tax: death of owner, owner in care, and redevelopment or major renovations. Furthermore, the tax does not apply if the legal ownership of a home was transferred in the reference year.

- 7 Dissemination blocks are actually the smallest unit, however the coding systems change between years, making them, therefore, unsuitable for our analysis.

- 8 Statistics Canada.

- 9 Consistent with Statistics Canada’s methodology. Another promising approach, that would help to avoid the misreporting issue, would be the identification of empty homes through utilities.

- 10 We choose Burnaby as our control group due to the richness of data (i.e., the number of Dissemination Areas) directly neighboring Vancouver.

- 11 The DID strategy critically relies on one fundamental assumption: the common trend assumption. This implies that the variables of interest for both groups, conditional on observables, should have moved in similar directions had there been no treatment. If the common trend assumption holds, any deviation of the trend of the treated group from the trend of the non-treated group can be directly attributed to the effect of the treatment.

- 12 Failure of this assumption would result in a negative bias in the coefficient, leading to an underestimation of the effect. However, in our case, since our coefficient is statistically significant (see Table 1), the risk, if any, is that we have underestimated the effect of the tax.

- 14 Here it is crucial to assume that homeowners’ declarations on the status of the property were truthful. It is, unfortunately, impossible to account for potential forms of tax avoidance/evasion.

- 15 OLS is a method used in statistics for estimating the parameters in a linear regression model by minimizing the sum of the squares of the differences between the observed and predicted values.