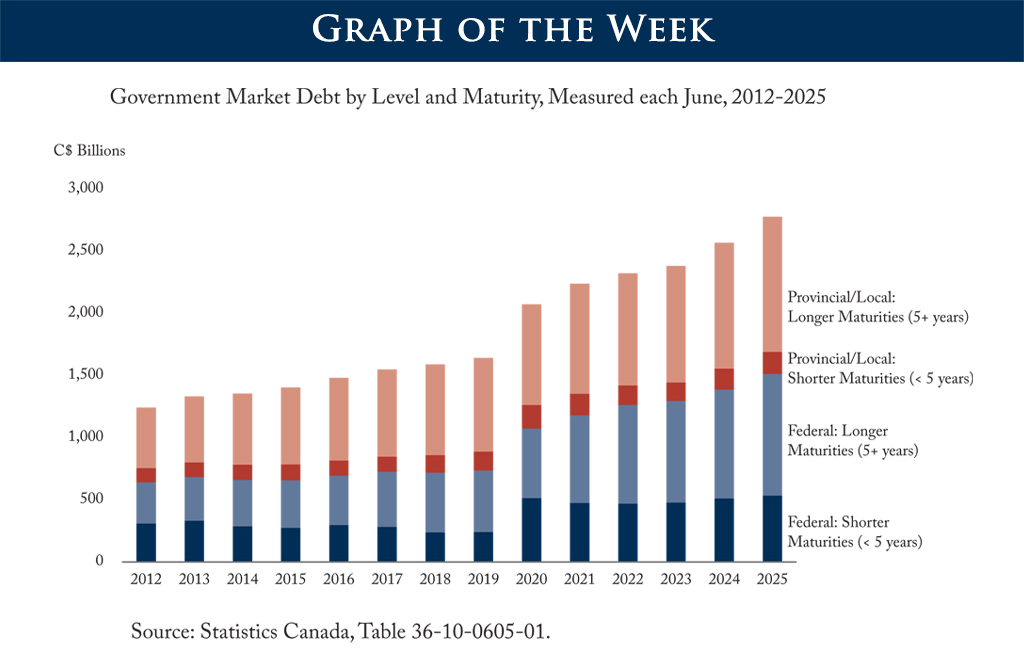

Government debt interest costs depend on the level of debt, the maturity structure of that debt, and prevailing interest rates across that structure. Concerningly, market debt for federal and provincial/local governments has doubled over the past decade, with much of the increase occurring after the pandemic. Encouragingly, most of this new debt has been issued in longer-term maturities of five years or more. Credit rating agencies will be watching the projections in Budget 2026 – to be tabled November 4th – closely, since they could affect Canada’s credit rating, and in turn influence interest rates and debt charges for years to come.

For more, see the C.D. Howe Institute’s March Shadow Budget and July Fiscal Update.