Home / Publications / Council Reports / Bank of Canada Should Maintain 2.25 Percent Overnight Rate for Next 12 Months, Says C.D. Howe Institute Monetary Policy Council

- Media Releases

- Council Reports

- |

Bank of Canada Should Maintain 2.25 Percent Overnight Rate for Next 12 Months, Says C.D. Howe Institute Monetary Policy Council

Summary:

| Citation | . 2026. "Bank of Canada Should Maintain 2.25 Percent Overnight Rate for Next 12 Months, Says C.D. Howe Institute Monetary Policy Council." Council Reports. Toronto: C.D. Howe Institute. |

| Page Title: | Bank of Canada Should Maintain 2.25 Percent Overnight Rate for Next 12 Months, Says C.D. Howe Institute Monetary Policy Council – C.D. Howe Institute |

| Article Title: | Bank of Canada Should Maintain 2.25 Percent Overnight Rate for Next 12 Months, Says C.D. Howe Institute Monetary Policy Council |

| URL: | https://cdhowe.org/publication/mpcjanuary2026/ |

| Published Date: | January 22, 2026 |

| Accessed Date: | January 24, 2026 |

Outline

Outline

Related Topics

Files

For all media inquiries, including requests for reports or interviews:

January 22, 2026 – The C.D. Howe Institute’s Monetary Policy Council (MPC) calls for the Bank of Canada to keep its target for the overnight rate, its benchmark policy interest rate, at 2.25 percent at its next announcement on January 28, and maintain it at that level until January 2027.

The MPC, chaired at this meeting by William B.P. Robson, the Institute’s President and CEO, includes the chief economists of the six largest Canadian banks, alongside six leading academic economists and financial market experts.

Acting as a shadow Bank of Canada Governing Council, the MPC provides an independent assessment of the monetary stance needed to achieve the Bank’s 2-percent inflation target. Its formal recommendation for each interest rate announcement is the median vote of members in attendance. Members vote on the upcoming announcement, the subsequent announcement, and the announcements six months and one year ahead.

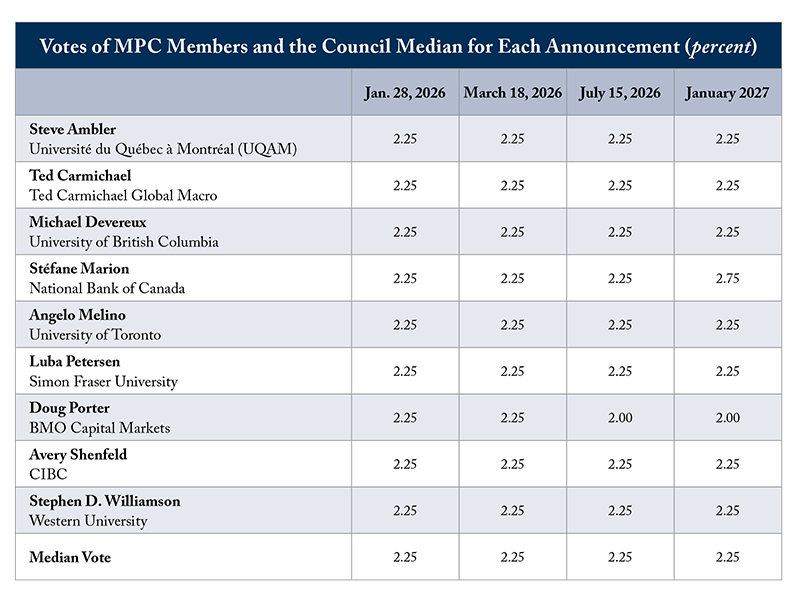

The nine MPC members attending the meeting showed a remarkable degree of unanimity in their recommendations. All nine called for the Bank of Canada to hold the overnight rate target at 2.25 next week and at the following announcement in March. Eight of the nine also called for a target of 2.25 percent in July, while one called for a cut to 2.00 percent. Seven of the nine maintained their recommendation of 2.25 for January 2027, while one called for a target of 2.00 and one called for a target of 2.75 by then (see table below).

The consensus for no change in the overnight rate target in the near term and the relatively narrow range of recommendations six and 12 months ahead reflected the group’s judgement that the current stance of monetary policy and the economy were consistent with inflation converging with the 2 percent target over time. Discussion of the world economy highlighted somewhat more robust growth than had seemed likely last fall, mainly in the United States. Turning to Canada, MPC members noted a loss of growth momentum since the fall. Notwithstanding an uptick in the year-over-year CPI increase in December as the GST reductions a year earlier dropped out of the calculation, most Council members judged that inflationary pressure is dropping, and that elevated prices for specific products such as coffee and beef did not threaten continued progress toward the inflation target. Although only one member called for a cut in the overnight target, several felt that the balance of risks tilted in that direction.

Many members emphasized the difficulty of judging where economic activity in Canada is relative to its potential at the moment. Several mentioned uncertainty about temporary residents and estimates of the population and labour force, although on balance, the slow growth of payroll employment, the higher unemployment rate and the moderation in growth of wages and unit labour costs increased their confidence that inflation will moderate. The group also noted that although the federal government has particularly emphasized major projects as a boost to investment, current indicators of business investment are weak, and any boost to activity from federal efforts will happen only slowly. Uncertainty about US protectionism and the future of the Canada-US trading relationship was a major focus of discussion, with several members noting that further disruption or improvements on that front would likely change their recommendations.

The views and opinions expressed by the participants are their own and do not necessarily reflect the views of the organizations with which they are affiliated, or those of the C.D. Howe Institute. Forecasters’ recommendations may differ from their predictions.

The MPC’s next vote will take place on March 12, 2026, prior to the Bank of Canada’s overnight rate announcement on March 18.

* * * * *

For more information, contact: Lauren Malyk, Manager, Communications, 416-873-6168, lmalyk@cdhowe.org.

Want more insights like this? Subscribe to our newsletter for the latest research and expert commentary.