The Downturn Was Bad Enough. Don’t Quadruple It! – Financial Post Op-ed

We knew the number would be big. Just how big was the question.

Statistics Canada released its initial estimate of second-quarter GDP on Friday. Output dropped by 11.5 per cent compared with first-quarter GDP and by a little over 13 per cent compared with the second quarter of 2019. This is the largest recorded quarterly decline since Statistics Canada began reporting quarterly GDP numbers in 1961.

The estimate was scary enough but the way it was reported may have caused either unnecessary panic or unnecessary pessimism. Media reports emphasized the “annualized” change in GDP, which was a drop of 38.7 per cent, which is worse than scary. Does this mean Canadian GDP will actually wind up falling almost 40 per cent, as it…

Henri-paul Rousseau – A New Agenda For Cios And CEOs Facing Systemic Risk (part Two)

From: Henri-Paul Rousseau To: Canada’s Pension Managers Date: August 26, 2020 Re: A New Agenda for CIOs and CEOs Facing Systemic Risk (Part Two) Yesterday, we outlined how a VUCA screen – assessing volatility, uncertainty, complexity and ambiguity – can be used in the context of pension management in order to better define an agenda […]

From: Henri-Paul Rousseau To: Canada’s Pension Managers Date: August 26, 2020 Re: A New Agenda for CIOs and CEOs Facing Systemic Risk (Part Two) Yesterday, we outlined how a VUCA screen – assessing volatility, uncertainty, complexity and ambiguity – can be used in the context of pension management in order to better define an agenda […] Henri-paul Rousseau – A New Agenda For Cios And CEOs Facing Systemic Risk (part One)

From: Henri-Paul Rousseau To: Canada’s Pension Managers Date: August 25, 2020 Re: A New Agenda for CIOs and CEOs Facing Systemic Risk (Part One) COVID-19 has moved the world into uncharted waters. It has forced governments to implement economic and social lockdowns to reduce the virus impacts, while simultaneously adopting unprecedented economic stimulus packages to […]

From: Henri-Paul Rousseau To: Canada’s Pension Managers Date: August 25, 2020 Re: A New Agenda for CIOs and CEOs Facing Systemic Risk (Part One) COVID-19 has moved the world into uncharted waters. It has forced governments to implement economic and social lockdowns to reduce the virus impacts, while simultaneously adopting unprecedented economic stimulus packages to […] Ambler, Kronick, Omran – When Can We Say The Recession Is Over?

From: Steve Ambler, Jeremy Kronick, and Farah Omran To: Canadians Worried About Debt Date: August 18, 2020 Re: When Can We Say the Recession Is Over? The art of calling the start and finish of economic recessions might seem a trivial pastime, but it is critical to understanding how policy decisions can affect the economy. This is normally a […]

From: Steve Ambler, Jeremy Kronick, and Farah Omran To: Canadians Worried About Debt Date: August 18, 2020 Re: When Can We Say the Recession Is Over? The art of calling the start and finish of economic recessions might seem a trivial pastime, but it is critical to understanding how policy decisions can affect the economy. This is normally a […] If This Recovery Sustains, This Recession Could Be Shortest On Record — Or One Of The Longest – Financial Post Op-ed

The art of calling the start and finish of economic recessions might seem a minor one but it is critical to understanding how policy decisions can affect the economy.

Making such calls is normally a backwards-looking exercise, with business cycle analysts waiting for the accumulation of enough data before they feel comfortable issuing even a nuanced interpretation of whether the economy has reached key points in a cycle. This spring, however, the sheer depth and size of the economic losses stemming from the COVID-19 lockdowns left no room for doubt. The C.D. Howe Institute’s Business Cycle Council was able to declare by May 1 that Canada had entered a recession in the first quarter of 2020 and that the peak of the…

Just a month or two more of this recession and it truly will be the Big One – Financial Post Op-Ed

Economic downturns are never pleasant but this one stands out for all the wrong reasons.

The C.D. Howe Business Cycle Council announced on May 1 that the Canadian economy entered a recession in the first quarter of 2020. Monthly GDP peaked in February, then fell by 7.5 per cent in March and, according to Statistics Canada’s flash estimate released June 30, by a further 11.6 per cent in April. These declines wiped out all the growth in Canadian real GDP since August 2010 and represent the steepest, fastest slide in the 59 years for which we have data.

Though there are some positive signs in May’s economic data — a 1.8 percentage point increase in employment, increases in hours worked, exports and building permits…

La bourse a-t-elle la berlue ? – La Presse Opinion

Qu’est-ce que peut bien voir la Bourse pour regagner si rapidement le terrain perdu, alors que l’économie réelle se contracte comme jamais dans une profonde récession ?

Comme se plaisait à répéter mon ancien collègue de La Presse Alain Dubuc, « la Bourse, ce n’est pas l’économie ! ». Elle est plutôt le reflet d’opinions variées quant à l’évolution future des bénéfices des seules entreprises cotées en Bourse. Ici, le mot clé est futur.

La Bourse est un marché qui met un prix sur le futur, diablement difficile à prévoir, surtout au beau milieu d’une crise sans précédent. Ce prix est rajusté au fur et mesure que le marché digère de nouvelles informations, parfois contradictoires, d’où la…

A Glimmer of Hope in Dismal Job Numbers

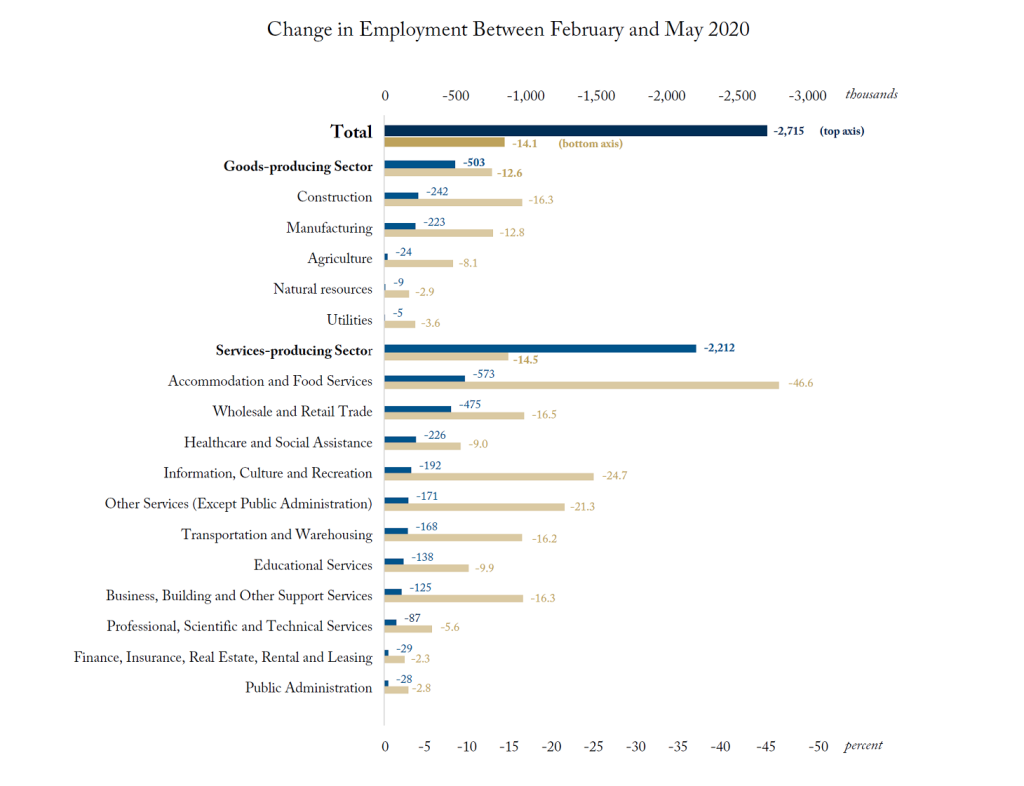

The latest release of the Labour Force Survey from Statistics Canada gives a glimmer of good news for the Canadian economy. Although Canada saw a 14.1 percent drop in employment between February and May, employment numbers showed a promising 1.8 percent gain in May over April. While the unemployment rate is at a record high, […]

The latest release of the Labour Force Survey from Statistics Canada gives a glimmer of good news for the Canadian economy. Although Canada saw a 14.1 percent drop in employment between February and May, employment numbers showed a promising 1.8 percent gain in May over April. While the unemployment rate is at a record high, […] Distress Signals: Canada’s GDP Contraction in March 2020

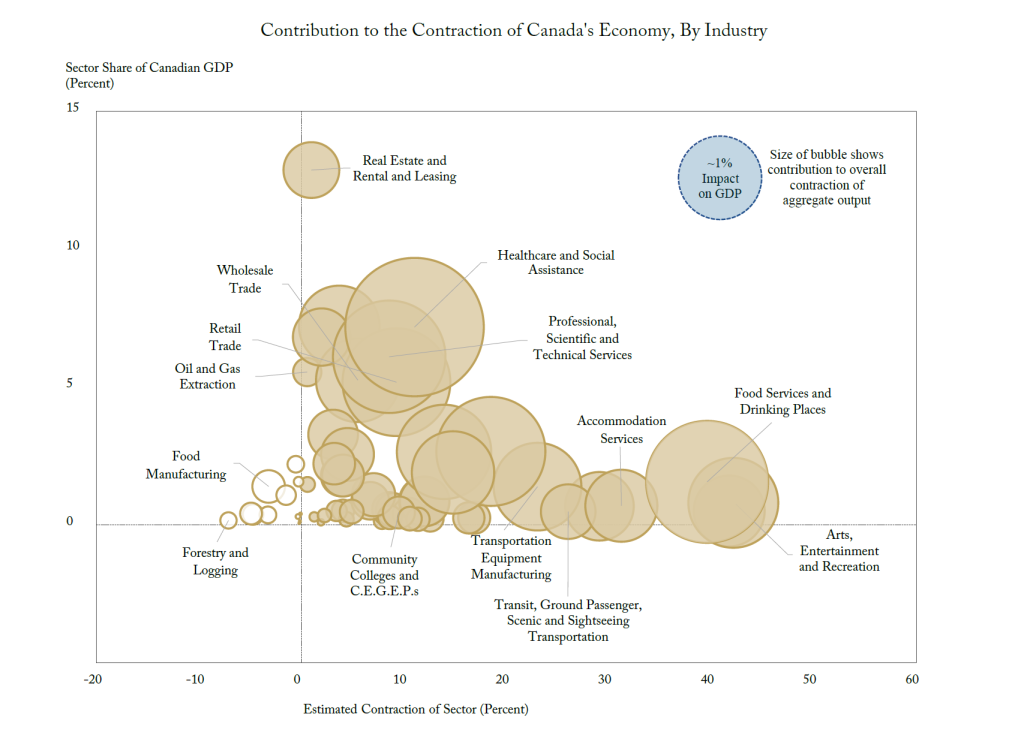

In this edition of Graphic Intelligence, we examine the earliest available GDP numbers by industry amid the COVID-19 crisis. Overall, Canada’s GDP shrank by 7.2 percent relative to February 2020, with arts, entertainment and recreation most affected at -42.2 percent. Also severely affected were air transportation at -41.8 percent, food services and drinking places at […]

In this edition of Graphic Intelligence, we examine the earliest available GDP numbers by industry amid the COVID-19 crisis. Overall, Canada’s GDP shrank by 7.2 percent relative to February 2020, with arts, entertainment and recreation most affected at -42.2 percent. Also severely affected were air transportation at -41.8 percent, food services and drinking places at […] Canada Entered Recession in First Quarter of 2020: C.D. Howe Institute Business Cycle Council

May 1, 2020 – Preliminary data suggest Canada entered a recession in the first quarter of 2020 with a February peak, says the C.D. Howe Institute’s Business Cycle Council.

The Council, comprised of Canada’s preeminent economists in the field and co-chaired by Steve Ambler and Jeremy Kronick, is an arbiter of business cycle dates in Canada. The Council typically meets annually, but also when economic conditions indicate the possibility of entry to, or exit from, a recession.

Due to the COVID-19 pandemic and the ensuring government shutdown that put a stop to much economic activity, the Council met on April 16 to review the case for calling the beginning of a recession in the first quarter of 2020 and the dating of…

Dwight Duncan – Extraordinary Events Call For Extraordinary Responses

From: Dwight Duncan To: Canadian Ministers of Finance Date: March 18, 2020 Re: Extraordinary events call for extraordinary responses The government of Canada did exactly what it should have done last Friday by postponing its March 30 budget and outlining the first part of its large-scale response to COVID-19. Suddenly, governments are faced with something little anticipated just weeks […]

From: Dwight Duncan To: Canadian Ministers of Finance Date: March 18, 2020 Re: Extraordinary events call for extraordinary responses The government of Canada did exactly what it should have done last Friday by postponing its March 30 budget and outlining the first part of its large-scale response to COVID-19. Suddenly, governments are faced with something little anticipated just weeks […]