Home / Publications / Research / Mandating the Impossible? Assessing Canada’s Electric Vehicle Mandate for 2026 and Beyond

- Research

- |

Mandating the Impossible? Assessing Canada’s Electric Vehicle Mandate for 2026 and Beyond

Summary:

| Citation | Brian Livingston. 2025. "Mandating the Impossible? Assessing Canada’s Electric Vehicle Mandate for 2026 and Beyond." ###. Toronto: C.D. Howe Institute. |

| Page Title: | Mandating the Impossible? Assessing Canada’s Electric Vehicle Mandate for 2026 and Beyond – C.D. Howe Institute |

| Article Title: | Mandating the Impossible? Assessing Canada’s Electric Vehicle Mandate for 2026 and Beyond |

| URL: | https://cdhowe.org/publication/mandating-the-impossible-assessing-canadas-electric-vehicle-mandate-for-2026-and-beyond/ |

| Published Date: | November 18, 2025 |

| Accessed Date: | November 18, 2025 |

Outline

Outline

Authors

Related Topics

Press Release

Files

• The prime minister also announced that the federal government was conducting a 60-day review of the policy itself, which requires new light-vehicle sales to be 100 percent comprised of ZEVs by 2035. This paper shows why such a review was needed: the targets are similarly unattainable beyond 2026. As a result of not meeting the target, automakers, under the scheme, might have had to collectively spend a considerable sum of money in 2026 – an unknown amount to purchase Excess Credits and over $200 million to create Charging Fund Credits for investing in charging station infrastructure.

• Given these penalties, manufacturers in this scenario might have had to comply with the required percentage by restricting sales of non-ZEVs. Further, such regulatory constraints could have reduced vehicle supply by over 400,000 vehicles in 2026. Economic constraints driven by the potential cost of credits relative to the benefits of selling non-ZEVs could further reduce sales by as many as 50,000 vehicles. Such reductions in sales would leave significant consumer demand unmet.

• Firms such as Tesla, Kia, Hyundai, Mitsubishi, Volvo, BMW, and Rivian, which can exceed the 20 percent threshold, stand to gain windfall revenues from selling excess credits. Meanwhile, Canadian-based producers such as GM, Ford, Toyota, Stellantis, and Honda would face higher costs and reduced competitiveness.

• This paper recommends looking at a blend of policy options to address the problem, if the policy is not abandoned altogether. First and most obvious, revise the current trajectory for the mandated percentage of ZEV sales to align with consumer preferences and with the actual availability of vehicles, as discussed in Livingston (2024). Second, send the proceeds from the sale of Excess Credits to the federal government. Third, count pure or non-plug-in hybrids (and not just plug-in hybrids) towards mandated targets.11 ZEVs consist of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), both of which qualify under the ZEV mandate. BEVs are fully electric and have no gasoline engine. Their range is getting comparable to that of vehicles with gasoline engines. PHEVs have both an electric motor and a gasoline engine that acts as a backup. PHEVs have smaller batteries than BEVs and therefore less range using just electric power – around 50 to 100 kilometres, but switch to conventional hybrid mode when that power is depleted, which extends the range considerably. Pure hybrids (often referred to just as hybrids) have even smaller batteries that cannot be charged from an external source. Their batteries are in effect indirectly charged by the gasoline engine through a process known as regenerative braking. Pure hybrids have very limited electrical range, but the assistance from the electric motor decreases gas consumption per kilometre by around 30 to 40 percent. Fourth, suspend the ZEV mandate until the shape of Canada’s auto industry – and availability of ZEVs on the market – are made clearer by the outcome of negotiations between Canada and the United States regarding new US tariffs and between Canada and China, the world’s largest exporter of electric cars.

Introduction: The Federal ZEV Mandate

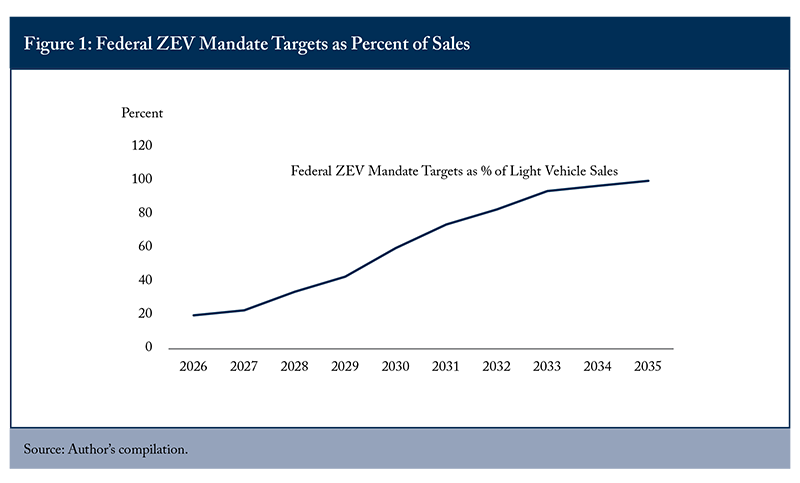

Canada’s Electric Vehicle Availability Standard, otherwise known as the federal Zero Emissions Vehicle (ZEV) mandate, has been in effect since December 2023. It represents one of the most ambitious industrial and environmental policies in recent decades. The regulations, enacted under the Canadian Environmental Protection Act (CEPA), require automakers to meet rising sales targets for ZEVs – beginning with 20 percent of new light-duty vehicle sales in 2026, rising to 60 percent in 2030, and reaching 100 percent by 2035 (Figure 1) (Canada 2023). In effect, the policy limits the number of gasoline and diesel vehicles that can be sold in Canada, with compliance enforced through a combination of penalties and requirements to acquire tradable credits when the target is not met.

It should be noted that the ZEV mandate regulations apply to model years, not calendar years. The analysis in this paper uses data for calendar years, more easily available from Statistics Canada, as a simplifying assumption and as a proxy for a model year.

The mandate has attracted substantial attention from industry leaders, policymakers, and consumers. Automakers warn that targets may be out of step with market realities, while others argue the regulations are necessary to accelerate the transition to a lower-carbon transportation system.

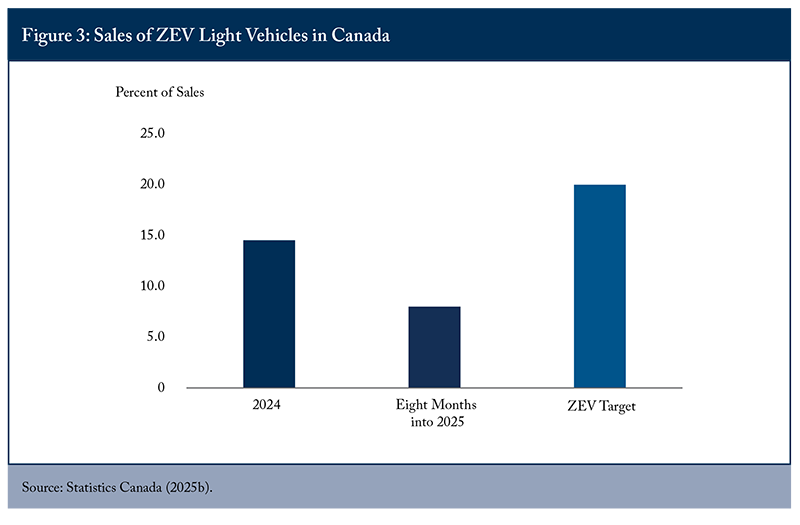

Current sales trends underline the challenge. In 2024, ZEVs accounted for about 14.5 percent of the 1.85 million light vehicles sold in Canada, but sales dropped to just 8 percent of the total in the first eight months of 2025 following the expiry of federal and provincial purchase incentives. This Working Paper evaluates the likely impact of the mandate using the example of the first original binding target year, 2026. Based on projected sales of 1.9 million light vehicles, with 270,000 expected to be ZEVs, the analysis finds that automakers are likely to fall well short of the required 380,000 ZEVs or 20 percent of sales. It further examines the distribution of compliance costs across companies, the incentives created by the credit-trading system, and the potential effects on consumers and manufacturers.

The evidence suggests that, under current conditions, the ZEV mandate will impose significant costs on firms unable to meet their targets, generate windfall revenues for companies with ZEV-heavy portfolios, and reduce the availability of non-ZEV vehicles for Canadian consumers. With US protectionist actions already straining Canada’s auto industry, and other emissions-reduction mechanisms still binding on the industry, a legitimate question is whether some form of mandate is even warranted. To the extent it continues, this Working Paper suggests options for reform, including modified targets, changes to credit rules, and treatment of hybrid vehicles.

Sales Trends in Canada

Vehicle Sales by Type and Fuel

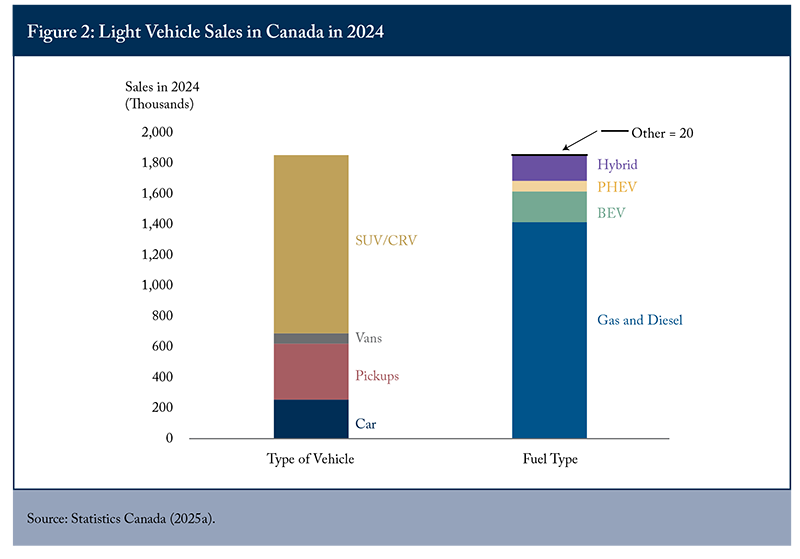

Light-vehicle sales in Canada totalled about 1.85 million units in 2024. As shown in Figure 2, more than 85 percent of these vehicles were sport-utility vehicles (SUVs), crossover vehicles (CRVs), or pickup trucks, indicating Canadians’ strong preference for larger vehicles. In terms of fuel type, gasoline and diesel vehicles still dominated the market, accounting for about 76 percent of sales. ZEVs and non-PHEV hybrids represented the remaining 24 percent.

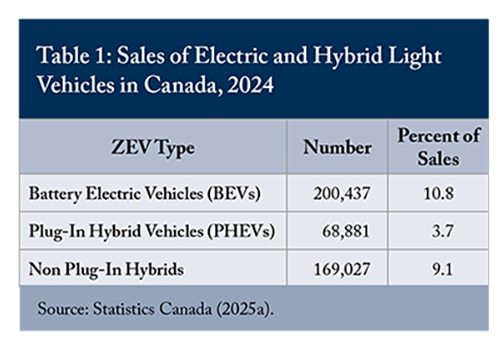

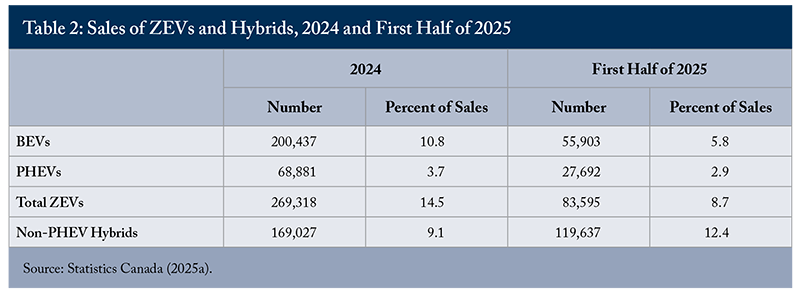

Table 1 provides more detail on the composition of electric vehicle sales. BEVs accounted for 200,437 units (10.8 percent of total sales) in 2024, while PHEVs added another 68,881 (3.7 percent). Non-plug-in hybrids, though not classified as ZEVs under the federal mandate, made up an additional 169,027 sales (9.1 percent). Notably, the number of hybrids sold in 2024 nearly matched the number of BEVs, reflecting persistent consumer interest in partial-electrification options.

Sales Patterns: Light Vehicles in 2024 and Early 2025

Light-vehicle sales in Canada totalled about 1.85 million in 2024, of which approximately 269,000 were ZEVs, representing 14.5 percent of the market. ZEV sales accelerated in the second half of the year, likely due to buyers anticipating the end of purchase incentives from the federal, Quebec, and British Columbia governments in 2025.

Sales declined dramatically in the first eight months of 2025, dropping to 108,000 units, compared with 158,000 during the same period in 2024. As shown in Figure 3, ZEVs accounted for just 8 percent of total sales in the first 8 months of 2025, likely because the purchase incentives stopped.

Hybrid vehicles, which are not classified as ZEVs under the federal regulations, continued to gain ground. Table 2 shows that hybrid sales rose from 169,027 units in 2024 (9.1 percent of sales) to 119,637 units in the first half of 2025 (12.4 percent of sales), surpassing total ZEV sales in that period. In this respect, ZEV adoption remains highly dependent on government incentives, and hybrids continue to attract significant consumer demand despite being excluded from compliance under the mandate.

Compliance under the ZEV Mandate

(a) Effective Prohibition of Non-ZEV Sales

The ZEV mandate is usually portrayed as a requirement for Canadian companies to sell a minimum number of ZEVs as a percentage of their total light vehicle sales (their ZEV target). Much like Prohibition in the United States a century ago, the obligation is on the sellers to comply, not the purchasing public.

A more subtle but more realistic portrayal of the regulations is that they operate as a cap on the number of non-ZEVs that can be sold in Canada, with non-compliant firms potentially facing criminal prosecution.

(b) Compliance by Selling ZEVs

Automakers may meet their ZEV target by earning credits in several ways. The most straightforward method is through the sale of ZEVs. For the purposes of this analysis, plug-in hybrids are assumed to receive full credit, provided that they do not exceed 45 percent of total ZEV credits, as specified in subsection 30.13(1) of the regulations.

When a company sells more ZEVs than required, it generates “Excess Credits.” For example, if a manufacturer sells 50,000 vehicles, its 20 percent target would be 10,000 units. If all its sales are ZEVs, the additional 40,000 sales above the target would create 40,000 credits. These credits can then be sold to firms that fall short of their own obligations, reflecting the cap-and-trade design of the system.

(c) Compliance Using Excess Credits and Charging Fund Credits

Firms that do not comply with their ZEV target can comply in two other ways. They may purchase Excess Credits from other companies at market price or invest in approved charging infrastructure. Under the second option, known as “Charging Fund Credits,” one ZEV credit is issued for every $20,000 of investment. This mechanism, however, is limited by subsection 30.15(4), which caps charging fund credits at 10 percent of a firm’s annual ZEV target. For example, if a company sells 100,000 vehicles in total, with only 10,000 being ZEVs, falling 10,000 units short of its ZEV target of 20,000, it could generate a maximum of 2,000 Charging Fund Credits, equal to 10 percent of its 20,000-unit ZEV target.

(d) Early Compliance Credits

The regulations allow companies to use Early Compliance Credits to meet their ZEV target. Section 30.16 of the regulations creates Early Compliance Credits if ZEV sales in 2024 and 2025 exceed a certain threshold of ZEV sales as a percentage of total sales. The thresholds for early credits are set high (8 percent in 2024 and 12 percent in 2025). Some companies with significant ZEV sales in 2024 may earn such Early Compliance Credits. The numbers in Table 5 show that the industry would have created about 140,000 Early Compliance Credits in 2024. However, the significant drop in ZEV sales projected in 2025 means that there will be virtually no Early Compliance Credits created in 2025.

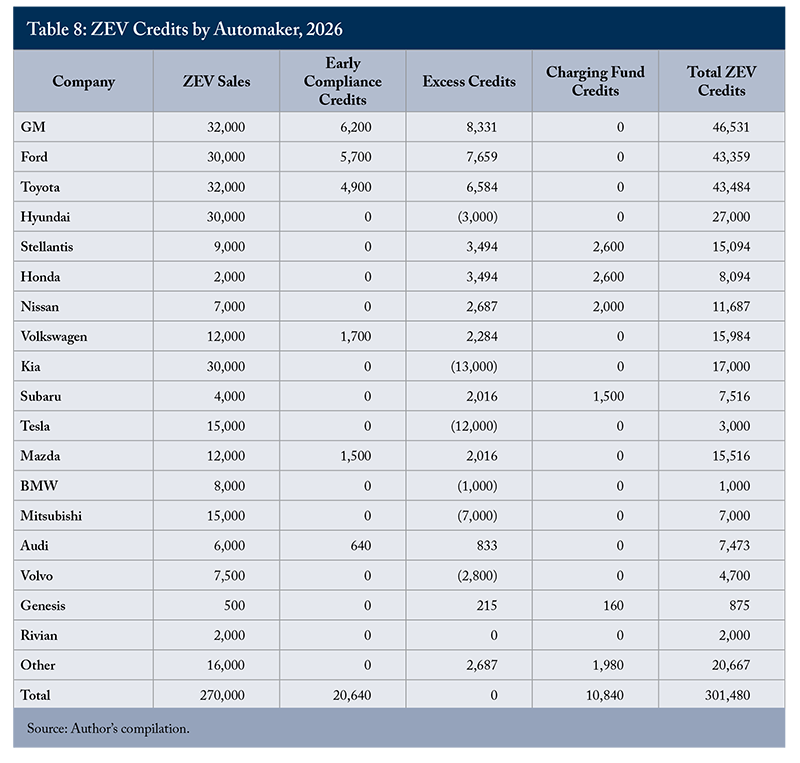

There are restrictions on the use of Early Compliance Credits. Subsection 30.16(5) states that companies that exceed their ZEV target are not allowed to sell their Early Compliance Credits to other companies. This means that companies falling short of their ZEV target are only permitted to use their Early Compliance Credits for themselves. Furthermore, 30.16(6) states that Early Compliance Credits cannot be used after 2027. Finally, the cap in subsection 30.15(4) includes Early Compliance Credits. This means that the total of Charging Fund Credits and Early Compliance Credits is capped at 10 percent of a company’s ZEV target. The result of all these restrictions is that even though 140,107 Early Compliance Credits were likely created (see Table 5), only 20,640 can be used (see Table 8).

The practical consequence is that the only benefit to a company is that it can use Early Compliance Credits to reduce the number of Charging Fund Credits it has to create at a price of $20,000 each. Simply put, Early Compliance Credits save money, but they do not increase the total ZEV credits of a company.

(e) Deferral of ZEV Obligation

The regulations allow companies to defer a deficit for up to three years. In practice, deferral merely shifts the obligation into future years, when the required percentages are higher. As a result, this analysis assumes that the deferral mechanism will not be used.

Example of Compliance with ZEV Mandate

(a) Legal Considerations

Given the above methods of compliance, the question arises: Will they allow a company to meet its ZEV target? The answer is not necessarily.

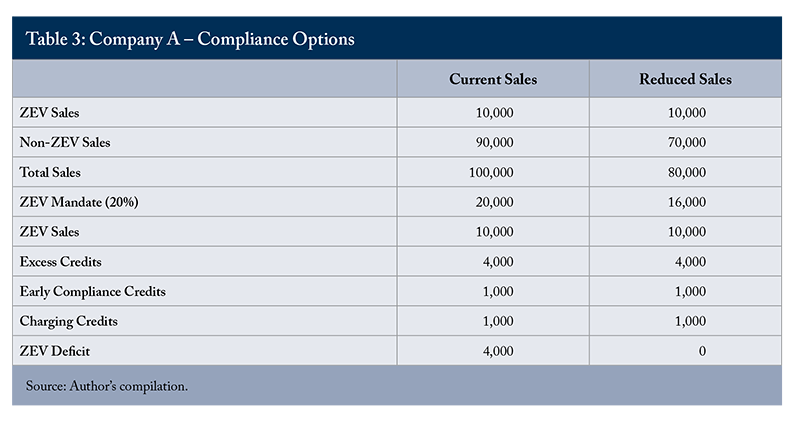

Consider Company A, which sells 100,000 vehicles in 2026, of which 10,000 are ZEVs. To reduce its shortfall, the company uses 1,000 of its Early Compliance Credits, purchases 4,000 Excess Credits from another firm at the market price and invests $20 million in charging projects to generate 1,000 Charging Fund Credits. The company can only create 1,000 Charging Fund Credits since the total of the 1,000 Early Compliance Credits and the 1,000 Charging Fund Credits is capped at 2,000, being 10 percent of its 20,000 ZEV target. In total, it spends at least $20 million on these purchased and created credits.

After these efforts, Company A holds 16,000 credits: 10,000 from its own ZEV sales, 4,000 purchased Excess Credits, 1,000 Early Compliance Credits, and 1,000 Charging Fund Credits. Its target, however, is 20,000, leaving a deficit of 4,000.

At this point, the company faces two options. It could remain non-compliant, but this would expose it to penalties under the CEPA, including potentially criminal sanctions and large fines – an outcome that few firms are likely to risk. Alternatively, it could reduce its sales of non-ZEVs, thereby lowering the overall target to align with the credits already secured.

As shown in Table 3, cutting non-ZEV sales from 90,000 to 70,000 reduces total sales to 80,000. With a target of 20 percent, this lowers the ZEV requirement to 16,000 units, which matches the company’s available credits and eliminates the deficit.

Simply put, Company A reduced its non-ZEV sales from 90,000 to 70,000 and incurred at least $20 million in compliance costs.

(b) Economic Considerations: Cost of Credits versus Sales on non-ZEVs

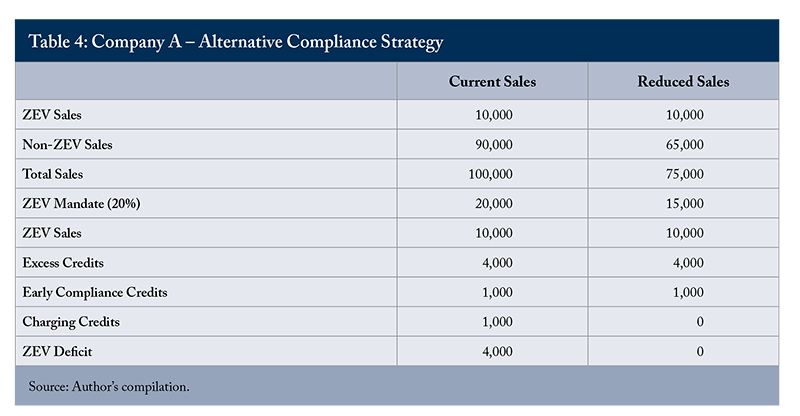

The company now has a second decision to make: whether to incur the costs associated with the purchase or creation of Excess Credits and Charging Fund Credits.

In simplest terms, buying or creating these credits is, in essence, paying a fee in return for the right to sell more non-ZEVs. Given the 20 percent ZEV target for 2026, the acquisition of one ZEV credit will permit the sale of four additional non-ZEVs. This ratio will decline quickly in future years to three in 2027, two in 2028, and less than one in 2030.

The company would likely first test the market price for Excess Credits. As with all markets, supply and demand will determine such a price. The supply will be determined by the extent to which companies such as Tesla and Hyundai exceed their ZEV targets. Any drop from the projected ZEV sales in 2026 will decrease this supply. Demand will be determined by the size of the total shortfall of companies (such as GM, Ford, Toyota, and Honda) if they continue to fall short of their ZEV Targets. Again, any drop from the projected ZEV sales in 2026 will increase this demand.

The next step would be to consider creating Charging Fund Credits at a cost of $20,000 per credit. The market price of Excess Credits may well be considerably less than $20,000, but will not be more than $20,000.

Given all this, companies will source credits in the order of Early Compliance Credits first (costing nothing, but expiring after 2027), Excess Credits second (costing a market price under $20,000), and Charging Fund Credits third (costing $20,000).

Companies will balance the price they are willing to pay for each Excess Credit and Charging Fund Credit against the margin they expect for the sale of four more non-ZEVs. As a result, a company’s strategy may be to focus on the sale of the more expensive and higher margin vehicles, such as pickup trucks, which just happen to be the light vehicles that emit more CO2 emissions. Still, the $20,000 cost of a Charging Fund Credit causes a $5,000 reduction in margin for these four additional sales.

These economics may cause companies to decline to create Charging Fund Credits and, therefore, reduce non-ZEV sales beyond what is just required to legally comply with the legislation. Using the numbers from the above example, the company may decline to create 1,000 Charging Fund Credits. As shown in Table 4, this decision would further reduce non-ZEV sales to 65,000 and therefore bring total sales down to 75,000. The company has met its ZEV target of 15,000 through a mix of ZEV sales, Early Compliance Credits, and the purchase of Excess Credits.

Again, this illustrates how firms may respond by reducing non-ZEV sales rather than absorbing the cost of compliance. The result is a contraction in the supply of gasoline and diesel vehicles available to Canadian consumers. By constraining the availability of gasoline and diesel vehicles, the policy could leave consumer demand for non-ZEVs unmet.

The Company A scenario is based on simplified figures to demonstrate the mechanics of compliance. I now attempt to show what it means for companies that sell light vehicles in Canada.

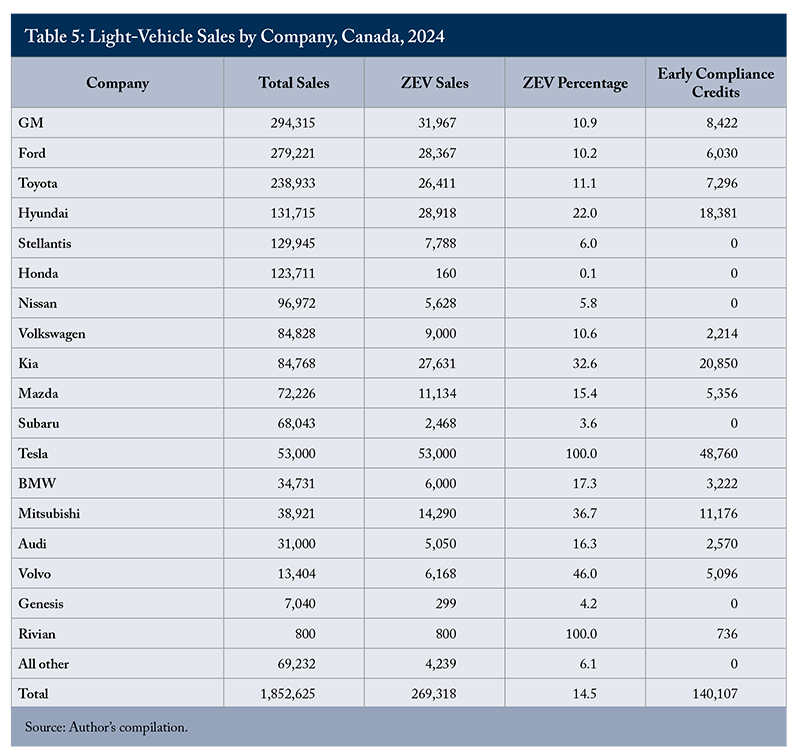

Sales by Companies in 2024

Total ZEV sales in 2024 were 269,318 units. Table 5 provides a breakdown by company. These figures were compiled from a combination of company-released data and Statistics Canada totals, as company-level ZEV reporting is not always consistently available (Statistics Canada 2025a).

The figures for Early Compliance Credits are for sales in 2024 that exceed the 8 percent threshold of total sales. For example, GM had total sales of 294,315 and ZEV sales of 31,967. Early Compliance Credits are 8,422 (31,967 minus 23,545, which is 8 percent of 294,315).

It should be noted that companies that are forecast to exceed their 2026 ZEV target of 20 percent of total sales will also create Early Compliance Credits, as shown in Table 5. However, they will not need to (and cannot) use them. Indeed, though I estimate that 140,107 Early Compliance Credits were created, Table 8 shows that only 20,640 could actually be used in 2026.

Taken together, ZEV sales were 14.5 percent of total sales in 2024, well below the 20 percent target that will apply in 2026. Six companies – including Tesla, Kia, Volvo, Mitsubishi, Hyundai, and Rivian – already exceed the 20 percent threshold and would therefore generate excess credits available for trade. However, the volume of credits produced by these firms would not be sufficient to cover the shortfalls of larger manufacturers such as GM, Ford, Toyota, Stellantis, and Honda.

Table 5 illustrates that while some firms could profit from selling credits, the rest of the firms would remain below the required threshold. As a result, a significant portion of the shortfall would likely need to be met through Early Compliance Credits and the creation of Charging Fund Credits, requiring substantial new investment in infrastructure projects.

Why Are Canadian Companies Not Selling More ZEVs?

The simplest answer to this question is that many Canadians still have concerns about buying ZEVs, particularly battery-electric vehicles – as reflected in a Nanos Research poll commissioned by the C.D. Howe Institute.2https://nanos.co/wp-content/uploads/2025/11/2025-2888-C.D.-Howe-August-Populated-report-Zero-emission-vehicle.pdf Concerns about range, affordability due to upfront purchase cost, cold-weather performance, and the adequacy of charging infrastructure continue to limit demand (see, for example, Canada Office of the Parliamentary Budget Officer 2024). Sales patterns in 2024 and 2025 suggest that government purchase incentives have a significant impact.

The data also show sustained consumer interest in plug-in hybrids and conventional hybrids. In the first half of 2025, hybrid sales exceeded those of ZEVs, reflecting a preference for vehicles that combine electric propulsion with the reliability of a gasoline or diesel engine.

Ultimately, Canadian companies can sell only what consumers are prepared to buy. Public policy must take this reality into account if it is to achieve its intended outcomes.

Will ZEV Purchase Incentives Be Reinstated in 2025?

In 2024, ZEV buyers could access purchase incentives of $5,000 from the federal government, $7,000 in Quebec, and $4,000 in British Columbia. By February 2025, all three programs had ended. The expiry of these subsidies coincided with a sharp decline in ZEV sales: from 14.5 percent of total sales in 2024 to 8.0 percent in the first eight months of the year.

Governments have since signalled that some form of support may return. Quebec reinstated rebates of $4,000 for BEVs and $2,000 for PHEVs (Electric Autonomy Canada 2025a). The federal government has indicated that a new program may be introduced, although no details have been finalized (CTV News 2025). British Columbia paused its program in May 2025 pending a review (Electric Autonomy Canada 2025b).

Fiscal pressures, however, complicate the reintroduction of large-scale subsidies. At the federal level, departments have reportedly been directed to cut program spending by 7.5 percent in the next fiscal year. Assuming 270,000 ZEV sales and a $5,000 rebate, a federal program would cost approximately $1.35 billion annually, which is difficult to reconcile with the government’s expenditure reduction targets (CBC News 2025). Quebec projects a deficit of $13.6 billion for 2025/26 (IEDM 2025). Based on 2024 sales volumes, its revived rebates could cost about $490 million annually. British Columbia faces a $10.9 billion deficit in 2025/26 (RBC 2025); if 34,000 BEVs were sold at a $4,000 incentive, the cost would be about $136 million per year. Each government is therefore balancing the objective of supporting ZEV adoption against significant fiscal challenges.

Policy developments in the United States may also affect Canadian outcomes. The US phased out its $7,500 federal purchase incentive on September 30, 2025, removing a subsidy that has been a major driver of electric vehicle sales in recent years (The Globe and Mail 2025).

Forecast of Light-Vehicle and ZEV Sales in 2026

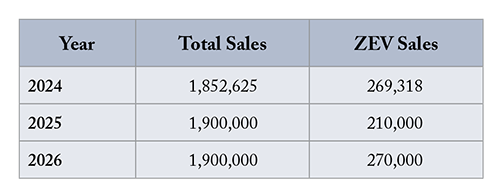

Forecasting is always a difficult exercise, but for the purposes of this analysis, I assume total and ZEV sales for 2025 and 2026 as follows:

These assumptions rest on two main considerations. First, total sales in the first eight months of 2025 were slightly ahead of the same period in 2024, suggesting that total annual sales in both 2025 and 2026 will be modestly higher than in 2024, at about 1.9 million units.

Second, ZEV sales are assumed to decline in 2025 before recovering in 2026. ZEV sales in the first eight months of 2025 were about 108,000, significantly below the 158,000 sold in the same period of 2024. This decline is attributed to the expiry of federal and Quebec purchase incentives after 2024. The forecast assumes that some form of incentives will be reinstated by the federal, Quebec, and British Columbia governments, though likely at lower levels than in 2024. As a result, it seems reasonable to project that ZEV sales will fall to 210,000 in 2025 before rebounding to about 270,000 in 2026 – returning to the levels seen in 2024. This would remain well below the mandated target of 380,000 units, equivalent to 20 percent of sales, leaving a shortfall of approximately 110,000 vehicles. The gap would need to be addressed either by purchasing Excess Credits from companies that exceed their targets or by creating Charging Fund Credits.

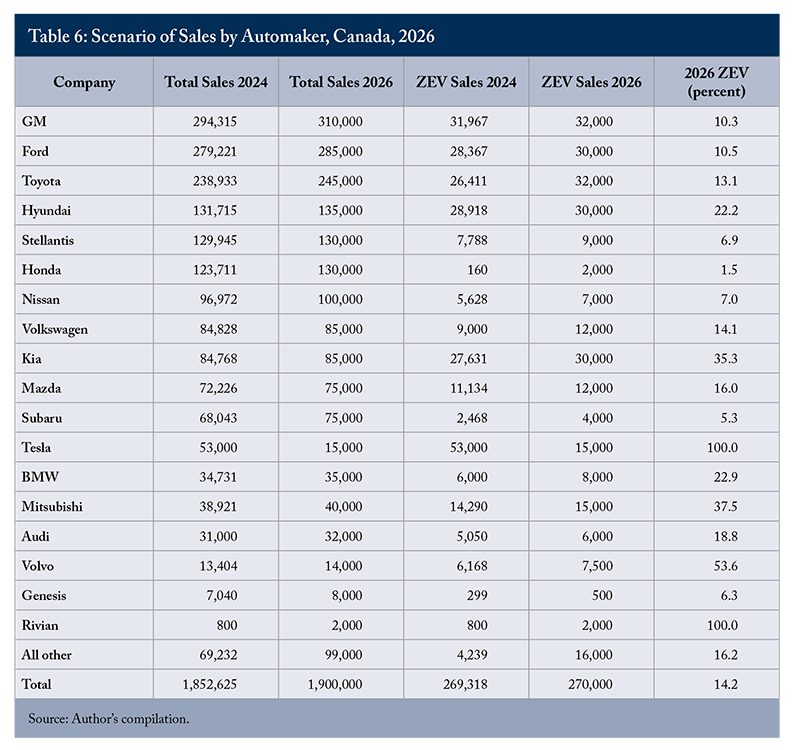

Sales by Company

Table 6 translates the forecast of company-level sales for 2026, the first year in which the 20 percent ZEV target would have applied. The projections assume that each company’s market share will remain broadly consistent with 2024 levels, except for Tesla. Tesla’s Canadian sales are assumed to fall from 53,000 in 2024 to 15,000 in 2026, reflecting the loss of eligibility for federal purchase incentives and the imposition of a 25 percent import tariff on the US content of vehicles from the United States. (The import tariff can be waived for a company’s vehicle imports to the extent it assembles vehicles in Canada, which Tesla does not.) These developments have significantly raised prices and are expected to reduce demand. In addition, as discussed in many news media reports, Elon Musk’s political profile has contributed to waning consumer interest in Tesla worldwide.

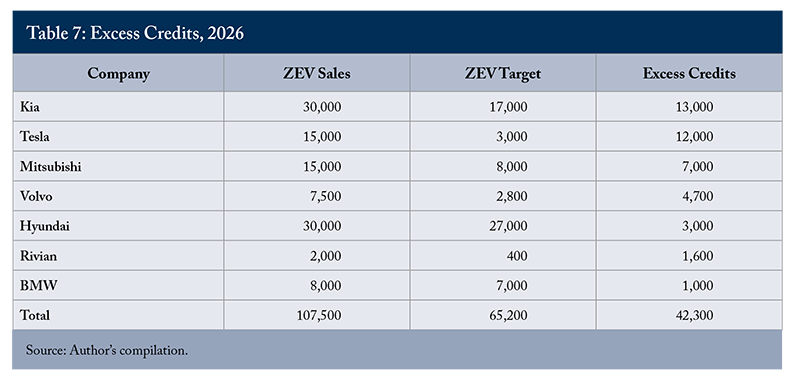

Creation of Excess Credits

Based on this scenario, in 2026, seven companies would have been projected to exceed their ZEV targets and generate excess credits. These firms will be able to sell their surplus to manufacturers that fall short of compliance. As stated above, the sale price for these Excess Credits will be determined in the market between the Exceed Companies and the Shortfall Companies.

The creation of Excess Credits does not increase the total number of ZEVs sold. Instead, it redistributes compliance costs within the industry, allowing some companies to benefit financially while others pay to close their deficits. In effect, companies such as Tesla are compensated twice – once when they sell the light vehicle and again when they sell the excess credit.

None of the seven firms generating excess credits in 2026 operates light-vehicle manufacturing facilities in Canada. By contrast, US policy is moving in the opposite direction: jurisdictions such as California are phasing out the ability to trade excess credits as part of their regulatory framework (Politico 2025).

Use of Excess Credits and Limits on Other Credits

(a) Early Compliance Credits and Charging Fund Credits

As noted earlier, the use of Early Compliance Credits and Charging Fund Credits is capped at 10 percent of a company’s annual ZEV obligation. This restriction directly affects the number of non-ZEVs a company may sell, since firms cannot rely exclusively on the above two credits to cover compliance shortfalls. Let’s see how this would have worked out in 2026.

Using GM as an example, Table 6 projects sales of 310,000 light vehicles in 2026, of which only 32,000 are ZEVs. GM’s ZEV target at 20 percent of sales is 62,000. The 10 percent cap means that GM can only use 6,200 Early Compliance Credits and Charging Fund Credits. Since GM has 8,422 Early Compliance Credits (see Table 5), it would use 6,200 of these Early Compliance Credits and would not be able to create and use any Charging Fund Credits. This is to GM’s advantage, since it can use its Early Compliance Credits for free and will not have to pay $20,000 to create a Charging Fund Credit.

On the other extreme, some companies do not have any Early Compliance Credits. For example, Honda ZEV sales in 2024 were only 0.1 percent (see Table 5), well below the 8 percent threshold, so it has zero Early Compliance Credits. Honda would be able to create 2,600 Charging Fund Credits, which is 10 percent of its 2026 ZEV target of 26,000.

Lastly, some companies (Tesla, Hyundai, etc.) achieve ZEV sales exceeding 20 percent of total sales. As a result, they do not need to use any of these credits to meet their ZEV Target.

(b) Excess Credits

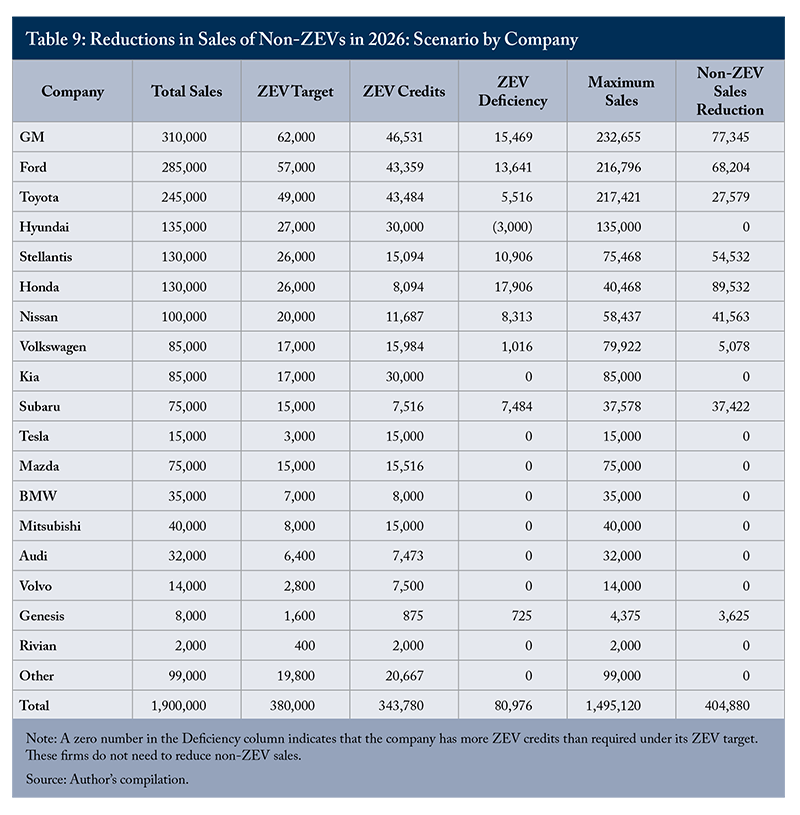

GM could purchase 8,331 excess credits, its proportional share of the 42,300 credits available in the market. It could also generate a maximum of 6,200 for Early Compliance Credits and Charging Fund Credits. GM would therefore hold a total of 46,531 ZEV credits (32,000 from sales, 8,331 purchased, and 6,200 created). This still leaves GM 15,469 credits short of its target.

To resolve the deficit, GM would be forced to reduce total sales from 310,000 to 232,655. At this level, its ZEV target falls to 46,531, exactly matching the total of ZEV credits it holds. The adjustment represents a reduction of 77,345 non-ZEV sales.

In addition to cutting sales, GM would incur compliance costs to purchase the 8,331 Excess Credits at the market price (at an unknown price), though less than $20,000 as noted above.

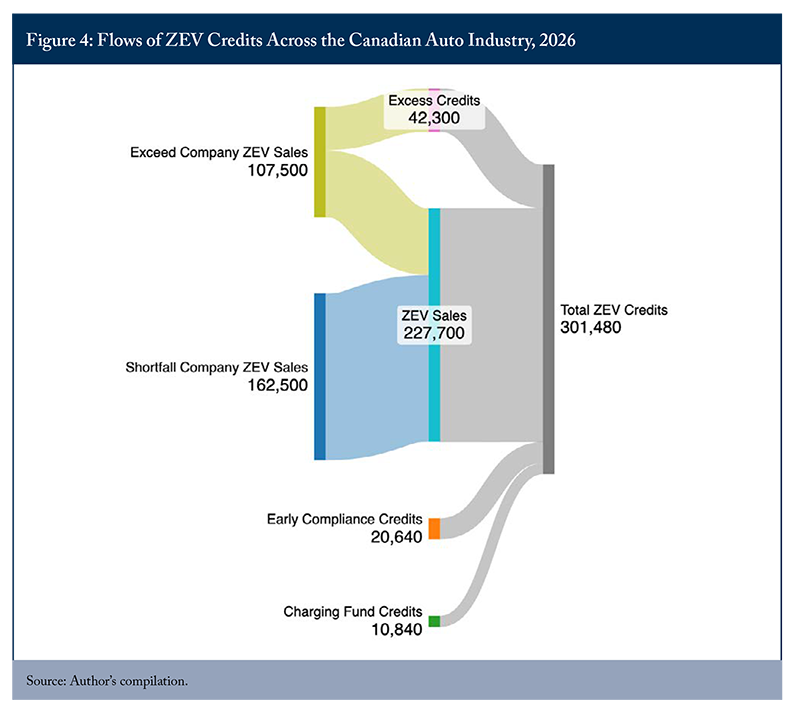

Figure 4 summarizes these dynamics for the entire industry. The Sankey diagram illustrates how Early Compliance Credits, Excess Credits, and Charging Fund Credits flow from firms that exceed their targets to those that fall short, and how these credits, when combined with actual ZEV sales, determine total compliance across the sector. In the figure, the term “Shortfall Company” means companies with ZEV sales below their ZEV target. The term “Exceed Company” means companies with ZEV sales that exceed their ZEV target.

Table 8 summarizes the total ZEV credits for each company in 2026, combining credits earned from ZEV sales, Early Compliance Credits, Excess Credits purchased from other automakers, and Charging Fund Credits.

The key point is that even after using all these other credit mechanisms, many companies will still not meet their 2026 20 percent ZEV target. In addition, these companies would need to create 10,840 Charging Fund Credits by making payments of $216,800,000.

The following section examines how companies might then be forced to reduce sales of non-ZEVs in order to achieve compliance.

Shutting In of Non-ZEV Sales

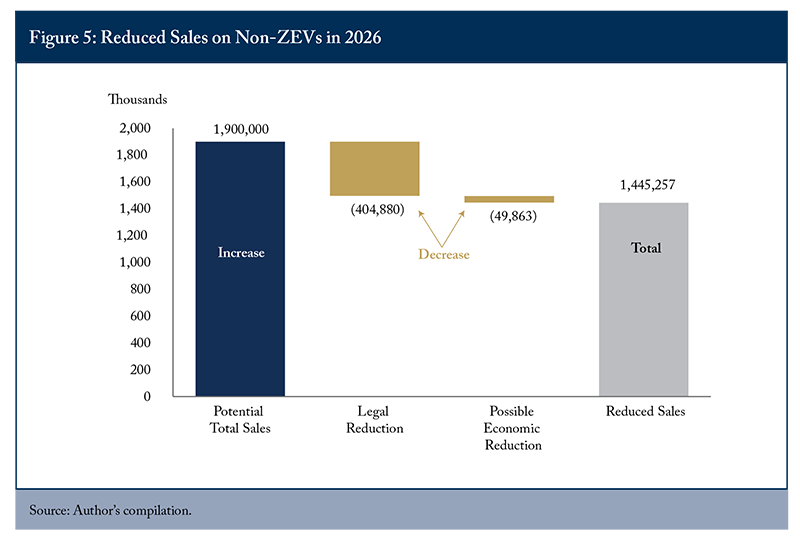

The ZEV mandate will require sellers of light vehicles to restrict sales in 2026, both for legal compliance and potentially for economic reasons. Figure 5 illustrates the impact.

Total consumer demand and potential sales are projected at 1.9 million units. Legal restrictions under the ZEV mandate reduce this number by 404,880 vehicles. Economic considerations described above – meaning actions to avoid penalties – could further reduce sales by about 50,000. Together, these effects would lower final permitted sales to 1,450,000 – representing a shortfall of 450,000 vehicles relative to demand. The following sections describe in more detail the mechanisms behind these reductions.

Meeting the Non-ZEV Sales Allowed by the Regulation

Table 9 shows the reduction of non-ZEV sales required for Canadian automakers in 2026. The calculations are based on the total ZEV credits presented in Table 8 and the methodology described above.

In short, to comply with the ZEV mandate, automakers in Canada would collectively need to reduce non-ZEV sales by 404,880 units in 2026. Past sales experience suggests that consumer demand for these vehicles remains strong, meaning that more than 400,000 Canadians would be unable to purchase the gasoline or diesel vehicles they prefer.3The number of non-ZEV vehicle sales shut-in depends on the demand for ZEVs. Sales of ZEVs so far in 2025 are even less robust than the scenario I have assumed. If that pattern holds, even fewer total vehicle sales would be legally allowed in 2026 under the mandate. For example, if ZEV sales in 2026 were only 200,000, shut-in sales of non-ZEVs would rise to 625,000.

Additional Economic Reasons

Even when automakers are technically able to comply with the ZEV mandate by purchasing Excess Credits or creating Charging Fund Credits, some may conclude that it is uneconomic to do so.

As discussed above, the purchase price of Excess Credits will be determined by supply and demand. The assumption in this paper is that the market price for Excess Credits will be such that companies will find it economic to purchase them and thereby increase the number of non-ZEVs that they can sell.

The economics of creating Charging Fund Credits at the prescribed amount of $20,000 may present a different situation. The $20,000 cost would translate to $5,000 for each of the four non-ZEVs that a company would be able to sell. Companies would have to conclude that the margin on the sale of each non-ZEV would exceed $5,000. If the company allocates this extra $5,000 to higher price and higher margin vehicles, such as pickup trucks, they may create such Charging Fund Units. If the company only sells lower-priced and lower-margin vehicles, it may choose not to create any Charging Fund Units and, therefore, not increase its non-ZEV sales.

As shown in Table 8, the projection is for a maximum of 10,840 Charging Fund Credits to be created in 2026. If all these Charging Fund Credits were not created, it would result in a reduction of total sales of light vehicles. As mentioned above, it is not clear what this number might be. The bottom line is that there may be a further reduction in sales for economic reasons of up to 50,000, over and above the reduction of 404,880 for legal reasons, as shown in Table 9.

Conclusions and Suggested Modifications to the ZEV Mandate

Based on the volume of 270,000 ZEV sales I expect for 2026, Canada would have been unlikely to achieve its mandated ZEV sales target for that year, which would have been 20 percent of projected light-vehicle sales, or 380,000 units. The point for 2026 and beyond is that the mandate on its own does not generate the increase in demand needed to close this gap.

Moreover, the policy is expected to produce several negative side effects. For example, companies that failed to reach the 20 percent requirement in 2026 would have faced legal constraints that forced them to reduce sales by 404,880 vehicles in that year. Had the 20 percent target not been waived, they would have needed to pay market prices for Excess Credits from firms that surpass their ZEV targets, as well as over $200 million for Charging Fund Credits. These two expenditures together would have made some sales of non-ZEVs uneconomic. To remain compliant in this scenario, companies would be forced to reduce their sales of gasoline and diesel vehicles. Industry-wide, as many as 450,000 non-ZEVs that consumers would otherwise purchase in 2026 would not have been sold, either because of the legal target for ZEV sales being, in effect, a cap on non-ZEV sales, or because the economics of compliance make those sales impossible.

The credit system also creates winners and losers. Under the waived target for 2026, companies that sold more than 20 percent of their vehicles as ZEVs would receive the market price in tradable credits in 2026. In this scenario, Tesla alone could realize significant revenue from these sales. In effect, companies such as Tesla are compensated twice – once when they sell a vehicle and again when they sell the associated credits. This outcome has become a subject of public debate, particularly because the firms positioned to benefit most – including Tesla, Hyundai, and Kia – do not operate light-vehicle manufacturing facilities in Canada. By contrast, Canadian-based manufacturers such as GM, Ford, Stellantis, Toyota, and Honda bear the cost of purchasing credits, further increasing their competitive disadvantage (EVXL 2025).

Finally, the mandate is subject to legal uncertainty. An application for judicial review was filed in the Quebec Superior Court by a refiner in 2024, who argued that the federal government lacks jurisdiction to impose the ZEV mandate under the CEPA. The provinces of Alberta and Quebec have intervened in support of the challenge (Gagnon, Sadikman et al. 2024).

Taken together, these findings raise the question of why the federal government would continue to impose a mandate that is forecast to fall short of its goals, add costs to Canadian automakers, deprive Canadians of vehicles they need, and benefit foreign producers without Canadian manufacturing operations. At a time when US tariffs on Canadian vehicle exports are already placing a heavy strain on the domestic industry, the ZEV mandate risks compounding the damage. Overarching emissions reduction targets applying to vehicle fleets bind the auto sector in any event.

Given all this, the question arises for the ZEV mandate as to whether it is better to end it or mend it.

Arguments for ending it are: (i) that the ZEV mandate is an unneeded policy that overlaps with the existing policies that prescribe overall emission caps and mileage requirements for the fleet of light vehicles sold by a light vehicle vendor; and (ii) the unintended side effects.

Arguments for mending it are based on several policy changes that could address the shortcomings identified in this paper.

First, the percentage targets should be reduced for the years 2027 to 2030. A review of the post-2030 trajectory could be scheduled for 2028, allowing policy to be recalibrated in light of consumer demand, technological progress, and infrastructure development.

Second, the sale of Excess Credits by companies such as Tesla should be changed so that the federal government receives the sale proceeds rather than the selling company. This could enable the federal government to develop an emissions credit market.

Third, pure hybrids should be counted as ZEVs under the mandate. Although not zero-emission, these non-PHEV hybrids deliver significant improvements in fuel efficiency compared to conventional gasoline vehicles. Canadian consumers have demonstrated a strong willingness to purchase them. In the first half of 2025, hybrids accounted for 12.4 percent of all sales. Including them in the ZEV mandate would have raised the ZEV share in that period from 8.6 percent to 21 percent, a much more attainable target.

Fourth, it would be a good idea to suspend the ZEV mandate indefinitely until the resolution of trade matters with the United States and China that deeply affect the prospects for the light vehicle market, including the availability of ZEVs.

The current federal ZEV mandate needs to be amended, and these changes should be made before January 1, 2026, when the policy comes into force for model year 2026. The waiver of the 20 percent target for 2026 is a start, but the ZEV mandate also needs to be amended for the years after 2026.

The author extends gratitude to Stephen Beatty, Tasnim Fariha, Daniel Schwanen, Grant Sprague, and several anonymous referees for valuable comments and suggestions. The author retains responsibility for any errors and the views expressed.

References

Beatty, Stephen. 2025. “Back to the Future? Canada’s Auto Strategy in a New Tariff Era.” E-Brief. Toronto: C.D. Howe Institute. May 8. https://cdhowe.org/wp-content/uploads/2025/05/E-Brief_372-1.pdf.

Canada. 2023. Regulations Amending the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations. Canada Gazette, Part II, December 20. SOR/2023-275. https://gazette.gc.ca/rp-pr/p2/2023/2023-12-20/html/sor-dors275-eng.html.

CBC News. 2025. “Ottawa to Announce $15 Billion in Spending Cuts.” https://www.cbc.ca/news/politics/ottawa-spending-cuts-1.7579022.

CTV News. 2025. “New EV Rebate Program in the Works, Environment Minister Says.” https://www.ctvnews.ca/business/autos/article/new-ev-rebate-program-in-the-works-environment-minister-says/.

Drive Tesla Canada. 2025. “Tesla Increases Prices in Canada as Much as 21% Due to Tariffs.” July 6. Available at: https://driveteslacanada.ca/news/tesla-increases-prices-in-canada-as-much-as-21-due-to-tariffs/.

Electric Autonomy Canada. 2025a. “Quebec EV Rebate Program.” March 28. Available at: https://electricautonomy.ca/policy-regulations/ev-rebates-incentives-funding/2025-03-28/quebec-ev-rebate-program-canada/.

———. 2025b. “B.C. EV Rebate Program Ending.” April 30. https://electricautonomy.ca/policy-regulations/ev-rebates-incentives-funding/2025-04-30/bc-ev-rebate-program-ending-canada/.

EVXL. 2025. “Tesla EV Credit Windfall in Canada.” July 6. https://evxl.co/2025/07/06/tesla-ev-credit-windfall-in-canada/.

Gagnon, Hugo-Pierre, Jacob A. Sadikman, Michael Fekete and Josy-Anne Therrien. 2025. “Québec adopts its regulation prohibiting motor vehicles and internal combustion engines by 2035.” Osler Updates, February 3. https://www.osler.com/en/insights/updates/quebec-adopts-its-regulation-prohibiting-motor-vehicles-and-internal-combustion-engines-by-2035/.

The Globe and Mail. 2025. “U.S. Electric Vehicle Tax Breaks Will Expire End of September.” https://www.theglobeandmail.com/business/article-us-electric-vehicle-tax-breaks-will-expire-end-of-september/.

Livingston, Brian. 2024. “Time to Reboot: The Federal ZEV mandate requires flexibility.” Working Paper. Toronto: C.D. Howe Institute. January 25. https://www.cdhowe.org/wp-content/uploads/2024/12/Working20Paper_ZEV_2024.pdf.

Montreal Economic Institute (IEDM). 2025. “A Lack of Budgetary Discipline Is Undermining Quebec’s Public Finances.” March. https://www.iedm.org/a-lack-of-budgetary-discipline-is-undermining-quebecs-public-finances/.

Office of the Parliamentary Budget Officer, Canada. 2024. “Electric Vehicle Availability Standard: Potential Impacts on Ownership Costs and Charger Supply.” https://www.pbo-dpb.ca/en/publications/RP-2425-012-S--electric-vehicle-availability-standard-potential-impacts-ownership-costs-charger-supply--norme-disponibilite-vehicules-electriques-couts-possession-offre-bornes-recharge.

Politico. 2025. “Trump Revokes California’s Nation-Leading Electric-Vehicle Mandate.” June 12. Available at: https://www.politico.com/news/2025/06/12/trump-revokes-californias-nation-leading-electric-vehicle-mandate-00402601

Royal Bank of Canada (RBC). 2025. “B.C. Budget 2025: Growing Deficits, Rising Debt and Looming U.S. Tariffs.” Provincial Budgets and Economic Statements. March. https://www.rbc.com/en/thought-leadership/economics/provincial-outlook-fiscal-analysis/provincial-budgets-and-economic-statements/b-c-budget-2025-growing-deficits-rising-debt-and-looming-u-s-tariffs/

Statistics Canada. 2025a. “Vehicle Registrations, by Type of Fuel.” Table 20-10-0025-01. Government of Canada. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2010002501

———. 2025b. “New Motor Vehicle Sales, by Type of Vehicle and Fuel.” Table 20-10-0085-01. Government of Canada. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2010008501.

Related Publications

- Research