Home / Publications / Research / Powering the Federation: A Blueprint for National Electricity Integration in Canada

- Media Releases

- Research

- |

Powering the Federation: A Blueprint for National Electricity Integration in Canada

Summary:

| Citation | Madeleine McPherson. 2025. "Powering the Federation: A Blueprint for National Electricity Integration in Canada." 695. Toronto: C.D. Howe Institute. |

| Page Title: | Powering the Federation: A Blueprint for National Electricity Integration in Canada – C.D. Howe Institute |

| Article Title: | Powering the Federation: A Blueprint for National Electricity Integration in Canada |

| URL: | https://cdhowe.org/publication/powering-the-federation-a-blueprint-for-national-electricity-integration-in-canada/ |

| Published Date: | October 30, 2025 |

| Accessed Date: | January 26, 2026 |

Outline

Outline

Authors

Related Topics

Files

For all media inquiries, including requests for reports or interviews:

• Canada’s power grids remain divided by provincial borders, limiting efficiency and reliability. While goods, services, and capital move across provinces, barriers still limit cooperation – and electricity is no exception. This fragmentation drives up costs, weakens reliability, and wastes opportunities to develop clean power.

• A more connected national grid would cut costs, strengthen reliability, and lower emissions. Modelling shows that expanding transmission links – for example, between BC and Alberta or Manitoba and Saskatchewan – could generate billions in net benefits, boost resilience for extreme events, and make better use of low-cost renewables.

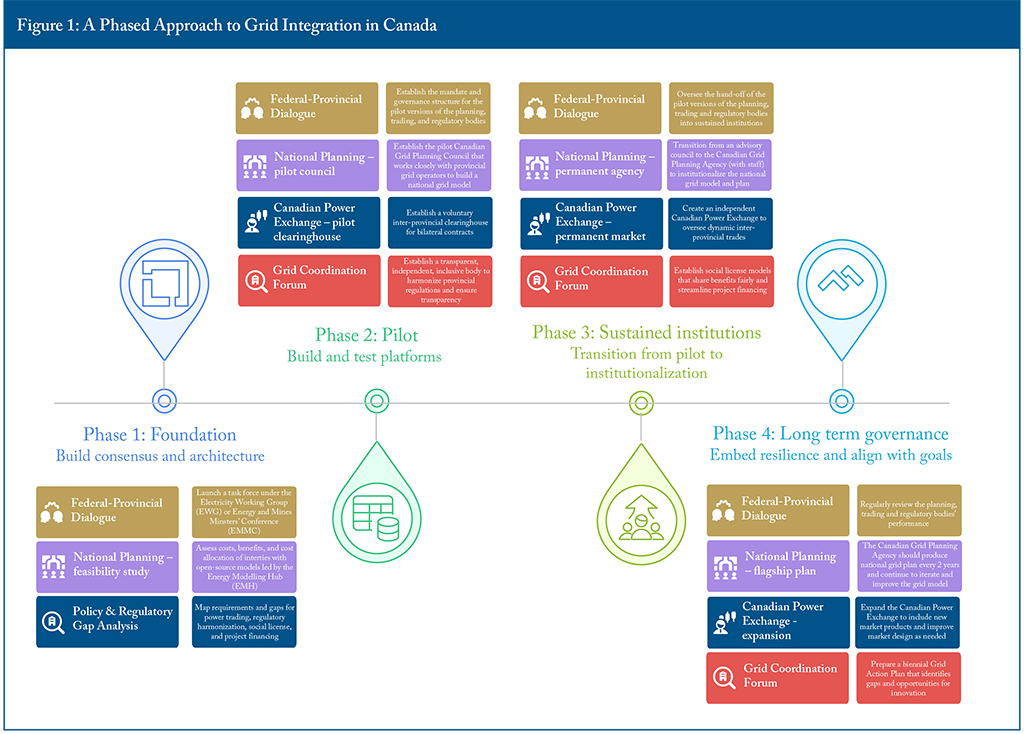

• This blueprint lays out a bottom-up, phased plan for integration. It begins with provincial plans and priorities and advances through four stages: forming a federal-provincial task force, piloting coordination and trading bodies, making them permanent, and building a lasting governance framework.

• Progress depends on cooperation and inclusion. The proposed Canadian Grid Planning Agency, Power Exchange, and Grid Coordination Forum would close governance gaps, strengthen Indigenous participation, and ensure the benefits of integration are shared equitably.

Introduction

Canada’s electrical grid is highly segregated: power remains largely trapped within provincial borders, and planning focuses on provincial footprints. This comes at a cost: larger, interconnected grids are typically more reliable, resilient, and cost-effective than smaller, isolated systems. Yet Canada remains an outlier: provincial grids are siloed, governed independently, and often more connected to the United States than to each other. The lack of meaningful east-west connections is increasingly costly, vulnerable, and misaligned with national climate and economic goals. Canada is not alone in facing these pressures.

Globally, grid integration has become a priority to prepare grids for a changing climate (extreme events), rapid electrification, and the growth of renewable energy. Isolated grids are costlier and less reliable, as illustrated by the 2016 blackout in South Australia and the 2021 power crisis in Texas. The 2022 energy crisis in Europe, meanwhile, accelerated cross-border integration to enhance resilience and affordability. As renewable costs plummet and high-quality sites move further afield, limited grid expansion will drive up costs. Grid modelling shows that Canada’s isolated provincial grids are more vulnerable, costly, and emissions intensive. Successful economies depend on access to low-cost, abundant energy resources. Canada must modernize its grid planning, with a focus on integration, to stay competitive as the world decarbonizes and electrifies.

Until recently, the political climate around grid integration in Canada was tepid. Canada avoided crises like those that spurred action in the United States, Australia, and Europe – until recently. Trade tariffs imposed by President Trump created urgency around nation building and sovereignty, and reframed trade dynamics. Greater interprovincial trade is essential if trade with the United States is disrupted, but even if it is not, north-south and east-west trade are complementary. With political will for nation-building projects now emerging, this is a moment to advance a framework for grid integration. Hopefully, a major blackout or crisis will not be required to trigger action. The question then becomes: how do we move forward?

This blueprint offers a plan to establish governance structures and processes to leverage this historic opportunity to create a more integrated Canadian electricity grid. This paper does not propose that electricity should become a federal jurisdiction, but rather that coordinated planning of the country’s electricity grid would benefit all provinces. The proposed bottom-up approach to governance and planning maintains provincial autonomy, while arguing for coordinated institutions can bridge today’s fragmentation. Integration must be built on mutual benefit: no province should carry disproportionate costs or risks, and utilities already under pressure must be supported. Indigenous partnership and equity ownership are essential for durable social license and reconciliation.

The blueprint is organized around five pillars:

- Governance structures to fill planning and regulatory gaps.

- Planning frameworks to integrate provincial plans into a coherent national vision.

- Trading frameworks to bridge diverse market structures and enable efficient cross-border electricity flows.

- Financing models that apply fair cost allocation and leverage diverse beneficiaries.

- Community engagement, with Indigenous ownership at the core of durable social license.

These pillars advance in four phases:

- Phase 1: Build the Foundation – Launch a federal–provincial task force, analyze policy and regulatory gaps, and conduct feasibility modelling to create a shared evidence base.

- Phase 2: Pilot Institutions – Test three pilots: a Canadian Grid Planning Council for national modelling, a Bilateral Contract Clearinghouse toward a Canadian Power Exchange, and a Grid Coordination Forum for regulatory alignment.

- Phase 3: Institutionalization – Transition pilots into permanent institutions with clear mandates, stable funding, and growing capabilities.

- Phase 4: Long-Term Governance – Mature these institutions, embed continuous improvement, and sustain coordination while respecting provincial autonomy and Indigenous sovereignty.

This blueprint provides a path for Canada to capture these benefits, building from a recent review of best practices for grid integration (McPherson 2025). By starting with provincial plans and building upward to a national framework, Canada can modernize its grid while respecting jurisdiction, strengthening sovereignty, advancing reconciliation, and delivering lasting economic and environmental benefits. Its focus is on building frameworks for governance, planning, trading, financing, and social license that enable grid integration. A truly integrated Canadian grid plan is not a federal imposition but a cooperative nation-building project – one that will shape prosperity and resilience for generations. The objective is to remove one barrier to integration – uncertainty about how to proceed – by laying out a clear path forward.

The paper does not discuss topics such as municipal engagement and support, environmental impacts, or community consultations, among others. Such topics would be the purview of the institutions discussed in this paper. The next section discusses benefits and challenges with integration as well as the founding principles for grid integration based on lessons from previous provincial and federal attempts at integration.

Motivation for Greater Integration

Greater integration between provincial power systems is essential for maintaining reliability and affordability amid climate change impacts, electrification, and decarbonization. Expanded trade between provinces would deliver several benefits:

Optimize Provincial Resource Endowments

Integration allows flexible hydro generation in BC, Manitoba, and Quebec to balance world-class but intermittent wind in Alberta, Saskatchewan, and the Atlantic provinces. Canada’s wind resources are among the cheapest new generation options – as low as 3.7 cents/kWh in Alberta’s 2017 auction. With integration, development can focus on the highest-quality resource areas, instead of building local wind with lower capacity factors and higher costs. Exploiting this power depends on dispatchable generation to balance wind. Flexible hydro, found in neighbouring provinces, is the ideal dance partner. By linking provincial grids, resource endowments are optimized, delivering more reliable, cheaper, cleaner electricity to consumers on both sides.

Reliability and Resilience

Integration improves reliability by enabling regions to share resources and grid services, especially during extreme weather. Bigger, interconnected grids let operators pool resources, balance variability, and share backup capacity. A grid spanning multiple provinces can draw on diverse sources – hydro, wind, nuclear – so surpluses offset shortages elsewhere. This diversity smooths climate-driven variability and reduces the risk that a single event, like a cold snap or wildfire, causes widespread outages. Time-zone diversity allows operators to smooth demand across cities. Integrated grids also allow reliance on larger reserve portfolios, meaning each jurisdiction needs fewer backup assets. Interconnection transforms local vulnerabilities into collective strengths, creating a more robust safety net than isolated systems.

Cost Reduction and Economic Opportunity

Transmission expansion delivers access to high-quality renewable areas, lowering the capital costs of generation. Interregional trade reduces production costs through diversification of generation and demand, and increased competition. By sharing resources, provinces avoid overbuilding redundant capacity and instead optimize investments across a larger system. This lowers system costs for consumers while creating opportunities to develop local renewables, sell surplus power into wider markets, generate revenue, attract private investment, and spur job creation. The result is not only cheaper power, but also a stronger, more dynamic energy economy.

Several analyses have demonstrated the value of integration across North America (Brinkman et al. 2021), Canada (GE Energy Consulting 2016), sub-Canadian regions (Natural Resources Canada 2018a, 2018b), and provincial pairs (Pedder et al. 2021; English et al. 2017; Seatle et al. 2025). Each adopts different modelling methods and policy suites (carbon pricing, coal phase-out, net-zero targets, Clean Electricity Regulation). Many studies considered only production and capital cost benefits, overlooking other benefits demonstrated by US system operators (MISO 2012, 2022; NYISO 2017, 2019; Southwest Power Pool 2016). Until recently, no similar analysis existed for Canada. A recent paper quantified integration benefits using the multi-value planning framework proposed by the Energy Systems Integration Group (ESIG 2022) with three linked electricity system models: a capacity expansion model, COPPER (Arjmand and McPherson 2022), a production cost model, SILVER (McPherson and Karney 2017), and a resource adequacy model, PRAS (Stephen 2021). Together, these quantify six categories of benefits: production cost, emissions reduction, generation capital cost, risk mitigation, resource adequacy, and resilience. Integration proved especially beneficial for reliability, reducing expected unserved energy.

The models suggested that expanding the BC-Alberta interconnection by 2.4 gigawatts – twice its current capacity – would yield $1.7 billion in net benefits11 Net benefits include: capital cost, production cost, and emissions savings, as well as improved reliability, resilience, and risk mitigation. over the investment period to 2050 (Seatle et al. 2025). Similarly, adding 1.5 gigawatts between Manitoba and Saskatchewan – triple current capacity – would yield $2.3 billion in net benefits over the same period (Seatle et al. 2025). These benefit-to-cost ratios of 5.9 and 4.5 represent a massive return on investment (Seatle et al. 2025). Another report, using a different methodology, found that a $1.7 billion federal investment in interprovincial transmission could unlock another $6.6 billion in private investment for transmission and another $92.5 billion over 10 years for renewable power plants.22 Torrie, Ralph, and Céline Bak. 2020. “Building Back Better with a Green Power Wave.” Corporate Knights. April 29. https://www.corporateknights.com/climate-and-energy/building-back-better-with-a-green-power-wave/. Of course, these techno-economic models contain uncertainties and do not account for political realities. However, they consistently point to the value that greater interconnection would bring.

Challenges with interconnecting provincial grids

Integration of Canada’s provincial grids is challenging. Each province has its own utility or system operator. Planning, ownership, and operations reside within provinces. Many provinces have resisted federal intervention, including planning and regulatory coordination, which are prerequisites for integration. Each province has its own market structure, ranging from unbundled competitive markets – where generation, transmission, and distribution are operated by separate entities – to vertically integrated Crown corporations. Designing a trading framework that incorporates these disparate structures is complex. Utilities and planners already face electrification, renewable integration, and climate change impacts; expanding the scope of planning may pose an added burden and require new resources. The lack of a national process means Canada lacks credible, cohesive insight into the value of integration or how its benefits would be shared. Governance gaps leave no clear pathways to resolve market mismatches or devise a coordinated national plan. As a result, stronger economic incentives to the south have often led provinces to prioritize trade with the United States over trade with each other.

Provinces have very different residential power rates, from as low as 12 cents/kWh in Vancouver to as high as 24 cents/kWh in Edmonton in 2024 (Hydro Quebec 2024). Indeed, a forthcoming C.D. Howe Institute Commentary updates a previous C.D. Howe Institute report analyzing the differences in power prices across provinces (Bishop, Ragab, and Shaffer 2020). The forthcoming Commentary also finds variability in residential power rates, with lower rates in Quebec and Ontario and higher rates in Alberta and Saskatchewan. Some fear that greater integration and price stabilization will forfeit their competitive advantage. Without analyses that include reliability, resilience, and risk management, it is difficult to see past basic price stabilization.

Yet provinces with the highest power costs, including Alberta and Saskatchewan, also have the country’s highest-quality, lowest-cost wind. If developed (with the help of interties), their neighbours with low current rates would benefit from importing this cheap wind. Because high shares of wind are enabled by flexible hydro and depend on integration, provinces on both sides of the intertie will benefit from lower prices. Historically, electricity generation was a major source of employment, but today’s generation – nuclear aside – supports fewer long-term jobs. Now, the economy will create more jobs through access to low-cost electricity, which enhances competitiveness, than are created at local generation facilities. Still, fears of “exporting” jobs when power is generated next door remain.

Federal initiatives such as the Canada Electricity Advisory Council (CEAC) included greater integration as one of their recommendations, but provincial reluctance persists, and action has stalled. Grid integration will require bold, ambitious provincial action. As has been recently witnessed with interprovincial trade barriers, in times of instability, provinces are capable of action on previously challenging issues.

Founding principles of a blueprint for greater integration

This report proposes a blueprint to overcome integration challenges across Canada. It does not ignore or undermine these challenges but addresses each directly with specific strategies. This blueprint moves beyond generalities to propose strategies that build from today’s starting point, respect tensions and priorities, and offer practical steps. The actions proposed here rest on the following principles:

- National planning must be bottom up, not top down: Provincial plans and priorities must remain foundational. The federal government has a role in coordination, but this blueprint is not a federal initiative.

- Cross-border infrastructure must distribute benefits equitably: Grid modernization places disparate challenges on provinces. Any cross-border infrastructure must be mutually beneficial with fair cost allocation based on the distribution of benefits.

- Proposed strategies must facilitate broader utility priorities: Utilities and system operators are under pressure to electrify, meet climate targets, and plan for new loads, including data centres. Strategies must help utilities meet these challenges and avoid extra burdens.

International experience

Integration has emerged as a top priority worldwide: Europe, Australia, and (to a lesser extent) the United States have devised strategies to overcome many of the challenges Canada faces. This blueprint synthesizes insights from widespread expert consultation to develop Canadian strategies, focusing on sovereignty, fair cost and benefit distribution, and governance gaps.33 Further details about the expert consultation can be found in McPherson (2025).

In Europe, grid modernization has moved beyond renewable deployment, which is viewed as on track: renewables are cost-competitive, policies are effective, and investment vehicles are working well. Attention has shifted to integration, with broad agreement that transmission expansion is needed but slow. The value of integration is well accepted: smoothing variable renewable generation and prices, accessing resources, improving reliability and security, and managing grid operations efficiently. Grid operators, member states, and the European Commission are pursuing integration initiatives. With consensus that more is needed quickly, the EU is pursuing a mutually beneficial, evidence-based approach to maximize implementation.

Following the 2016 blackout in South Australia, Australia’s energy and environment minister commissioned an independent review on grid security. The Finkel Review recommended integrated planning “to facilitate the efficient development and connection of renewable energy zones across the National Electricity Market” (Finkel 2017), marking a pivotal moment for the sector. It proposed reforms to modernize Australia’s system amid rapid decarbonization and decentralization. Among other things, it called for stronger planning frameworks to manage reliability, specifically through the Integrated System Plan (ISP) by the Australian Energy Market Operator (AEMO), which has since become a cornerstone of grid development across the National Electricity Market (which does not include Western Australia or the Northern Territory). Through successive iterations, the ISP has shifted the sector toward expert-driven planning and away from ad hoc policymaking. It has created coordinated, least-cost transmission investment and strategic development to unlock renewable zones and connect resources efficiently. Today, coordinated system planning and integration are top modernization priorities in Australia.

The United States has done regional planning for decades, but like Canada, it lacks national-scale planning despite calls from researchers and analysts. Currently, the Federal Energy Regulatory Commission (FERC) requires “coordination” between Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs), but requirements are weak. True interregional coordination does not yet exist. Many experts advocate for stronger regional collaboration. For FERC to impose such requirements, it would need expanded authority from Congress, which some believe is politically impossible.44 A bipartisan permitting bill from Senators Manchin and Barrasso recently proposed interregional transmission provisions among many permitting topics (Senate Committee on Energy and Natural Resources 2024). Republicans generally support transmission that improves reliability and supports data centres, but resist expanding federal authority or subsidizing renewables. Democrats, by contrast, want to broaden federal oversight, add planning requirements, and emphasize the reliability, affordability, and decarbonization benefits of greater grid integration. Whether broad coalition support for interregional expansion and political momentum for change will continue remains open.

Of course, there are many differences between Canada and every other jurisdiction, making unedited adoption impossible. Europe has a much greater and more evenly distributed population density. The history of unbundling and liberalization differs. Nonetheless, lessons can be learned and applied to create a made-in-Canada approach.

Blueprint for Canada: A Phased Approach

This blueprint draws on international best practices and detailed modelling of the Canadian power system. It recognizes that sectoral and institutional change is gradual: governance takes time to build, planning should be inclusive, financing structures are complex, and stakeholders are numerous. It defines a sequence of activities across five pillars – governance structures, planning frameworks, trading frameworks, financing structures, and community engagement – organized into four phases. While the grid planning should be pan-Canadian, regional governance structures and bilateral transmission lines are likely a practical starting point. Figure 1 provides an overview of the blueprint, which serves as an outline for the remainder of this report.

Phase 1: Build the foundation

The first phase establishes the groundwork for sustained grid integration and power trading across provinces. It focuses on three activities: launching a federal–provincial task force, conducting a policy and regulatory gap analysis, and completing a modelling feasibility study. These steps set the stage for Phase 2, which will launch three pilot institutions: a Canadian Grid Planning Council to integrate provincial plans into a unified national plan, a Canadian Power Exchange as a central clearinghouse for electricity trading, and a Grid Coordination Forum to promote regulatory consistency. Each of these pilots could evolve into permanent institutions in Phase 3.

Federal–Provincial Dialogue: Launch Task Force

Early coalition building between provinces and the federal government is essential. Canada lacks a dedicated forum for interprovincial electricity issues. The Canada Electricity Advisory Council identified this gap in Recommendation 19 of its May 2024 report to “construct a framework to support inter-regional electricity transmission projects.” Provincial governments, utilities, Indigenous governments and rights-holders, and regulators need a neutral venue to discuss trade opportunities, address barriers, and plan cross-border electricity flows.

Existing groups such as the Electricity Working Group (EWG) and the Energy and Mines Ministers’ Conference (EMMC) could serve as a base for coalition building. A new task force within one of these bodies should focus on grid integration, mapping policy and regulatory needs, and building trust. In Phase 2, this task force could evolve into the Grid Coordination Forum, tasked with harmonizing regulations and ensuring transparency. By Phase 3, it would develop a social licence framework and financing models. In Phase 4, it would publish a biennial Grid Action Plan highlighting gaps and innovation opportunities.

Policy and Regulatory Gap Analysis: Define requirements and launch pilots

The task force should consolidate Canadian and international experience to shape the governance and mandates of three new bodies:

- The Canadian Grid Planning Council, composed of provincial planners and operators, would design a national planning process and oversee a modelling exercise, drawing on lessons from the European Network of Transmission System Operators for Electricity’s (ENTSO-E) Ten-Year Network Development Plan (TYNDP) and AEMO’s ISP.

- The Canadian Power Exchange would streamline interprovincial trading by documenting current arrangements, identifying shortcomings such as bilateral contract limits, scheduling misalignments, tariff structures, and exploring protocols for scheduling and settlement.

- The Grid Coordination Forum would harmonize regulations, improve transparency, build social licence models, and support innovation, building on the Canada’s Energy & Utility Regulators (CAMPUT) network.

These three new bodies would be pilots to start; the initial implementation should be designed to test, learn, and refine before full rollout. As they evolve and mature, their structure and operations should be reviewed and refined before establishing themselves as permanent bodies.

Modelling feasibility study: preliminary model development and analysis

While many studies have shown the benefits of expanded integration, most were one-off efforts by academics or consultants, often using proprietary models and data. They lack institutional legitimacy and the sustained effort needed for long-term planning.

The Energy Modelling Hub (EMH), established in 2019 with funding from Natural Resources Canada, is well positioned to fill this gap. It convenes modellers and policymakers, manages open-source models and data, and engages stakeholders. Its validated modelling suite, database, and visualization tools provide the foundation for a national grid plan. The EMH’s M3 Platform has been used to assess intertie expansion benefits, including capital and production costs, emissions, reliability, resilience, and risk mitigation.55 A detailed methodology is outlined in Seatle et al. (2025), which applies a six-metric evaluation to expanded BC–Alberta and Manitoba–Saskatchewan interties.

In Phase 1, EMH should build on its modelling suite by: (1) integrating provincial grid plans into scenario development; (2) improving cost–benefit methodology; and (3) creating a framework to share cross-border costs fairly. The national grid plan should be based on existing provincial plans, such as BC Hydro’s Integrated Resource Plan and the Alberta Electric System Operator’s (AESO) Long-Term Transmission Plan, to ensure a bottom-up approach that reflects provincial priorities. The plan should incorporate a consistent methodology for evaluating integration, using a common definition of benefits. The methodology proposed in the accompanying academic paper should be refined through stakeholder consultations and informed by best practices, including ENTSO-E’s fourth-generation cost-benefit framework (2024) and FERC Order 1920’s list of benefits for cost-benefit analyses (2025). The benefits listed in these methods include lower wholesale prices, improved reliability, reduced congestion, reduced emissions, and greater renewable integration. Finally, connecting grid models to macroeconomic and labour models would allow Canada to assess the broader impacts of integration, including GDP and job creation.

By the end of Phase 1, EMH should have integrated provincial grid data into CODERS – the Canadian Open-source Database for Energy Research and Systems Modelling – refined its cost-benefit methods, and developed a tool to calculate cross-border cost allocation. The task force can then use these tools to produce an initial national grid plan. Publishing this early version would help build confidence, improve transparency, and lay the foundation for Phase 2, when the Canadian Grid Planning Council takes over the process.

Phase 2: Pilot Planning, Trading, and Regulatory Harmonization Frameworks

Phase 2 focuses on a soft implementation of three pilot organizations: a Canadian Grid Planning Council to coordinate provincial grid operators on cross-border modelling and planning; a Canadian Power Exchange to establish a voluntary interprovincial clearinghouse for bilateral contracts; and a Grid Coordination Forum to harmonize provincial regulations. These pilots could occur on a regional basis and build on efforts that are already underway, such as the New Brunswick-Nova Scotia Intertie (Wasoqonatl Reliability Intertie) and the Atlantic Canada Offshore Wind Integration and Transmission Study.

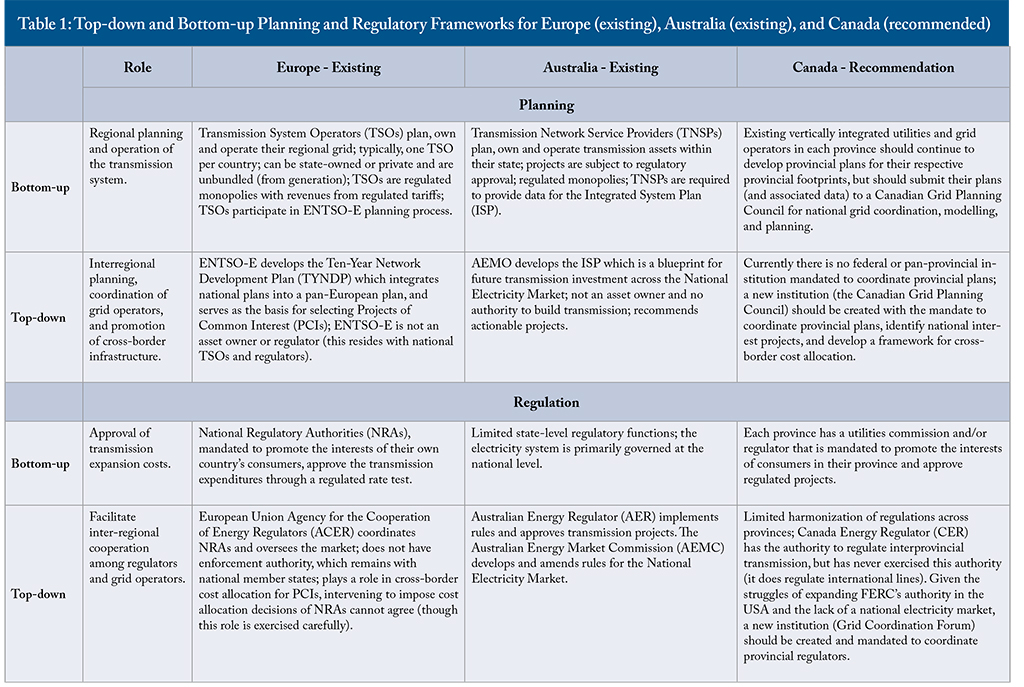

Each of these organizations should combine top-down and bottom-up governance to fit within Canada’s existing institutional landscape, where grid planning, operation, and ownership are the responsibility of individual provinces, each with its own planner, operator, and regulator. A strong belief that federal intervention, in what is viewed as a provincial matter, would be unacceptable has long been a major barrier to integrating provincial power grids. However, as Europe and Australia demonstrate, it is possible to preserve provincial autonomy while federal coordination enables integration. Europe and Australia faced similar tensions and developed governance structures that balance cross-border planning and regulatory harmonization without overstepping regional authority. The table below illustrates how Canada could draw from these models.

Pilot a Canadian Grid Planning Council to Coordinate Provincial Plans

Currently, each province develops a long-term outlook in reports such as BC Hydro’s Integrated Resource Plan or Alberta’s Long-Term Transmission Plan. These plans focus only on the provincial footprint and miss potentially beneficial opportunities. Canada needs a national plan that integrates but does not supplant these provincial plans. The provincial plans should be the starting points for the national plan, which can identify missed, mutually beneficial opportunities that no single province can achieve on their own.

Europe’s ENTSO-E (European Network for Transmission System Operators for Electricity) and Australia’s AEMO (Australian Energy Market Operator) coordinate across 36 countries and five states, respectively. These entities ensure coherence while respecting national (Europe) or state-level (Australia) policy. In the US, regional transmission organizations develop plans for their footprints, but there is no framework for interregional planning.

Canada has no regional or national plan or mechanism to align provincial ones. Canada could adopt the European and Australian model by creating a coordinating body to assemble provincial plans into an interregional plan or adopt the American model by expanding the Canada Energy Regulator’s (CER) mandate to impose interregional planning. However, given the success of Europe and Australia, the importance of a bottom-up approach in the Canadian context, and the ongoing struggles with expanding FERC jurisdiction, establishing a new body with authority to assemble provincial plans into a national plan is preferable. The Planning Council could begin at the regional level and only later merge into a single national entity. Ultimately, a national grid plan will deliver the greatest benefits, but a regional grid plan may be more practical in the near term. While planning may be national (or regional), bilateral transmission infrastructure is a practical starting point. This entity should have the authority to require provinces to submit generation and transmission plans and data in a standardized format for national alignment.

The Canadian Grid Planning Council should include provincial planners, utilities, and grid operators to ensure planning remains bottom up, following ENTSO-E’s model, where members are each country’s TSO. In this pilot phase, the Council could advise EMH on improving the national grid model and develop an inclusive planning process, preparing to assume full responsibility in Phase 3. The federal government would play a coordinating and supporting role.

Pilot a Canadian Power Exchange

Each province has its own electricity market: Alberta is unbundled and liberalized, Ontario is unbundled with a hybrid market, and Manitoba, Quebec, and BC are vertically integrated, hydro-dominated Crown corporations. This mix complicates interprovincial trade and is often cited as a barrier to a national grid. By contrast, Europe and Australia have harmonized markets enabling interregional trading. While mismatched structures complicate trade, they do not make it unworkable; appropriate frameworks can facilitate it. Trading already occurs between liberalized and vertically integrated provinces, as well as between integrated provinces. Every utility in Canada has a trading desk that cooperates across borders. The Canadian Power Exchange could expand these flows. The design of the Exchange should be a product of consultation and independent (operationally) from planning activities, so that challenges establishing the Exchange (as seen in the competition between the Southwest Power Pool and California ISO market development) do not deter the planning activities.

Current Frameworks for Trading Across Provincial Borders

Alberta–BC (Liberalized–Vertically Integrated): In Alberta’s liberalized market, imports and exports are compensated at the pool price set by the AESO, subject to losses and transmission charges. When Powerex, BC Hydro’s trading arm, imports from Alberta, it pays the pool price; its export bids are based on internal opportunity cost.

Manitoba–Saskatchewan (Vertically Integrated–Vertically Integrated): Without competitive wholesale markets, trades occur through long-term bilateral power purchase agreements, which specify volumes, schedules, and prices. For example, a 20-year, 100-megawatt agreement was signed in 2016 and expanded to 215 megawatts in 2018.

Emergency reserves: Neighbouring provinces also share power during emergencies. In January 2024, Alberta faced extreme cold that caused gas turbine and wind failures, pushing the grid to the brink. The AESO issued a grid alert, and imports from SaskPower and BC Hydro helped to avert widespread outages.

Setting Up a Bilateral Contract Clearinghouse

A voluntary, platform-based exchange could allow provinces to trade electricity without relinquishing operational control or unbundling. Mirroring Nord Pool (a pan-European power exchange), a phased approach could begin with a voluntary Bilateral Contract Clearinghouse in Phase 2, followed by a Canadian Power Exchange in Phase 3. In its early stages, Norway’s regulated hydro and Sweden’s liberalized market used a neutral day-ahead interface while TSOs retained real-time dispatch. Over time, participants expanded into intraday trading, forming today’s coupled market. This gradual process let participants learn rules and price signals before deeper integration.

A central platform could host existing bilateral contracts to build transparency. Initially, the Clearinghouse would register contracts, clear trades, and publish available transfer capacity, loss factors, seam flows, and prices. It could focus on win-win reliability opportunities and joint operating initiatives like sharing spinning reserve and balancing. These items are less threatening than full trade and still provide economic benefits. Once trust is built, provinces could expand into more integrated trade (Phase 3). The Clearinghouse could also publish near-real-time prices across zones, a first step to socialize price differences across provinces. Grid operators would continue to hold real-time balancing authority, as they do now. For example, Powerex participates in the Western Energy Imbalance Market.

The Canadian Power Exchange could be created as an independent organization with a board including provincial grid operators, independent directors, and Indigenous advisors. Exchange operations should be independent from grid operators, though they would be key partners: providing intertie capacity and data, participating in the advisory committee, and implementing results. An independent market monitor would investigate manipulation or withholding at seams and arbitrate disputes. To fund operations, the platform could auction intertie capacity and/or impose a small wheeling charge, with proceeds directed to an Interprovincial Settlement and Community Benefit Fund.

While transparent and compatible with current frameworks, this model lacks the responsiveness of day-ahead or real-time markets, which will be increasingly important as renewable generation grows. In Phase 3, the Canadian Power Exchange could evolve into a liquid market enabling provinces and utilities to respond to real-time conditions and volatility.

Pilot a Grid Coordination Forum

Each province has its own regulator; the CER oversees interprovincial infrastructure but lacks the authority to enforce a unified framework. Consequently, no common rules govern interties, and there is no recourse when disputes arise, as shown by Alberta’s unilateral decision to derate the BC–AB intertie.

Australia and the US (excluding Texas) both have national energy regulators: the Australian Energy Regulator and FERC, respectively. Europe uses a hybrid approach: national regulators retain authority, while the Agency for the Cooperation of Energy Regulators (ACER) facilitates coordination, monitors the EU internal energy market, and enforces the EU competition policy – all of which enable grid integration.

Given the provinces’ constitutional authority, a European-style model is preferable. A federal harmonizing body, modelled on ACER, could align provincial regulators without supplanting them. Such an entity should preserve provincial autonomy, promote harmonization, remain politically independent, and facilitate inclusive consultations.

- Provincial Ownership: Provinces would retain grid ownership and authority but coordinate technical standards and scheduling. Trading rules should interface with provincial systems while allowing provinces to keep current structures. Provinces would maintain control over pricing, regulation, reliability, and planning, while aligning intertie scheduling, congestion management, and net transfer capacity reporting. Provincial operators would need added resources to participate in the Exchange.

- Regulatory Harmonization: The Exchange will require agreement on market design, governance, transparency, grid codes, and settlement rules. A key enabler of trade is open, transparent access to transmission, similar to FERC Order No. 888’s Open Access Transmission Tariff (OATT). The harmonization efforts must also remain consistent with the North American Electricity Reliability Corporation (NERC) standards and practices, which Canadian utilities already do.

- Political Independence and Inclusive Consultations: The Forum should be free from political interference and prioritize inclusive, transparent consultations.

Phase 3: Transition from Pilots to Sustained Governance Structures

In Phase 3, the three pilot organizations – having been established, tested, and de-risked, and already seeing some benefits – should transition into permanent institutions with durable governance, multi-year funding, and clear mandates. Provinces would still maintain control of electricity within their jurisdictions. However, by this stage, the benefits of greater grid integration should be clear.

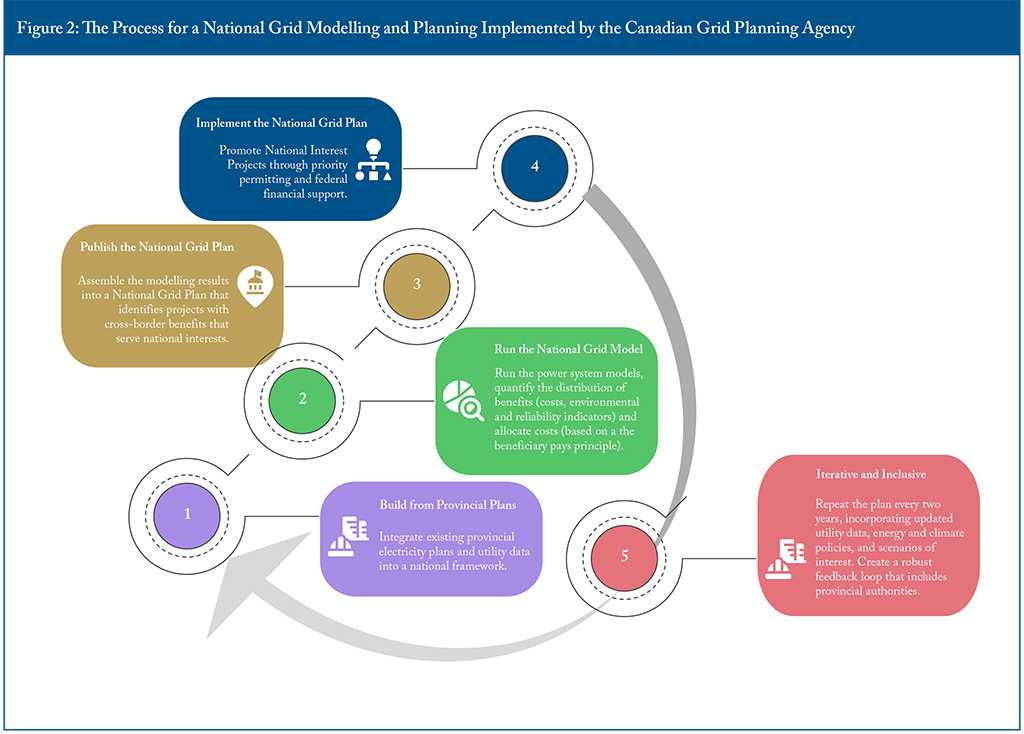

Establish the Canadian Grid Planning Agency

In Phase 3, the Grid Planning Council established in Phase 2 should become the Canadian Grid Planning Agency, with dedicated staff to maintain the national grid model, integrate provincial inputs, and publish the national plan on a regular schedule. Provincial grid operators would play a direct role by providing the utility data and candidate projects that anchor the modelling work.

The Agency’s core responsibilities would include maintaining the national grid model and publishing an updated national plan every two years. Canada can draw practical lessons from Europe’s ENTSO-E TYNDP and Australia’s AEMO ISP. Both rely on detailed inputs from grid operators, reflect state (Australia) or national (Europe) policies, and invite public and stakeholder consultation. The Canadian Grid Planning

Agency should:

- Be composed of full-time modelling and administrative staff with ongoing engagement with provincial grid planners.

- Secure agreements with provincial grid operators and planners for the timely sharing of utility data and collaboration on scenario development.

- Include each province’s energy and climate policies from their long-term plans as foundational inputs to scenarios.

- Create a robust feedback loop that allows provincial authorities to review and approve draft scenarios before they are finalized.

- Prepare a national plan that identifies national interest projects, which then receive priority permitting and financing support, similar to Europe’s Projects of Common Interest and Australia’s ISP Actionable Projects.

The planning cadence should be iterative, beginning with up-to-date data from provincial plans, then running the national modelling suite (including cost-benefit and cost-allocation analyses) to identify financially and operationally attractive national interest projects, and finally publishing a National Grid Plan. The process should be repeated on a biennial schedule and continually updated as policies, technologies, and regional needs evolve. This process is illustrated in Figure 2 below.

Deepen Integration in the Canadian Power Exchange

As wind and solar capacity grow, weather-driven variability will create wider price spreads across seams and drive resource adequacy requirements. Long-term bilateral contracts cannot fully cover this short-term volatility or long-term resource planning. Instead, Canada, led by utilities, should develop rules to govern electricity trade. In Phase 3, the Bilateral Contract Clearinghouse should mature into the Canadian Power Exchange: a dynamic market that supports efficient interprovincial trading, improves dispatch, and facilitates integration of variable renewables. A dynamic Exchange would allow provinces to respond to real-time and day-ahead signals; this improved dispatch would lower production costs, reduce curtailment, strengthen reliability, and guide efficient investment in intertie capacity.

The Exchange must be designed so that provinces are not required to overhaul their existing structure, whether vertically integrated or unbundled and liberalized. In the western United States, which has not established an RTO, several trading frameworks have emerged to enable coordination among authorities in both market and non-market regions. The Western Energy Imbalance Market (WEIM) is a real-time energy market that balances supply and demand across 21 balancing authorities, including Powerex and California ISO.66 California ISO. 2025. “California Independent System Operator. Western Energy Markets.” https://www.westerneim.com/pages/default.aspx. Established in 2014, the WEIM continues to expand as new participants join. Two additional initiatives are underway to cover the day-ahead timeframe: California ISO’s Extended Day-Ahead Market (EDAM) and SPP’s Markets+.77 Southwest Power Pool. 2016. “The Value of Transmission.” https://www.spp.org/value-of-transmission/. Powerex has committed funding to Markets+ and has raised concerns about EDAM’s design.

Across Canada, other utilities also participate in US markets. For example, Manitoba Hydro joined MISO in 2001, and Hydro-Quebec set up a trading floor to sell its surplus energy into US markets in 2000. The Canadian Power Exchange should not supplant this existing integration with US markets, which continue to be important revenue streams. Rather, it should complement US market integration with greater interprovincial market integration.

Create a Shared Market Platform

Building on the experience of the WEIM, EDAM, and Markets+, provinces could devise a structure that accommodates the diverse provincial market structures while allowing the Exchange operator to coordinate trading between provinces efficiently. The Exchange operators could schedule hourly intertie capacity, settle transactions, and report prices. The auction design will require careful consultation with balancing authorities, but should maximize social welfare by directing flows that deliver the greatest net benefits. Congestion rents – revenues collected when transmission lines reach capacity and price differences emerge between regions – accrued at seams could be deposited into an Interprovincial Settlement Fund and used to invest in new infrastructure and share benefits with affected communities.

Expand Market Participation and Increase the Granularity of Price Zones

At launch, participation could be limited to provincial balancing authorities, treating each province as a single bidding zone. Over time, participation can expand to generators, retailers, large consumers, and aggregators if provinces choose to do so. As participation widens, provinces could reveal internal constraints, so that bidding zones become more spatially granular, again, only if provinces choose to do so. Ultimately, Canada could follow the Nord Pool model and allow third-party generators, retailers, Indigenous utilities, and large customers to transact directly. Or, if provinces prefer a strictly intertie-focused platform, it can remain single-zone (i.e., existing balancing authorities).

Gradually Layer in New Products and Services

Gradually, the Exchange can add additional layers (e.g., intraday or real-time rebalancing trades) and market products (e.g., capacity and ancillary services). To do so, reserve-sharing protocols must be standardized. Emissions credit trading could also be introduced, but provinces would retain authority over energy and climate policies.

Governance

The Exchange must be structurally independent from market participants. It should be governed by a board that includes provincial nominees, independent directors, and Indigenous advisors, and overseen by an independent market monitor with investigative authority. Provincial regulators would need to recognize and accept the Exchange’s rulebook, but provincial oversight would be maintained. Independence, transparency, and predictable rules are essential for confidence in outcomes and to ensure that scheduled trades are efficient, non-discriminatory, and competitive.

Grid Coordination Forum

The Grid Coordination Forum, launched in Phase 2, should continue closing gaps, including building social licence frameworks that share benefits with communities and First Nations and improving access to financing.

Establish Social Licence Models

Public opposition to linear infrastructure that crosses many properties and traditional territories is a persistent barrier. History offers clear warnings. In 1978, protests by Minnesota farmers against a long high-voltage line escalated to sabotage attempts and large law-enforcement deployments. In Miryang, South Korea, protests over a transmission line culminated in tragedy when 74-year-old Lee Chi-woo self-immolated.88 Sun-ae, Kim. 2025. “Behind The Electricity We Use. The Korea Times. March 17. https://www.koreatimes.co.kr/opinion/20250317/behind-the-electricity-we-use. In Canada, Manitoba’s Bipole III project drew intense objections from farmers, property owners, First Nations, and former utility employees.

A lack of meaningful engagement has long delayed and sometimes derailed energy infrastructure in Canada. Effective engagement must be early, genuine, and tied to tangible benefits. International and domestic examples provide insights. In Texas, Competitive Renewable Energy Zones succeeded in part because landowners recognized that benefits from wind development depended on accepting transmission easements (Baldick 2023).

Indigenous participation models are gaining traction in Canada, motivated by self-governance, economic opportunity, environmental protection, and community development (Stefanelli 2019). Indigenous equity ownership is emerging as a practical and principled way to align clean energy development with Indigenous sovereignty, opportunity, and stewardship. In 2024, BC Hydro required a minimum of 25 percent First Nations equity ownership in new projects; eight of nine selected wind projects exceeded that threshold with 51 percent Indigenous ownership. These deals were supported by financing tools such as the Canada Infrastructure Bank’s Indigenous Community Infrastructure Initiative and BC’s First Nations Equity Financing Framework.

The joint ownership of a transmission line between Hydro-Quebec and the Mohawk Council of Kahnawà:ke illustrates another successful model. The 540-kilometre line is expected to carry 1,250 megawatts of renewable power to New York City and represents Hydro-Quebec’s first shared ownership of transmission infrastructure with a First Nations community (The Gazette 2024). Under a limited partnership, the Council has the right to become at least a 10 percent partner, with the option to increase ownership over time, and to earn dividends on that investment. Community leaders emphasize that this approach can reset relationships around major infrastructure.

Transmission investments can serve Indigenous autonomy and reconciliation priorities by unlocking renewable resources, enabling industrial development, generating stable revenue, and engaging Indigenous governments as more equal partners. However, policies, practices, and market conditions must ensure lines are used and generate revenue. Without common policies, enforcement, and consistent, transparent markets, there will be risks to Indigenous groups investing in equity shares of interprovincial lines. The Forum should develop a social license framework that centres Indigenous Peoples’ and First Nations’ autonomy and decision-making, sets expectations for equity ownership or revenue sharing along proposed routes, and lays out transparent processes for consent, consultation, and benefits agreements. Such a framework can support reconciliation, reduce opposition and legal risk, and improve project timelines by building durable public support.

Facilitate Project Financing

Financing should follow a transparent cost-allocation framework that reflects the distribution of benefits. Because many parties benefit – ratepayers, renewable developers, large industrial consumers, merchant traders, and the federal government – diverse financing can be leveraged. The breadth of beneficiaries is an advantage, reducing risk concentration, but it also adds coordination complexity that the Forum should help manage. Potential sources include:

- Funding from the regulated rate base, whose customers benefit from improved reliability.

- Bilateral agreements with renewable generators seeking better grid access and with industrial consumers seeking reliable, stable power.

- Revenues from interprovincial price arbitrage.

- Federal funding to advance reconciliation, nation building, and climate objectives.

The following sections consider each possible source in turn.

1. Regulated Rate Base

Grid integration improves reliability by reducing outage risk, enhances resilience by limiting extreme-event impacts, and mitigates risk by providing insurance against uncertain future conditions. Modelling in the accompanying paper on multi-value benefits illustrates how to quantify these gains and distribute them across systems (Seatle 2025). For example, a stronger BC–Alberta interconnection can help British Columbia manage increasingly variable seasonal water availability and allow Alberta to ride through extreme weather in a wind-dominant future. These reliability benefits justify assigning a portion of costs to ratepayers in both provinces.

Provincial regulators are mandated to ensure reliable, affordable service and that expenditures serve the public interest. Utilities must apply to their regulator for rate changes, justify the need and cost-effectiveness, and show that alternatives were considered. Intertie costs can be included to the extent they serve customers in their province. The Forum should promote a consistent approach for assessing reliability, resilience, and risk mitigation across provinces.

2. Bilateral Agreements with Renewable Generators and Industrial Consumers

Renewable developers often face long connection queues or limited transmission access. New interties can open high-quality renewable zones, justifying direct investment from developers who benefit from better access and more stable prices. A share of intertie capacity can be sold through bilateral agreements to generators or large industrial customers. In Australia, developers have worked with transmission providers to co-finance lines into the best resource areas. Texas’ Competitive Renewable Energy Zones identified five high-wind areas, supported $6.9 billion in transmission, and enabled 11 gigawatts of wind (Baldick 2023). Industrial customers can also contribute where expansions directly support new or expanded operations. Alberta’s largest loads already pay for participant-related upgrades, and BC Hydro has signed custom agreements with mining and LNG projects to share transmission extension costs. In addition to grid access, both developers and industrial users value price stability, which interconnection provides.

3. Revenues from Arbitrage Traders

Revenues earned by merchants who profit from price differences between provinces could help finance a portion of the line by bidding for line capacity. This energy sharing leverages provincial complementarities and creates a revenue stream without displacing utility functions.

4. Federal Government Funding

Grid integration has national benefits, including efforts towards reconciliation, climate action, and economic security. Federal funding can reflect those objectives. The federal government could use financial contributions to catalyze provincial action – using low-cost, flexible equity and loans through entities such as the Canada Infrastructure Bank or taking an anchor-tenant position to de-risk projects (similar to US Department of Energy initiatives). Federal support can be conditioned on provincial participation in minimum planning standards, data sharing, and engagement with the Canadian Power Exchange and Grid Coordination Forum. The approval for federal funding could be part of the Canadian Grid Planning Agency, as is the case in Europe and Australia. This approach aligns with the Canadian Climate Institute’s “electric federalism,” where the federal government funds or backstops critical infrastructure while provinces retain operational control (Canadian Climate Institute 2023).99 Ragan, C., Greenspon, E., Smith, R. 2023. “Electric Federalism: An Idea Whose Time Has Come.” The Globe and Mail. July 27. https://www.theglobeandmail.com/opinion/article-with-demand-surging-canada-must-upgrade-its-electricity-grid-can-we.

The mix of benefits and beneficiaries varies by project, which naturally leads to a diverse, project-specific financing base. The Grid Coordination Forum should steward the cost-allocation process by upholding standardized methods, ensuring the beneficiary-pays principle is applied, and resolving disputes when they arise.

Phase 4: Long-Term Governance and Implementation

Phase 4 marks the transition from building organizations and processes to embedding them as enduring pillars of Canada’s electricity system. By this stage, the three institutions piloted in Phase 2 and formalized in Phase 3 have stable mandates, proven processes, and established trust. The focus now shifts to continuous improvement, refining flagship products, and innovation. This phase emphasizes maintaining momentum, fostering adaptability to technological and policy change, and ensuring governance remains capable of addressing emerging challenges and opportunities over decades.

Canadian Grid Planning Agency

The Agency’s primary role is to maintain and enhance the national grid model and publish the biennial National Grid Plan. Core responsibilities include:

- Managing the national modelling platform;

- Integrating recent datasets from provincial operators and planners;

- Updating resource assessments for renewable and conventional generation;

- Refining cost and performance data for generation, storage, and transmission;

- Incorporating evolving provincial policy targets and regulations;

- Updating operational data such as congestion patterns and seasonal demand.

Iterative Improvement and Trust-building

As planning cycles accumulate, the Agency can reduce uncertainties around key variables such as technology costs, demand growth, electrification rates, and climate change impacts. Each biennial cycle serves as both a technical and engagement exercise, strengthening trust among provinces, Indigenous governments, market participants, and the public. By transparently documenting methods, assumptions, and results, the Agency builds credibility and provides a shared evidence base for investment and regulatory decisions.

Integration with Other Institutions

The Agency’s outputs feed directly into the Canadian Power Exchange’s market design and the Grid Coordination Forum’s regulatory recommendations. Over time, the Agency can align scenario analysis with market performance data, creating feedback loops that improve planning accuracy and market efficiency.

Long-term Vision

The Agency’s planning process should become a continuously updated plan, supported by near-real-time data streams. It should enhance work by reflecting lessons learned, incorporating new technologies, and adapting to changing drivers.

Canadian Power Exchange

The Exchange’s long-term mission is to grow a dynamic, transparent, and efficient trading platform. Having matured from a bilateral clearinghouse into a robust market, it now focuses on expanding participation, diversifying products, and ensuring integrity. Core responsibilities include optimizing seam flows based on transparent price signals and grid capacity. This clearing function remains central to integrating variable renewables, improving dispatch, and revealing the value of transmission capacity. Over time, the Exchange should broaden its suite to include:

- Ancillary services (frequency regulation, spinning reserves, reactive power);

- Flexibility products to incentivize demand response and storage;

- Capacity or long-term adequacy products to enhance reliability.

Market participation should continue to expand to increase liquidity and competition, improving price discovery and investment signals. The Exchange should operate under strong governance, with an independent monitor, transparent reporting, and frameworks to mitigate emerging risks.

Grid Coordination Forum

The Forum’s long-term role is to maintain a coherent, responsive regulatory environment that enables the full realization of integration benefits. It should be a solutions-oriented body capable of anticipating issues and coordinating responses. Core responsibilities include publishing a Grid Action Plan that:

- Reviews the performance of the Planning Agency and Power Exchange;

- Identifies opportunities for innovation in planning, financing, or regulation;

- Recommends adjustments to rules or cost-allocation frameworks;

- Highlights emerging trends in technology, market design, and climate policy.

Indigenous Engagement and Social Licence

The Forum should continue refining social licence frameworks, ensuring Indigenous communities maintain decision-making power, equity opportunities, and long-term benefits. It should monitor effectiveness, update best practices, and facilitate dispute resolution.

Regulatory Harmonization and Innovation

Where feasible, the Forum should encourage alignment of rules across provinces to reduce trade barriers. It can also act as a test bed for regulatory sandboxes, enabling controlled trials of new business models, technologies, or mechanisms without undue risk.

Long-term Vision

The Forum should be recognized as a trusted, independent convener capable of balancing provincial autonomy with the efficiencies of harmonization, and of translating policy goals into implementable regulatory changes. The institutions built and matured earlier must remain adaptive, transparent, and collaborative to respond effectively to shifting political, economic, and technological landscapes.

By embedding continuous improvement into their core mandates, the Canadian Grid Planning Agency, the Canadian Power Exchange, and the Grid Coordination Forum can sustain the benefits of integration for decades. In doing so, they will ensure Canada’s electricity system remains reliable, affordable, and aligned with climate and energy goals while respecting jurisdiction, advancing Indigenous sovereignty, and fostering public trust.

Conclusion: Building Canada’s National Grid

Canada stands at an inflection point in its energy history. The twin pressures of climate change and electrification demand a grid that is more resilient and affordable than ever. Grid integration is not just a technical enhancement. It is a strategic necessity. By connecting provinces and territories, the country and its senior governments can unlock diverse, complementary renewable resources that balance supply and demand across time zones and seasons and reduce costs through shared infrastructure and market efficiencies. A national grid also strengthens energy security, allowing Canada to manage disruptions, adapt to a changing climate, and maintain reliable service amid global market volatility.

The blueprint in this report lays out a pragmatic, staged path to this future. Its four phases move from vision to implementation with achievable steps:

- Phase 1 builds alignment, establishes trust, and sets shared priorities;

- Phase 2 pilots institutions and frameworks for coordination and trading, demonstrating proof of concept;

- Phase 3 institutionalizes these bodies, expands capabilities, and embeds them in governance;

- Phase 4 transitions to long-term governance focused on improvement, innovation, and inclusion.

At every stage, the blueprint’s five pillars – governance, planning, trading, financing, and social licence – anchor the work in principles that balance provincial autonomy with national benefit. Governance fills planning and regulatory gaps with clear mandates that prevent duplication. Planning frameworks bring coherence to long-term investment. Trading frameworks enable efficient sharing while respecting provincial market designs. Financing models leverage the diverse stakeholders who benefit. Community engagement, particularly with Indigenous governments and communities, ensures benefits are shared and social license is earned.

Together, these phases and pillars offer a durable process. The blueprint recognizes constitutional realities and political culture, avoids over-centralization, and builds the trust and capabilities that make lasting cooperation possible. It incorporates lessons from leading jurisdictions – Europe’s cross-border coordination and Australia’s integrated planning – and adapts them to Canadian conditions.

Success will require sustained political will, steady capacity-building, and a willingness to see past jurisdictional boundaries toward shared national advantage. But Canada’s record shows such achievements are within reach. From the transcontinental railway to universal healthcare, Canadians have undertaken ambitious, cooperative projects that knit the country together and improved quality of life for all.

This opportunity is no less transformative. By building an integrated national grid, Canada can deliver cleaner power at lower cost, create jobs, support Indigenous development, and build the backbone for economic growth. The benefits will endure for generations. This blueprint is not a wish list. It is a call to action backed by a clear, phased strategy. The tools, expertise, and vision exist. What remains is to act collaboratively and with confidence that Canada’s future is brighter when we are connected.

References

Arjmand, R., and McPherson, M. 2022. “Canada’s electricity system transition under alternative policy scenarios.” Energy Policy 163: 112844. https://doi.org/10.1016/j.enpol.2022.112844.

Baldick, R. 2023. Renewable energy zones and transmission planning: Lessons from Texas. University of Texas at Austin.

Bishop, Grant, Ragab, M., and Shaffer, B. 2020. The Price of Power: Comparative Electricity Costs across Provinces. Commentary 582. Toronto: C.D. Howe Institute. https://cdhowe.org/publication/price-power-comparative-electricity-costs-across-provinces/.

Brinkman, G., Bain, D., Buster, G., Draxl, C., Das, P., Ho, J., Ibanez, E., Jones, R., Koebrich, S., Murphy, S., Narwade, V., Novacheck, J., Purkayastha, A., Rossol, M., Sigrin, B., Stephen, G., and Zhang, J. 2021. The North American Renewable Integration Study: A Canadian Perspective. https://doi.org/10.2172/1804702.

Bruemmer, Rene. 2024. “A Special Moment In Our History’: Mohawk Council of Kahnawake Inks Deal With Hydro Quebec.” The Gazette. April 18. https://www.montrealgazette.com/news/article144715.html.

Casper, B., and Wellstone, P. 1981. Powerline: The First Battle of America’s Energy War. University of Massachusetts Press.

English, J., Niet, T., Lyseng, B., Palmer-Wilson, K., Keller, V., Moazzen, I., Pitt, L., Wild, P., & Rowe, A. (2017). “Impact of electrical intertie capacity on carbon policy effectiveness.” Energy Policy. 101: 571–581. https://doi.org/10.1016/j.enpol.2016.10.026.

ENTSO-E. 2024. “ENTSO-E publishes the final guideline for cost benefit analysis of grid development projects.” April 9. https://www.entsoe.eu/news/2024/04/09/entso-e-publishes-the-final-guideline-for-cost-benefit-analysis-of-grid-development-projects/.

ESIG. 2022. “Multi-Value Transmission Planning for a Clean Energy Future: A Report of the Transmission Benefits Valuation Task Force.” Energy Systems Integration Group. https://www.esig.energy/multi-value-transmission-planning-report.

FERC. 2025. “Explainer on the Transmission Planning and Cost Allocation Final Rule.” https://www.ferc.gov/explainer-transmission-planning-and-cost-allocation-final-rule.

GE Energy Consulting. 2016. “Pan-Canadian Wind Integration Study (PCWIS).” The Canadian Wind Energy Association. https://renewablesassociation.ca/wp-content/uploads/2021/10/pcwis-fullreport.pdf.

Grid Status. 2025 “Nodal Price Map”. August. https://docs.gridstatus.io/monitor/nodal-price-map.

Hydro Quebec. 2024. “Mohawk Council of Kahnawà:ke and Hydro-Quebec Sign Hertel-New York Line Agreements.” April 18. https://news.hydroquebec.com/en/press-releases/2067/mohawk-council-of-kahnawake-and-hydro-quebec-sign-hertelnew-york-line-agreements/#:~:text=The%20Mohawk%20Council%20of%20Kahnaw%C3%A0,Mohawk%20Territory%20of%20Kahnaw%C3%A0%3Ake.

McPherson, M., and Karney, B. 2017. “A scenario based approach to designing electricity grids with high variable renewable energy penetrations in Ontario, Canada: Development and application of the SILVER model.” Energy 138: 185–196. https://doi.org/10.1016/j.energy.2017.07.027.

McPherson, M. 2025. “Best Practices for Grid Integration.” Paper presented at the 24th Wind and Solar Integration Workshop, Berlin, Germany, October 7–10.

MISO. 2012. “Multi Value Project Portfolio: Results and Analyses. Midcontinent Independent System Operator.” https://cdn.misoenergy.org/2011%20MVP%20Portfolio%20Analysis%20 Full%20Report117059.pdf.

_______. 2022. “Reliability Imperative: Long Range Transmission Planning.” https://cdn.misoenergy.org/20220725%20Board%20of%20Directors%20Item%2002a%20Reliability%20Imperative%20LRTP625714.pdf.

Natural Resources Canada. 2018a. Regional Electricity Cooperation and Strategic Infrastructure (RECSI): Atlantic Region Summary for Policy Makers (M134-50/2018E-PDF). Natural Resources Canada. https://www.publications.gc.ca/collections/collection_2019/rncan-nrcan/M134-50-2018-eng.pdf.

______________. 2018b. Regional Electricity Cooperation and Strategic Infrastructure (RECSI) Western Region Summary for Policy Makers (M134-49/2018E-PDF). Natural Resources Canada. https://natural-resources.canada.ca/sites/www.nrcan.gc.ca/files/energy/clean/RECSI_WR-SPM_eng.pdf.

NYISO. 2017. “Western New York Public Policy Transmission Planning Report.” New York Independent System Operator. https://www.nyiso.com/documents/20142/2892590/Western-New-York-Public-Policy-Transmission-Planning-Report.pdf/d3f62964-2e2d-588c-2da4-9aa33bb5470b.

_______. 2019. “AC Transmission Public Policy Transmission Plan.” New York Independent System Operator. https://www.nyiso.com/documents/20142/5990605/AC-Transmission-Public-Policy-Transmission-Plan-2019-04-08.pdf/0f5c4a04-79f4-5289-8d78-32c4197bcdf2.

Pedder, S., Duboviks, V., and Ravas, K. 2021. “SaskPower/Manitoba Hydro Regional Coordination Study Summary.” General Electric International, Inc.

Seatle, Madeleine, and Madeleine McPherson. 2025. “Mitigation and adaptation: Assessing the multi-value benefits of transmission expansion.” Energy Policy 207: 114821. https://doi.org/10.1016/j.enpol.2025.114821.

SPP. 2025. “Southwest Power Pool.” https://www.spp.org/marketsplus.

Stefanelli, J., et al. 2019. “Indigenous ownership of energy projects in Canada: Case studies and policy implications.” Canadian Institute for Climate Choices.

Stephen, G. 2021. “Probabilistic Resource Adequacy Suite (PRAS) v0.6 Model Documentation” (NREL/TP--5C00-79698, 1785462, MainId:35919). National Renewable Energy Laboratory. https://doi.org/10.2172/1785462.